The manager of the WS Whitman UK Small Cap Growth fund highlights three UK quality-growth small-caps that he believes will emerge stronger from the current turmoil.

UK small- and mid-caps have been the targets of M&A activities in recent years, as valuations have collapsed in this part of the market.

This has reached a point where even quality companies, which were once too expensive for potential acquirers, are now on their radar.

For instance, WS Whitman UK Small Cap Growth – a top ‘young’ UK fund investing with a quality growth bias – has had some of its investee companies taken over in the past two years, including DX Group, Ideagen and Emis.

However, looking for potential M&A targets is not a strategy the manager of the fund, Joshua Northrop, is pursuing. Instead, he is looking to back leading businesses that he believes will come out stronger from this challenging period.

He said: “They are businesses that are taking market share, have better capacity and have invested in their operations. It will really come through in the earnings when we get a better period of economic growth.”

Below, Northrop highlights three UK quality-growth small-caps he feels particularly confident can match his expectations.

JTC

JTC is a FTSE 250 constituent that was launched in 1987 as a provider of fund management services and currently is WS Whitman UK Small Cap Growth’s largest holding.

Northrop said: “What this company does is basically back office and admin for financial services. It is the market leader in those areas. The nature of the business means its revenues are sticky, it has mid-30% EBITDA [earnings before interest, tax, depreciation and amortisation] margin and just reported organic growth of 20%.

“At the peak of the market, JTC traded on 30x price-to-earnings (P/E), but trades now on 18x. To us, this is high quality and good value.”

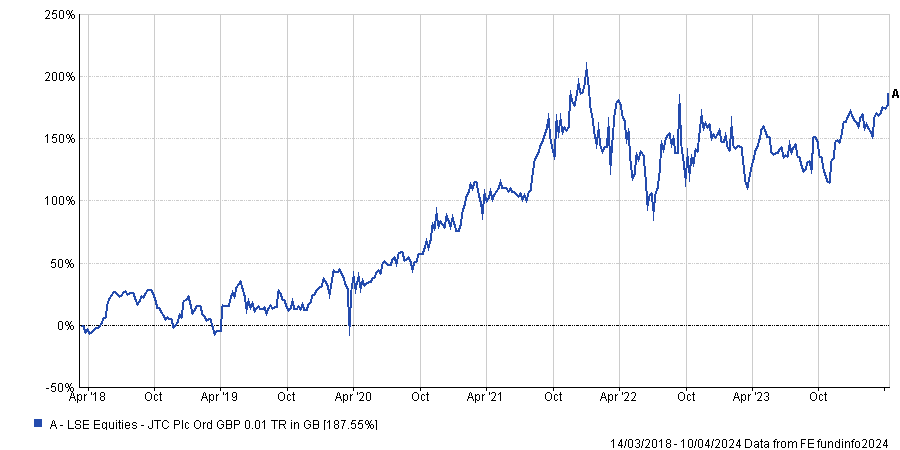

Performance of stock since listing

Source: FE Analytics

Another thing he finds exciting about JTC is that it operates globally and recently expanded its activities in the US with the acquisition of a business called South Dakota Trust.

Northrop explained: “This business has a very unique position in the US personal trust sector. It is doing trusts administration for 1,700 high net and ultra-high net worth clients. JTC has just acquired it, which gives the company a fantastic ability to cross sell to that client base.“

Johnson Service Group

Another stock Northrop highlighted is Johnson Service Group, which is one of the fund’s top five holdings. The company provides textile rental, cleaning and care, but he also highlighted its market leading position in the workwear and hospitality markets.

He said: “It is growing organically and by acquisition. The management team has invested in capacity over the past two years and has opened up a new facility in the southeast for 600,000 items per week. It has also done some M&As with the acquisition of a business in Ireland called Celtic Linen.”

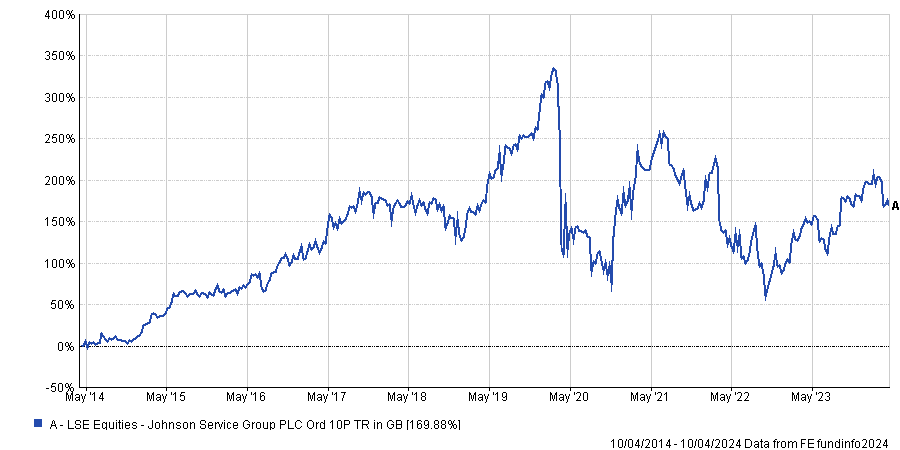

Performance of stock over 10yrs

Source: FE Analytics

Northrop also believes Johnson Service Group’s operating margin is poised to increase in the coming years, as energy prices come down.

He explained that energy bills used to account for 6.5% of the company’s sales but currently stands at 10% because energy costs have surged.

However, he expects operating margin to grow from 10% to 15% when energy bills fall back to 6.5% Johnson Service Group’s sales. He added: “There's a margin story underneath the top line growth story here.”

Lok'nstore

A third stock Northrop highlighted is Lok’nstore, which unlike the two previous companies does not feature in the fund’s top five holdings. The company owns self-storage sites and also manage sites on behalf of other owners of self-storage facilities.

Northrop explained that a difficulty in this market is that self-storage sites are expensive to build. However, they are very cheap to run because it does not require a lot of people on-site.

He added: “Lok'nstore owns the vast majority of its sites, but more interestingly, it has a pipeline of new sites. This will lead to a roughly 40% increase in the amount of square footage that Lok'nstore manage and, therefore, a much larger business.

“You can buy this company now at a 20% discount to net asset value, but this net asset value is going to go up over the next six or seven years by at least 50%.

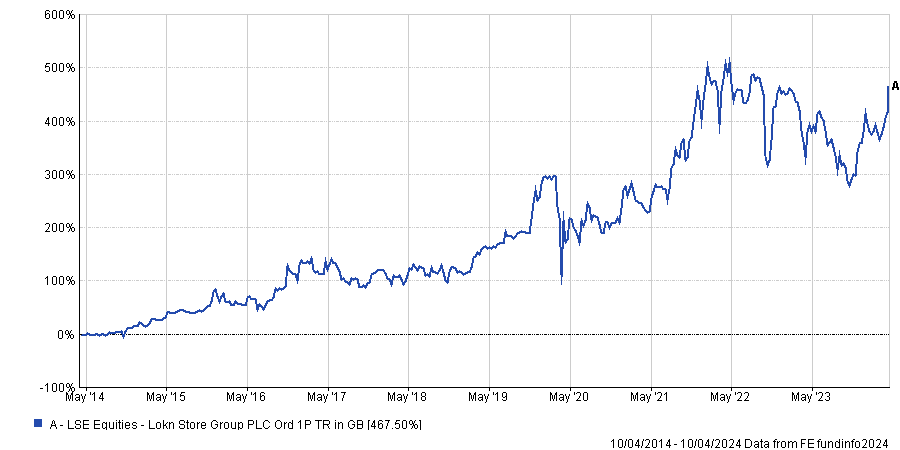

Performance of stock over 10yrs

Source: FE Analytics

While properties in the UK have suffered in recent times, Northrop does not believe self-storage is exposed to the same headwinds.

He explained: “There's a structural under supply of self-storage, which is different from commercial property or other areas of the property market. That’s why we think this discount to NAV is wholly unwarranted.”

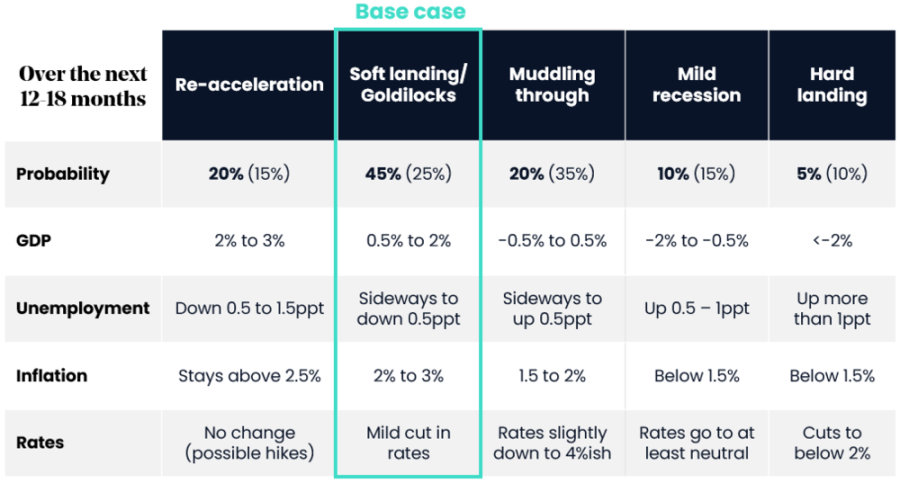

Despite this rosy picture, we are also aware that many things could go wrong.

