Financial advisers reveal their top choices for savers building up their pension pots and for retirees already withdrawing from their SIPPs.

Ruffer, Worldwide Healthcare and JP Morgan Global Income & Growth are among the best options for investors putting their pensions into investment trusts, according to IFAs.

There are typically two stages to pensions: the accumulation (or wealth building) phase where those yet to reach retirement are trying to increase their pot as much as possible; and the withdrawal phase for people who have finished work and are relying on their savings for income.

This tax year, savers can put up to £60,000 into a self-invested personal pension (SIPP), an increase on the £40,000 available 12 months ago, and can carry forward any unused allowances over the past three years.

As such, now may be a good time to consider what to buy. Below, financial advisers give their favourite investment trusts for each of the two stages of pensions.

The accumulation/wealth building phase

People with a long time horizon until retirement can consider taking more risk and investing in trusts that should grow over the long term, even if they experience short-term wobbles.

As such, Philippa Maffioli, senior investment manager of Blyth-Richmond Investment Managers, said growth and diversification during this period are crucial.

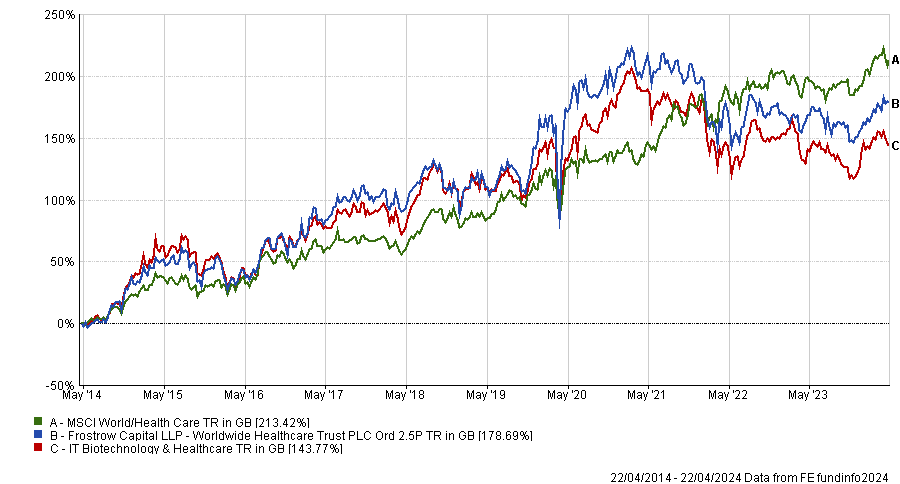

She suggested Worldwide Healthcare Trust, which gives investors exposure to pharmaceutical, biotechnology and other related healthcare companies ranging from multinational brands to unquoted companies.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund is managed by OrbiMed Capital which was founded in 1989 and has become the largest healthcare investment firm in the world. The team is actively looking at nearly 1,000 companies and works to identify sources of outperformance, as well as those with underappreciated products in the pipeline with high quality management teams and strong financial resources,” she said.

Another option with a broader remit is Monks Investment Trust, managed by Spencer Adair and Malcolm MacColl from Baillie Gifford.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“Their aim is to focus on global companies from a range of profiles with above average earnings growth, which they expect to hold for around five years,” Maffioli said, although noting that they “address issues head on and aren’t afraid to take a critical look at their portfolio when necessary”.

For those unwilling to take such big bets on styles or themes, Chancery Lane chief executive Doug Brodie suggested trusts with long track records of outperformance such as Lowland, Murray International and City of London, which he said have “handsomely” beaten the FTSE All Share over 20 years. However, it is worth noting that Murray International is a global portfolio while the other two are UK focused.

Performance of trusts vs FTSE All Share index over 20yrs

Source: FE Analytics

“Investment trusts may not have the sales and marketing budgets of pension companies so investors have to look a bit harder. A quick look at the long-term returns will show folk there’s a good reason that institutional investors are big investors in trusts,” Brodie said.

For more tactical investors, Paul Chilver, associate and financial planning manager of Birkett Long IFA, suggested concentrating on trusts currently on a discount – of which there are many.

“Discounts are particularly attractive on UK-focused investment trusts and one suggestion for the accumulation stage of investment is the Mercantile Investment Trust managed by JPMorgan, which has been at a double-digit discount for many months despite very good short-term performance,” he said.

The decumulation/withdrawal phase

People already in retirement have to marry two competing issues. The first is to make sure that their investments continue to grow so they do not run out of cash, while the other is to withdraw money to help them make up the shortfall from a lack of earnings.

To balance this, Neil Mumford, chartered financial planner of Milestone Wealth Management, suggested the Scottish American Investment Company, known as SAINTS for short.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“This is my choice for someone looking at building either an income or growth portfolio and is a top five holding in my own SIPP. I am still accumulating but it will stay once I am drawing down,” he said.

“It is a truly diversified equity portfolio, spread equally between the US and Europe at around 35% each of the portfolio. Although it doesn’t have the highest yield at 2.9%, this dividend hero has increased its payouts by an average of 4.2% a year over the past five years and this dividend increase has not hampered its ability to grow capital – a total return of more than 170% over the past 10 years should please any investor.”

Now could also be a good time to get in as the share price is a “complete bargain”, trading at a discount of 10% to the trust’s net asset value.

More defensive investors might prefer the Personal Assets Trust or Ruffer Investment Company, said Maffioli, which both focus on capital preservation.

The former, managed by Sebastian Lyon and Charlotte Yonge, “offers global diversification across four asset classes and is a bedrock for lower risk and/or decumulating portfolios,” she said.

Ruffer meanwhile uses a “very disciplined approach”, aiming to maintain value over one year and grow capital incrementally over the longer term. “This means they would perceive a loss in line with the market as a failure,” Maffioli noted.

A trust for both?

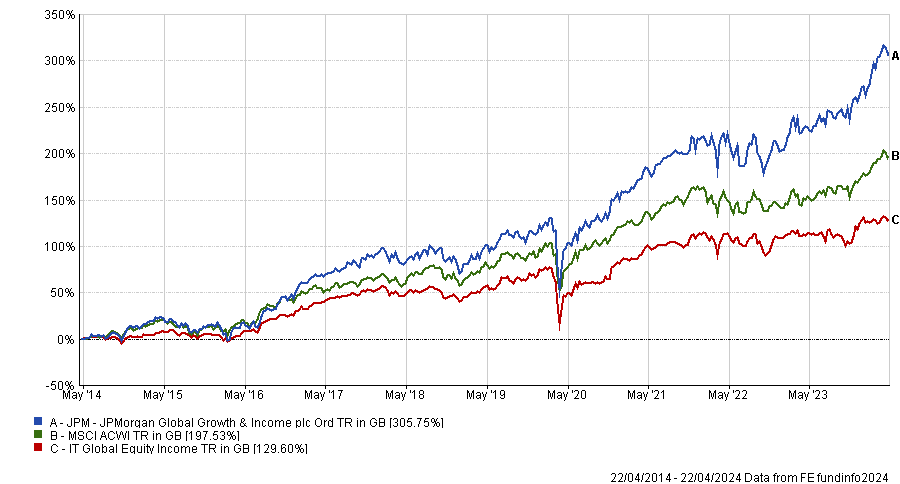

One trust that appeared in the recommendations for both phases was JPMorgan Global Growth & Income Trust. Mumford said it was a strong option for those looking to build their wealth, as it invests predominantly in the high-growth US market, which makes up two-thirds of the portfolio.

“It is a high conviction portfolio with 50 to 90 holdings, with the top 10 making up more than 40% of the portfolio. This has allowed it to outperform by some margin with a 305% return over the past 10 years,” he said.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

It is one of the few trusts trading on a premium at present, but this should not concern long-term investors, Mumford noted, adding it is “ideal” for regular monthly investments.

Chilver meanwhile highlighted the trust for those in the decumulation stage of their pension, noting that its 3.4% yield makes it attractive, despite its high weighting to the typically lower yielding US market.

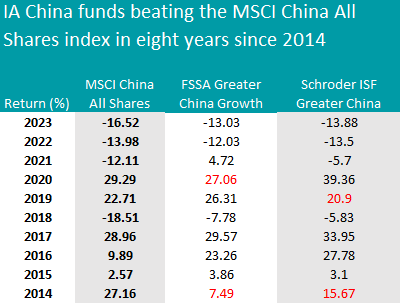

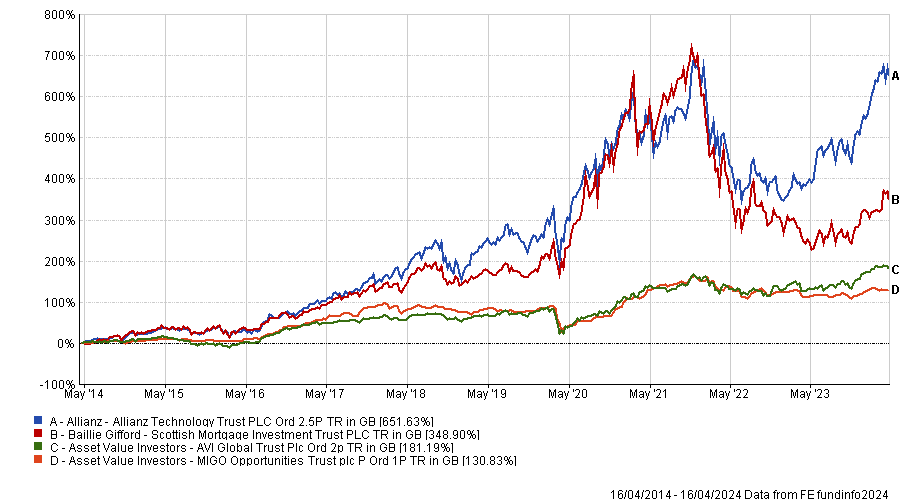

Passive exposure to EMs isn’t likely to give investors what they are actually looking for…

Last year returns in US equities were driven by an exceptionally concentrated group of companies. Close to 70% of returns in the S&P 500 came from just 10 stocks. A consequence of this was only 28% of companies outperformed the benchmark.

Overexuberance around AI stocks was partly responsible for this. However, another argument is that this is also being driven by passive flows, which are fuelling a giant momentum trade.

The US is less than 20% of global GDP but almost 70% of stock market value, with increasing allocations to market cap weighted passive funds driving this process.

Whatever the case, the US is not alone in being subject to the malformations that indexing can cause. Emerging markets (EMs) today are a prime example and are arguably increasingly unattractive to access via passive funds because of the manner in which indices are constructed.

This is true for a couple of key reasons. One is that China, although down from its near 50% weighting, remains predominant in emerging market indices, making up just over a quarter of the value of the MSCI Emerging Markets Index at the end of March.

Although there are still attractive opportunities in China, there is lots of political risk, both as it pertains to internal policy making and to relations with the US. The result is that many investors want to minimise their exposure to the country, whereas the index continues to give it a large weighting.

