Experts ponder whether AMD could dethrone its larger rival.

Nvidia has been the poster child of the artificial intelligence frenzy, spearheading the accompanying stock market rally.

The stock fell back last week, however, along with the rest of the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Tesla).

But does this sudden change in fortunes mark a turning point for the graphics processing units (GPU) market leader?

The company is due to reveal its cards on 22 May when it will publish its results for the first quarter of 2024-25. Depending on the figures, this may or may not reassure the market that Nvidia can live up to the high expectations surrounding it.

Over the long term, possible threats to the company’s hegemony might include the emergence of a competitor in the GPU market, such as Advanced Micro Devices (AMD).

Zehrid Osmani, head of the Global Long-Term Unconstrained team at Martin Currie, said: “AMD is seen as an alternative company to Nvidia in the GPU segment and could potentially expand its market share from currently c.5% in data centres to 20% over the longer term.”

So should investors consider taking profits from Nvidia and investing in AMD?

Not so fast, said Chris Ford, co-manager of the Sanlam Global Artificial Intelligence fund. While AMD may well gain market share, it remains a “distant second player” to Nvidia, he said.

One of AMD’s issues is that it is spread thinly across both the GPU and central processing units (CPU) markets, where it trails behind Nvidia and Intel, respectively.

AMD is smaller than Nvidia, which means its research and development capacities are more limited, he continued. AMD is also constrained by the necessity to compete with Intel in the CPU space.

These dynamics have “led to a persistent capability for Nvidia to deliver significantly superior operational performance from their chips compared to AMD”, Ford concluded.

Dom Rizzo, portfolio Manager of the T. Rowe Price Global Technology Equity fund, added that chips from Nvidia and AMD are not interchangeable without “a noticeable degradation in performance”.

AMD is still the new kid in town, yet to gain recognition, he continued. “AMD’s product offering is relatively new to the market, so it has to go through testing. It is at a different stage in terms of adoption and acceptance, so it is difficult to make a direct comparison between the two.”

Nvidia has built a software and services ecosystem on top of its chips, which is something AMD lacks, as it has been focusing on a wider range of products.

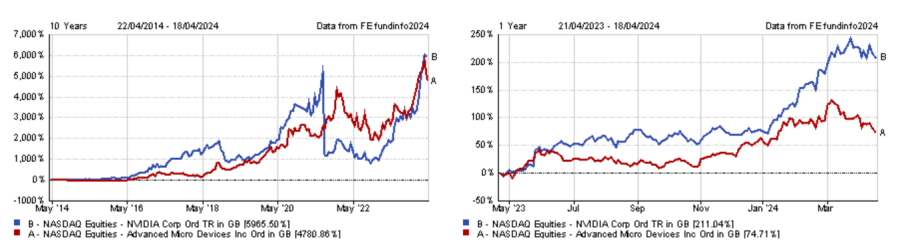

Performance of stocks over 10yrs and 1yr

Source: FE Analytics

For Allan Clarke, investment manager at Aegon Asset Management, the GPU market bears resemblance to the smartphone market in the late 2000s with Apple and Samsung.

While Apple built an entire software ecosystem attached to the iPhone, Samsung didn’t and ran Google’s Android on its phones.

Clarke said: “That made a huge difference to the way the two companies were able to monetise the mobile market: shareholders in Samsung would have done fine since the start of the smartphone era, whereas shareholders in Apple have done very nicely indeed. Apple managed to extract something like 80% of the value of the mobile-era of computing, with other players fighting over the remaining 20%.

“Nvidia will be looking to achieve something similar from this next era of computing. If it achieves that (and it currently is), then AMD will be among a number of players fighting for the remaining 20%.”

In spite of this, Rizzo believes the GPU segment is growing fast enough to accommodate both companies and that capturing 10% of the market share would be enough for AMD to thrive.

“AMD has forecast the market to grow from $45bn to $400bn between now and 2027. If AMD were to secure 10% of the market in 2027 that is still significant room for them to grow,” he said.

Furthermore, once generative AI moves from training large language models – which requires fast computing power, and therefore heavy use of GPUs – the application of these models (inference) will depend less on fast-compute. This could lead to more extensive use of CPUs, which would play to AMD’s strengths, Osmani explained.

However, he disputed this thesis. “We believe that inference is also very data intensive and therefore will still require fast computing power and fast processing microchips. Therefore, the market might come to realise that the significant need for GPUs is sustained for longer than expected, which would favour Nvidia,” he explained.

While Nvidia has no obvious competitors apart from AMD in the GPU market, it could face external threats, such as from application-specific integrated circuit (ASIC) manufacturers.

Ford said: “They’re designed to address a very particular computational problem and deliver a silicone solution that addresses it.

“One of the problems with that approach is that designing and manufacturing chips is extraordinarily expensive. Ideally, you want to design a chip, which you can then manufacture as many times as you possibly can. That means you need to find particular computational tasks that have huge scale attached to them to develop an ASIC, but there really aren't very many of those.

“You could argue that there are more now than there were 10 years ago, but we believe it will remain somewhat limited. However, if there is an element of competition for Nvidia over the course of the next decade, we think it's far more likely to emerge from the ASIC manufacturers than from AMD.”

Clarke also pointed to the likes of Alphabet, Microsoft and Meta as potential threats because they are looking to design their own chips to reduce their reliance on Nvidia – although he thinks they are a long way off from threatening the GPU giant.

He concluded: “Time will tell, but the current rate of development, product advantage and market position for Nvidia looks formidable.”

The Tokyo Stock Exchange is targeting companies with low valuations and its initiatives should inherently benefit value stocks as Japan’s rally broadens.

It is a year since the Tokyo Stock Exchange (TSE) published new corporate governance guidelines pressing Japanese companies into driving greater capital efficiency and profitability.

Much has happened since. Now it feels the corporate governance movement is firmly embedded and tangible progress has helped to propel the Nikkei and the Topix to new heights. All of this is underpinned by a pivot towards an inflationary economy following decades of deflation, prompting the Bank of Japan to exit its ultra-easy monetary policy stance last month.

All eyes are now on the annual general meeting (AGM) season in June when more corporates are set to disclose their plans to improve shareholder value. While we are not expecting overnight change, we are anticipating some significant announcements.

Plenty of room to improve

While disclosure rates so far have been impressive, 35% of corporates have still not responded to the TSE’s demands to outline their initiatives. These laggards find themselves firmly under the microscope and must explicitly outline the reasons for not making the required changes.

The TSE continues to ramp up the pressure in other ways. Earlier this year it published a detailed set of requests alongside case studies of companies that had made a head start on improving their corporate governance.

It now publishes a monthly list naming those companies which have disclosed their initiatives – thereby exposing those which have failed to do so – which acts as an important incentive for management teams. The shame associated with not disclosing adequate initiatives weighs heavily on firms and executives.

It is not, however, all stick and no carrot. Positive announcements have generally seen strong reactions. Research by Goldman Sachs has highlighted how companies’ willingness to respond is reflected in their share price performance. As of the end of 2023, an equal weighted basket of the 810 TSE Prime Market names that had responded to the TSE’s request outperformed non-responders by around 12%.

Activist pressure

While there have been many examples of improvements since the turn of the year, with cross shareholdings – a longstanding bugbear of investors in Japan – increasingly under the spotlight, there is mounting pressure for these to be reduced at a faster rate. Some of this pressure came from activists. Indeed, the first quarter saw a 156% year-on-year increase in the number of activist events.

Activists have been relatively successful in cases where they specifically target outsized cross shareholdings. For example, in early 2023, Dai Nippon Printing announced that it would conduct a record share buyback of around $2.2bn and aim to generate $1.6bn in cash through the sale of cross shareholdings. This followed reports that an activist investor had built a 5% position in the stock with the goal of encouraging similar initiatives.

There are many such examples, and they often encourage rival firms, fearful of being targeted themselves or seeming inactive relative to a competitor, to pre-emptively act themselves.

Where next?

While progress to date has been encouraging, a large portion (43%) of listed stocks on the TSE Prime market still trade below book value, a far higher percentage than rival markets. For comparison, just 2% of the S&P 500 and 23% of the Euro Stoxx trade on a sub 1x price-to-book (P/B) valuation.

So far, many companies have focused on low-hanging fruit to improve their return on equity (ROE) – easy-to-achieve initiatives like the reduction of cash and/or cross shareholdings to enhance balance sheet efficiency.

At the forthcoming AGM season, some additional announcements of this ilk are expected. To some extent this is already being reflected in the share prices of the most likely candidates for change.

But the average Japanese corporate balance sheet remains unlevered and cash rich. The percentage of companies with net cash on their balance sheet remains high at 46% versus 14% in the US and 21% in Europe. That means there is plenty of work left to do on this front.

However, the more radical improvements to underlying profitability and the successful reform of cost structures, business models and business portfolios will take time to implement. But these longer-term solutions should extend the longevity of corporate governance reforms as an investment story.

A broader rally

With a policy that is generally targeting companies with low valuations, the TSE’s initiatives should inherently benefit value stocks.

Yet very much like the US, Japanese market breadth over the last 12 months has been narrow.

Performance has largely been driven by a select number of top cap value stocks as well as some technology stocks – even though these two areas of the market are expected to benefit less from the corporate reform push.

The reason is that foreign investors, who have flocked back to Japan, have focused on a small collection of well-known companies. With some stocks now looking overvalued, we expect the rally to broaden to more value names.

Moreover, the TSE has emphasised the need for the wider market to focus on long-term improvements to shareholder value; simply reaching 1x P/B – something some companies will achieve simply through market appreciation – is not going to be enough.

A year ago, we said ‘this time is different’. Given the disappointments of the Abenomics era, this was a bold claim. But the TSE has proved it really does mean business – and corporate Japan, long so adept at resisting change, is finally listening.

Emily Badger is a portfolio manager in the Japan CoreAlpha strategy team of Man Group. The views expressed above should not be taken as investment advice.

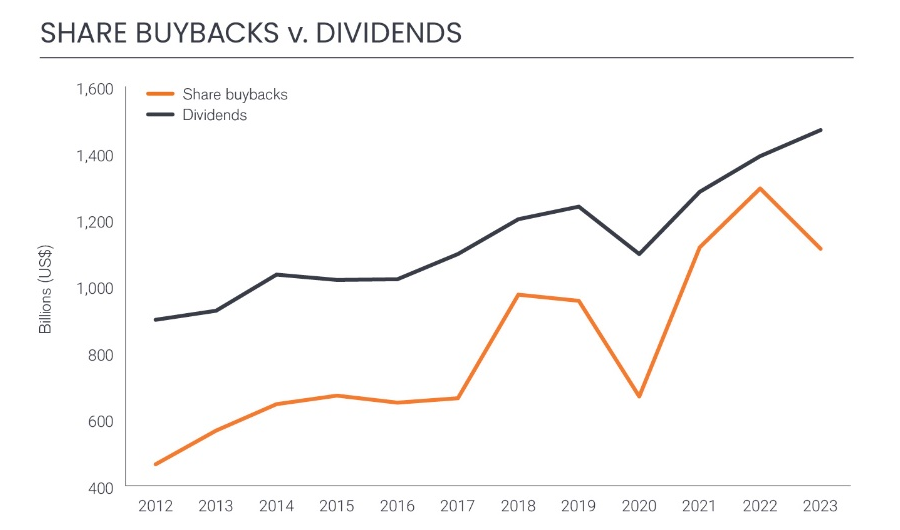

Share buybacks fell 14% year-on-year.