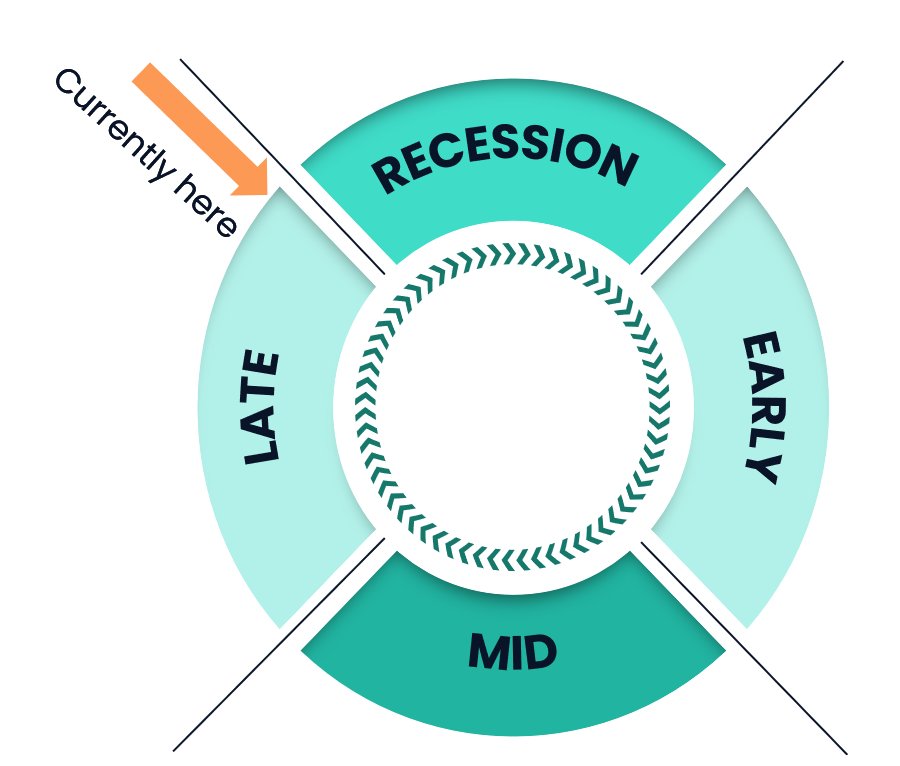

The global growth cycle hit its lowest point in 2023 and is now picking up and earnings estimates have been creeping higher. Although central banks are hesitant to lower interest rates at this moment, they are conveying more accommodative signals to the market, which maintains the prevailing ‘risk-on’ sentiment.

This time last year, California’s Silicon Valley Bank collapsed and sparked a brief banking crisis in the US, roiling financial markets and ultimately claiming a few additional regional bank victims.

Fast forward to March 2024: the St Louis Financial stress index is the lowest since the Fed began raising rates. Bank deposits have stabilised and risen since the 2023 banking panic, showing that confidence in the banking system is returning. What a difference one year makes.

Indeed, while the number of Fed rate cut expectations has moved from seven at the start of 2024 to three as of now, markets do not seem to care: the S&P 500 just crossed 5,200 for the first time ever, the Nikkei 225 index is trading above 40,000 for the first time in three decades, the Europe Stoxx 600 hit new all-time highs, gold is trading above $2,200 for the first time ever, oil prices are creeping higher, copper has suddenly broken out and US corporate bond spreads remain very tight. Last but not least, Bitcoin has hit a new all-time high at $73,000 dollars.

Are we in the middle of a new mania?

To be fair, there are indeed some reasons to be cheerful. First, the global economy is doing better than anticipated. A global manufacturing recovery seems to be unfolding, US consumer sentiment is holding up, China is finally considering deploying more fiscal stimulus, the hard landing scenario seems unlikely and the ‘no landing’ probability is rising.

Better-than-expected economic numbers are propelling earnings estimates higher while artificial intelligence (AI) could trigger a productivity boom which should help keep corporate margins at a high level.

Market dynamics are also sending positive messages to investors: the upward trend remains robust, the participation to the upside is broadening, cyclicals are outperforming defensives and commodities are starting to pick up. Meanwhile, bond volatility is decreasing and the dollar is stabilising.

Finally, investors seem to be cheering the fact that central banks will still cut rates despite the resilience of economic growth and the stickiness of inflation. The ‘reflation’ thesis was corroborated by two important central banks meetings.

First, Bank of Japan Governor Kazuo Ueda decided to end the policy of negative rates. This move was widely anticipated, and the dovish tone around this decision pleased investors and didn’t lead to the yen appreciation which was feared by markets.

In the US, the Fed has kept interest rates unchanged as expected. But there was a positive surprise for investors: as compared to their December forecasts, the Fed is expecting higher real GDP growth (2.1% vs. 1.4%), lower unemployment (4.0% vs. 4.1%) and higher core PCE inflation (2.6% vs. 2.4%), but it is still anticipating three rate cuts this year. This sounds reflationary for markets: as in the case of Japan, the Fed hawks are flying like doves.

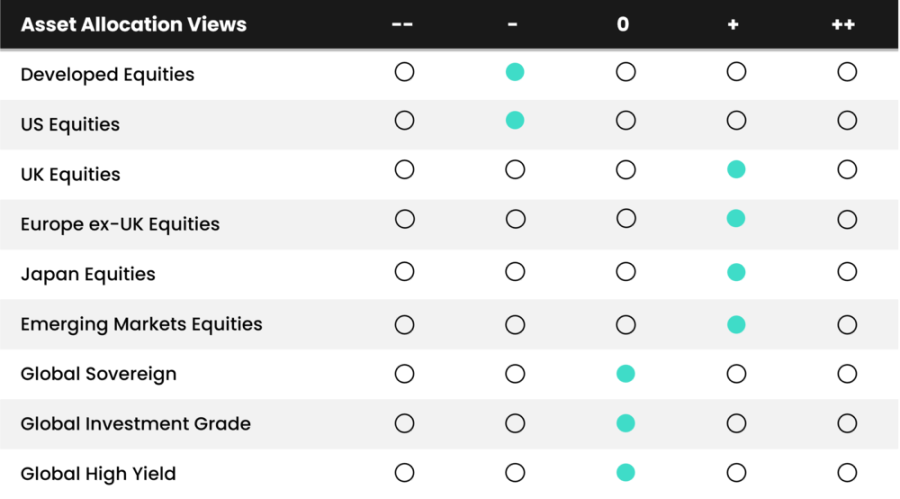

This positive mix of decent growth, stable inflation (albeit at a higher level than central bank’s target), loosening financial conditions and upward trending markets with broader participation to the upside lead us to keep our global equity allocation unchanged (with the market effect, our tactical asset allocation to equities is now slightly higher than our strategic asset allocation).

So why not increase our equity allocation further?

Despite this rosy picture, we are also aware that many things could go wrong. The sectors of the economy which are the most affected by higher rates (e.g. US commercial real estate, small- and medium-sized enterprises, etc.) continue to struggle.

Sticky inflation in services and the rise of commodity prices could lead to higher headline inflation in the months to come – hence preventing rate cuts by central banks at a time when global debt keeps ballooning.

A cracking of market heavyweights could lead global indices lower. Geopolitical conflict escalation in Ukraine or Middle East remains a risk. Investor sentiment appears complacent and elevated equity market multiples do not leave any room for disappointment. As such, we are keeping our global equity allocation close to our strategic asset allocation and we won’t be adding more exposure to equities at this stage.

However, we believe some sector and style rotation could continue to unfold. Indeed, the ‘reflation’ thesis might trigger new leadership within equities. We are starting to see some large-cap tech stocks stalling while sectors such as energy and materials have been outperforming the S&P 500 index recently.

Within non-US markets, we are keeping our preference for Japan and staying neutral on Europe. Although momentum in China's equity markets is on the rise, we are currently choosing not to increase our investments in this region.

On the rates side, Treasury supply continues to rise and, coupled with sticky inflation, is exerting upward pressures on long-dated bond yields. In this context, we are decreasing our allocation to government bonds 1-10 years from positive to neutral and the 10 years+ government bonds from neutral to negative. Proceeds are reinvested into cash which continues to offer positive real yields.

The downtrend in credit spreads has continued towards multi-year lows. We remain neutral on credit with a preference for quality (investment grade). On an aggregate basis, our fixed income positioning has moved from neutral to negative.

Within commodities, we are maintaining our allocation to gold. The resilience of the yellow metal despite higher rates and exchange-traded fund outflows is remarkable. Gold continues to offer a protection against geopolitical shocks and currency debasement. The recent technical breakout seems to indicate further upside ahead.

In Forex, we are keeping our neutral stance on the euro, Swiss franc and pound against the dollar. Central banks on both sides of the Atlantic seem to be on a wait and see mode for the time being. We still believe that the change in monetary policy in Japan (raising rates at the time other central banks are contemplating a cut) could lead to some yen appreciation – hence our positive view on the yen versus dollar.

Charles-Henry Monchau chief investment officer at Bank Syz. The views expressed above should not be taken as investment advice.