Another factor is that index rules mean that the emerging market index is now dominated by countries that arguably don’t offer the sorts of traits that investors are looking for – namely the potential for large-scale GDP growth and returns that are less correlated with developed markets.

For example, Taiwan and South Korea constitute close to 30% of the MSCI Emerging Markets Index combined. Both countries have per capita incomes and living standards that are on par with, or even surpass, what we would think of as the developed economies.

Moreover, their constituent companies – firms such as TSMC and Samsung – are deeply intertwined with the global economy. This means there is less opportunity for an endogenous growth story and a strong likelihood that returns are going to be correlated with stock markets in developed economies.

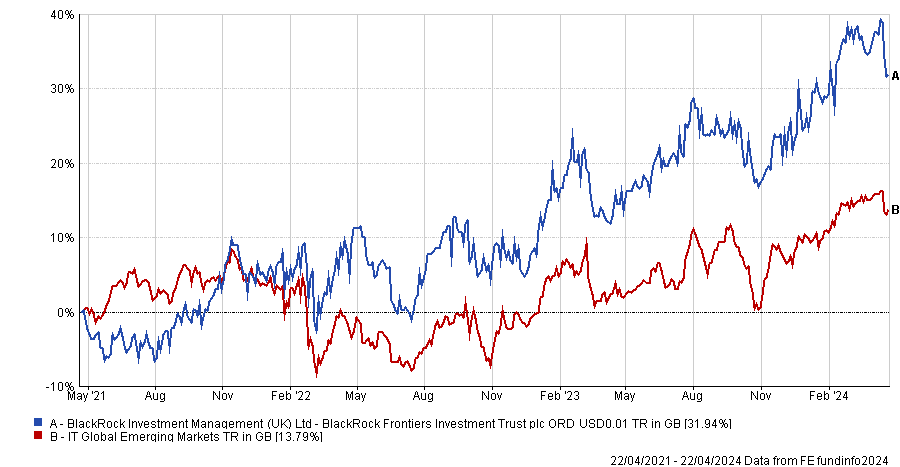

One trust that arguably provides an attractive counterbalance to this is BlackRock Frontiers. The trust’s investable universe takes both emerging and frontier markets. However, it the eight largest countries from the EM index.

The result is that the trust provides exposure to the sort of growth stories that EM investors are typically looking for, as well as meaningful diversification. The proof has been in the pudding in this regard over the past three years, as the trust has delivered both meaningful outperformance as well as returns that look very different from those in developed markets.

Total return of trust vs sector over 3yrs

Source: FE Analytics

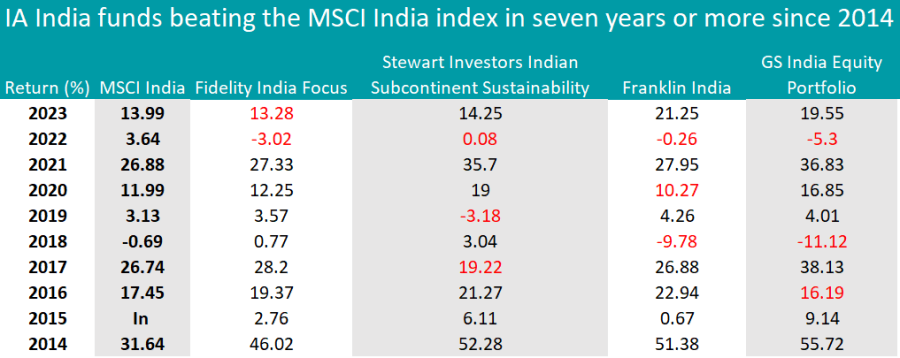

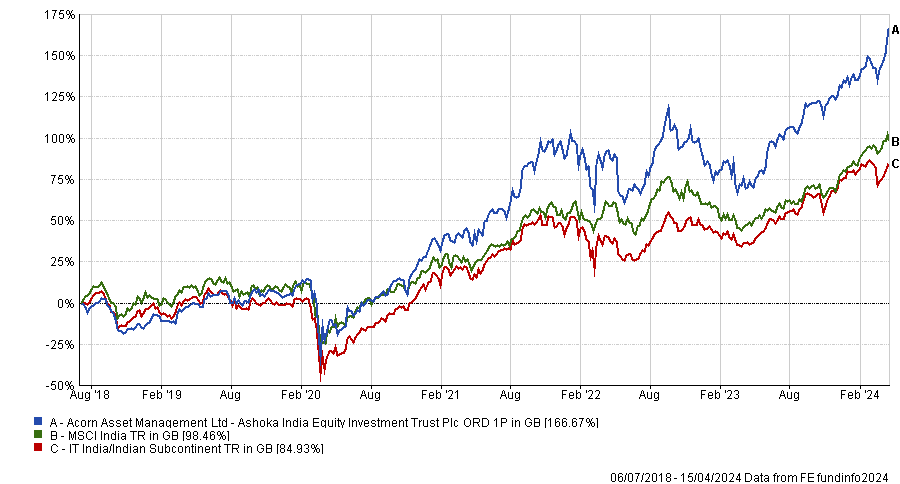

Another way of playing the emerging market theme is to invest in country-specific trusts. Ashoka India Equity may appeal here, in large part because of its fee structure. The trust charges no management fee, with a performance fee of 30% paid on any outperformance delivered against the benchmark over a three-year period instead. Half of that fee is paid in shares, which are locked up for a further three years.

Whether or not this has been the causal factor, the trust has been the best performer in its peer group since IPO in 2018, having delivered annualised returns of close to 20% to the end of March this year. It has also been one of only a small number of closed-ended funds to issue new equity over the past 12 months.

Vietnam Enterprise Investments is another country specialist and one of the only closed-ended funds that provides investors with dedicated exposure to Vietnam.

The country’s stock market has seen a downturn over the past couple of years. However, the wider macro picture remains strong, with FDI rising year-on-year by 32% in 2023 and GDP growth projected to exceed 6% in 2024.

That reflects a variety of trends, including increasing investment in infrastructure and companies moving manufacturing to a country that offers cheaper labour and is seen as more secure than China.

Like BlackRock Frontiers, it’s also worth noting that the countries Ashoka India Equity and Vietnam Enterprise Investments invest also offer the sort of GDP growth, driven more by domestic factors, that investors in EM are usually looking for. An index won’t give you that…

David Kimberley is an investment trust writer at Kepler Partners. The views expressed above should not be taken as investment advice.

The ‘Granolas’ have made lower returns but been far less volatile, research shows.

Top US stocks dubbed the ‘Magnificent Seven’ have been on a stratospheric rise over the past few years on the back of investor enthusiasm for artificial intelligence (AI), but there is a new acronym on the other side of the Atlantic: Granola.

While the US group consists of Apple, Alphabet (Google’s parent company), Amazon, Meta, Microsoft, Nvidia and Tesla, Granola is a list of 11 European companies.

Graham Smith, an investment writer at Fidelity International, said: “Like the Magnificent Seven in America, Europe’s Granolas have spearheaded a major surge in stock markets over the past year. That spells strong structural themes coupled with higher-than-average valuations.”

List of 'Granola' stocks

Source: Fidelity International

The Granolas are among the largest companies in Europe and have performed well over the past few years as investors have favoured quality large-cap names. Together they account for around 20% of the European market, slightly below the Magnificent Seven’s weighting in the S&P 500 index.

While tech dominates the Magnificent Seven, the Granolas are a combination of global leaders in sectors as diverse as pharmaceuticals, beauty and food.

One major difference is the size of the companies. Tesla is the smallest of the Magnificent Seven – less than half the size of the next-closest. Yet with a market capitalisation of $500bn it is larger than all the European Granolas, the most valuable of which is pharmaceutical giant Novo Nordisk, valued at around $430bn.

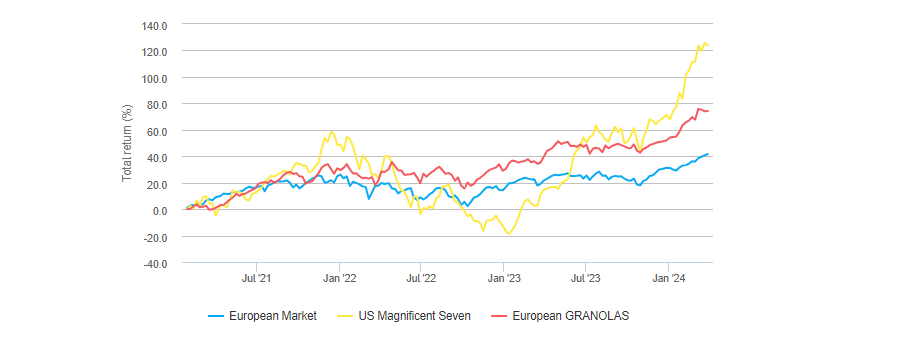

Looking at performance, it should be unsurprising that the US block has significantly outperformed in recent years. Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said: “Since the start of 2021 both groups have performed well and returns have moved broadly in line with each other. But the gap’s widened since the start of 2024. That’s largely thanks to NVIDIA which has benefited from the AI boom.”

However, he noted that this has led to a valuation dispersion. The Magnificent Seven have an average price-to-earnings (P/E) ratio of 44.5x compared to the Granolas’ 30.7x, meaning the market has put higher expectations on the US companies, “demanding a higher rate of future growth”.

Performance of stocks over 3yrs

Source: Hargreaves Lansdown

While investors should not ignore the Magnificent Seven as their “dominance is likely to persist”, neither should they neglect the opportunities in Europe’s largest companies.

They offer diversification as well as lower valuations and can help to smooth out returns, Chiekrie said, as the European stalwarts have been less volatile than their US counterparts.

But not all of the Granolas were created equal and Chiekrie highlighted three that are of particular interest. First was ASML – the only tech name among the European cohort. The firm makes lithography machines, which are integral for the production of microchips.

“With the AI boom fuelling demand for the most powerful kind of chips, ASML finds itself essentially selling the picks and shovels in an AI gold rush. The group’s revenue and operating profit jumped around 30% and 39% respectively in 2023,” he said.

UK-based GSK is another on the list. The pharmaceutical company spun off its consumer division last year into Haleon. Instead, HIV medicines and vaccines have proven to be the main areas of interest, with Chiekrie noting the firm’s “strong clinical pipeline” as particularly interesting.

However, GSK’s valuation is much less demanding than its peers, perhaps in part due to questions over cancer links to its heartburn drug, Zantac, with a key legal hearing underway.

“Markets are expecting settlement to be the most likely outcome,” the Hargreaves Lansdown analyst said, noting that investors in the stock might be in for a “bumpy ride” but could be rewarded if they “ride out any possible storms”.

Chiekrie’s final pick was LVMH, the fashion retailer behind brands such as Louis Vuitton, Christian Dior, Givenchy and TAG Heuer.

“The group’s performance has been commendable in recent years, far outpacing the broader market [yet] the valuation is broadly in line with its long-run average of around 23.3x times forward earnings,” he said.

“Compared to peers, that’s middle of the pack. To us, it suggests that not all of the group’s strengths are currently priced in, and could offer an attractive entry point. However, of course, there are no guarantees.”