Companies focused more on dividends than share buybacks in 2023, according to data from Janus Henderson’s Global Dividend Index, with the $1.1trn spent on repurchasing shares last year some $181bn lower than in 2022.

This is a decline of 14% year-on-year and means 2023’s buybacks total was below even the 2021 level, although it remains far ahead of pre-pandemic marks.

Ben Lofthouse, head of global equity income at Janus Henderson, said higher interest rates have played a role in the decline of share buybacks.

“When debt is cheap it makes sense for companies to borrow more (as long as they borrow prudently) and use the proceeds to retire expensive equity capital,” he said.

“With rates at multi-year highs, that calculation is more nuanced; some companies are paying down debt at this point in the cycle, using cash that might otherwise have gone to buybacks.”

Buying back shares is a key tool for companies to reduce the amount of stock in issuance and therefore enhance the share price. It is a way of returning value to shareholders through capital gains.

Some prefer this to dividends, which is income paid out to investors, as share buybacks can be more flexible; whereas once a company starts paying dividends, shareholders expect to be paid at least the same amount every year – if not for the income to increase.

Source: Janus Henderson Global Dividend Index

Lofthouse said: “Many companies use buybacks as a release valve – a way of returning excess capital to shareholders without setting expectations for dividends that might not be sustainable long term. This is especially appropriate in cyclical industries like oil or banking.

“That flexibility explains why buybacks are more volatile than dividends. It also means there is no real evidence that buybacks are taking over from dividends.”

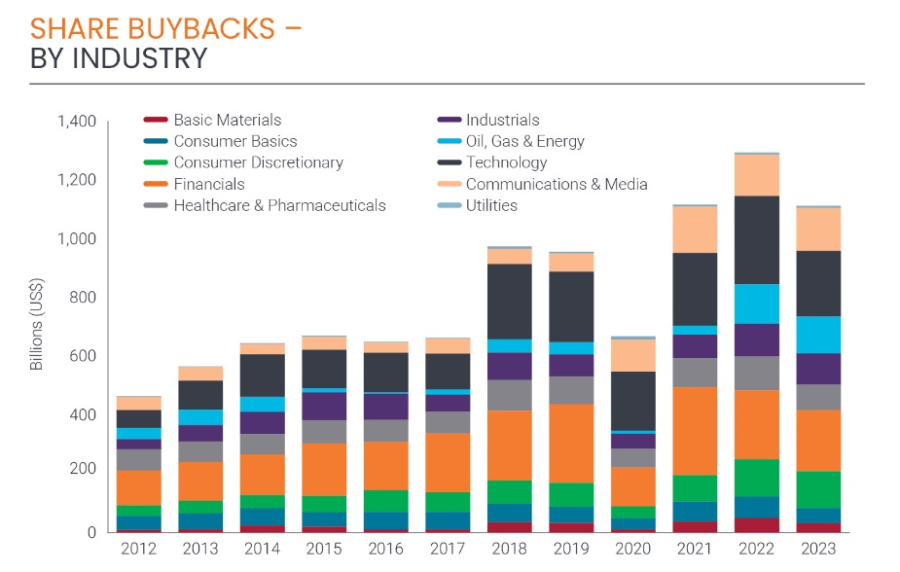

US companies bought the most shares last year. American companies are known for preferring buybacks to dividends and they accounted for some 70% of all share repurchases last year, with a total of $773bn.

This was down some $159bn on the previous year (or 17%) but remained 1.2x larger than the value of dividends paid by US companies.

Source: Janus Henderson Global Dividend Index

Outside the US, companies in the UK were the biggest buyers of their own shares, accounting for $1 in every $17 of the global total in 2023, the report found.

A total $64.2bn in repurchases was 2.6% lower year-on-year and equalled 75% of dividends paid, with oil major Shell leading the way. It is the largest non-US buyer of its own shares, (accounting for almost a quarter of the UK total).

However, the firm cut back last year, as did the likes of BP, British American Tobacco and Lloyds, among others. This was counterbalanced by an increase in share buybacks from banks such as HSBC and Barclays.

Share buybacks are also becoming more prominent in Europe, the report found, where the total paid rose 2.9% to $146bn in 2023, although it remains less of a tool for Asian stocks.

Dividends or buybacks?

Lofthouse noted the relative size of buybacks when compared to dividends shrank in every region except Japan and the emerging markets, suggesting dividends remain the most coveted option by companies and their shareholders.

However, he was quick to ward investors off assuming the trend for share buybacks was over.

“It’s tempting to extrapolate a new trend of decline for buybacks. But one down year from multi-year highs is not evidence that this is happening. It is all about companies finding the appropriate balance between capital expenditure, their financing needs and shareholder returns via dividends, buybacks or both,” he said.

The FTSE 100 is expected to leave Monday’s record close in the dust and climb to the dizzy heights of 8,500 to 9,000 this year.

The FTSE 100 hit a milestone on Monday, closing at an all-time high of 8,023.87, and experts expect the UK stock market to continue gathering steam.

Axel Rudolph, a senior market analyst at IG Group, thinks the FTSE could notch up to 8,300 this summer before flying as high as 8,500 by year’s end, while Darius McDermott, managing director of Chelsea Financial Services, believes 9,000 could be possible.

AJ Bell investment director Russ Mould stuck at a more conservative forecast of 8,300, arguing that ample dividend payments and record amounts of share buybacks are signs of corporate confidence.

Rudolph said: “Since the FTSE 100 is on track for its third consecutive month of gains, helped by foreign investors buying undervalued UK shares and companies, a technical analysis upside target called the 161.8% Fibonacci extension around the 8,300 mark may be hit over the next few months.”

A 161.8% Fibonacci extension is used by technical analysts to forecast price targets when financial markets hit all-time highs and is a 1.618 times price projection of a previous move.

“The depreciating pound sterling, making foreign purchases of UK shares cheaper to buy, is expected to underpin the UK blue-chip index as well,” Rudolph continued.

“By year-end the 8,500 mark may be reached, especially if the UK economy starts to grow again amid future interest rate cuts by the Bank of England, the first of which is expected to be seen in August.”

McDermott agreed and was even more bullish. “We like the UK and could easily see the FTSE 100 moving towards 9,000 by year-end if commodity prices continue their upward trajectory. There is also a renewed political realisation that the UK market is falling behind and the government has finally recognised it needs to do more to support its domestic stock market,” he said.

Taking a step back, the Covid-19 pandemic gave companies the chance to press the reset button on their dividend policies and adjust them to more sustainable levels.

“Now, with healthier cash flows, these businesses are using those resources to repurchase their own shares at historically cheap valuations, further boosting stock prices,” McDermott said.

“Increased geopolitical tension is also increasing commodity prices, benefiting the FTSE’s energy and mining stocks.”

Jason Hollands, managing director at Bestinvest, agreed. “The UK equity market is home to a significant aerospace and defence sector where stock prices have soared, reflecting ongoing global crises and increased defence spending. The standout performer here has been Rolls-Royce, whose shares are up 167% over the past 12 months, matching the aggregate returns from the Bloomberg Magnificent Seven Index of US mega-caps.”

Monetary policy divergence and US dollar strength have contributed to recent gains as well, he continued. “Global investors now anticipate two rate cuts from the Bank of England this year, as the inflationary environment looks more benign than it does in the US, where a possible reverse-ferret rate hike is back on the cards at the Fed.”

The domestic economy, meanwhile, is improving. “An unexpected rise in the composite Purchasing Managers Index in April suggests the economy grew faster at the start of the second quarter. GDP data earlier this month confirmed that the technical recession that the UK entered at the end of last year is almost certainly over and this signal might have boosted investors’ faith in UK equities,” Hollands explained.

Emma Moriarty, an investment manager at CG Asset Management, sees the next general election as a catalyst that “might resolve some of the more structural political uncertainty that has created an overhang for the UK markets”.

Despite breaking records, UK equities still appear attractively valued compared to other developed markets, Hollands pointed out. “UK shares are trading at a price-to-earnings (P/E) ratio of 11x, a 37% discount to global equities, and well below their long-term median valuations.”

Mould added that even if the FTSE 100 advanced to 8,350, the index would still be on a P/E of 12x and a yield of 3.9%.

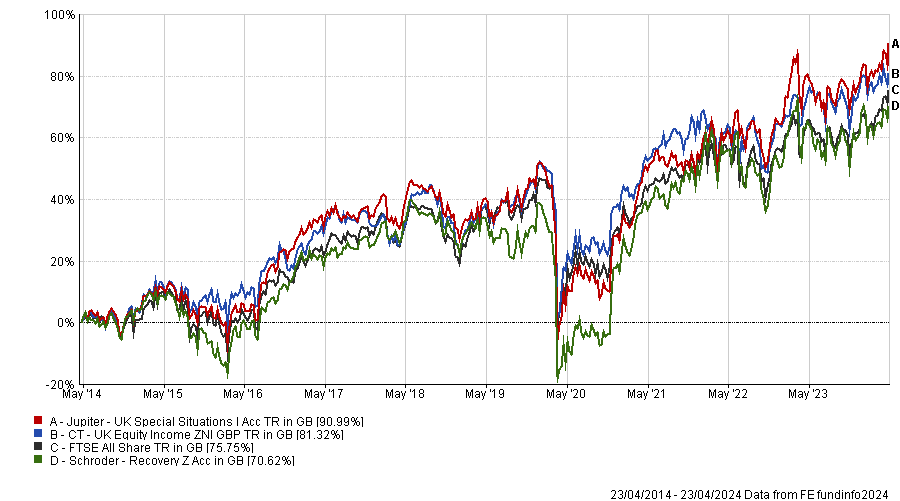

For investors who want to bet on the UK equity market’s sustained recovery and take advantage of the current reasonable valuations, McDermott suggested CT UK Equity Income, Jupiter UK Special Situations and Schroder Recovery. “These funds offer well-diversified portfolios, primarily focused on larger UK companies,” he said.