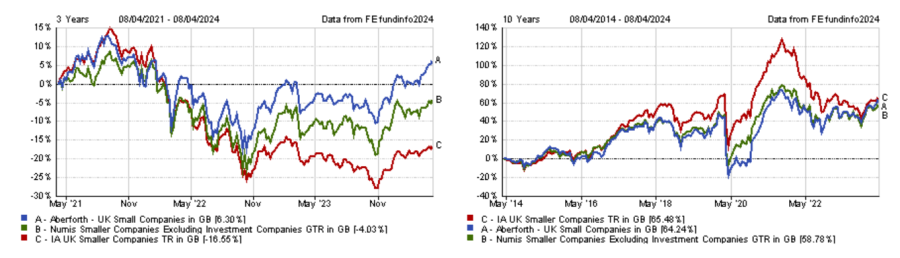

While being underweight domestic stocks has hurt active managers, a white paper from the asset management house argues that this positioning could eventually pay off.

New research by Invesco claims to have found the reason why active UK funds have underperformed trackers over the past few years, but argues that this might not be a disadvantage over the long run.

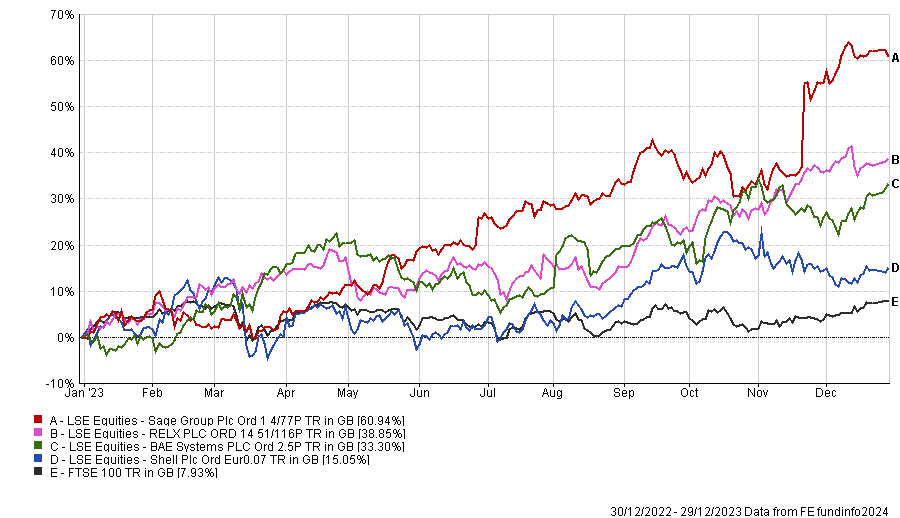

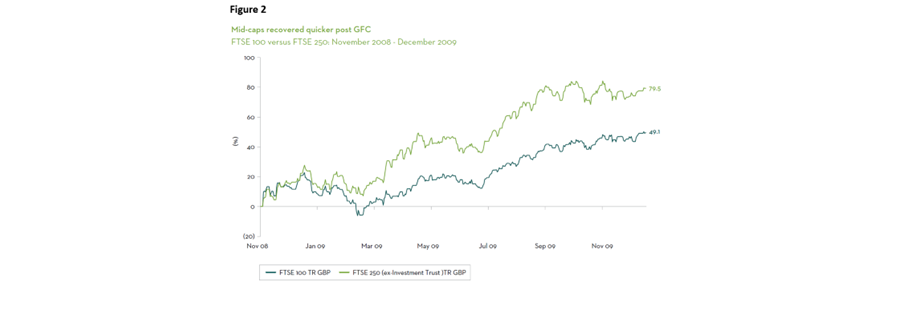

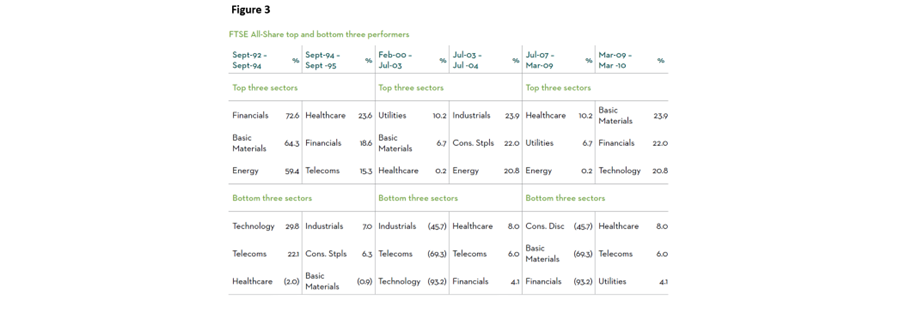

The recent underperformance of UK funds has been stark, with the average IA UK All Companies fund making a total return of just 14.5% over the three years to the end of 2023 compared with a 28.1% gain from the FTSE All Share index. Only 40 funds out of 208 in the sector beat the index over this period and 12 of those were passives, mainly tracking the FTSE 100.

In a white paper entitled Active management of UK equities: Understanding historical underperformance and identifying long term opportunity, Invesco UK equities product director Neville Pike and EMEA investment analysis manager Miguel Ucha aim to identify why this underperformance has occurred and ask if active management still offers value to investors.

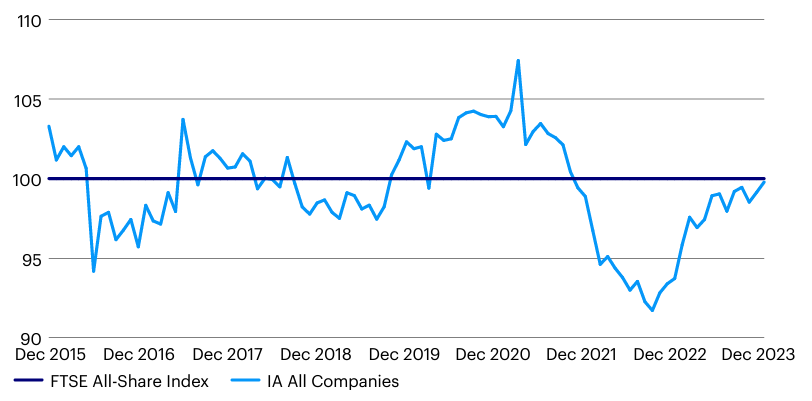

Total return of IA UK All Companies funds relative to FTSE All Share over rolling 12 months

Source: Invesco, Investment Association

Looking back over history, Pike and Ucha found that this underperformance is not typical – in fact, the IA UK All Companies sector was ahead of the FTSE All Share in almost 60% of the rolling 12-month periods between December 2015 and October 2021 (shown in the chart above).

“Peak relative outperformance by the IA sector occurred in March 2021, but active performance then faded such that by September 2022, there had been a swing of 16 percentage points in favour of the FTSE All Share index,” they said.

“Relative performance of active management vs the index therefore appears to move in cycles. The rotation that we can observe over the past three years in favour of the FTSE All Share is not unusual in its incidence. But what sets it apart from previous rotations is its magnitude.”

Putting the past three years under the microscope to explore this further, Invesco created a portfolio of (which it calls Model IA) of the top 50 holdings in the sector for each month in the three-year period. It compared this to the composition and performance of the FTSE All Share.

“The clear inference from this analysis is that the average fund manager represented in the IA sector is significantly underweight a relatively narrow base of the very largest companies in the FTSE All Share index, with active overweights spread more broadly across a larger number of smaller companies (not just in small- and mid-caps) below the top tier,” the paper argued.

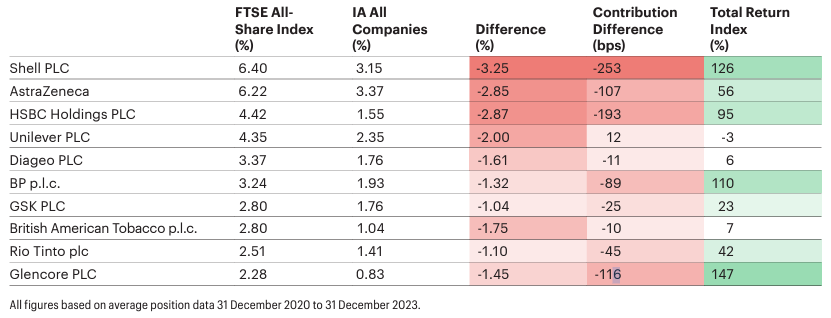

The table below shows the biggest underweights among IA UK All Companies funds and how they have impacted performance relative to the index.

Impact on total return from weight differences between FTSE All Share and IA All Companies

Source: Invesco, Factset, Morningstar

Invesco estimated around 95% of the underperformance of the Model IA relative to the FTSE All Share resulted from being underweight the 10 largest positions in the index.

In a separate note, Rathbone UK Opportunities Fund manager Alexandra Jackson pointed out that the UK market is very concentrated even when compared with the US, with the FTSE All Share’s top 10 stocks accounting for 40% of its weight. This causes problems for active managers.

“These top-heavy indices make it hard for active managers to be ‘at weight’. Doing so would mean jettisoning reasonable diversification and taking on huge risks that wouldn’t benefit investors. In some cases, it would nudge close to, or even exceed, regulatory limits on position sizes,” she explained.

“High concentration also means that performance (for good and bad) is driven by an ever-smaller group of stocks – in the UK, for example, the top end of the market is dominated by a few, very mature, often ex-‘growth’ names (albeit ones paying big dividends). Lots of oil, mining, banking, tobacco and consumer staples – but no technology. This seems to crowd out dynamism as well – in the UK, at least – with few changes to the top-10s from year to year.”

In addition to this, Invesco’s white paper suggested that UK active managers are underweight the largest companies because global/pan-European strategies and UK trackers (which tend to be benchmarked against the FTSE 100 so have an even greater weighting than the All Share to the biggest constituents) are essentially reducing the availability of stock for domestic funds.