For fund investors, Smith noted that the passively managed Vanguard FTSE Developed Europe ex UK fund “naturally” provides exposure to nine of the 11 Granolas, with the exceptions being GSK and AstraZeneca, which are both UK-listed.

It is one of three European equity funds on Fidelity’s Select 50 list, the others being Comgest Growth Europe ex UK and Schroder European Recovery.

Comgest’s fund has ASML and Novo Nordisk as its top two holdings, together accounting for around 15% of its portfolio. LVMH sits in eighth. It is managed by FE fundinfo Alpha Managers Alistair Wittet and Franz Weis, alongside James Hanford.

“The Schroder European Recovery fund is understandably structured rather differently with just one Granola – Sanofi – in its top-10,” Smith said.

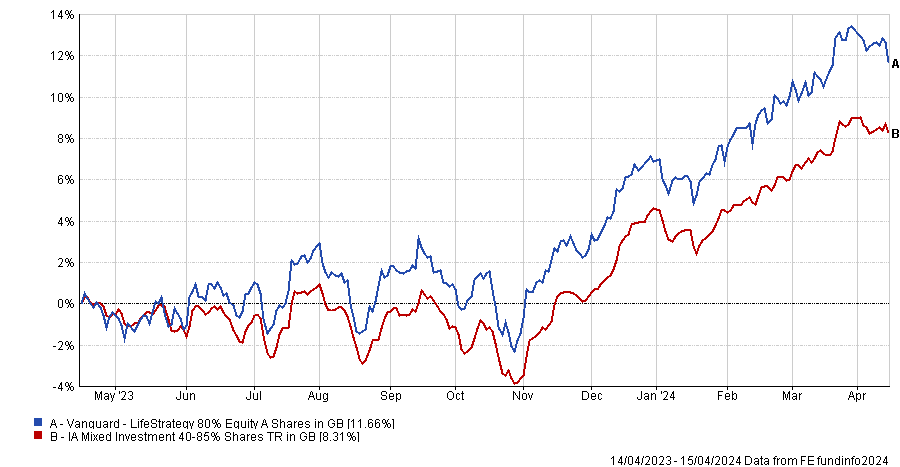

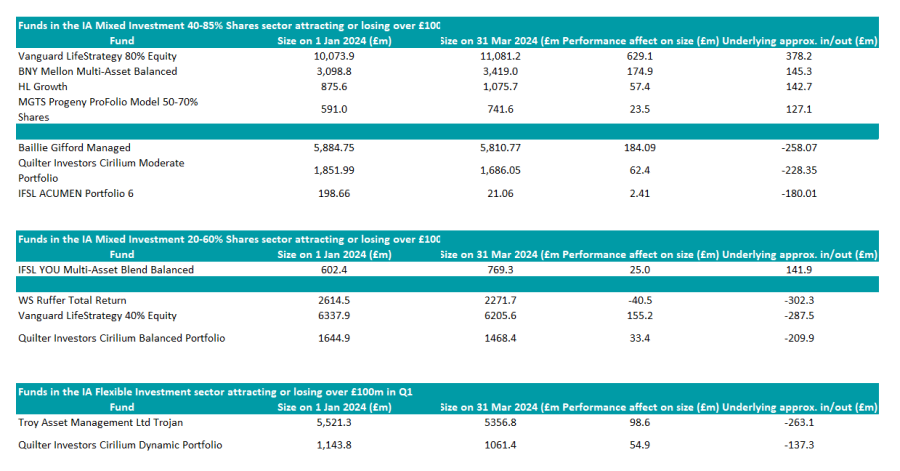

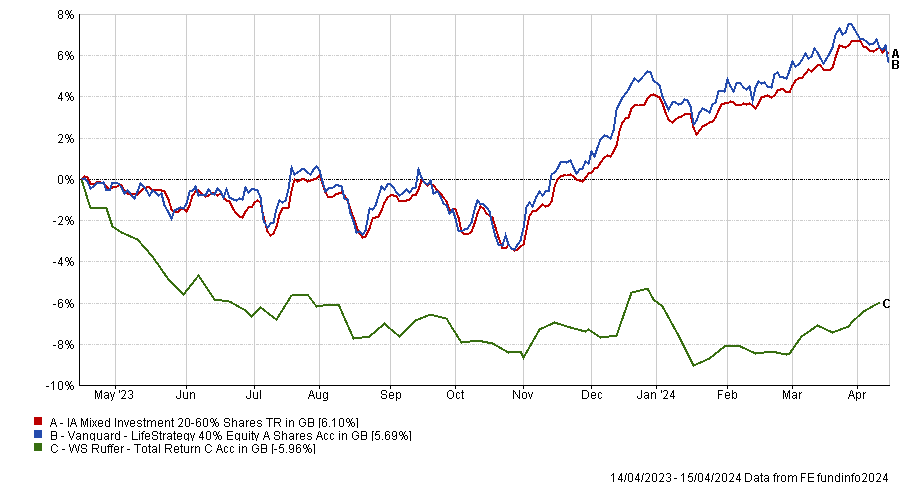

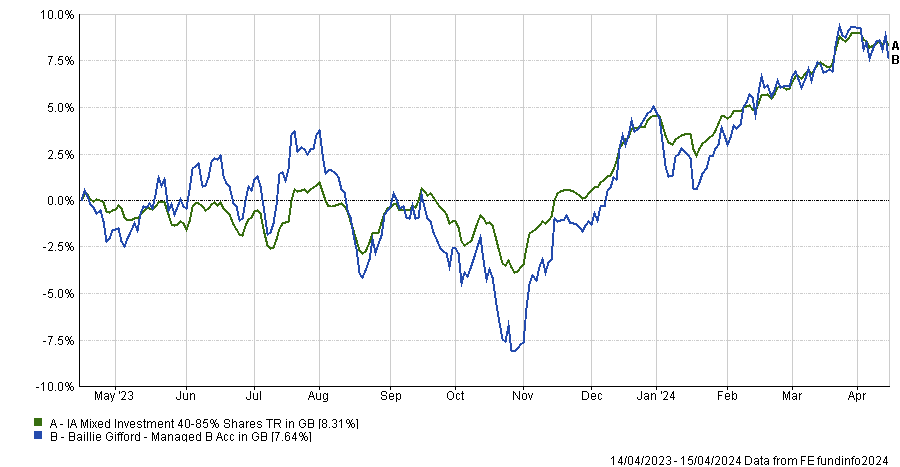

The fund management group has haemorrhaged money in the first quarter of 2024.

Both Hargreaves Lansdown and AJ Bell have dropped previously recommended Jupiter funds from their best-buy lists following the departure of veteran stockpicker Ben Whitmore.

Hargreaves, which had previously included both the Jupiter UK Income and Jupiter Global Value Equity funds in its Wealth List, took the decision to remove both.

The former has been taken over by Adrian Gosden and Chris Morrison, who joined Jupiter from GAM at the start of the year.

Senior investment analyst Joseph Hill noted that while the pair have a long track record and are “capable” and “experienced”, he reiterated that Hargreaves’ conviction had been with Whitmore.

“We don’t currently have the required conviction in them to remain on the Wealth Shortlist running this larger company biased fund,” he said.

Hill noted that the new duo are also value investors but they have historically invested more in smaller and medium-sized companies, which are higher risk than the larger firms preferred by Whitmore.

“The style the fund offers investors is one we feel we have well covered in our UK Equity Income fund selections on the Wealth Shortlist, where we have higher conviction in other managers. Jupiter Income will remain under research coverage and we will be updating clients of changes under the new management in due course,” Hill concluded.

Turning to Jupiter Global Value Equity, the plan is for the fund to remain under Whitmore’s control once he has set up on his own with the launch of Brickwood Asset Management.

Jupiter plans to hire Brickwood to run the fund on a sub-advisory basis, meaning it would remain under the manager and his team.

However, investment analyst Aidan Moyle said: “Running [the fund] on a sub-advisory basis causes additional complexity from a governance perspective.”

Hargreaves Lansdown looks at fund groups through multiple lenses, evaluating people and culture, governance, investment risk and oversight, compliance and audit, operations and portfolio management and the business’ financial strength.

“As things stand it’s unclear whether the new business would meet the required standards in these areas, for either Jupiter or Hargreaves Lansdown,” Moyle said.

“Jupiter has also not yet confirmed this is the direction it will take for the fund. As a result of this continued uncertainty, we have taken the decision to remove the fund from the Wealth Shortlist.”

The firm noted, however, that this was not a recommendation for investors to sell either fund at this time. “Investors should make sure any investments match their investment goals and attitude to risk and are held as part of a diversified portfolio. If you're not sure if an investment is suitable for your circumstances, please seek personal advice,” said Moyle.

Meanwhile AJ Bell has removed Jupiter UK Special Situations from its best-buy list, after it was announced former JOHCM UK Dynamic manager Alex Savvides would be moving over to take charge of the fund.

The firm had previously removed the JO Hambro fund from its list in October 2023 to “consolidate” its UK equity fund recommendations.

The news comes after Jupiter announced investors had withdrawn a net £1.6bn from the firm in the first quarter of 2024, with the majority (£1.1bn) being pulled from Whitmore’s funds. The departure of Chrysalis Investments and its managers Richard Watts and Nick Williamson, who are leaving Jupiter to focus full time on the trust, led to an £800m reduction in Jupiter’s assets under management (AUM)..

Group AUM rose however to £52.6bn after positive market movements contributed £2bn to its AUM.

Domestic equities look poised to continue their strong run on the back of attractive valuations, sterling weakness and potential monetary policy divergence.

The FTSE 100 reached a record high at yesterday’s market close of 8,023.87, surpassing its previous zenith of 8,014.31 on 20 February 2023. It gained 1.62% on Monday 22 April 2024, up from last Friday’s close of 7,895.85.

David Cumming, head of UK equities at Newton Investment Management, believes that the domestic equity market has further to run and is on the verge of “a new dawn”.

“The new market high has been a long time coming but despite the global uncertainty this has the potential for being a new dawn, rather than a short-term blip. The UK is cheap, relative to other markets, while relative trends in commodity prices and interest rates now favour the UK’s company mix as the global tech rally fades,” he said.

“For the UK consumer, in the near term things are looking up – with recent tax cuts, lower inflation figures and rising earnings. Retailers such as Tesco, with exposure to these trends, were notable upward gainers yesterday. The recent rise in bid activity is a further positive valuation signal for the FTSE.”

Currency weakness has played a part in the UK stock market’s performance, boosting sterling-denominated profits for companies with substantial overseas revenues.

If the Bank of England cuts rates before the US Federal Reserve, monetary policy divergence will probably push the pound even lower, said Lindsay James, investment strategist at Quilter Investors.

“With economic growth still lagging many of its G7 peers, the UK has turned this to its strength in the fight against inflation, which last month fell below that of the US and saw governor Andrew Bailey announce that this data shows the UK is ‘pretty much on track’ with the central bank’s forecasts,” she said.