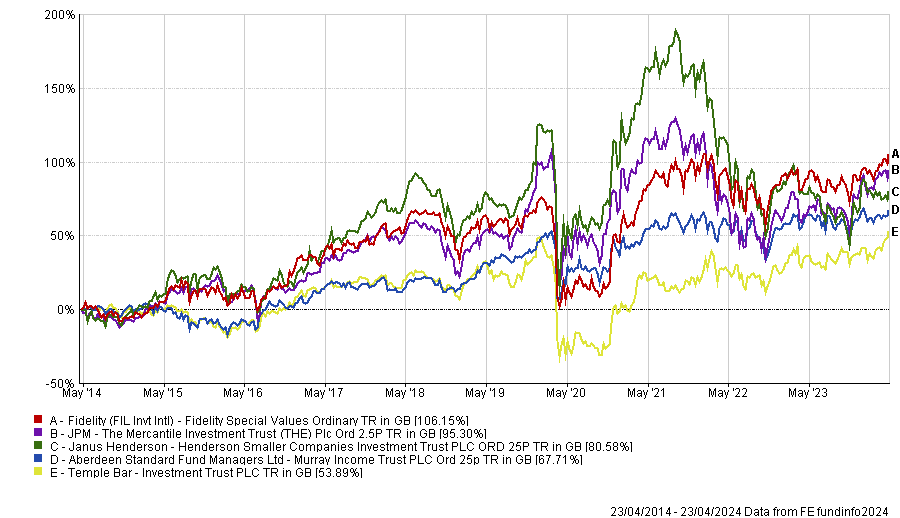

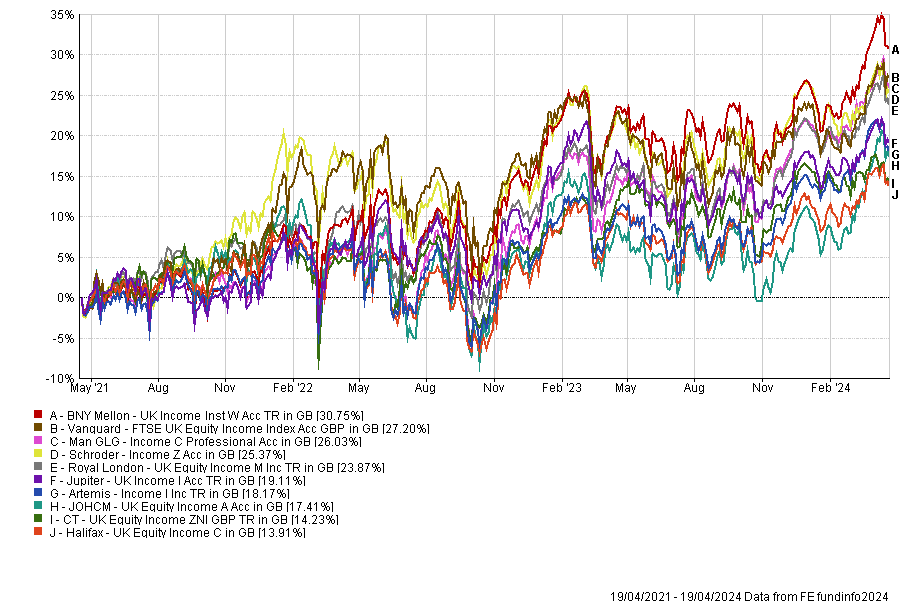

Performance of funds vs benchmark over 10yrs

Source: FE Analytics

Hollands recommended considering investment trusts trading at discounts. “Strong trusts to consider include Fidelity Special Values (-10.1% discount), Mercantile Investment Trust (-11.2% discount), Murray Income Trust (-9.9% discount), Temple Bar Investment Trust (-7.4%) and Henderson Smaller Companies (-14.3%).”

Performance of trusts over 10 years

Source: FE Analytics

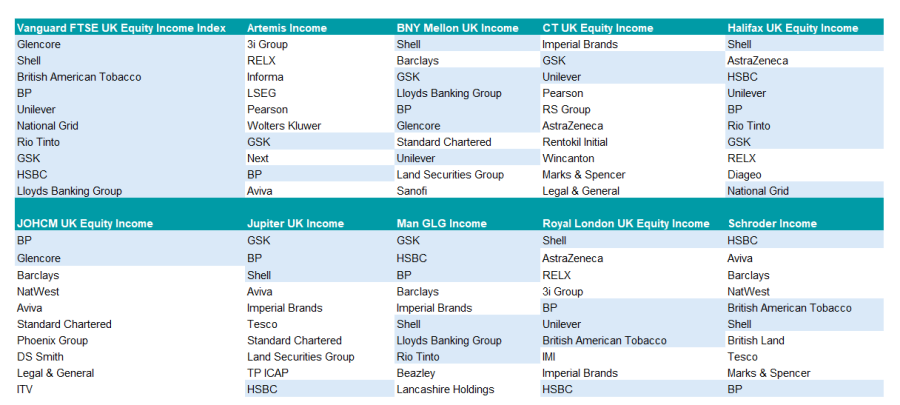

Most of the UK Equity Income funds with more than £1bn under management own BP, Shell and GSK.

Several of the largest and most popular UK equity income funds hold the same stocks so investors who split their income portfolios between these funds might not be getting the diversification they are trying to achieve – depending on which funds they choose.

The IA UK Equity Income sector houses 10 funds with more than £1bn under management. One of these – the £1.2bn Vanguard FTSE UK Equity Income Index fund – is a passive tracker so Trustnet compared its top 10 holdings with those of the other nine funds.

Halifax UK Equity Income has the greatest overlap, with seven of the Vanguard tracker’s largest holdings amongst its own top 10, closely followed by BNY Mellon UK Income and Man GLG Income with six apiece.

Royal London UK Equity Income shares half of its top 10 stocks with the FTSE UK Equity Income Index. Four of Jupiter UK Income and Schroder Income's holdings overlapped.

At the other end of the spectrum, three funds share just two stocks with the Vanguard FTSE UK Equity Income Index’s top 10: Artemis Income, CT UK Equity Income and JOHCM UK Equity Income.

The most popular stock is BP; only CT UK Equity Income doesn’t have the oil giant in its top 10.

Shell and GSK are owned by seven of the 10 funds (including Vanguard), six hold HSBC and five have Unilever.

Beyond the index, several of these large funds’ highest conviction positions overlap with each other. Aviva, Barclays and Imperial Brands are owned by four of the funds, while AstraZeneca and Standard Chartered feature in three funds apiece.

Funds’ top 10 holdings

Sources: FE Analytics, funds’ factsheets

Market concentration forces large funds into the same stocks

One of the reasons that UK equity income funds’ holdings overlap is that the FTSE 100 is a highly concentrated market. Its top 10 holdings comprise almost half of its market capitalisation, while 57% of all dividends are paid by just 10 companies, according to Octopus Investments’ ‘Dividend Barometer’.

Sector concentration is significant too and can cause issues in times of market stress, such as the Covid-19 pandemic when oil companies slashed their dividends and banks were compelled to stop paying dividends completely.

AJ Bell investment director Russ Mould highlighted the UK market’s “hefty portion of earnings from unpredictable sectors such as miners and oil, and economically sensitive ones such as banks and consumer discretionary.”

Market concentration is even more of an issue for funds that have amassed a lot of assets – such as those in this study – which are compelled by their sheer size to channel assets towards the UK’s biggest companies.

Analysts at interactive investor, who added the £4.6bn Artemis Income fund to their Super 60 buy list this year, observed: “With its considerable size, the fund does not have the flexibility to invest significantly down the market-cap scale, but that has not hindered performance relative to the index over the medium term.”

The fund with the most differentiated holdings

Artemis Income had the most original line up from amongst the largest funds in the IA UK Equity Income sector. Four of its top 10 stocks were absent from its peers and from the FTSE UK Equity Income Index’s largest 10 positions.

FE fundinfo Alpha Manager Adrian Frost, Andy Marsh and Nick Shenton have struck out on their own by investing in Informa, LSEG, Wolters Kluwer and Next.

Managers who took bold off-benchmark bets

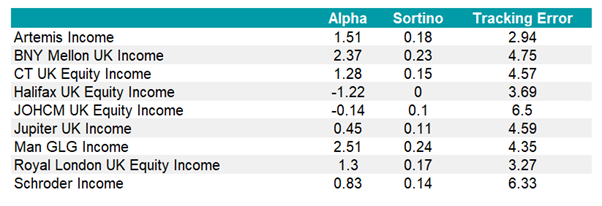

However, it was not the most actively-managed fund over the long term, according to the data.

Indeed, JOHCM UK Equity Income, led by Clive Beagles and James Lowen, came out on top with the highest tracking error over 10 years and 15 years, meaning that the managers deviated from their benchmark and took active bets.

It was followed by Schroder Income under Andrew Evans and Kevin Murphy. Both houses have a value investment style.

Funds’ tracking error, alpha and Sortino ratios over 10yrs

Source: FE Analytics, data to 22 April 2024

The least correlated fund to the benchmark

The 10 largest funds in the IA UK Equity Income sector are closely correlated, which is to be expected as they have similar mandates; although CT UK Equity Income stands apart in this regard.

The only fund not holding BP in its top 10, CT UK Equity Income was significantly less correlated than its peers to the Vanguard FTSE UK Equity Income Index fund during the past three years to 19 April 2024. Its correlation was 0.76 according to FE Analytics, whereas the next lowest was Royal London UK Equity Income at 0.87.

Managed by Jeremy Smith, co-head of UK equities at Columbia Threadneedle Investments (and by veteran manager Richard Colwell until his retirement in 2022), the £3.2bn fund pursues a contrarian, value-oriented strategy and focuses on both mid- and large-caps. Smith aims for above-market yields with dividend and capital growth.

Kamal Warraich, head of equity fund research at Canaccord Genuity Wealth Management, pointed out that “the contrarian approach has often led to significant sector biases” such as a zero weight to energy and banks, but a large overweight to industrials.