“The overall conclusion is that, for reasons associated with ownership of some of the largest UK listed companies in non-UK funds, and the growth in passive funds tracking the FTSE 100, the opportunity set for active managers is structurally very different from the FTSE All Share and weighted more to companies below the top quintile” Pike and Ucha wrote.

The above explains why active UK funds are underweight the large-cap stocks that have led the market over the past three years but the paper warns this should not necessarily be seen as a long-term disadvantage.

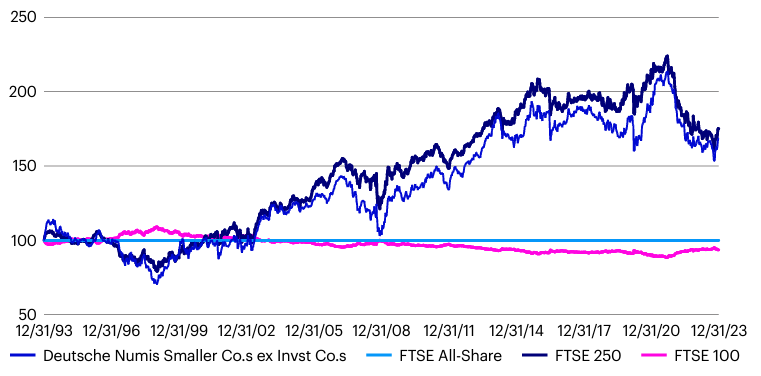

Total return relative to FTSE All Share (Indexed, 31 Dec 1993=100)

Source: Invesco, Factset

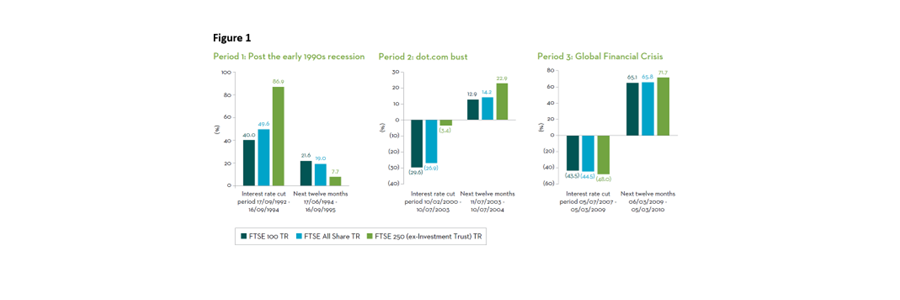

While the past three years have witnessed the significant underperformance of the small- and mid-cap indices, and outperformance of the FTSE 100 (thus the underperformance of active funds), the opposite is true over the long run – as shown above.

“There have been times (in the build up to the first dot.com boom, during the global financial crisis, around the Brexit Referendum of 2016, the first wave of Covid in April 2020, and the most recent period since September 2021) when smaller and mid-caps have underperformed,” the research finished.

“But the long-term outperformance of smaller and mid-caps, and the ‘oxygen’ of increased volatility that fuels opportunity for stock picking, suggests that the long-term outlook for UK active managers, relative to passive funds, remains especially attractive.”

Active managers outside of Invesco agree, with Rathbones’ Jackson liking the opportunities created by the FTSE 250. Just 11% of the UK mid-cap equity index is in its 10 largest names, so it is well-diversified, and Jackson believes this means it is home to quality companies “flying under the radar”.

“Many of these businesses are little known, with strong opportunities for growth both at home and abroad,” she said. “And they seem cheap relative to their counterparts in other markets and when compared with the past.”

Over at Premier Miton, Gervais Williams thinks markets could be approaching “an explosive period of small-cap recovery”.

With the very strong performance of global mega-caps such as Microsoft, Apple, Tesla and Novo Nordisk being driven by “an unusually large rise in their valuations” rather than earnings growth, Williams sees them as being vulnerable to a snap-back.

“The key point is that quoted small-caps have already had their bear market. They’re already standing on absurdly sub-normal valuations because capital flows over recent years have skewed so heavily into mega-caps,” the Premier Miton UK Smaller Companies co-manager said.

“Reallocating just 1% from mega-caps to small-caps dramatically scales up its impact, so the new small-cap supercycle is currently on a hair trigger.”

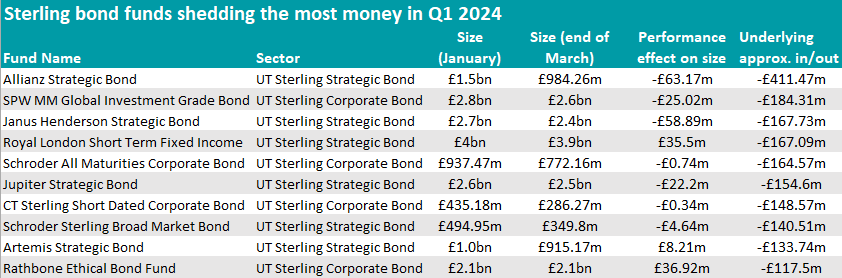

Latest data reveals which sterling bond funds have lost or gained investors’ confidence so far this year.

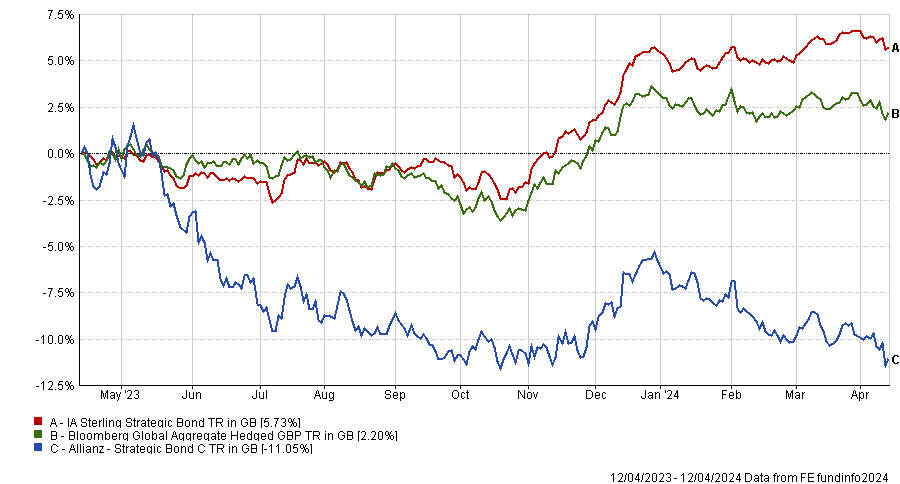

Taking macro views sometimes pays off and at other times is hard to get right. Mike Riddell’s Allianz Strategic Bond fund and John Pattullo's Janus Henderson Strategic Bond fund have been on the latter side of the equation lately, with investors taking money out of the funds and putting it instead into short-duration strategies.

This is what emerged from the latest FE Analytics data on fund flows for the first quarter of 2024.

The largest sum was withdrawn from Mike Riddell’s Allianz Strategic Bond fund, which shed almost half a million in 2024 (£411.5m to be precise, exacerbated by £63.2m in performance-related losses).

Performance of fund against sector and index over 1yr

Source: FE Analytics

The strategy has come down from its heyday in May 2021, when it had amassed a £3.5bn war chest, to today’s £962.4m in assets under management. Part of this decline is down to the manager’s ultra-defensive stance, whose preference for the longer-maturity part of the market hasn’t paid off.

Despite this, FE Investments analysts continue to rate the fund.

“Riddell has been able to time fixed-income markets impressively for the most part, often by implementing contrarian views that have driven superb performance over the long term,” they said.

“More recently the timing of some of the team’s market calls has proven premature, meaning the fund has struggled to maintain pace with the benchmark. Nonetheless, Riddell is able to clearly articulate and justify the ongoing active bets in the portfolio.”

Source: FE Analytics

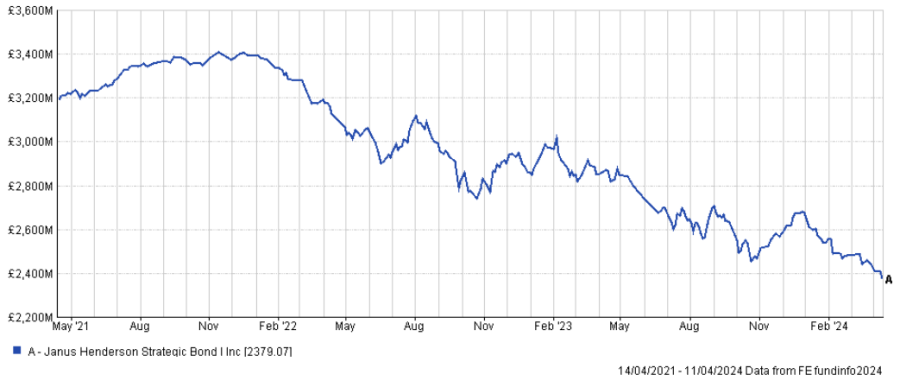

Remaining in the IA Strategic Bond sector, Janus Henderson Strategic Bond was also penalised by investors, who took £167.7m out of the fund. Performance hasn’t helped, and assets under management (AUM) have shrunk from their peak of £3.4bn in November 2021 to the current £2.3bn, as shown in the chart below.

Despite the recent struggles, FE Investments analysts spoke positively of the strategy.

“Accurate economic analysis is key to the fund’s performance. This is something that is hard to get right every year, but the team has a strong track record in market calls, albeit interest rate positioning proving particularly costly over 2022,” they said.

“It is a good option for those who want a manager capable of being flexible with their bond allocation depending on the macroeconomic environment.”