“This has led investors to anticipate that rate cuts could arrive in the UK well before the US, weakening sterling by just over 3% against the dollar so far this year, and continuing a long running trend that has seen the pound decline more than 25% against the dollar in the past decade, a period over which the FTSE 100 has delivered only around a quarter of the returns generated by the S&P 500.”

Performance of FTSE 100 vs S&P 500 over 10yrs

Source: FE Analytics

James concluded that sterling weakness could propel the FTSE 100 to continue its upwards trajectory. “With the bulk of FTSE 100 company earnings generated internationally, this currency weakening conversely benefits UK-based investors as those earnings have risen in sterling terms, offering some relief in the story of long-term underperformance of the home market relative to Europe and the US,” she explained.

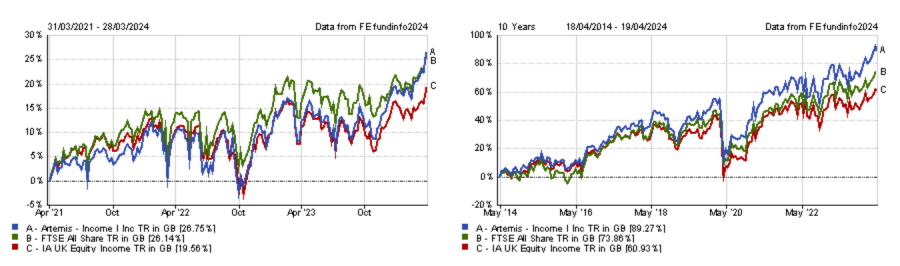

Trustnet looked for funds in the IA UK Equity Income sector that have been managed by the same person since 2004 or earlier and have achieved top-quartile returns over the past three years.

Few seasoned fund managers are able to stay ahead of the competition for extended periods of time. They might live off their previous track records or fall behind newer managers with fresher ideas.

Yet Artemis’ Adrian Frost, who has been managing Artemis Income since 2002, has achieved that rare feat of beating his peers during the tumultuous market conditions of the past three years, bringing to bear his experience garnered during a 22-year track record.

Trustnet researched which funds have been managed by the same person for 20 years or more and have produced top-quartile returns over the past three years. Artemis Income is the only strategy in the IA Equity Income sector to tick both boxes.FE fundinfo Alpha Manager Frost was joined by Nick Shenton in 2012 and Andy Marsh in 2018. Over the three years to 31 March 2024, the trio made 26.8%, with Artemis Income ranking 13th out of 73 in its sector in terms of performance.

Frost, Shenton and Marsh look to grow both income and capital over five-year periods by focusing on free cash flow, as they believe this metric determines a company’s ability to grow its dividend.

Analysts at Square Mile said: “In general, this approach guides the managers towards robust companies and can help highlight the potential risks in their business models.

“The fund has been designed to generate a yield in excess of the market, but the managers will not unnecessarily place capital at risk in order to achieve this, which is in keeping with the managers' total return aspirations.”

The fund has also done well over longer timeframes and sits in the top-quartile of its sector over 10 years and 15 years.

Moreover, Artemis Income’s Sharpe ratio over those periods has been among the best in the sector, suggesting that the amount of risk taken was worthwhile.

In terms of volatility, the fund has been less turbulent than many of its competitors over the long term, but fell into the third quartile on that metric over three years.

Performance of fund over 3 years and 10 years vs sector and benchmark

Source: FE Analytics

One concern highlighted by Square Mile analysts is the size of the fund, which may be a consequence of the successful longer-term track record.

Yet, the £4.5bn of assets under management might not be too much of an impediment, as Frost and his colleagues tend to focus on large-cap stocks. For instance, the fund’s top 10 holdings include FTSE 100 constituents such as 3i Group, London Stock Exchange Group and GSK as well as some overseas large-caps such as Amsterdam-listed information services company Wolters Kluwer.

Due to Artemis Income’s ‘conservative’ approach to investment, analysts at RSMR suggested using the fund as a core holding.

Previously we looked for funds with veteran managers at the helm that have outperformed for the past three years in the IA UK All Companies and IA UK Smaller Companies sectors.

Experts pointed to future economic security, defence, demographic divergence and affordable healthcare.

Investors have been well rewarded for identifying the rise of artificial intelligence (AI) as a dominant investment theme but AI is not the only game in town. Other mega-trends will come to the fore during the next 10 years as geopolitical risk rises, populations in developed countries age and healthcare systems around the world become overstretched.

Below, experts highlight the themes investors should monitor in the coming years.

Future economic security

The pandemic brought to light the interdependence and over-concentration of global supply chains, making them vulnerable to external shocks. For instance, 80% of industries suffered from supply chain disruptions during the Covid-19 pandemic.

Moreover, recent geopolitical tensions have highlighted the risks to supply chains in critical technologies and resources, such as semiconductors, energy and key basic materials.

As a result, the US, European Union and Japan have already invested more than $190bn in semiconductor research, development and manufacturing to diversify and onshore supply chains.

Based on those dynamics, Luke Barrs, global head of fundamental equity client portfolio management at Goldman Sachs Asset Management, identified “future economic security” as the investment thematic of the coming decade, which he divides into three sub-themes: supply chain security, resource security and national security.

He said: “With security threats growing in magnitude and complexity, this is driving the need for the latest defence and cybersecurity solutions.

“As a result, there is an opportunity to invest in the beneficiaries of governments and corporations investing in their future economic security.

“We are seeing the upside of this investment reflected in the earnings of companies in critical industries, such as chip manufacturing, as well as companies benefiting from increased investment in domestic manufacturing capacity.”

This theme enables investors to combine value sectors such as industrials and energy with growth-oriented companies in areas such as technology, he added.

Defence

The surge in geopolitical tensions has put an end to the ‘peace dividend’ that the world – including investors – had benefited from since the end of the Cold War.

After the fall of the Berlin wall, governments made large-scale cuts to their defence budgets as geopolitical risk subsided.

Since the outbreak of the war in Ukraine, however, they have been ramping up military spending.

Tom Bailey, head of research at HANetf, said: “From Europe to Asia, new big spending packages have been announced, while national defence strategies have been rewritten.

“One particular area of focus is European NATO members. The declines in European defence spending post-Cold War resulted in many European countries falling short of the 2% of GDP defence spending target, set by NATO. These cuts have left European military inventories troublingly low.

“Following the 2022 invasion of Ukraine, the need to address this has become apparent to governments across the continent.”

To tackle this issue, Germany has announced a €100bn spending package to accelerate its modernisation, while Poland has committed to spend over 4% of GDP on defence.

For Bailey, key beneficiaries of this uptick in spending will be the big European defence firms such as Rheinmetall, Leonardo and BAE Systems.

Demographic divergence

Around the globe, life expectancy is increasing while birth rates are declining in most developed markets as well as in China. This means that populations are getting older while the number of people of working age is shrinking.

Wei Li, global chief investment strategist at BlackRock Investment Institute, said: “This poses an economic challenge; all else being equal, a shrinking workforce means an economy cannot grow as fast.

“Demographic changes – and their effects – will vary across countries, and the dispersion of outcomes will create plentiful investment opportunities.”

In many emerging market countries, the working-age population is still growing, giving them an economic advantage that could lead to outperformance if they can capitalise on demographic trends by improving workforce participation and investing in infrastructure.

“We think higher returns could be on offer in countries with greater demand for investment, such as India, Indonesia, Mexico and Saudi Arabia,” she said.

Another area Li pointed to is healthcare in the US and Europe.

Affordability of healthcare

Chris Eccles, portfolio manager at AXA Investment Managers, highlighted the issue of affordable healthcare, as medical systems around the world are stretched and in many cases at “breaking point”.

He referred to recent figures from the US Treasury Department showing that the unfunded liability for Medicare – the federal health insurance programme in the United States – over the next 70 years stands at $175trn.

He added: “To bring this into more immediate terms, Medicare Part A – which is the part of the US Social Security healthcare system that pays for hospital bills for Americans over age 65 – is unfunded beyond 2028. That's four years away.”

However, this issue does not only affect the public side of the healthcare system, but also the private and commercial sectors.

Referring to research from the Kaiser Family Foundation, Eccles pointed out that nine out 10 employers in the US believe their healthcare costs will become unsustainable in the next five to 10 years.

Meanwhile, he noted that patient outcomes are “far too often sub-standard”.

“Something has to be done, it's an absolute imperative. The healthcare system must do better for less,” Eccles said.

“In that sense, affordability and innovation are at the centre of how we think about opportunities and risks across our investment space.

“We're trying to select companies that are either solution providers or beneficiaries as we shift towards a more sustainable healthcare system.”

While this thematic affects the healthcare system as a whole, he stressed that it is manifesting itself in different ways through the different sub-sectors.

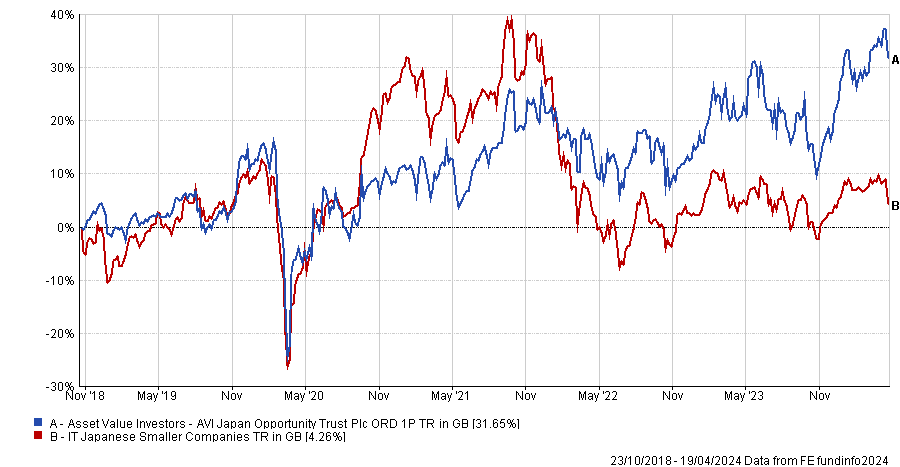

The fund will be managed by Joe Bauernfreund.

Asset Value Investors (AVI) will launch a new Japan Special Situations fund with Joe Bauernfreund at the helm, the firm has announced today.

The manager of the existing £177.5m Japan Opportunity Trust said the decision will address the “significant demand” for a UCITS version of the closed-ended company launched in 2018.

Since then, the portfolio has proved successful and was the top-performing trust in the three-strong IT Japanese Smaller Companies sector over five years and second-best over three years and 12 months. Since launch, it made a 31.6% return against the sector’s average of 4.3%, as the chart below illustrates.

Performance of fund against sector and index since launch

Source: FE Analytics

Bauernfreund will be supported by AVI’s six-strong Japan-dedicated research team and employ the same bottom-up, research-driven approach of the trust, engaging with companies to unlock hidden value.

The portfolio will be concentrated in 25-35 companies and charge a 1% ongoing charges figure (OCF).