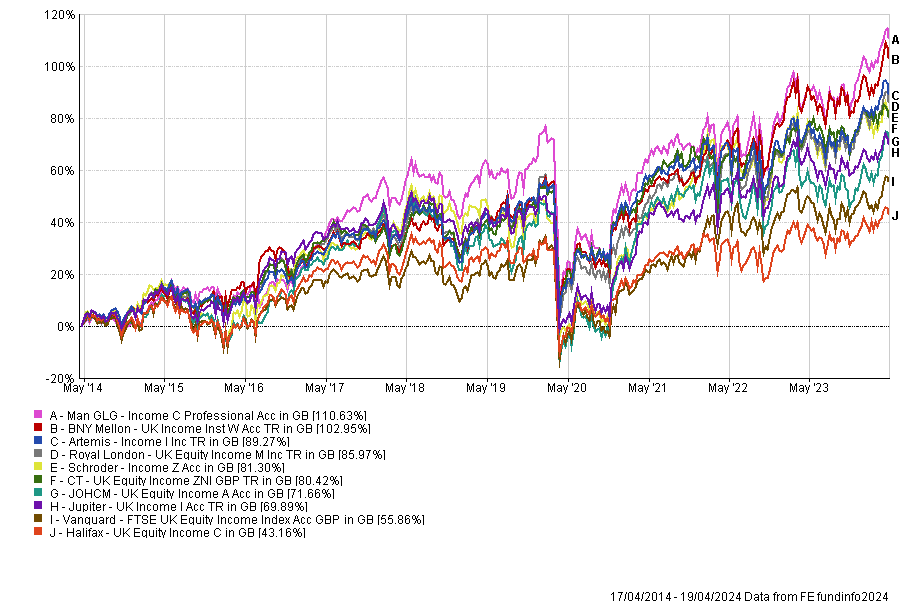

The best performers

Despite the overlapping stock picks between some of the most popular funds, the outcomes experienced by investors diverged significantly over the long term.

The best performers were Man GLG Income and BNY Mellon UK Income, both of which have doubled their investors’ money over 10 years to 19 April 2024, up 110.6% and 103%, respectively.

Vanguard’s tracker delivered half of that and was the second-worst performer of the group, up 55.9%, while Halifax UK Equity Income brought up the rear with 43.2%.

Performance of funds over 10yrs

Source: FE Analytics

Paul Angell, head of investment research at AJ Bell, recommended Man GLG Income for ISA investors. “The manager has a preference for stocks which have strong potential for dividend growth (exceeding twice the market average) and bonds (max 20%) that on a relative basis appear more attractive than their company’s equity,” he explained. “In order to avoid value traps the manager additionally focuses on a firm’s cash, cash flow, and assets.” The £1.7bn fund has a yield of 5%.

More recently however, Vanguard FTSE UK Equity Income Index has had its moment in the sun. The low-cost passive fund delivered the second-best returns of the group over three years, up 27.2%.

Performance of funds over 3yrs

Source: FE Analytics

BNY Mellon UK Income pulled ahead with 30.8% and had the highest alpha by a long way (5.1). Man GLG Income and Schroder Income returned 26% and 25.4%, respectively, with alpha scores of 3.33 and 3.35 over three years.

Financial advisers reveal their top choices for savers building up their pension pots and for retirees already withdrawing from their SIPPs.

Ruffer, Worldwide Healthcare and JP Morgan Global Income & Growth are among the best options for investors putting their pensions into investment trusts, according to IFAs.

There are typically two stages to pensions: the accumulation (or wealth building) phase where those yet to reach retirement are trying to increase their pot as much as possible; and the withdrawal phase for people who have finished work and are relying on their savings for income.

This tax year, savers can put up to £60,000 into a self-invested personal pension (SIPP), an increase on the £40,000 available 12 months ago, and can carry forward any unused allowances over the past three years.

As such, now may be a good time to consider what to buy. Below, financial advisers give their favourite investment trusts for each of the two stages of pensions.

The accumulation/wealth building phase

People with a long time horizon until retirement can consider taking more risk and investing in trusts that should grow over the long term, even if they experience short-term wobbles.

As such, Philippa Maffioli, senior investment manager of Blyth-Richmond Investment Managers, said growth and diversification during this period are crucial.

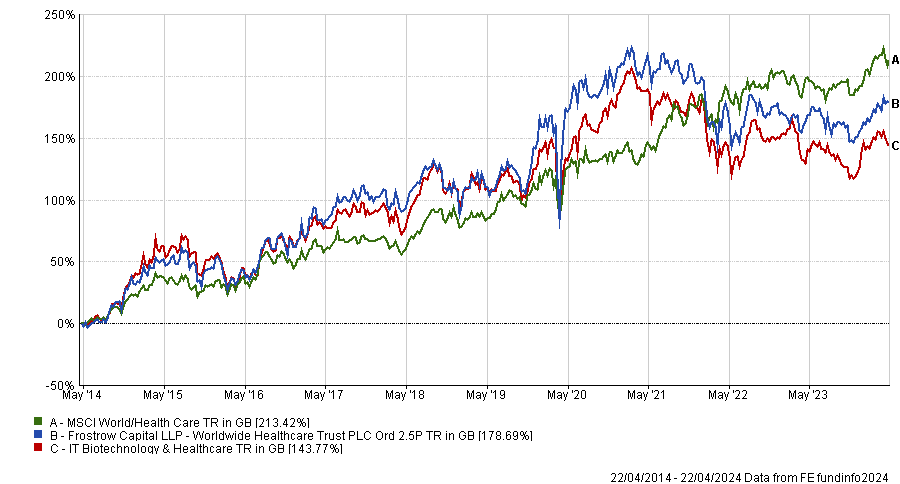

She suggested Worldwide Healthcare Trust, which gives investors exposure to pharmaceutical, biotechnology and other related healthcare companies ranging from multinational brands to unquoted companies.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund is managed by OrbiMed Capital which was founded in 1989 and has become the largest healthcare investment firm in the world. The team is actively looking at nearly 1,000 companies and works to identify sources of outperformance, as well as those with underappreciated products in the pipeline with high quality management teams and strong financial resources,” she said.

Another option with a broader remit is Monks Investment Trust, managed by Spencer Adair and Malcolm MacColl from Baillie Gifford.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“Their aim is to focus on global companies from a range of profiles with above average earnings growth, which they expect to hold for around five years,” Maffioli said, although noting that they “address issues head on and aren’t afraid to take a critical look at their portfolio when necessary”.

For those unwilling to take such big bets on styles or themes, Chancery Lane chief executive Doug Brodie suggested trusts with long track records of outperformance such as Lowland, Murray International and City of London, which he said have “handsomely” beaten the FTSE All Share over 20 years. However, it is worth noting that Murray International is a global portfolio while the other two are UK focused.

Performance of trusts vs FTSE All Share index over 20yrs

Source: FE Analytics

“Investment trusts may not have the sales and marketing budgets of pension companies so investors have to look a bit harder. A quick look at the long-term returns will show folk there’s a good reason that institutional investors are big investors in trusts,” Brodie said.

For more tactical investors, Paul Chilver, associate and financial planning manager of Birkett Long IFA, suggested concentrating on trusts currently on a discount – of which there are many.

“Discounts are particularly attractive on UK-focused investment trusts and one suggestion for the accumulation stage of investment is the Mercantile Investment Trust managed by JPMorgan, which has been at a double-digit discount for many months despite very good short-term performance,” he said.

The decumulation/withdrawal phase

People already in retirement have to marry two competing issues. The first is to make sure that their investments continue to grow so they do not run out of cash, while the other is to withdraw money to help them make up the shortfall from a lack of earnings.

To balance this, Neil Mumford, chartered financial planner of Milestone Wealth Management, suggested the Scottish American Investment Company, known as SAINTS for short.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“This is my choice for someone looking at building either an income or growth portfolio and is a top five holding in my own SIPP. I am still accumulating but it will stay once I am drawing down,” he said.

“It is a truly diversified equity portfolio, spread equally between the US and Europe at around 35% each of the portfolio. Although it doesn’t have the highest yield at 2.9%, this dividend hero has increased its payouts by an average of 4.2% a year over the past five years and this dividend increase has not hampered its ability to grow capital – a total return of more than 170% over the past 10 years should please any investor.”

Now could also be a good time to get in as the share price is a “complete bargain”, trading at a discount of 10% to the trust’s net asset value.

More defensive investors might prefer the Personal Assets Trust or Ruffer Investment Company, said Maffioli, which both focus on capital preservation.

The former, managed by Sebastian Lyon and Charlotte Yonge, “offers global diversification across four asset classes and is a bedrock for lower risk and/or decumulating portfolios,” she said.

Ruffer meanwhile uses a “very disciplined approach”, aiming to maintain value over one year and grow capital incrementally over the longer term. “This means they would perceive a loss in line with the market as a failure,” Maffioli noted.

A trust for both?

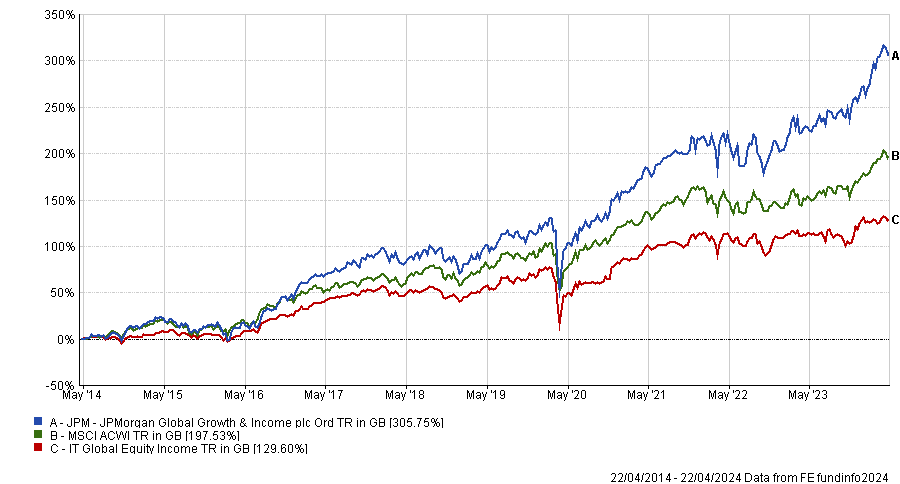

One trust that appeared in the recommendations for both phases was JPMorgan Global Growth & Income Trust. Mumford said it was a strong option for those looking to build their wealth, as it invests predominantly in the high-growth US market, which makes up two-thirds of the portfolio.

“It is a high conviction portfolio with 50 to 90 holdings, with the top 10 making up more than 40% of the portfolio. This has allowed it to outperform by some margin with a 305% return over the past 10 years,” he said.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

It is one of the few trusts trading on a premium at present, but this should not concern long-term investors, Mumford noted, adding it is “ideal” for regular monthly investments.

Chilver meanwhile highlighted the trust for those in the decumulation stage of their pension, noting that its 3.4% yield makes it attractive, despite its high weighting to the typically lower yielding US market.

Passive exposure to EMs isn’t likely to give investors what they are actually looking for…

Last year returns in US equities were driven by an exceptionally concentrated group of companies. Close to 70% of returns in the S&P 500 came from just 10 stocks. A consequence of this was only 28% of companies outperformed the benchmark.

Overexuberance around AI stocks was partly responsible for this. However, another argument is that this is also being driven by passive flows, which are fuelling a giant momentum trade.