Fund size since peak

Source: FE Analytics

The Royal London Short Term Fixed Income fund also had to part with a similar sum (£167.1m) but was one of the few funds to add some money through performance (£35.5m).

In that, it was only outdone by the Rathbone Ethical Bond Fund, which focuses on corporate bonds and returned £36.9m between January and March this year.

In the IA Corporate Bond sector, Schroder All Maturities Corporate Bond and CT Sterling Short Dated Corporate Bond also suffered similar outflows.

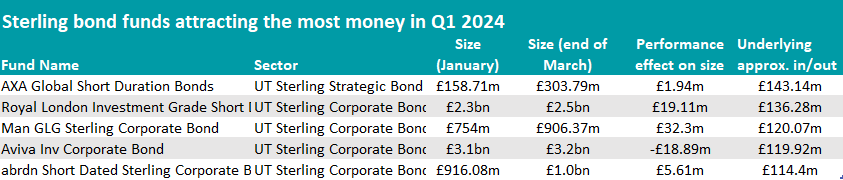

While 10 funds lost more than £100m, only five managed to do the opposite and added the same amount or more.

Most of them were short-duration strategies, which have been going through a renaissance, profiting from anticipated rate cuts.

Here, the AXA Global Short Duration Bonds fund attracted the most buyers.

The portfolio can now count on an extra £143.1m of investors’ money, which almost doubled the fund’s AUM, taking it from £158.7m to £303.8m.

It is run by FE fundinfo Alpha Manager Nicolas Trindade and Nick Hayes and was highlighted by Square Mile analysts as an “attractive fund for investors seeking some income and the potential diversification benefits that investing in fixed income can bring without the volatility of a full duration product.”

Source: FE Analytics

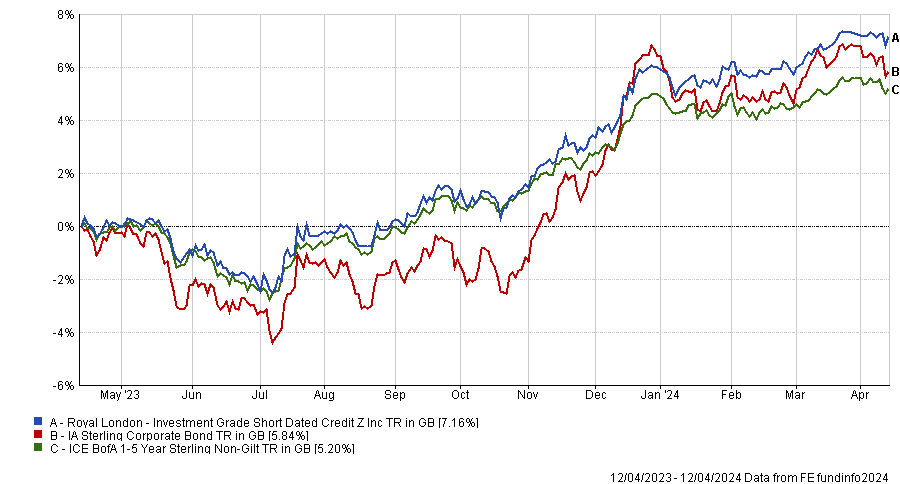

The largest and most popular fund in the list was Royal London Investment Grade Short Dated Credit, which added £136.3m to the £2.3bn it had at the beginning of the year.

It has been growing consistently since 2021, when its portfolio was worth £1.4bn. In the past 12 months, it returned 7.2% against the sector’s 5.8%, as the chart below shows.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The best returns, however, were made by the Man GLG Sterling Corporate Bond fund, which gained £32.3m from investment performance and attracted £120.1m in inflows between January and March.

It is managed by FE fundinfo Alpha Manager Jonathan Golan, a “young, talented fixed income manager, passionate about credit selection”, as Square Mile analysts described him, who moved to Man GLG and launched this fund in September 2021.

“Different from many other funds in the sterling corporate bond space, this fund's edge lies in its bottom-up focus on smaller issuers and the team's ability to extract alpha from undervalued credits which are overlooked by larger scale investors,” they said.

“This fund is for those investors looking to access strong returns from the sterling corporate bond market but are willing to endure periods of elevated volatility.”

Aviva Inv Corporate Bond also attracted more than £100m of inflows, as did the passive abrdn Short Dated Sterling Corporate Bond Tracker fund.

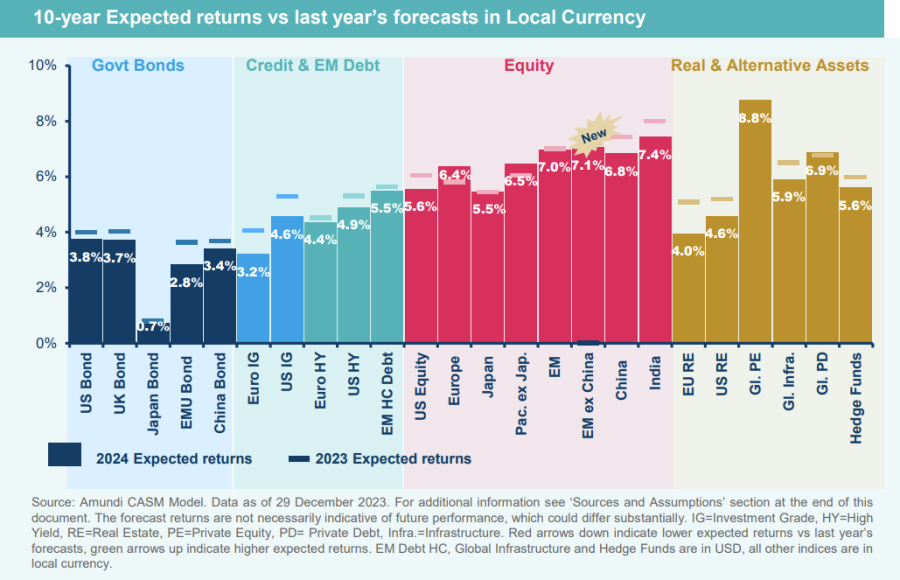

Amundi analysts suggest emerging markets outside of China will flourish, while the US and Japan struggle.

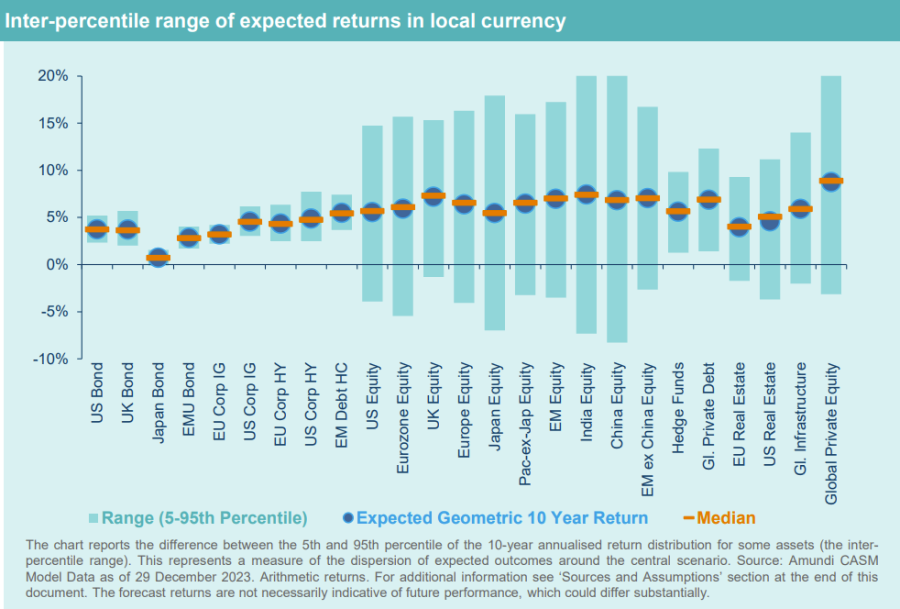

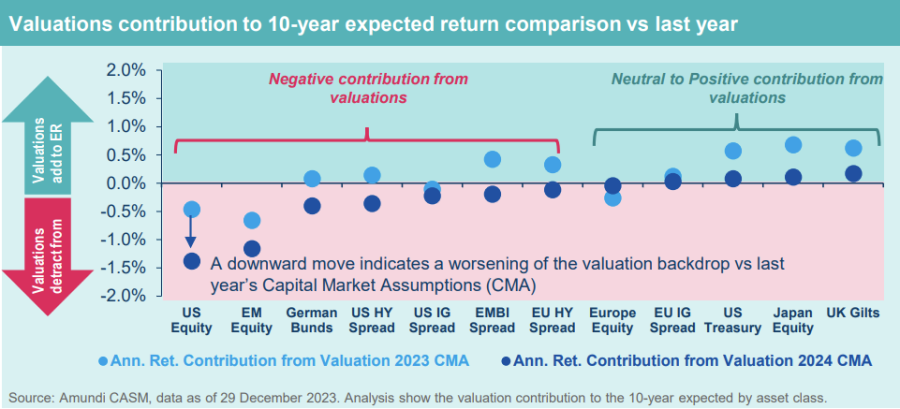

US stocks will make the second-lowest returns of all major markets over the next decade, according to data from Amundi, which forecasts expected returns over 10 years based on current valuations.

It downgraded its expectations for future US gains compared to last year’s forecast “on the assumption that, although the US could continue generating solid earnings per share growth, the market has almost entirely priced in growth expectations, particularly in certain parts of the market (mega caps)”, said Viviana Gisimundo, head of quant and multi-asset solutions at Amundi.