Bauernfreund is optimistic about the macro-economic environment in Japan.

“The weak yen makes Japan highly cost-competitive, both for tourism and manufacturing. Inflation has returned after a 40-year absence and, with wage growth and increased spending, we could see a more rational allocation of capital and improved productivity, which would bode well for our portfolio companies,” he said.

“For sterling-based investors the yen has been a significant headwind over the past 10 years, but Japan’s central bank abandoning its yield curve control will enhance the returns on offer on the country’s debt, leading some investors to forecast that a ‘great repatriation’ of Japanese investment flows is set to accelerate.”

The market has been gaining momentum recently with a number of managers bullish on the opportunities going forward.

Bauernfreund’s AVI Japan Opportunity trust was also recently flagged by head of investment companies at QuotedData James Carthew (alongside JPMorgan Japanese) for investors seeking exposure to Japan’s improving corporate governance and rising stock market.

Investing in the healthcare sector offers protection against the possibility of an economic downturn as well as diversification away from the hottest parts of the market.

Ignoring the healthcare sector has been easy to do over the past couple of years, even though the case for owning it has never been stronger.

Part of the reason the healthcare sector has been overlooked is due to the financial volatility caused by the Covid-19 pandemic. Some companies benefitted from increased demand for their products and services during the dark days of 2020-2021 and then lost out as (thankfully) the pandemic subsided. Others lost out and then benefitted, as patients returned to their doctors for more routine healthcare needs.

Over the past couple of years, many healthcare companies have been labelled as ‘too difficult’ due to the challenges of determining their financial standing. This includes assessing whether they were on the positive or negative side of the ledger, and predicting when ‘normal’ demand might re-emerge.

Time and patience have been necessary to reveal the answers. As we move through 2024, the fog of uncertainty is starting to lift, providing a clearer perspective. It is now widely accepted that a fair picture of Covid-adjusted trend growth can be obtained by combining two years of pre-pandemic growth rates, two years during the pandemic, and two years post-pandemic.

Even if the healthcare sector has endured a difficult 2022-2023, we will not be afraid to add to our positions in areas where we believe that the trend growth looks strong and sustainable, and the valuation attractive. Our holdings in the life science tools subsector, such as Danaher and Bio-Techne, are good examples.

Due to unprecedented post-pandemic destocking, a Chinese regulatory clamp down and a necessary return to more focused investments by the biotech industry, 2022 and 2023 have been difficult years. However, we believe that we are only in the very early stages of a new wave in scientific/medical advances – one in which a greater understanding of the human genome allows us to target new areas for medicines with artificial intelligence (AI) expediting the identification of treatments that are most likely to work. Consequently, the order books at Danaher and Bio-Techne could start to fill up quickly as we move into the second half of 2024.

A return to growth should allow the life sciences and tools subsector to recouple with (or even outperform) other growth sectors such as technology that consistently deliver high cash returns on investment. The tech sector quickly addressed its own post-Covid demand growth blip through very assertive cost cutting and the rise of AI.

Why take an umbrella when it is sunny outside?

It is also fair to note that economic conditions have remained better than many observers expected. In particular, labour markets have been tight – allowing positive real wages in many sectors and supporting consumer confidence.

Why increase your exposure to a relatively defensive sector like healthcare when the economy is purring, the US Federal Reserve is about to cut rates and we could enjoy the softest of soft landings?

Given the optimism observable at present, in terms of stock market levels and financial conditions, we do think that a bit of insurance makes sense – just in case interest rates do not come down as quickly as expected or if emerging pockets of economic softness grow in size.

Our most defensive holdings within healthcare all have stock-specific attractions that matter more to us than their average beta of 0.7.

Cencora, Elevance and Encompass Health are all expected to benefit from sustained, demographics-led demand growth; they also offer services that will be indispensable in lowering the cost of healthcare delivery.

Cencora stands to benefit from improved distribution dynamics as $200 bn worth of US prescription drugs lose patent protection over the coming five years, a change that will also benefit patients.

Elevance has embraced value-based care, tying the payments it receives as a healthcare insurer to the health benefit received by patients (and replacing the old, less efficient fee-for-service model).

Meanwhile, Encompass Health’s inpatient rehabilitation facilities are increasingly recognised as providers of the best quality post-acute care for patients. Often, they offer a more cost-effective solution compared to alternatives such as nursing homes or general hospitals.

You don’t want all your eggs in one (AI) basket

By staying invested in healthcare, it is not just the possibility of an economic downturn that we are protecting our clients’ capital against. The sector also offers welcome diversification from some of today’s most exciting parts of the market.

We are firm believers that the infrastructure for generative AI will be developed, even as we wait for the emergence of pivotal applications. We do not have to wait, however, for healthcare’s socio-economic necessity to be established.

We remain strong supporters of the healthcare sector. In addition to the well-known demographic drivers (ageing societies, rising prevalence of chronic illness, etc.), innovation is enabling structural changes in healthcare delivery and in our view, these changes will confer years of strong organic growth opportunities if we choose the right companies.

Greig Bryson is a portfolio manager, global equity at Nikko Asset Management. The views expressed above should not be taken as investment advice.

How to avoid concentration risk in the top-heavy index.

If you had to name a market that’s highly concentrated, you would probably say the US. With the vast success of technology companies in the past few decades (and more recently of the Magnificent Seven stocks in the past year) just a handful of businesses now make up most of the S&P500 index. To be precise, the top-10 companies represent just over 30% of the whole index’ weighting.

But you needn’t look across the ocean to find an example of concentration. The domestic market is even more top-heavy, with the FTSE 100’s biggest companies almost reaching 50%, as the chart below shows.

Concentration in top-10 stocks

Source: FTSE, Bloomberg, S&P Dow Jones, Rathbones; data as of 29 February 2024

This means that investors who buy the index are directing half of their money towards 10 companies only – Shell, Astra Zeneca, HSBC, Unilever, BP, GSK, Relx, Diageo, Rio Tinto and Glencore.

Such concentration is a very poor deal for investors, said Leigh Himsworth, FE fundinfo Alpha Manager of the Fidelity UK Opportunities fund.

“The main reason for investing in a fund is to not have all your eggs in one basket and spread the risk, but one does not necessarily achieve this by investing largely in 10 stocks,” the manager said.

“A reliance on a small number of stocks to drive returns can introduce biases in portfolios and increase risk – problematic, if the stocks start to underperform as happened post the bursting on the TMT bubble back in early 2000.”

On top of that, only seven sectors are represented – older industries such as oil, banks, pharmaceuticals, mining, beverages and consumer goods, with little or no exposure to exciting new areas of growth, Himsworth continued.

“Being larger also tends to suggest lower rates of growth, a feature that many investing in the market are seeking, especially in an index fund, and even worse, an index-fund investor compounds their own problem, as the fund will continue to buy into this.”

David Smith, manager of the Henderson High Income Trust, agreed the issue is more relevant for passive investors, while active managers can make decisions to invest not just based on market capitalisation, but on companies’ valuations and the fundamental outlooks for their businesses.

“This means we can underweight or completely avoid large stocks that we think are expensive provided it is within the risk tolerances of the fund,” he said.

“The concentration of the UK market is well recognised by UK fund managers who are accustomed to dealing with some of the challenges it poses with regards to portfolio construction and ensuring sufficient diversification.”

While this might be true, even active managers are having a hard time staying away from benchmarks. BNY Mellon UK Income co-manager Tim Lucas admitted that “there is generally a risk that asset managers look to manage their portfolios too closely to their benchmarks and thus risk total returns to investors”.

“A key to circumvent this is to have a large number of shares to choose from when constructing a portfolio and to be willing to deviate from the benchmark,” he said.

But this is becoming more difficult to achieve in an industry that’s being pushed into owning the same assets – not least for the career risk that derives from going against the grain, as IBOSS’ Metcalfe recently told Trustnet.

One option is for fund managers to put a proportion of the fund into off-benchmark holdings, such as overseas investments – which they are allowed to do. However, this comes with its own pros and cons.

Another issue is that fund managers must take enormous bets on some of the UK’s largest companies that they are in favour of, a problem highlighted by Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. She said it can be hard for active managers to even be at an equal weighting to the index.

“Doing so would mean jettisoning reasonable diversification and taking on huge risks that wouldn’t benefit investors. In some cases, it would nudge close to, or even exceed, regulatory limits on position sizes,” she said.

To mitigate these risks, Jackson is looking at the FTSE 250, where the 10 largest businesses account for just 11% of the UK mid-cap equity index so it’s well-diversified.

“I believe this makes it easier to spot quality companies flying under the radar. Many of these businesses are little known, with strong opportunities for growth both at home and abroad,” she said.

“And they seem cheap relative to their counterparts in other markets and when compared with the past, with sausage-maker Cranswick and fund administrator JTC being two examples”.

Lucas agreed, noting that he is seeing “a large number of choices all way through the FTSE 350”. “The limit in being able to invest in these shares is liquidity, meaning that investors should pay attention to make sure that the fund size is not too large. Very large funds are not easily able to invest in smaller companies without taking on more liquidity risk, if they invest exclusively in the UK,” he said.

Wealth managers discuss the merits of a purely bottom-up approach.

Many fund managers follow an entirely bottom-up approach without giving much weight to the macroeconomic environment in their investment decisions.

While not uncommon, especially among equity fund managers, this investment philosophy may raise questions from fund buyers, as companies do not operate in isolation.

For example, fiscal and monetary policies influence the wider economy, which, in turn, impacts companies.

Shakhista Mukhamedova, co-head of global manager research Europe at RBC Brewin Dolphin, said: “It is not sensible to ignore the macro environment, it is an additional source of information that could give you a better perspective – it’s like cycling with one eye closed, even if your bike is made by the best bicycle makers you still run the risk of riding into a tree.

“The majority of investors realise that no company operates in a vacuum and the macro environment will affect businesses, including those seen as traditionally defensive/non-cyclical.”

However, predicting the trajectory of the macro environment is, at the very least, complicated, if not impossible.

Due to the complexity of the task, David Morcher, head of collectives at Avellemy, understands why many fund managers do not give much importance to macro in their investment process.

Yet, there are a few macroeconomic considerations that he believes cannot be ignored, such as the general economic climate in the countries where a company operates or an analysis of the market sector and the competitive landscape to which a company belongs.

He added: “I would expect a bottom-up fund manager to consider the risks a corporate is exposed to and I would want to see evidence that this impacts their investment decision making, either through position sizing or within their investment thesis.

“If a manager genuinely expresses complete disregard for what is going on in the environment within which their companies are operating, then this would be a point of concern.

“However, if a manager pays due attention to external factors pertaining to their investments, yet shows no interest in forecasting or explaining the current macro environment or trends, but focuses on a company’s fundamentals, I am more sanguine.”

Meera Hearnden, investment director at Parmenion, feels more comfortable with ‘macro-agnostic’ managers, as she believes there is a place for both bottom-up and top-down strategies in a portfolio.