The US is less than 20% of global GDP but almost 70% of stock market value, with increasing allocations to market cap weighted passive funds driving this process.

Whatever the case, the US is not alone in being subject to the malformations that indexing can cause. Emerging markets (EMs) today are a prime example and are arguably increasingly unattractive to access via passive funds because of the manner in which indices are constructed.

This is true for a couple of key reasons. One is that China, although down from its near 50% weighting, remains predominant in emerging market indices, making up just over a quarter of the value of the MSCI Emerging Markets Index at the end of March.

Although there are still attractive opportunities in China, there is lots of political risk, both as it pertains to internal policy making and to relations with the US. The result is that many investors want to minimise their exposure to the country, whereas the index continues to give it a large weighting.

Another factor is that index rules mean that the emerging market index is now dominated by countries that arguably don’t offer the sorts of traits that investors are looking for – namely the potential for large-scale GDP growth and returns that are less correlated with developed markets.

For example, Taiwan and South Korea constitute close to 30% of the MSCI Emerging Markets Index combined. Both countries have per capita incomes and living standards that are on par with, or even surpass, what we would think of as the developed economies.

Moreover, their constituent companies – firms such as TSMC and Samsung – are deeply intertwined with the global economy. This means there is less opportunity for an endogenous growth story and a strong likelihood that returns are going to be correlated with stock markets in developed economies.

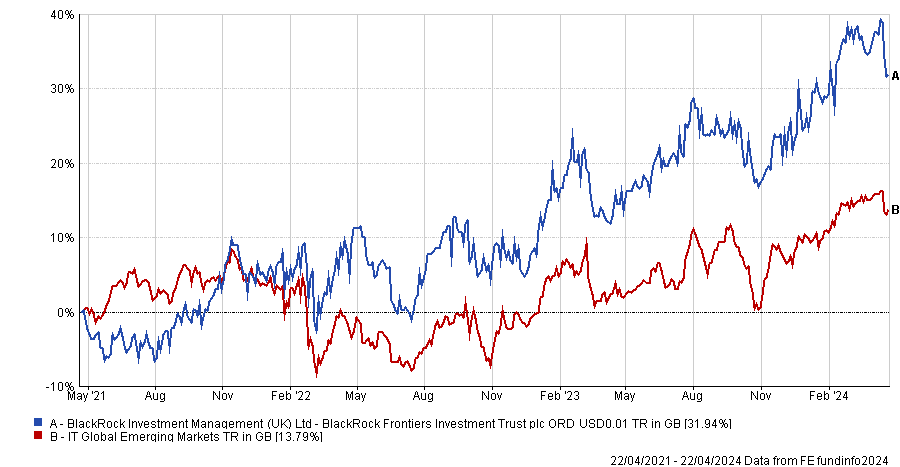

One trust that arguably provides an attractive counterbalance to this is BlackRock Frontiers. The trust’s investable universe takes both emerging and frontier markets. However, it the eight largest countries from the EM index.

The result is that the trust provides exposure to the sort of growth stories that EM investors are typically looking for, as well as meaningful diversification. The proof has been in the pudding in this regard over the past three years, as the trust has delivered both meaningful outperformance as well as returns that look very different from those in developed markets.

Total return of trust vs sector over 3yrs

Source: FE Analytics

Another way of playing the emerging market theme is to invest in country-specific trusts. Ashoka India Equity may appeal here, in large part because of its fee structure. The trust charges no management fee, with a performance fee of 30% paid on any outperformance delivered against the benchmark over a three-year period instead. Half of that fee is paid in shares, which are locked up for a further three years.

Whether or not this has been the causal factor, the trust has been the best performer in its peer group since IPO in 2018, having delivered annualised returns of close to 20% to the end of March this year. It has also been one of only a small number of closed-ended funds to issue new equity over the past 12 months.

Vietnam Enterprise Investments is another country specialist and one of the only closed-ended funds that provides investors with dedicated exposure to Vietnam.

The country’s stock market has seen a downturn over the past couple of years. However, the wider macro picture remains strong, with FDI rising year-on-year by 32% in 2023 and GDP growth projected to exceed 6% in 2024.

That reflects a variety of trends, including increasing investment in infrastructure and companies moving manufacturing to a country that offers cheaper labour and is seen as more secure than China.

Like BlackRock Frontiers, it’s also worth noting that the countries Ashoka India Equity and Vietnam Enterprise Investments invest also offer the sort of GDP growth, driven more by domestic factors, that investors in EM are usually looking for. An index won’t give you that…

David Kimberley is an investment trust writer at Kepler Partners. The views expressed above should not be taken as investment advice.

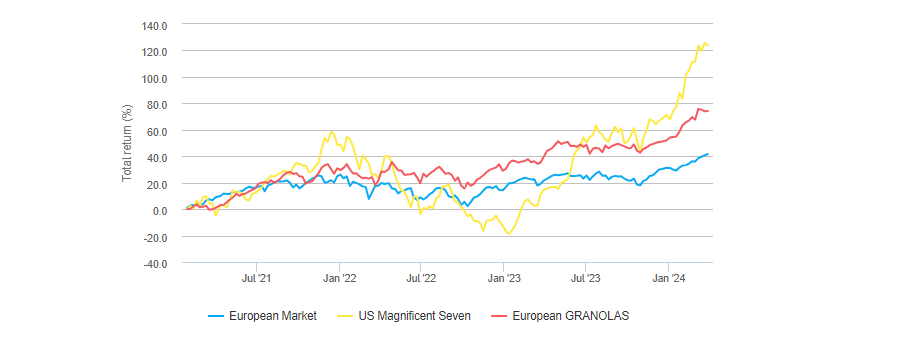

The ‘Granolas’ have made lower returns but been far less volatile, research shows.

Top US stocks dubbed the ‘Magnificent Seven’ have been on a stratospheric rise over the past few years on the back of investor enthusiasm for artificial intelligence (AI), but there is a new acronym on the other side of the Atlantic: Granola.

While the US group consists of Apple, Alphabet (Google’s parent company), Amazon, Meta, Microsoft, Nvidia and Tesla, Granola is a list of 11 European companies.

Graham Smith, an investment writer at Fidelity International, said: “Like the Magnificent Seven in America, Europe’s Granolas have spearheaded a major surge in stock markets over the past year. That spells strong structural themes coupled with higher-than-average valuations.”

List of 'Granola' stocks

Source: Fidelity International

The Granolas are among the largest companies in Europe and have performed well over the past few years as investors have favoured quality large-cap names. Together they account for around 20% of the European market, slightly below the Magnificent Seven’s weighting in the S&P 500 index.

While tech dominates the Magnificent Seven, the Granolas are a combination of global leaders in sectors as diverse as pharmaceuticals, beauty and food.

One major difference is the size of the companies. Tesla is the smallest of the Magnificent Seven – less than half the size of the next-closest. Yet with a market capitalisation of $500bn it is larger than all the European Granolas, the most valuable of which is pharmaceutical giant Novo Nordisk, valued at around $430bn.

Looking at performance, it should be unsurprising that the US block has significantly outperformed in recent years. Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said: “Since the start of 2021 both groups have performed well and returns have moved broadly in line with each other. But the gap’s widened since the start of 2024. That’s largely thanks to NVIDIA which has benefited from the AI boom.”

However, he noted that this has led to a valuation dispersion. The Magnificent Seven have an average price-to-earnings (P/E) ratio of 44.5x compared to the Granolas’ 30.7x, meaning the market has put higher expectations on the US companies, “demanding a higher rate of future growth”.

Performance of stocks over 3yrs

Source: Hargreaves Lansdown

While investors should not ignore the Magnificent Seven as their “dominance is likely to persist”, neither should they neglect the opportunities in Europe’s largest companies.

They offer diversification as well as lower valuations and can help to smooth out returns, Chiekrie said, as the European stalwarts have been less volatile than their US counterparts.

But not all of the Granolas were created equal and Chiekrie highlighted three that are of particular interest. First was ASML – the only tech name among the European cohort. The firm makes lithography machines, which are integral for the production of microchips.

“With the AI boom fuelling demand for the most powerful kind of chips, ASML finds itself essentially selling the picks and shovels in an AI gold rush. The group’s revenue and operating profit jumped around 30% and 39% respectively in 2023,” he said.

UK-based GSK is another on the list. The pharmaceutical company spun off its consumer division last year into Haleon. Instead, HIV medicines and vaccines have proven to be the main areas of interest, with Chiekrie noting the firm’s “strong clinical pipeline” as particularly interesting.

However, GSK’s valuation is much less demanding than its peers, perhaps in part due to questions over cancer links to its heartburn drug, Zantac, with a key legal hearing underway.

“Markets are expecting settlement to be the most likely outcome,” the Hargreaves Lansdown analyst said, noting that investors in the stock might be in for a “bumpy ride” but could be rewarded if they “ride out any possible storms”.

Chiekrie’s final pick was LVMH, the fashion retailer behind brands such as Louis Vuitton, Christian Dior, Givenchy and TAG Heuer.

“The group’s performance has been commendable in recent years, far outpacing the broader market [yet] the valuation is broadly in line with its long-run average of around 23.3x times forward earnings,” he said.

“Compared to peers, that’s middle of the pack. To us, it suggests that not all of the group’s strengths are currently priced in, and could offer an attractive entry point. However, of course, there are no guarantees.”

For fund investors, Smith noted that the passively managed Vanguard FTSE Developed Europe ex UK fund “naturally” provides exposure to nine of the 11 Granolas, with the exceptions being GSK and AstraZeneca, which are both UK-listed.

It is one of three European equity funds on Fidelity’s Select 50 list, the others being Comgest Growth Europe ex UK and Schroder European Recovery.

Comgest’s fund has ASML and Novo Nordisk as its top two holdings, together accounting for around 15% of its portfolio. LVMH sits in eighth. It is managed by FE fundinfo Alpha Managers Alistair Wittet and Franz Weis, alongside James Hanford.

“The Schroder European Recovery fund is understandably structured rather differently with just one Granola – Sanofi – in its top-10,” Smith said.

The fund management group has haemorrhaged money in the first quarter of 2024.

Both Hargreaves Lansdown and AJ Bell have dropped previously recommended Jupiter funds from their best-buy lists following the departure of veteran stockpicker Ben Whitmore.

Hargreaves, which had previously included both the Jupiter UK Income and Jupiter Global Value Equity funds in its Wealth List, took the decision to remove both.

The former has been taken over by Adrian Gosden and Chris Morrison, who joined Jupiter from GAM at the start of the year.

Senior investment analyst Joseph Hill noted that while the pair have a long track record and are “capable” and “experienced”, he reiterated that Hargreaves’ conviction had been with Whitmore.

“We don’t currently have the required conviction in them to remain on the Wealth Shortlist running this larger company biased fund,” he said.