She suggested investors will “have to look deeper within markets in the search for the most appealing opportunities”.

The US is anticipated to make 5.6% per year for the next decade, but other regions such as Europe (6.4%) and Asia Pacific excluding Japan (6.5%) could be a better place to invest thanks to higher earnings per share growth and dividend yields.

However, the US is not expected to be the worst performing market. That falls on Japan, which has been a darling of late as investors have rushed in to take advantage of corporate governance reforms, stock market gains and the improving economic backdrop.

“With regards to Japan equity, although new corporate governance rules are supportive, the Japanese market maintains lower growth potential compared to other developed markets,” Gisimundo said.

The big winner was emerging markets, where Amundi has retained its slight preference versus developed peers, although she warned that performance can be volatile.

“Within the emerging market basket, we anticipate a shift in preferences, as potential growth will be driven by countries other than China,” Gisimundo said.

Indeed, Amundi has added an emerging market excluding China index for the first time into its analysis, which is expected to make 7.1% per annum, bolstered by India, which is the highest returning market on the list at 7.4%.

“We remain cautious about Chinese fundamental and macro assumptions (reflecting the most recent update on the long-term inflation environment),” she said.

“While acknowledging China’s elevated uncertainty, we assume extreme valuations can provide a partial tailwind, particularly for the onshore market.”

The research looks at asset class return expectations in local currencies without considering foreign exchange, which can significantly alter the performance profile.

Turning to bonds, Gisimundo noted that yield curves remain inverted but she expects these to steepen in the medium term as monetary policy normalises.

“More expensive valuations should cause reductions in bond indices’ expected returns and term premiums (particularly in core Europe), while they have slightly improved in Japan, however, where expected returns remain at the low end of the spectrum,” she said.

In credit markets, spreads are “significantly narrower” than their long-term levels and, as such, she expects this to widen out over the medium-to-long term, which should lead to lower returns than had been expected a year ago.

“Overall, the outlook for fixed income assets remains positive, particularly relative to the other asset classes and notably for the high-grade segment and emerging market bonds,” Gisimundo said.

However, she cautioned that although return expectations are greater for high yield than for investment grade bonds, this relative advantage “does not compensate for the higher intrinsic risks”, particularly in the US market.

The firm also produced a chart to highlight the potential range of outcomes that could take place over the next 10 years, as well as the average. Here, although the US has a lower upside than some of the other markets, it has a much better downside.

Japanese, Indian and Chinese equity have the greatest potential downside risk, according to Amundi’s calculations. “Dispersion increases notably when comparing single emerging countries such as India and China versus emerging market aggregates,” said Gisimundo.

“It is key for investors to understand that for some equity and alternative assets, there is a 5% chance of experiencing negative returns over the next decade.”

Bonds typically have a narrower range in comparison to riskier assets such as equities and alternatives.

Lastly, on the economic front, Amundi said fundamentals have slightly improved from last year, but noted the new 10-year expected returns are, on average, slightly lower than last year’s forecasts after taking starting valuations into account, which are now “more stretched”.

Overall, she said bonds will continue to be a “key engine” for portfolio returns, while in equities diversification will be key as markets will be more volatile. Emerging markets excluding China are favoured here, while private equity could also be considered for those with a higher risk appetite.

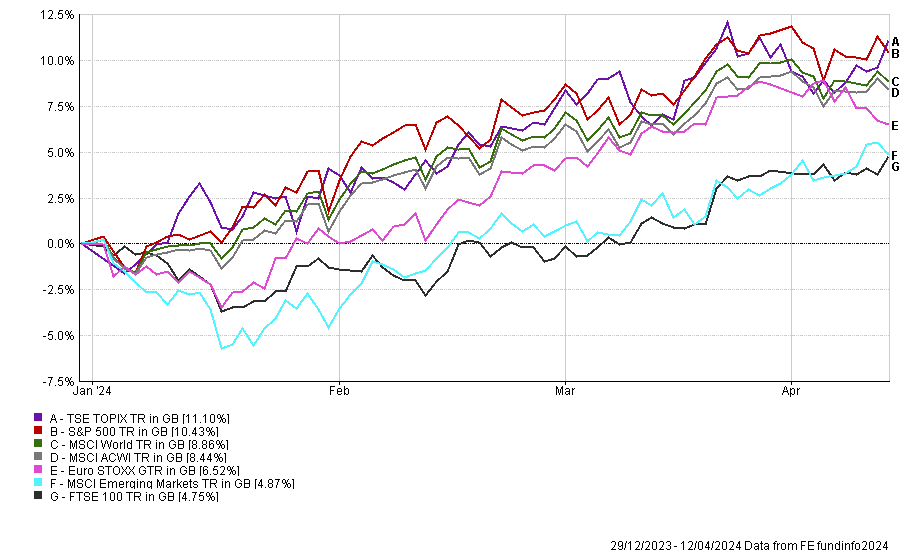

The FTSE 100 broke through 8,000 last week and Peel Hunt analysts suggest this could be a good opportunity to back the domestic market.

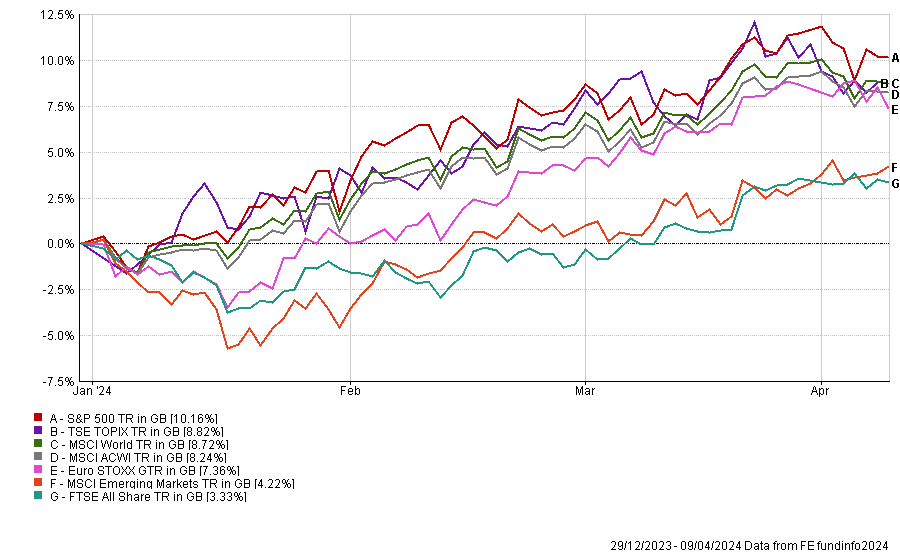

It has been a slow start to the year for UK stocks, which have lagged all other major indices, but the FTSE 100 broke through 8,000 last week, suggesting the tide could be turning, according to analysts at Peel Hunt.

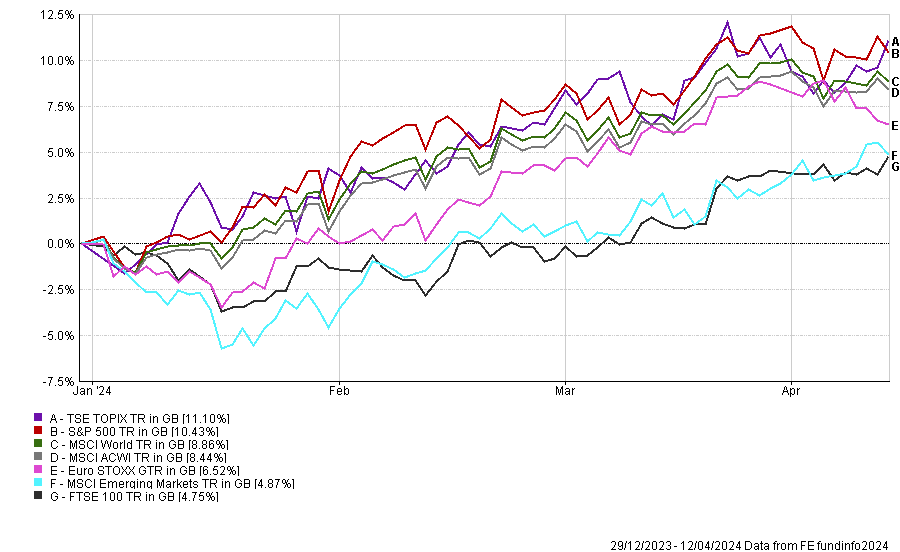

Although the main UK index is last among other major markets over the year to date, as highlighted by the chart below, there are reasons for optimism.

“We see some exciting opportunities to gain access to the UK equity recovery in some well-established trusts with excellent long-term track records trading on attractive valuations,” they said.