She explained: “As long as our fund managers stick to their beliefs and process and add value by doing what they say, then they should be afforded the flexibility to be bottom-up if they choose or adopt an approach that combines the two. We look for fund managers that can add value in different ways.

“We also look at how our funds in their respective asset classes blend together by style and market cap so that over the longer term there is no reliance on just one style of investing.

“Diversifying our portfolios in this way is what we believe will deliver consistently good risk-adjusted returns over the long term.”

While Hearnden sees merits in those different approaches, she expects more from bottom-up equity fund managers running very concentrated portfolios. She would expect them to know their business “like the back of their hand” and understand all the risks their investee companies are exposed to, such as balance sheet risk and management risk.

Another macroeconomic consideration she would demand from such fund managers is to have a clear idea of how a rise in interest rates will likely impact any of their businesses that have high levels of debt, as this could impact their earnings and profitability.

Hearnden said: “While interest rate movements would be considered a top-down factor on its own, inadvertently, this could be construed as a bottom-up consideration at an individual company level as a company’s debt and the interest on that debt is inextricably linked.”

In addition to managers running concentrated portfolios, she also highlighted that emerging market managers may “arguably” need to consider top-down factors, such as interest rates, exchange rates and geopolitics.

While a pure bottom-up approach may be acceptable for equity fund managers, Mukhamedova warned that it is a “red flag” for bond fund managers, as understanding the macro environment is crucial for them to make certain decisions.

Morcher also has higher expectations from bond fund managers when it comes to having a strong grasp of changing economic fundamentals.

He said: “I would expect them to have a view on dynamics such as central bank interest rate policy, as this will drive the attractiveness of future returns from large parts of their universe.

“With this in mind, I would expect them to regularly analyse such factors in a consistent manner to allow them to make investment decisions based on stable economic inputs.”

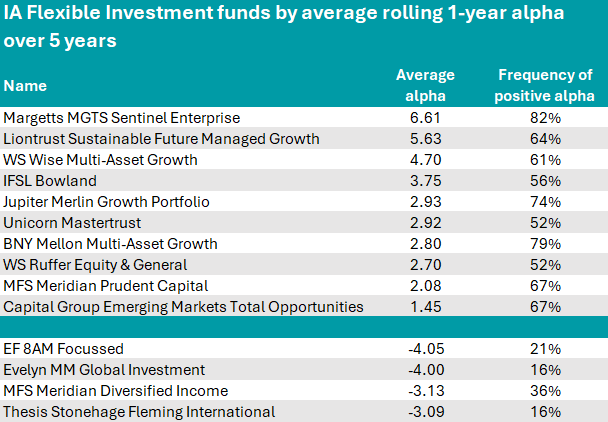

Liontrust’s multi-asset strategies have led the pack for the past five years.

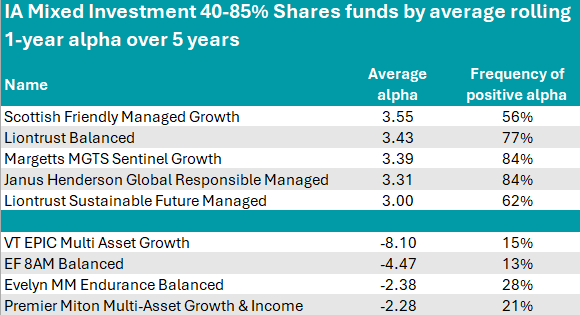

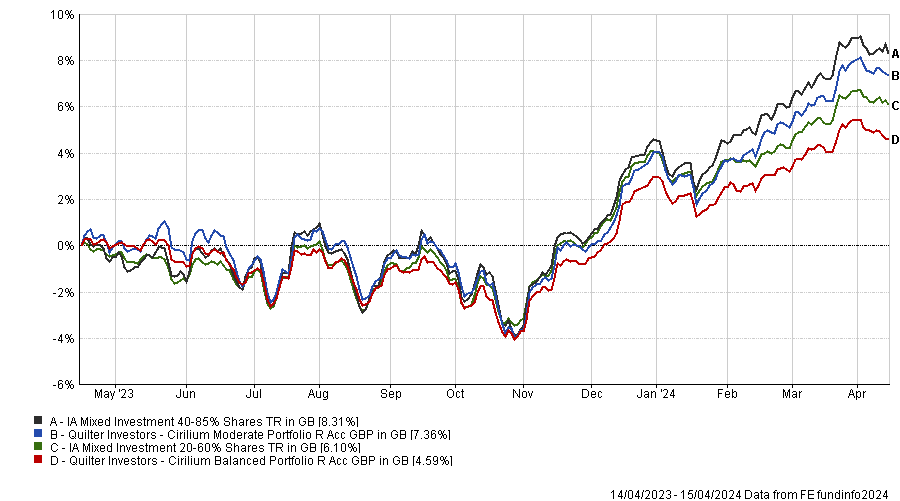

Liontrust Asset Management beat its multi-asset competitors by having the most balanced and adventurous strategies that consistently outperformed during the past five years, data from FinXL reveals.

Trustnet compared multi-asset funds by measuring their alpha – an indicator of a fund’s performance in excess of its benchmark that is often used by investors as a way to tell whether their funds have been worth their fees.

In the study below, we look at the IA Flexible Investment and the IA Mixed Investment 40-85% Shares sectors and highlight the constituents that have the highest 12-month average rolling alpha of the past five years, meaning that they outperformed their benchmarks in most of the 61 year-long periods that begin each month from January 2018 to December 2023.

In the IA Flexible Investment sector, where most funds measure their performance against the peer group average, the top vehicle was Margetts MGTS Sentinel Enterprise. This £105.2m portfolio had an average alpha of 6.61 and is led by FE fundinfo Alpha Manager Gerrit Smit, who is also in charge of the much bigger Stonehage Fleming Global Best Ideas Equity fund.

The Sentinel Enterprise strategy has been a top-decile performer over the past 10 and five years and remained in the second decile over the past three years and 12 months too.

Source: FinXL

A whole point below it, in second position, was the first Liontrust vehicle we encounter, the Sustainable Future Managed Growth fund, whose average alpha was 5.63.

The strategy, alongside the whole Sustainable Future range, is considered by Square Mile analysts “a strong choice” for investors who are looking to grow their capital by investing in companies that are making a positive contribution to the planet and society.

“The managers have demonstrated they are able to deliver robust returns following this tried and tested process but the approach can lead to a return profile that is more volatile than many peers. However, we think over the long term it can deliver superior returns,” they said.

The list also included the Jupiter Merlin Growth Portfolio (2.93) and WS Ruffer Equity & General (2.7).

Jupiter Asset Management featured predominantly amongst the cautious funds that keep delivering the most bang for your buck and its Growth Portfolio’s alpha confirms the group’s strength in managing multi-asset strategies.

The Ruffer fund, managed by FE fundinfo Alpha Manager Alex Grispos, beat its benchmark – the FTSE All Share – by an average of 2.7% in the past five years.

In pole position in the IA Mixed Investment 40-85% Shares sector sits the £163m Scottish Friendly Managed Growth fund, a five FE fundinfo Crown-rated strategy managed by Colin McLean, benchmarked against the FTSE All Share.

With an average alpha of 3.55, it was a top-decile performer in the 196-strong peer group over the past three years and a second-decile performer over five, while dropping to the second-quartile over 10 years and 12 months.

Source: FinXL

Moving on to funds that use the sector average as their benchmark, in second position was Liontrust Balanced, with an average alpha of 3.43.

The fund and its managers Tom Hosking and Hong Yi Chen joined the Liontrust stable in April 2022 with the acquisition of Majedie Asset Management.

The fund has bested its benchmark in more rolling one-year periods than not, but it hasn’t all been plain sailing. Between the transition to Liontrust and the end of 2023, the fund trailed the sector average but it returned to form this year, as the chart below shows.

Performance of fund against sector since moving to Liontrust

Source: FE Analytics

Another Liontrust fund, Sustainable Future Managed, also had a high average alpha score of 3.

Meanwhile, Janus Henderson Global Responsible Managed had a positive alpha in 51 out of the 61 periods measured and achieved an average alpha of 3.31. This is another strategy that avoids harmful industries and has a focus on sustainability.

It stood out to Square Mile analysts for its style diversification provided by its three sub-portfolios: a UK sleeve with an income focus, which balances out the global, growth-biased sleeve; and a fixed-income sleeve that is usually the smallest component but acts as a volatility dampener through a portfolio of G7 government bonds and global credit.

Finally, at the foot of the table was VT EPIC Multi Asset Growth, which had the worst average alpha of the sector at -8.1.

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds.

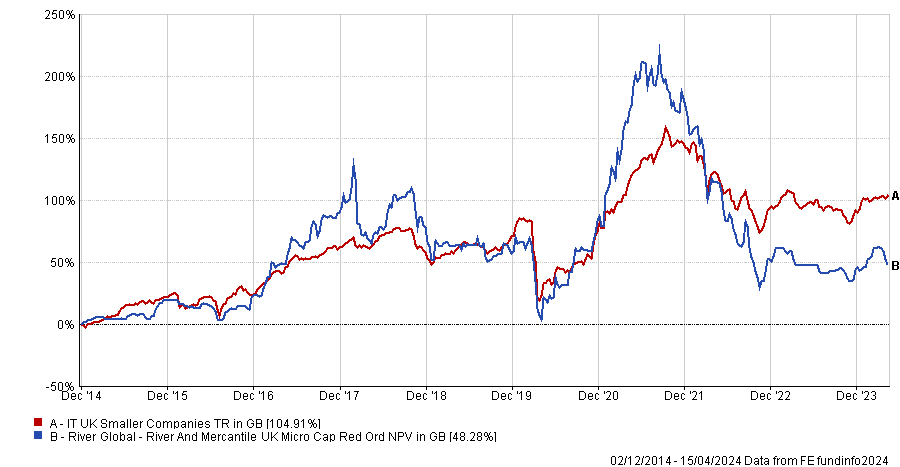

The two longstanding funds will close later this year.

The £20m CT UK Smaller Cap fund and £28m Aviva Investors UK Smaller Companies fund are both to be closed in the coming months. The former will close its doors on 6 June while the latter is to shut on 10 May.

UK small-caps have had a torrid time of late, with investors moving away from riskier assets in favour of defensive holdings such as bonds and cash, which now offer attractive returns thanks to higher interest rates.

This, along with economic uncertainty surrounding inflation and geopolitical tensions around the world, has caused investors to take a more cautious approach.

While some believe better times are ahead, Columbia Threadneedle and Aviva have thrown in the towel on their funds.

CT UK Smaller Cap, managed by Catherine Stanley since 2004 and Patrick Newens since 2019, was originally launched in February 1988 and has been one of the best performers in the IA UK All Companies sector over three years, making an 11.5% loss. Over 10 years the fund has made 78.6%, placing it in the second quartile of the sector.

However, the fund has failed to accumulate significant assets under management (AUM), with its total assets peaking in2021 around £33m.