Hill noted that the new duo are also value investors but they have historically invested more in smaller and medium-sized companies, which are higher risk than the larger firms preferred by Whitmore.

“The style the fund offers investors is one we feel we have well covered in our UK Equity Income fund selections on the Wealth Shortlist, where we have higher conviction in other managers. Jupiter Income will remain under research coverage and we will be updating clients of changes under the new management in due course,” Hill concluded.

Turning to Jupiter Global Value Equity, the plan is for the fund to remain under Whitmore’s control once he has set up on his own with the launch of Brickwood Asset Management.

Jupiter plans to hire Brickwood to run the fund on a sub-advisory basis, meaning it would remain under the manager and his team.

However, investment analyst Aidan Moyle said: “Running [the fund] on a sub-advisory basis causes additional complexity from a governance perspective.”

Hargreaves Lansdown looks at fund groups through multiple lenses, evaluating people and culture, governance, investment risk and oversight, compliance and audit, operations and portfolio management and the business’ financial strength.

“As things stand it’s unclear whether the new business would meet the required standards in these areas, for either Jupiter or Hargreaves Lansdown,” Moyle said.

“Jupiter has also not yet confirmed this is the direction it will take for the fund. As a result of this continued uncertainty, we have taken the decision to remove the fund from the Wealth Shortlist.”

The firm noted, however, that this was not a recommendation for investors to sell either fund at this time. “Investors should make sure any investments match their investment goals and attitude to risk and are held as part of a diversified portfolio. If you're not sure if an investment is suitable for your circumstances, please seek personal advice,” said Moyle.

Meanwhile AJ Bell has removed Jupiter UK Special Situations from its best-buy list, after it was announced former JOHCM UK Dynamic manager Alex Savvides would be moving over to take charge of the fund.

The firm had previously removed the JO Hambro fund from its list in October 2023 to “consolidate” its UK equity fund recommendations.

The news comes after Jupiter announced investors had withdrawn a net £1.6bn from the firm in the first quarter of 2024, with the majority (£1.1bn) being pulled from Whitmore’s funds. The departure of Chrysalis Investments and its managers Richard Watts and Nick Williamson, who are leaving Jupiter to focus full time on the trust, led to an £800m reduction in Jupiter’s assets under management (AUM)..

Group AUM rose however to £52.6bn after positive market movements contributed £2bn to its AUM.

Domestic equities look poised to continue their strong run on the back of attractive valuations, sterling weakness and potential monetary policy divergence.

The FTSE 100 reached a record high at yesterday’s market close of 8,023.87, surpassing its previous zenith of 8,014.31 on 20 February 2023. It gained 1.62% on Monday 22 April 2024, up from last Friday’s close of 7,895.85.

David Cumming, head of UK equities at Newton Investment Management, believes that the domestic equity market has further to run and is on the verge of “a new dawn”.

“The new market high has been a long time coming but despite the global uncertainty this has the potential for being a new dawn, rather than a short-term blip. The UK is cheap, relative to other markets, while relative trends in commodity prices and interest rates now favour the UK’s company mix as the global tech rally fades,” he said.

“For the UK consumer, in the near term things are looking up – with recent tax cuts, lower inflation figures and rising earnings. Retailers such as Tesco, with exposure to these trends, were notable upward gainers yesterday. The recent rise in bid activity is a further positive valuation signal for the FTSE.”

Currency weakness has played a part in the UK stock market’s performance, boosting sterling-denominated profits for companies with substantial overseas revenues.

If the Bank of England cuts rates before the US Federal Reserve, monetary policy divergence will probably push the pound even lower, said Lindsay James, investment strategist at Quilter Investors.

“With economic growth still lagging many of its G7 peers, the UK has turned this to its strength in the fight against inflation, which last month fell below that of the US and saw governor Andrew Bailey announce that this data shows the UK is ‘pretty much on track’ with the central bank’s forecasts,” she said.

“This has led investors to anticipate that rate cuts could arrive in the UK well before the US, weakening sterling by just over 3% against the dollar so far this year, and continuing a long running trend that has seen the pound decline more than 25% against the dollar in the past decade, a period over which the FTSE 100 has delivered only around a quarter of the returns generated by the S&P 500.”

Performance of FTSE 100 vs S&P 500 over 10yrs

Source: FE Analytics

James concluded that sterling weakness could propel the FTSE 100 to continue its upwards trajectory. “With the bulk of FTSE 100 company earnings generated internationally, this currency weakening conversely benefits UK-based investors as those earnings have risen in sterling terms, offering some relief in the story of long-term underperformance of the home market relative to Europe and the US,” she explained.

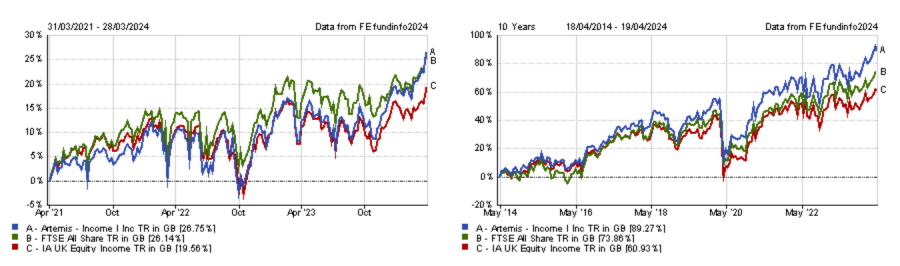

Trustnet looked for funds in the IA UK Equity Income sector that have been managed by the same person since 2004 or earlier and have achieved top-quartile returns over the past three years.

Few seasoned fund managers are able to stay ahead of the competition for extended periods of time. They might live off their previous track records or fall behind newer managers with fresher ideas.

Yet Artemis’ Adrian Frost, who has been managing Artemis Income since 2002, has achieved that rare feat of beating his peers during the tumultuous market conditions of the past three years, bringing to bear his experience garnered during a 22-year track record.

Trustnet researched which funds have been managed by the same person for 20 years or more and have produced top-quartile returns over the past three years. Artemis Income is the only strategy in the IA Equity Income sector to tick both boxes.FE fundinfo Alpha Manager Frost was joined by Nick Shenton in 2012 and Andy Marsh in 2018. Over the three years to 31 March 2024, the trio made 26.8%, with Artemis Income ranking 13th out of 73 in its sector in terms of performance.

Frost, Shenton and Marsh look to grow both income and capital over five-year periods by focusing on free cash flow, as they believe this metric determines a company’s ability to grow its dividend.

Analysts at Square Mile said: “In general, this approach guides the managers towards robust companies and can help highlight the potential risks in their business models.

“The fund has been designed to generate a yield in excess of the market, but the managers will not unnecessarily place capital at risk in order to achieve this, which is in keeping with the managers' total return aspirations.”

The fund has also done well over longer timeframes and sits in the top-quartile of its sector over 10 years and 15 years.

Moreover, Artemis Income’s Sharpe ratio over those periods has been among the best in the sector, suggesting that the amount of risk taken was worthwhile.

In terms of volatility, the fund has been less turbulent than many of its competitors over the long term, but fell into the third quartile on that metric over three years.

Performance of fund over 3 years and 10 years vs sector and benchmark

Source: FE Analytics

One concern highlighted by Square Mile analysts is the size of the fund, which may be a consequence of the successful longer-term track record.

Yet, the £4.5bn of assets under management might not be too much of an impediment, as Frost and his colleagues tend to focus on large-cap stocks. For instance, the fund’s top 10 holdings include FTSE 100 constituents such as 3i Group, London Stock Exchange Group and GSK as well as some overseas large-caps such as Amsterdam-listed information services company Wolters Kluwer.

Due to Artemis Income’s ‘conservative’ approach to investment, analysts at RSMR suggested using the fund as a core holding.

Previously we looked for funds with veteran managers at the helm that have outperformed for the past three years in the IA UK All Companies and IA UK Smaller Companies sectors.

Experts pointed to future economic security, defence, demographic divergence and affordable healthcare.

Investors have been well rewarded for identifying the rise of artificial intelligence (AI) as a dominant investment theme but AI is not the only game in town. Other mega-trends will come to the fore during the next 10 years as geopolitical risk rises, populations in developed countries age and healthcare systems around the world become overstretched.

Below, experts highlight the themes investors should monitor in the coming years.

Future economic security

The pandemic brought to light the interdependence and over-concentration of global supply chains, making them vulnerable to external shocks. For instance, 80% of industries suffered from supply chain disruptions during the Covid-19 pandemic.

Moreover, recent geopolitical tensions have highlighted the risks to supply chains in critical technologies and resources, such as semiconductors, energy and key basic materials.

As a result, the US, European Union and Japan have already invested more than $190bn in semiconductor research, development and manufacturing to diversify and onshore supply chains.

Based on those dynamics, Luke Barrs, global head of fundamental equity client portfolio management at Goldman Sachs Asset Management, identified “future economic security” as the investment thematic of the coming decade, which he divides into three sub-themes: supply chain security, resource security and national security.

He said: “With security threats growing in magnitude and complexity, this is driving the need for the latest defence and cybersecurity solutions.

“As a result, there is an opportunity to invest in the beneficiaries of governments and corporations investing in their future economic security.

“We are seeing the upside of this investment reflected in the earnings of companies in critical industries, such as chip manufacturing, as well as companies benefiting from increased investment in domestic manufacturing capacity.”

This theme enables investors to combine value sectors such as industrials and energy with growth-oriented companies in areas such as technology, he added.

Defence

The surge in geopolitical tensions has put an end to the ‘peace dividend’ that the world – including investors – had benefited from since the end of the Cold War.

After the fall of the Berlin wall, governments made large-scale cuts to their defence budgets as geopolitical risk subsided.

Since the outbreak of the war in Ukraine, however, they have been ramping up military spending.

Tom Bailey, head of research at HANetf, said: “From Europe to Asia, new big spending packages have been announced, while national defence strategies have been rewritten.

“One particular area of focus is European NATO members. The declines in European defence spending post-Cold War resulted in many European countries falling short of the 2% of GDP defence spending target, set by NATO. These cuts have left European military inventories troublingly low.

“Following the 2022 invasion of Ukraine, the need to address this has become apparent to governments across the continent.”

To tackle this issue, Germany has announced a €100bn spending package to accelerate its modernisation, while Poland has committed to spend over 4% of GDP on defence.

For Bailey, key beneficiaries of this uptick in spending will be the big European defence firms such as Rheinmetall, Leonardo and BAE Systems.

Demographic divergence

Around the globe, life expectancy is increasing while birth rates are declining in most developed markets as well as in China. This means that populations are getting older while the number of people of working age is shrinking.

Wei Li, global chief investment strategist at BlackRock Investment Institute, said: “This poses an economic challenge; all else being equal, a shrinking workforce means an economy cannot grow as fast.