Performance of indices over YTD

Source: FE Analytics

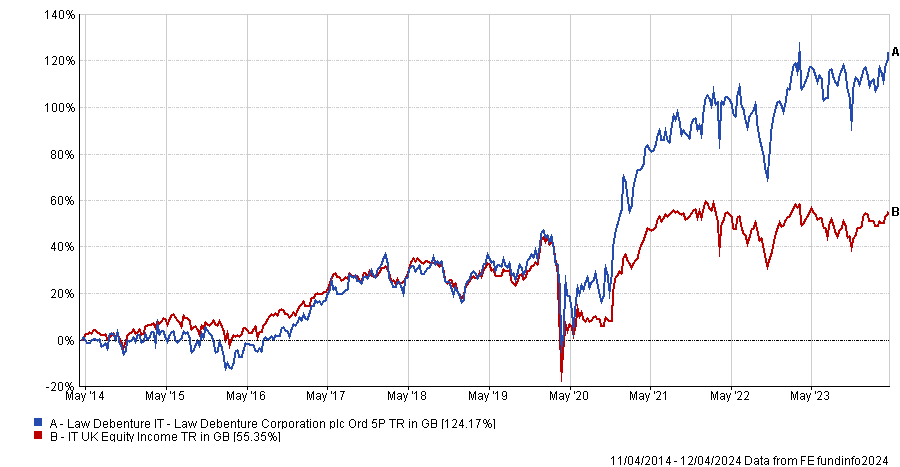

One option is Law Debenture, which has been in the top or second quartile of the IT UK Equity Income sector in each of the past five calendar years. Last year it made 8.1%, placing it in the top five of the 19-strong sector.

Although the discount “remains relatively narrow at 2%” the proposed dividend for this year has risen to 4.9% and a 10-year dividend compound annual growth rate of 7.9% make it “an attractive proposition”, the analysts said.

Law Debenture combines an investment trust with an independent professional services (IPS) business that provides structured finance services, pensions trustee advice, corporate secretarial services and other business critical activities.

“Over the past decade, the independent professional services business, which represents 20% of net asset value (NAV), has funded more than 30% of Law Debenture’s dividends,” they added.

The trust, which is a corporate client of Peel Hunt, has the highest five-year dividend growth in the UK equity income sector, supported by its “unique structure”.

“The consistent growth and cash generation of IPS facilitates an unconstrained investment approach, accessing the full opportunity set in an undervalued UK equity market,” they said.

Performance of fund vs sector over 10yrs

Source: FE Analytics

At £1.1bn, it is one of the largest trusts in the sector and the equity portion of the portfolio is managed by FE fundinfo Alpha Manager James Henderson and Laura Foll.

They have a “contrarian, value-focused investment style” and have propelled the trust to the top of the sector over five and 10 years – making 124.2% over the decade.

“For the past 10 years the IPS business has contributed 34% of Law Debenbture’s revenues and, given the recurring nature of this income stream, this provides the scope for the equity portfolio to be invested unconstrained by yield criteria,” the analysts sad. “This is a significant competitive advantage for a trust operating in the UK Equity Income sector.”

For investors looking to take on more risk, UK mid- and small-caps have been hit harder than the FTSE 100 and are even more out of favour than their large-cap peers. If sentiment is changing, there could be a more rapid rebound in this area of the market.

One such name that could benefit from the UK becoming more popular is Aberforth Smaller Companies, a value strategy.

“The trust has a strong track record, including through years of growth outperformance. Since inception in 1990, it has delivered an annualised NAV total return of 11.4%, 1.8 percentage points higher than the Numis Smaller companies (ex-Investment Companies) index per annum,” the analysts said.

It focuses on the smallest companies in the UK markets where the discount to global markets is particularly stark, with the underlying price-to-earnings (P/E) ratio of the trust’s holdings at just 6.9x, which is a “near record low”.

“Historical evidence suggests that it should support a future five-year annualised return of more than 20%,” the analysts forecast.

Despite their low valuations, just 20% of the stocks in the portfolio have net debt to earnings before interest, tax, depreciation and amortisation of more than 2x – suggesting the majority have strong balance sheets.

“The value in UK small caps is beginning to be recognised and M&A has been a key source of recent returns for Aberforth Smaller Companies,” the analysts noted.

Current valuations give investors a good entry point, they argued, with the current discount of 13% slightly above its 12-month average of 12%.

“As international and domestic buyers alike begin to realise the returns on offer at the small-cap end of the UK equity market, there could be scope for discount narrowing,” they concluded.

Following a major air attack against Israel, Mirabaud Group highlights the parts of the market that might react to continued tensions between the two countries.

Oil, gold, cryptocurrencies and defence stocks are among a wide range of investments that could be affected by the aftermath of Iran’s “historic” attack on Israel, Mirabaud Group has warned.

Iran launched a major air attack against Israel late on Saturday, after it fired several hundred drones and missiles at the country and the territory it controls. This was the first direct attack of this kind launched from Iranian territory after decades of shadow warfare between the two nations.

There were no fatalities in the attack, which was in response to a recent strike on a building in the Iranian embassy complex in Syria (it is believed to have been carried out by Israel, although the country has a policy of not confirming or denying its involvement in such incidents). However, 12 people were taken to hospital and the Nevatim air base, located in the Negev desert in southern Israel, was reportedly slightly damaged.

John Plassard, a senior investment specialist at Mirabaud Group, said: “Tensions have soared in the region following six months of brutal warfare between Israel and Hamas, the Palestinian militant group backed (unofficially) by Iran, triggered by the latter’s attacks on 7 October last year. Rear admiral Daniel Hagari of the Israel Defence Forces (IDF) described Saturday's barrage as a ‘major escalation’.

“Iran, a long-standing enemy of Israel, has always used proxies to carry out its interventions, hence the interest in groups allied to it in the Middle East. This time the situation is different, because it's historic.”

In light of this, Plassard highlighted several areas of the market that investors should pay close attention to in the wake of the attack, starting with the oil price.

Iran's control over the Strait of Hormuz, a crucial route for oil transportation, places it in a strategic position that can influence global oil supplies. This control became evident as oil prices surged on Friday due to rumours of potential military actions, although they later subsided slightly. Despite this, the general trend for oil prices is expected to continue rising.

Other commodities might also fluctuate depending on their regional ties and the evolving geopolitical situation. Continued tensions could lead to increased volatility in these markets.

Gold, often seen as a stable investment during times of uncertainty, has responded to the recent tension in the Middle East. The yellow metal hit a new all-time high last Friday and could rise further if the conflict intensifies.

Meanwhile, the cryptocurrency market reacted negatively to Iran's recent attack on Israel. Bitcoin, for example, dropped from around $67,000 to $61,625, erasing over $130m in market capitalisation shortly after the event, underscoring the volatile nature of cryptocurrencies during geopolitical crises.

In the defence and aerospace sectors, stocks may gain as investor interest grows, fuelled by Israel's effective defence measures against the Iranian attack. Confidence in Israel’s military capabilities could enhance the appeal of stocks related to defence technologies.

Currency values are sensitive to international conflicts, potentially affecting the exchange rates of those directly involved in or connected to the region. Typically, safe-haven currencies such as the Swiss franc and the US dollar would experience gains in such scenarios.

Stock markets in the Middle East are particularly susceptible to shifts in geopolitical dynamics, which could lead to increased volatility. Conversely, markets perceived as more defensive, such as Switzerland, might benefit from investors seeking safer assets.

Market volatility, which has been relatively “dead” since November 2023, showed signs of resurgence following the weekend's events. The VIX, known as ‘the fear index’, exceeded 17 for the first time since the previous October, indicating market volatility could escalate if the conflict continues.

Finally, Plassard said investors might demand a higher risk premium for all assets in the region on the back of this geopolitical uncertainty and tensions. “In short, in the event of Iran's involvement (or continued involvement), many assets could be affected,” he argued.

QuotedData weighs up the relative merits of AVI Japan Opportunity and JPMorgan Japanese for investors seeking exposure to Japan’s improving corporate governance and rising stock market.

The Nikkei 225, one of the flagship indices used to measure the performance of the Japanese market, hit a new all-time high in February and has carried on climbing since. That is a big deal because the previous high was set in 1989 and was followed by a prolonged and deep slump.

There have been many false dawns since, but the cumulative effect of far-reaching corporate governance reforms and more favourable economic conditions finally seems to be feeding through into Japanese equity markets.

The market’s tale can be told by following the fortunes of two very different funds focused on the country. With a market cap of £780m, JPMorgan Japanese is the largest investment company specialising in Japan. The trust has been managed since 2010 by Nicholas Weindling and, for many years, he has been assisted in this by Miyako Urabe.

Their management style is to identify fast-growing companies that can thrive by opening up new markets or by taking market share from incumbents. Such businesses are relatively rare, but once the managers have found great companies, they back them for the long term and so portfolio turnover tends to be quite low as a result.

The point here is that they place little or no reliance on economic growth within Japan, which is held back by a shrinking workforce and ageing population.

The JPMorgan Japanese approach does seem to work over the long run (all four Japanese large-cap trusts have very similar returns over 10 years), and we only have to go back to 2020 to find a period when it was by far the best-performing of all Japanese trusts. However, in retrospect, valuations were probably overstretched.

Like most other growth-focused funds, it had a difficult period over the first few months of 2022, a period that coincided with sharply rising interest rates in the US (which more recently look to have peaked but have not yet started to fall).

For many years, the Japanese authorities have sought ways to encourage growth. Just over a decade ago, a new Prime Minister, Shinzo Abe ushered in an environment of ‘easy money’, government stimulus, and crucially structural reform, that has expanded into a comprehensive shake-up of corporate governance.

On the ‘easy money’ front, very low interest rates were a core part of that. This has put downward pressure on the Japanese yen, which in turn makes the returns that Japanese funds have generated look worse than they otherwise would do.

Despite having low interest rates, for a long time a backdrop of deflation encouraged investors (and many companies) to hoard cash. Many companies built up cross-shareholdings too. However, these unproductive parts of balance sheets tended to be discounted by investors and many companies ended up trading at less than the value of this cash and unnecessary investments.

The majority of the 4,000 or so listed Japanese companies have no analyst coverage and are not particularly investor-friendly. That enabled some pronounced value opportunities to emerge.