Conversely, the Aviva Investors UK Smaller Companies fund has struggled over the long term, with a return of 60.5% over 10 years and has fared even worse over three years, down 25.4%.

Trevor Green has managed the fund since 2014 and was joined by co-manager Charlotte Meyrick in 2017. The fund pre-dates both however, having been initially launched in 1998. Assets under management reached £66m in July 2021 but have slipped back to the £28m in the fund at present.

A spokesperson for Aviva Investors said: “To ensure our fund range remains efficient, of high quality and provides the best outcomes for our clients, we regularly assess the value offered by our funds. This assessment process has led us to take the decision that it is in the best interests of investors to close the fund.

“The fund possessed a relatively small AUM and as such we would expect the broader impact of this decision to be very limited. The announcement has already been communicated to clients.”

Investors will have the option to switch into another Aviva Investors fund free of charge or to receive the proceeds of the sale of their investment as cash.

A spokesperson from Columbia Threadneedle Investments said: “We keep our range of funds under regular review and are committed to offering investors the best possible opportunities and value for money.

“Following a recent review, we have decided to close the CT UK Smaller Cap fund. The fund has experienced a fall in assets and became too small to run as efficiently as we would wish. We believe the closure of the fund is in the best interests of investors.”

Please note, a previous version of this article stated the CT UK Smaller Companies fund managed by James Thorne was to close. This was incorrect and the article has been amended accordingly to reflect the closure of the CT UK Smaller Cap fund.

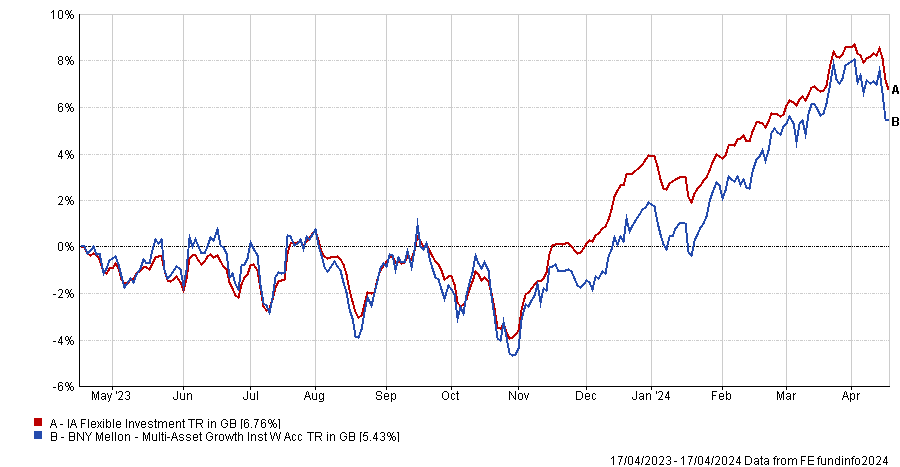

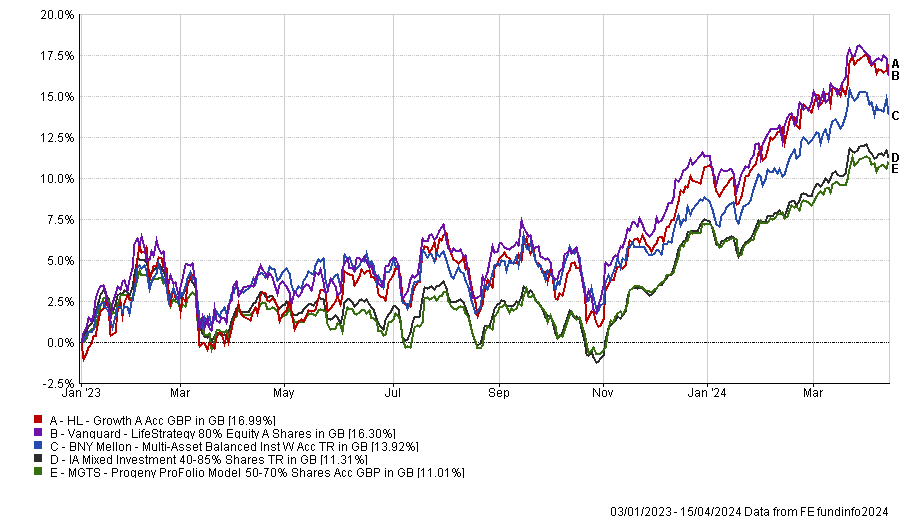

The market is underestimating the tailwinds of US housing companies, according to BNY Mellon’s Paul Flood.

Tech stocks have done particularly well recently but there another industries that have grown exponentially and the market underestimates them.

Within the £2.2bn BNY Mellon Multi-Asset Growth portfolio, US home builders have been among the top performers of the past 12 months, with relative contributions higher than Microsoft’s.

The fund has achieved top-quartile performance over 10, five and three years and is co-managed by FE fundinfo Alpha Manager Bhavin Shah, Simon Nichols and Paul Flood – the same team behind the highly successful and popular £3.4bn Balanced fund.

Below, Flood discusses the underestimated tailwinds for US home builders, the sectors he sees as opportunities and those he avoids, and why he favours UK gilts over US treasuries.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Can you sum up your investment process?

We're investing in companies that have long-term structural thematic support, proven business models and attractive valuations with bias towards growth companies or companies in sectors where we think there's a cyclical opportunity.

It’s a very flexible product as we can invest everywhere and we aim to get the broadest views around the house. We’re willing to take more aggressive stances and to be zero weights in some industries, as we’ve been in the past for bonds, for example.

When did you increase your fixed income allocation?

We've had very little in bonds for a long time, until the past 12 to 18 months, when they have started to become more attractive and got a yield and a return on them. The allocation still remains fairly low, however, at 10%.

Because the growth element of the fund is going to be driven by our equity allocation, we want bonds that work when there's more volatility and down-trending growth in the global economy, which is why the vast majority is in government bonds.

We've got some Australian, New Zealand and US Treasuries as well as UK gilts. We're favouring gilts over US Treasuries, given the risks that we see in the long end of the curve in the US, due to the fiscal expenditure and the continued deficit, which we think is a bit of a risk.

What equity sectors are you more bullish on?

We’re always looking at technology because it has the most growth, and industrials as it benefits from fiscal spending. Within that, we favour industries that are exposed to the long-term dramatic changes that we're seeing across global economies as we look to reduce the impact of global warming – so electrification, renewables, decarbonisation.

And it’s not just wind and solar – we think HVAC [heating, ventilation, and air conditioning] technologies are very interesting, as heating and ventilating our buildings represents 25% of global carbon emissions.

Here, we invest in Trane Technologies, which provides equipment that is 20-40% more efficient than legacy systems, so clients can massively reduce their carbon intensity.

What areas do you not invest in?

We’ve had zero in real estate for a long time, where we have fairly negative views from a thematic standpoint.

More and more trade is done online, which is a headwind to the high street – both on the industrials side of real estate but also offices. Even pre-pandemic, the internet was allowing us to be more flexible and we saw that as a headwind.

What have been the worst calls of the past year?

The area that has struggled the most recently was the electric vehicles supply chain. Battery manufacturer Samsung SDI was the biggest detractor to relative performance at -1%, alongside chemical manufacturer Albemarle.

With those stocks and our position in physical nickel, the EV supply chain cost the fund 2.6% in relative performance versus the IA Flexible sector.

Asian life and health insurers AIA and Prudential also cost the fund 1.5% in relative performance, but we continue to believe they are well placed over the longer term, given the ageing populations.

What has done well instead?

Our top holding is Microsoft, which did extremely well and added 0.55% of relative performance, but it wasn’t our top performer, which was US home builder Toll Brothers. It added 1.1% of relative performance.

So not a growth stock?

Surprisingly, yes. The market massively underestimated the changing business model of house builders in the US. Because they overbuilt in the financial crisis, there's been a huge under-build since then.

Generally speaking, it's not the same industry that caused the last crisis to cause the next, and US housing companies have moved away from having all the land development on their balance sheets. Instead of buying it, they take options on it, which is less balance-sheet intensive.

Interest rates are a massive headwind for moving into existing housing, as people want to avoid re-mortgaging at higher rates, so we’re seeing many more renovations instead. Houses are being built for the post-pandemic workforce that is moving out of California towards Texas, out of cities and into the suburbs.

Another tailwind comes from the fact that the US is the second little piggy, it builds its house out of wood, and so there is a replacement cycle unlike in Europe, where we build our houses out of brick.

What do you do outside of fund management?

Running and cycling help with the stress of the job and give you time to think away from screens.

People who mine the cryptocurrency will receive 3.125 Bitcoins for their effort, down from the 6.24 Bitcoins they currently receive.

Bitcoin, the world’s largest cryptocurrency, could be in line for a sharp rise in price following the latest halving, according to Pieran Maru, investment manager in the Liontrust Global Equities team.

Bitcoin is ‘mined’ by computers, which create new coins. When it first started, each time a successful block of coins was mined in January 2009, the individual responsible for doing so would receive 50 Bitcoins.

However, this has come down significantly thanks to ‘halving’ events, which occur every 210,000 blocks mined. There have been three so far, but the fourth is expected to take place this week.

In the first ‘halving’ event in 2012, the number of Bitcoins given to someone who successfully mined a block dropped from 50 to 25. Once the next halving event occurs in the coming days, people who mine the cryptocurrency will receive 3.125 Bitcoins for their effort, down from the 6.24 Bitcoins they currently receive. This is expected to take the number of new Bitcoins produced per day down from 900 to 450.

“This potentially could lead to an increase in the price of Bitcoin, if the demand remains constant or increases, while the rate of supply slows,” said Maru.

Following the first halving in November 2012, Bitcoin’s price jumped around 9,500% to a peak of $1,160 in one year, while after the 2016 halving the price rose by 3,040% to $19,660 around 18 months later. After the halving in 2020 the price took time to rise but ended up 802% higher to a top of $73,800 almost four years later.

However, not all were convinced. Nigel Green, founder of deVere Group, said: “It is likely to be a major price non-event. Investors, traders and speculators priced in the halving months ago. As a result, a significant portion of the positive economic impact was experienced previously, driving up prices to fresh all-time highs last month.”

Indeed, Bitcoin reached a new all-time high of $75,830 on March 14 2024.

Either way, Maru said it is clear cryptocurrencies are becoming an increasingly significant part of the financial world, despite some likening it to the ‘wild west’, a term given after several scandals.

“From being a niche digital currency to a defined asset class, with approximately one in five Americans owning crypto, the future appears bright. Bitcoin has experienced a surge in retail and institutional activity following the announcement by the US Securities and Exchange Commission (SEC) in January approving the long-awaited Bitcoin ETFs (exchange traded funds). To date, the total fund assets in these ETFs has reached $56.2bn, representing about 4.4% of Bitcoin supply,” said Maru.

Progress is being made on regulatory frameworks for cryptocurrency, he added, including the Markets in Crypto-Assets Regulation (MiCA) in Europe, which came into effect last year.