“Demographic changes – and their effects – will vary across countries, and the dispersion of outcomes will create plentiful investment opportunities.”

In many emerging market countries, the working-age population is still growing, giving them an economic advantage that could lead to outperformance if they can capitalise on demographic trends by improving workforce participation and investing in infrastructure.

“We think higher returns could be on offer in countries with greater demand for investment, such as India, Indonesia, Mexico and Saudi Arabia,” she said.

Another area Li pointed to is healthcare in the US and Europe.

Affordability of healthcare

Chris Eccles, portfolio manager at AXA Investment Managers, highlighted the issue of affordable healthcare, as medical systems around the world are stretched and in many cases at “breaking point”.

He referred to recent figures from the US Treasury Department showing that the unfunded liability for Medicare – the federal health insurance programme in the United States – over the next 70 years stands at $175trn.

He added: “To bring this into more immediate terms, Medicare Part A – which is the part of the US Social Security healthcare system that pays for hospital bills for Americans over age 65 – is unfunded beyond 2028. That's four years away.”

However, this issue does not only affect the public side of the healthcare system, but also the private and commercial sectors.

Referring to research from the Kaiser Family Foundation, Eccles pointed out that nine out 10 employers in the US believe their healthcare costs will become unsustainable in the next five to 10 years.

Meanwhile, he noted that patient outcomes are “far too often sub-standard”.

“Something has to be done, it's an absolute imperative. The healthcare system must do better for less,” Eccles said.

“In that sense, affordability and innovation are at the centre of how we think about opportunities and risks across our investment space.

“We're trying to select companies that are either solution providers or beneficiaries as we shift towards a more sustainable healthcare system.”

While this thematic affects the healthcare system as a whole, he stressed that it is manifesting itself in different ways through the different sub-sectors.

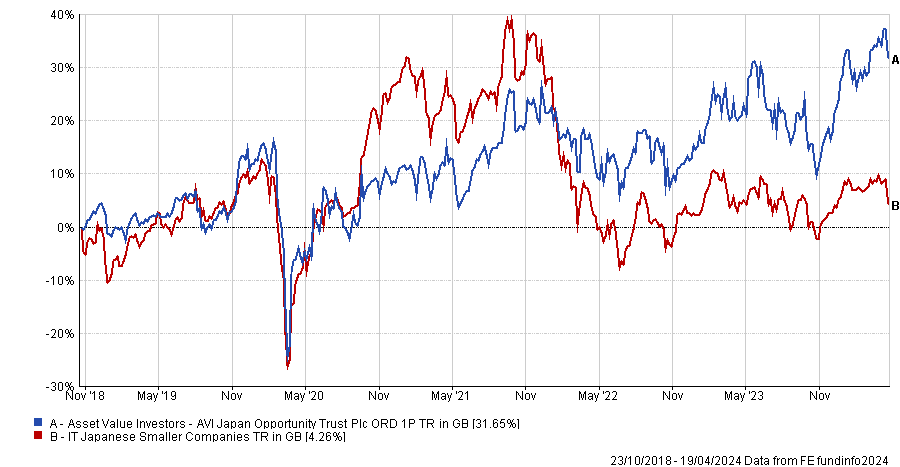

The fund will be managed by Joe Bauernfreund.

Asset Value Investors (AVI) will launch a new Japan Special Situations fund with Joe Bauernfreund at the helm, the firm has announced today.

The manager of the existing £177.5m Japan Opportunity Trust said the decision will address the “significant demand” for a UCITS version of the closed-ended company launched in 2018.

Since then, the portfolio has proved successful and was the top-performing trust in the three-strong IT Japanese Smaller Companies sector over five years and second-best over three years and 12 months. Since launch, it made a 31.6% return against the sector’s average of 4.3%, as the chart below illustrates.

Performance of fund against sector and index since launch

Source: FE Analytics

Bauernfreund will be supported by AVI’s six-strong Japan-dedicated research team and employ the same bottom-up, research-driven approach of the trust, engaging with companies to unlock hidden value.

The portfolio will be concentrated in 25-35 companies and charge a 1% ongoing charges figure (OCF).

Bauernfreund is optimistic about the macro-economic environment in Japan.

“The weak yen makes Japan highly cost-competitive, both for tourism and manufacturing. Inflation has returned after a 40-year absence and, with wage growth and increased spending, we could see a more rational allocation of capital and improved productivity, which would bode well for our portfolio companies,” he said.

“For sterling-based investors the yen has been a significant headwind over the past 10 years, but Japan’s central bank abandoning its yield curve control will enhance the returns on offer on the country’s debt, leading some investors to forecast that a ‘great repatriation’ of Japanese investment flows is set to accelerate.”

The market has been gaining momentum recently with a number of managers bullish on the opportunities going forward.

Bauernfreund’s AVI Japan Opportunity trust was also recently flagged by head of investment companies at QuotedData James Carthew (alongside JPMorgan Japanese) for investors seeking exposure to Japan’s improving corporate governance and rising stock market.

Investing in the healthcare sector offers protection against the possibility of an economic downturn as well as diversification away from the hottest parts of the market.

Ignoring the healthcare sector has been easy to do over the past couple of years, even though the case for owning it has never been stronger.

Part of the reason the healthcare sector has been overlooked is due to the financial volatility caused by the Covid-19 pandemic. Some companies benefitted from increased demand for their products and services during the dark days of 2020-2021 and then lost out as (thankfully) the pandemic subsided. Others lost out and then benefitted, as patients returned to their doctors for more routine healthcare needs.

Over the past couple of years, many healthcare companies have been labelled as ‘too difficult’ due to the challenges of determining their financial standing. This includes assessing whether they were on the positive or negative side of the ledger, and predicting when ‘normal’ demand might re-emerge.

Time and patience have been necessary to reveal the answers. As we move through 2024, the fog of uncertainty is starting to lift, providing a clearer perspective. It is now widely accepted that a fair picture of Covid-adjusted trend growth can be obtained by combining two years of pre-pandemic growth rates, two years during the pandemic, and two years post-pandemic.

Even if the healthcare sector has endured a difficult 2022-2023, we will not be afraid to add to our positions in areas where we believe that the trend growth looks strong and sustainable, and the valuation attractive. Our holdings in the life science tools subsector, such as Danaher and Bio-Techne, are good examples.

Due to unprecedented post-pandemic destocking, a Chinese regulatory clamp down and a necessary return to more focused investments by the biotech industry, 2022 and 2023 have been difficult years. However, we believe that we are only in the very early stages of a new wave in scientific/medical advances – one in which a greater understanding of the human genome allows us to target new areas for medicines with artificial intelligence (AI) expediting the identification of treatments that are most likely to work. Consequently, the order books at Danaher and Bio-Techne could start to fill up quickly as we move into the second half of 2024.

A return to growth should allow the life sciences and tools subsector to recouple with (or even outperform) other growth sectors such as technology that consistently deliver high cash returns on investment. The tech sector quickly addressed its own post-Covid demand growth blip through very assertive cost cutting and the rise of AI.

Why take an umbrella when it is sunny outside?

It is also fair to note that economic conditions have remained better than many observers expected. In particular, labour markets have been tight – allowing positive real wages in many sectors and supporting consumer confidence.

Why increase your exposure to a relatively defensive sector like healthcare when the economy is purring, the US Federal Reserve is about to cut rates and we could enjoy the softest of soft landings?

Given the optimism observable at present, in terms of stock market levels and financial conditions, we do think that a bit of insurance makes sense – just in case interest rates do not come down as quickly as expected or if emerging pockets of economic softness grow in size.

Our most defensive holdings within healthcare all have stock-specific attractions that matter more to us than their average beta of 0.7.

Cencora, Elevance and Encompass Health are all expected to benefit from sustained, demographics-led demand growth; they also offer services that will be indispensable in lowering the cost of healthcare delivery.

Cencora stands to benefit from improved distribution dynamics as $200 bn worth of US prescription drugs lose patent protection over the coming five years, a change that will also benefit patients.

Elevance has embraced value-based care, tying the payments it receives as a healthcare insurer to the health benefit received by patients (and replacing the old, less efficient fee-for-service model).

Meanwhile, Encompass Health’s inpatient rehabilitation facilities are increasingly recognised as providers of the best quality post-acute care for patients. Often, they offer a more cost-effective solution compared to alternatives such as nursing homes or general hospitals.

You don’t want all your eggs in one (AI) basket

By staying invested in healthcare, it is not just the possibility of an economic downturn that we are protecting our clients’ capital against. The sector also offers welcome diversification from some of today’s most exciting parts of the market.

We are firm believers that the infrastructure for generative AI will be developed, even as we wait for the emergence of pivotal applications. We do not have to wait, however, for healthcare’s socio-economic necessity to be established.

We remain strong supporters of the healthcare sector. In addition to the well-known demographic drivers (ageing societies, rising prevalence of chronic illness, etc.), innovation is enabling structural changes in healthcare delivery and in our view, these changes will confer years of strong organic growth opportunities if we choose the right companies.

Greig Bryson is a portfolio manager, global equity at Nikko Asset Management. The views expressed above should not be taken as investment advice.

How to avoid concentration risk in the top-heavy index.

If you had to name a market that’s highly concentrated, you would probably say the US. With the vast success of technology companies in the past few decades (and more recently of the Magnificent Seven stocks in the past year) just a handful of businesses now make up most of the S&P500 index. To be precise, the top-10 companies represent just over 30% of the whole index’ weighting.

But you needn’t look across the ocean to find an example of concentration. The domestic market is even more top-heavy, with the FTSE 100’s biggest companies almost reaching 50%, as the chart below shows.

Concentration in top-10 stocks

Source: FTSE, Bloomberg, S&P Dow Jones, Rathbones; data as of 29 February 2024

This means that investors who buy the index are directing half of their money towards 10 companies only – Shell, Astra Zeneca, HSBC, Unilever, BP, GSK, Relx, Diageo, Rio Tinto and Glencore.

Such concentration is a very poor deal for investors, said Leigh Himsworth, FE fundinfo Alpha Manager of the Fidelity UK Opportunities fund.

“The main reason for investing in a fund is to not have all your eggs in one basket and spread the risk, but one does not necessarily achieve this by investing largely in 10 stocks,” the manager said.

“A reliance on a small number of stocks to drive returns can introduce biases in portfolios and increase risk – problematic, if the stocks start to underperform as happened post the bursting on the TMT bubble back in early 2000.”

On top of that, only seven sectors are represented – older industries such as oil, banks, pharmaceuticals, mining, beverages and consumer goods, with little or no exposure to exciting new areas of growth, Himsworth continued.