“Bitcoin, as the pioneer, has inspired the creation of new blockchains that are more scalable and have added utility, such as decentralised apps and smart contracts. Despite this, Bitcoin's dominance continues to hold as the original truly decentralised blockchain,” he said.

Some domestic companies are paying 10% dividends – more than double the amount investors can get from bonds and cash.

Cash has been king for the past 18 months or so as investors have taken advantage of higher interest rates and locked in good returns in cash accounts.

For investors, this has also meant a return to fixed income, which struggled in 2022 but now appears to be on strong footing, as Pictet’s Jon Mawby told Emma Wallis this week.

Yet with interest rates likely to be on their way down this year, investors may start to return to the stock market for their income. While riskier, it presents a good opportunity to gain an income far higher than from cash and bonds.

The 10-year gilt currently offers investors an income of 4.07% per year, while the top easy access savings accounts are higher at 5.2%.

Yet there are some companies far exceeding this. At the top of the tree is cigarette maker British American Tobacco, which currently offers a 9.9% dividend yield, according to data from AJ Bell investment director Russ Mould.

It has dividend cover – how much it receives in earnings versus the amount it pays to shareholders – of 1.4x and has not cut its dividend in more than a decade.

“It can even point to a streak of increases in its annual dividend payment that stretches back to 1998,” Mould noted.

Insurance firm Phoenix Group is another with a 9.9% yield, although dividend cover is lower at 0.3x and it has a habit of lowering its dividend – doing so in both 2016 and 2018.

But there are a plethora of stocks with high income payouts. Asset manager M&G currently yields 9.4%, followed by fellow tobacconist Imperial Brands (8.7%) as well as financial juggernauts Legal and General (8.4%), HSBC (7.6%) and Aviva (7.1%).

However, investors need to keep in mind that investing directly in single stocks is much riskier than diversifying.

Furthermore, companies may be paying sky high yields because their share prices are cheap for a reason. An oft-used rule of thumb states “any dividend yield which exceeds the risk-free rate by a factor of two may turn out to be too good to be true”, Mould said.

“The 10-year gilt yield is a good proxy for the risk-free rate. A dozen years of interest rates at near zero rendered the rule pretty useless but now monetary policy is returning to something akin to ‘normal’ it may regain some of its former relevance.”

Taking British American Tobacco as an example, despite its long track record of upping dividends, the firm continues to face ongoing regulatory pressure.

“Investors should never take anything for granted. There have been 138 dividend cuts across the current crop of FTSE 100 members in the past decade and even if 74 of those came in the Covid-blighted years of 2019 and 2020 there were still nine in 2023,” said Mould.

Still, for those unwilling to take the risk on individual stocks, the FTSE 100’s forecast dividend yield of 3.8% for 2024 (and 4.1% for 2025) makes it an interesting option at a time when interest rates are expected to come down.

“Financial markets continue to price in three interest rate cuts of one-quarter of a percentage point apiece from the Bank of England by the end of 2024. That would take the base rate down to 4.5% and potentially weigh on UK government bond yields, to further raise the profile of the UK equity market’s income potential, at least if inflation stays relatively benign,” said Mould.

There are myriad factors to consider when investing for income, but now could be a chance for investors to put some of their cash into equities. Although it may be riskier, the prospect of capital gains and a strong starting yield mean they are a good option for the long term.

And as I wrote last week, those willing to explore further down the market capitalisation away from the FTSE 100 may be in line for even better yields in the future.

Bestinvest’s Jason Hollands picks four funds with a complementary approach to Fundsmith for investors who want to diversify manager and stock-specific risk.

With £25bn in assets, Fundsmith Equity is one the most popular and widely-held funds amongst UK retail investors but the once-mighty giant has waned in recent years, so much so that the fund was included in Bestinvest’s Spot the Dog list for the first time in the latest report.

Despite this, its long-term track record remains impressive. Between 2014 and 2021, Fundsmith Equity outperformed the IA Global sector in every calendar year. It then fell behind its peer group average in 2022 and 2023, although it has come roaring back this year so far, returning 7.3% year to date as of 17 April, versus 4.7% for the average global fund.

Given the concentrated nature of its 28-stock portfolio, with 9% apiece in Microsoft and Novo Nordisk, investors may wish to pair Fundsmith with other global equity strategies owning a different batch of stocks.

For investors who hold Fundsmith but want to add complementary strategies alongside it, Jason Hollands, managing director at Bestinvest, recommended four contenders, below.

Brown Advisory Global Leaders

Mick Dillon and Bertie Thomson, who run the $2.9bn Brown Advisory Global Leaders fund, oversee a portfolio of 30-40 stocks. Their fund has a 9% allocation to Microsoft in common with Fundsmith Equity and both strategies hold Visa but beyond that, their top 10 positions do not overlap.

Brown Advisory Global Leaders’ high conviction holdings include General Electric, the London Stock Exchange Group, Taiwan Semiconductor Manufacturing Co. and Safran, the French aerospace and defence group.

“This fund is not wildly dissimilar from Fundsmith in approach with a focus on high quality cash-generating businesses delivering positive and sustainable returns on capital. The fund has low portfolio turnover too,” Hollands said.

Despite that, this is the least correlated to Fundsmith out of all of Hollands’ suggestions, with a 0.75 correlation over the past five years. The three funds below have a 0.83-0.86 correlation to Fundsmith.

Long-term performance has been broadly in line with Fundsmith Equity, but Brown Advisory Global Leaders has pulled ahead in the past year, as the chart below shows.

Brown Advisory Global Leaders vs Fundsmith Equity and sector over 10yrs

Source: FE Analytics

GuardCap Global Equity

The $3.4bn GuardCap Global Equity fund is managed by Michael Boyd, Giles Warren, Bojana Bidovec and Orlaith O’Connor.

“Boyd and Warren have worked together for more than 25 years and have developed a highly collaborative and successful approach focused on investing in a concentrated portfolio of circa 20-25 high quality, large companies that they believe can deliver sustainable earnings growth and can be bought at attractive valuations,” Hollands explained.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The only overlap with Fundsmith in GuardCap's top 10 is Novo Nordisk. GuardCap's other significant holdings include French-Italian eyewear group Essilor Luxottica, derivatives marketplace CME Group, Alphabet and Mastercard.

Fiera Atlas Global Companies

Since inception, the $1bn Fiera Atlas Global Companies fund has trounced its sector, benchmark and the mighty Fundsmith, as the chart below shows.

Performance of fund since inception vs sector, benchmark and Fundsmith

Source: FE Analytics

The fund invests in 25-35 “exceptional growth companies with strong wealth creation credentials”, Hollands said.

Managers Simon Steele and Neil Mitchell look for companies with “competitive advantages, runways for growth and a track record of making wise capital allocation decisions, which are backed up by repeatable and diversified cash flows that can compound over time,” he explained.

The fund is benchmark unconstrained and “differs considerably from the index and many other global funds which invariably own the ‘usual’ names,” he continued.

It shares Fundsmith’s conviction in Visa and IDEXX Laboratories, which provides a range of products for veterinarians. Other large positions are in luxury products group LVMH, technological research and consulting firm Gartner, electronic design and semiconductor specialist Synopsys and animal health company Zoetis.

Evenlode Global Income

“This fund certainly brings something different to the table, as targeting companies that can grow their dividends is part of the brief,” Hollands said.

Evenlode Global Income’s managers Ben Peters and Chris Elliott look for “companies with low capital expenditure requirements, which means they can fund their own growth and pay those sustainable dividends,” he explained.

“Low leverage is another tick in the fund’s box. Peters also looks at qualitative factors, including companies with hard to replicate business models and intangible assets such as a strong brand name. The final portfolio is concentrated, currently holding 28 stocks with the intention being to hold them for the long term.”

Evenlode Global Income is comfortably ahead of the IA Global Equity Income sector over 10 years but it has not kept pace with Fundsmith, reflecting the differences in the two strategies’ mandates, with the former delivering steady income and the latter focusing on growth.

Performance of fund vs sector and Fundsmith over 10yrs

Source: FE Analytics

Microsoft is the only overlap with Fundsmith’s top 10; it is the second-largest position in Evenlode Global Income, worth 4.3% of the fund.

Other high conviction holdings include Unilever, consultancy Accenture, professional data and software provider Walters Kluwer and healthcare technology company Medtronic.

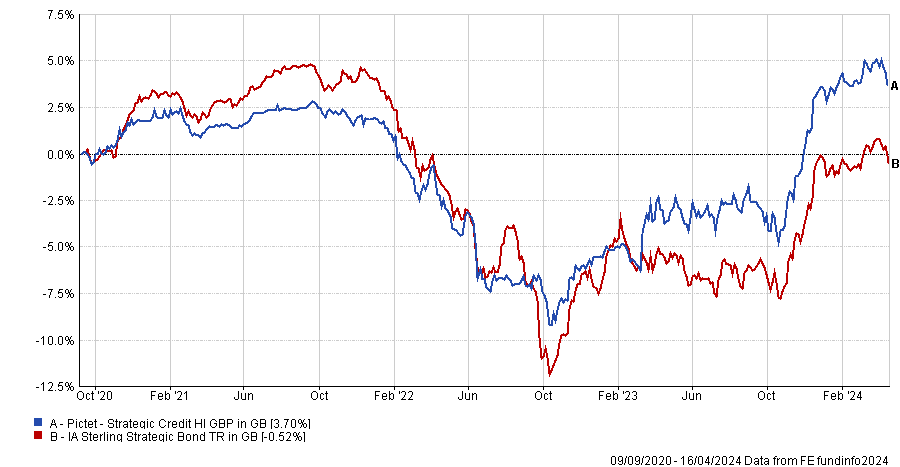

Pictet Asset Management expects strategic credit portfolios to deliver high returns due to the elevated yields on offer.

‘It was the best of times, it was the worst of times.’ The opening lines of ‘A Tale of Two Cities’ by Charles Dickens is an apt description of the fixed income markets for the past couple of years, although the bad times in 2022 and early 2023 preceded the good.

For bonds, it currently looks like the best of times. Yields across the board are attractive and the income is back in fixed income – even though spreads are below long-term averages.

The high starting yields mean that strategic bond portfolios should be capable of delivering returns in the mid-to-high teens, said Jon Mawby, co-head of total and absolute return credit at Pictet Asset Management.

“That sort of return would be expected over an 18-24 month horizon if rates stay elevated. It would be possible over 12 months only if yields fall (e.g. due to a rate cutting cycle) and then bonds could benefit from significant capital gains,” he explained.

Further rate hikes would be detrimental for fixed income but returns should still be flat to slightly positive because yields are so high that they provide an element of protection, he continued.

“You’re being paid for the risk. If you’ve got the ability to be nimble, dynamic and strategic with no cognitive bias, it’s actually a great environment for the asset class.”

Maximum confusion amongst investors and central bankers

Yet despite the potential for high returns, many investors remain uncertain and are sheltering in cash and money market funds. Mawby described the current environment as one of “maximum confusion” because the dynamics of a normal economic cycle have been disrupted by massive fiscal stimulus after the pandemic.