“Being larger also tends to suggest lower rates of growth, a feature that many investing in the market are seeking, especially in an index fund, and even worse, an index-fund investor compounds their own problem, as the fund will continue to buy into this.”

David Smith, manager of the Henderson High Income Trust, agreed the issue is more relevant for passive investors, while active managers can make decisions to invest not just based on market capitalisation, but on companies’ valuations and the fundamental outlooks for their businesses.

“This means we can underweight or completely avoid large stocks that we think are expensive provided it is within the risk tolerances of the fund,” he said.

“The concentration of the UK market is well recognised by UK fund managers who are accustomed to dealing with some of the challenges it poses with regards to portfolio construction and ensuring sufficient diversification.”

While this might be true, even active managers are having a hard time staying away from benchmarks. BNY Mellon UK Income co-manager Tim Lucas admitted that “there is generally a risk that asset managers look to manage their portfolios too closely to their benchmarks and thus risk total returns to investors”.

“A key to circumvent this is to have a large number of shares to choose from when constructing a portfolio and to be willing to deviate from the benchmark,” he said.

But this is becoming more difficult to achieve in an industry that’s being pushed into owning the same assets – not least for the career risk that derives from going against the grain, as IBOSS’ Metcalfe recently told Trustnet.

One option is for fund managers to put a proportion of the fund into off-benchmark holdings, such as overseas investments – which they are allowed to do. However, this comes with its own pros and cons.

Another issue is that fund managers must take enormous bets on some of the UK’s largest companies that they are in favour of, a problem highlighted by Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. She said it can be hard for active managers to even be at an equal weighting to the index.

“Doing so would mean jettisoning reasonable diversification and taking on huge risks that wouldn’t benefit investors. In some cases, it would nudge close to, or even exceed, regulatory limits on position sizes,” she said.

To mitigate these risks, Jackson is looking at the FTSE 250, where the 10 largest businesses account for just 11% of the UK mid-cap equity index so it’s well-diversified.

“I believe this makes it easier to spot quality companies flying under the radar. Many of these businesses are little known, with strong opportunities for growth both at home and abroad,” she said.

“And they seem cheap relative to their counterparts in other markets and when compared with the past, with sausage-maker Cranswick and fund administrator JTC being two examples”.

Lucas agreed, noting that he is seeing “a large number of choices all way through the FTSE 350”. “The limit in being able to invest in these shares is liquidity, meaning that investors should pay attention to make sure that the fund size is not too large. Very large funds are not easily able to invest in smaller companies without taking on more liquidity risk, if they invest exclusively in the UK,” he said.

Wealth managers discuss the merits of a purely bottom-up approach.

Many fund managers follow an entirely bottom-up approach without giving much weight to the macroeconomic environment in their investment decisions.

While not uncommon, especially among equity fund managers, this investment philosophy may raise questions from fund buyers, as companies do not operate in isolation.

For example, fiscal and monetary policies influence the wider economy, which, in turn, impacts companies.

Shakhista Mukhamedova, co-head of global manager research Europe at RBC Brewin Dolphin, said: “It is not sensible to ignore the macro environment, it is an additional source of information that could give you a better perspective – it’s like cycling with one eye closed, even if your bike is made by the best bicycle makers you still run the risk of riding into a tree.

“The majority of investors realise that no company operates in a vacuum and the macro environment will affect businesses, including those seen as traditionally defensive/non-cyclical.”

However, predicting the trajectory of the macro environment is, at the very least, complicated, if not impossible.

Due to the complexity of the task, David Morcher, head of collectives at Avellemy, understands why many fund managers do not give much importance to macro in their investment process.

Yet, there are a few macroeconomic considerations that he believes cannot be ignored, such as the general economic climate in the countries where a company operates or an analysis of the market sector and the competitive landscape to which a company belongs.

He added: “I would expect a bottom-up fund manager to consider the risks a corporate is exposed to and I would want to see evidence that this impacts their investment decision making, either through position sizing or within their investment thesis.

“If a manager genuinely expresses complete disregard for what is going on in the environment within which their companies are operating, then this would be a point of concern.

“However, if a manager pays due attention to external factors pertaining to their investments, yet shows no interest in forecasting or explaining the current macro environment or trends, but focuses on a company’s fundamentals, I am more sanguine.”

Meera Hearnden, investment director at Parmenion, feels more comfortable with ‘macro-agnostic’ managers, as she believes there is a place for both bottom-up and top-down strategies in a portfolio.

She explained: “As long as our fund managers stick to their beliefs and process and add value by doing what they say, then they should be afforded the flexibility to be bottom-up if they choose or adopt an approach that combines the two. We look for fund managers that can add value in different ways.

“We also look at how our funds in their respective asset classes blend together by style and market cap so that over the longer term there is no reliance on just one style of investing.

“Diversifying our portfolios in this way is what we believe will deliver consistently good risk-adjusted returns over the long term.”

While Hearnden sees merits in those different approaches, she expects more from bottom-up equity fund managers running very concentrated portfolios. She would expect them to know their business “like the back of their hand” and understand all the risks their investee companies are exposed to, such as balance sheet risk and management risk.

Another macroeconomic consideration she would demand from such fund managers is to have a clear idea of how a rise in interest rates will likely impact any of their businesses that have high levels of debt, as this could impact their earnings and profitability.

Hearnden said: “While interest rate movements would be considered a top-down factor on its own, inadvertently, this could be construed as a bottom-up consideration at an individual company level as a company’s debt and the interest on that debt is inextricably linked.”

In addition to managers running concentrated portfolios, she also highlighted that emerging market managers may “arguably” need to consider top-down factors, such as interest rates, exchange rates and geopolitics.

While a pure bottom-up approach may be acceptable for equity fund managers, Mukhamedova warned that it is a “red flag” for bond fund managers, as understanding the macro environment is crucial for them to make certain decisions.

Morcher also has higher expectations from bond fund managers when it comes to having a strong grasp of changing economic fundamentals.

He said: “I would expect them to have a view on dynamics such as central bank interest rate policy, as this will drive the attractiveness of future returns from large parts of their universe.

“With this in mind, I would expect them to regularly analyse such factors in a consistent manner to allow them to make investment decisions based on stable economic inputs.”

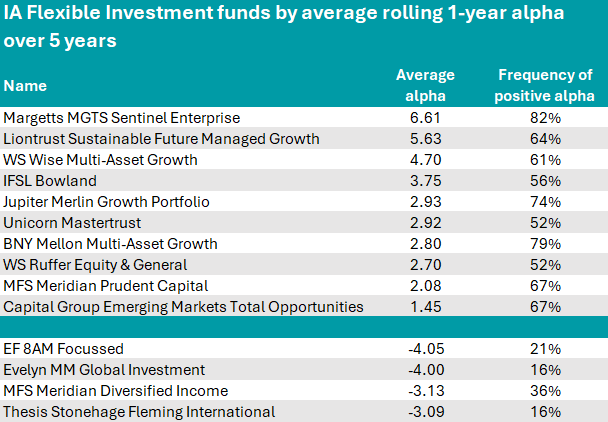

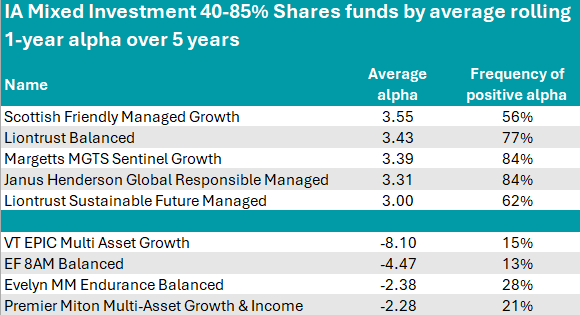

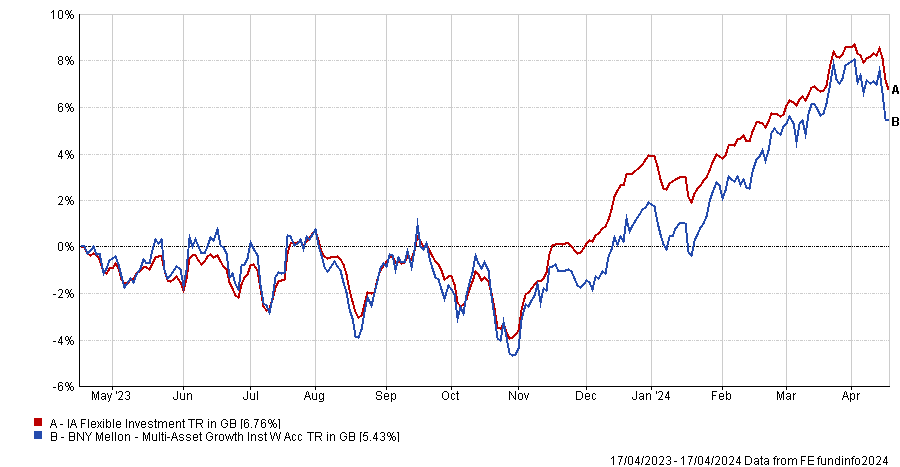

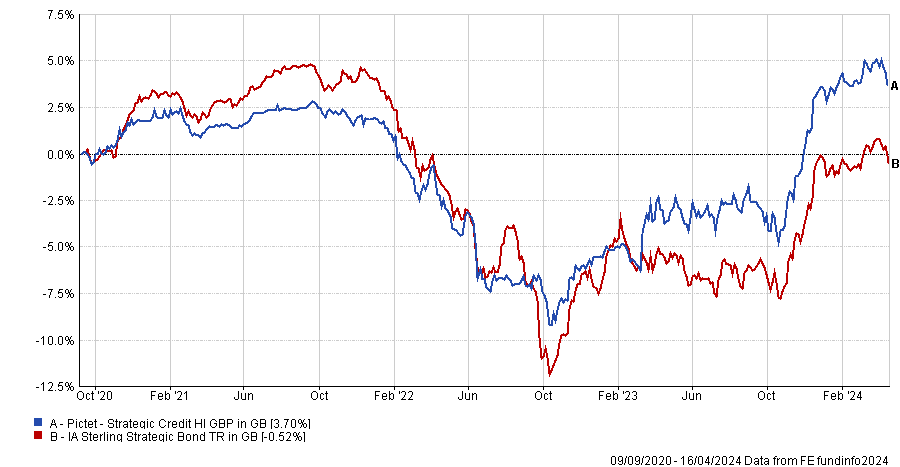

Liontrust’s multi-asset strategies have led the pack for the past five years.

Liontrust Asset Management beat its multi-asset competitors by having the most balanced and adventurous strategies that consistently outperformed during the past five years, data from FinXL reveals.

Trustnet compared multi-asset funds by measuring their alpha – an indicator of a fund’s performance in excess of its benchmark that is often used by investors as a way to tell whether their funds have been worth their fees.