Over time, efforts to improve corporate governance have strengthened and this is having a material impact on Japan’s stock market.

One of the drivers of this has been the Tokyo Stock Exchange; last March it asked companies with a price/book ratio of less than one to explain how they were going to tackle this, for example. Cross-shareholdings are being unwound, dividend pay-out ratios are rising, and share buy backs are proliferating. Nevertheless, some companies are still dragging their feet.

As corporate governance reforms started to bite, funds were launched to take advantage of the many bargains on offer. In the investment company market, a pioneer in this area was AVI Japan Opportunity, which was launched in October 2018.

This £184m market cap trust was the brainchild of the team behind AVI Global Trust, which had already had some success targeting undervalued Japanese companies. That success has continued with AVI Japan Opportunity, which since launch is amongst the best-performing of all Japanese-focused investment companies.

AVI Japan Opportunity estimates that there are about 470 companies that have net cash and securities greater than 30% of their market cap. Its managers have constructed detailed models on approximately 60 companies.

Once it has built a stake (big enough to be influential but it is not seeking control), the team will approach the company with ideas of how it can unlock value. This often involves streamlining the balance sheet but sometimes the team has suggestions about improving business efficiency too. These approaches take place behind closed doors, but if target companies prove intransigent, AVI may go public with its proposals and put forward resolutions at company meetings.

In these situations, AVI Japan Opportunity needs to be patient, but the rewards for success – which often flow through to all stakeholders – can be significant. Hence returns tend to be lumpy.

International investors have been encouraged by the commitment to reform in the country. There are signs of positive change in the economy too. Inflation has returned and wages are rising in some sectors. Domestic investors are taking more of an interest in equities but for these funds, a real boost could be a strengthening yen.

James Carthew is head of investment companies at QuotedData. The views expressed above should not be taken as investment advice.

The Finsbury Growth & Income Trust manager has had a poor start to the year, but says there were pockets of positivity.

It has been a disappointing start to the year for investors in the Finsbury Growth & Income Trust and WS Lindsell Train UK Equity fund, which have made a loss of 2.4% and 2.5% respectively so far in 2023.

Yet FE fundinfo Alpha Manager Nick Train believes there were positives as well as negatives for his quality-growth strategy between January and March.

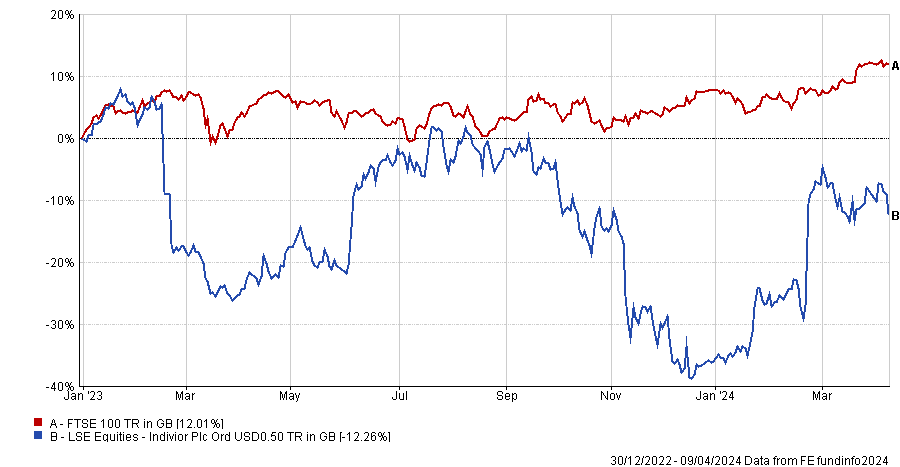

What didn’t work in the first quarter was luxury, particularly companies exposed to the Chinese consumer, he said in the trust’s latest monthly factsheet.

Performance of fund and trust vs sectors and benchmark over YTD

Source: FE Analytics

“Our worst performers were Burberry and Remy Cointreau, both down well over 10%, both with important franchises in Asia and greater China,” he said. “It is frustrating to note that the two are now trading at below half the peak share prices they set in 2023 (Burberry) and 2022 (Remy).”

China has been a contentious area of the market since Covid as the country emerged from lockdown much later than most of the rest of the world. It has also suffered myriad issues surrounding its property sector as well concerns over government intervention in areas such as tech.

However, of more concern to luxury companies is the trend of Chinese consumers preferring domestic products to foreign goods – a change that has taken place since in recent years.

“What has undermined them [Burberry and Remy] has been justified concerns about weakening Chinese demand for western luxury products,” said Train, although he noted that “we must hope these big share price falls have created future opportunity”.

“We know both companies continue to invest behind their brands in the region and that one day growth and consumer confidence in Asia will recover.”

Diageo has also been a poor performer over the quarter. Last week Liontrust’s Anthony Cross said the “jury was still out” on the company after stocking problems in Latin America led to a profit warning.

Train said Diageo’s premium spirits portfolio marginally underperformed during the quarter, with a gain of 3.5%, but noted that the firm was able to reassure investors that its problems in Latin America are easing. “Many, including us, now hope for an improvement in its sales performance elsewhere,” he said.

Asset managers also struggled in the first quarter, with Schroders down 9% and Rathbones also trailing.

“We understand the reasons the industry is out of favour, but believe the companies we hold have differentiated and winning strategies and, as a result, their share prices have become undervalued,” said Train.

“For instance, Schroders has a clearly-articulated and patiently executed strategy to shift its business mix to higher growth and higher margin segments, such as private wealth and private equity, and the strategy is clearly working. If the company can deliver even a smidgen of secular growth then that rating and share price could change meaningfully for the better.”

It was not all doom and gloom however. Tech continued to do well, which the Finsbury Growth & Income Trust has access to through UK-listed data and software companies such as RELX (up 10.1%), Experian (8.4%) and Sage (9.1%).

Performance of stocks in Q1 2024

Source: FE Analytics

Train said: “A smart shareholder asked me recently – which of your holdings really has the potential to double or treble profits over the next decade or more and, as a result, become a much bigger market capitalised company and higher share price?

“My answer was that we believe in all our companies – you have to be a true long-term investor. But that amongst the large-cap holdings in the fund, it is readily conceivable that RELX and Sage have transformative profit potential ahead.”

Another in this sector, LSEG was up 2% in the quarter, underperforming the index, but “creeping back” toward its share price peak set in 2021. It is now 4% adrift.

“We hope that further business progress for LSEG and a likely final placing of the Refinitiv vendors’ stake will clear the way for new share price highs in due course,” he said.

There were idiosyncratic winners in the quarter too, such as tonic maker Fever-Tree, which was up 14% on the back of strong growth numbers in its year-end results. While Train noted the shares currently seem expensive, he said they “will look a bargain” if it can live up its potential.

Unilever was up 5% after announcing the sale or demerger of its ice-cream division, which he said “demonstrated the management’s ambition to highlight and realise the growth and value intrinsic in the group’s portfolio”.

The only meaningful change to the portfolio was Train continued to add to its newest holding Rightmove, taking its position to 3.5% of the net asset value (NAV).

“We have been able to build this position easily, because there are ready sellers at current prices. Those sellers are concerned that UK interest rates higher for longer will continue to retard the UK housing market and, in addition, that new competition may challenge Rightmove’s market share and profitability,” he said.

Last year was the lowest number of housing transactions in the UK (1 million) in a decade, but revenues were up 10% and Train noted the company is developing new products and services which “help its customers close more deals, more efficiently in a difficult market”.

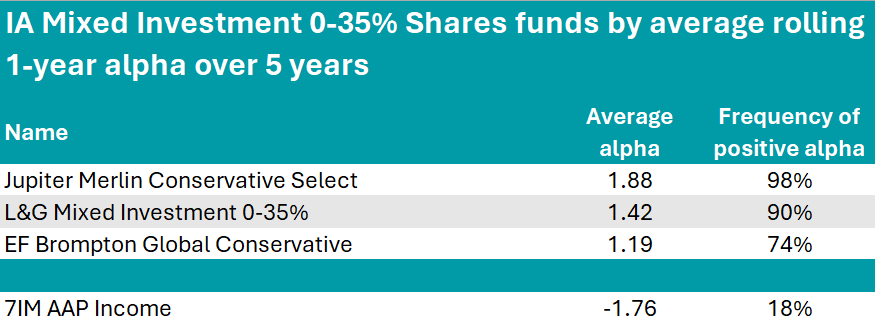

Jupiter and Chelsea notably outperformed in the past five years.

Investors who don’t have the time or the drive to manage their own asset allocation, sometimes rely on mixed-asset managers to do that for them.

This doesn’t mean however that they can completely forget about their investments, and investors should always make the time to review their choice of fund and ensure they’re getting their money’s worth.

One way of doing that is through alpha, or the measure of outperformance against the fund’s own benchmark – the higher the alpha score, the more bang for your buck.

Below, we highlight the average alpha scores of the two Investment Association cautious mixed-assets sectors measured monthly since 2018 over 61 year-long periods. Outperformance is relative to the funds' own benchmarks – which for every fund below was the peer group.

For those who invest in the IA Mixed Investment 0-35% Shares funds, the best choice, with the highest average score of 1.88, was the Jupiter Merlin Conservative Select fund, which maintained a positive alpha in 60 of the 61 periods measured.

Jupiter’s fund-of-funds range took up many top positions in the other sectors as well, and according to Square Mile’s analysts, much of its longer-term success can be attributed to managers John ChatfeildRoberts and Algy SmithMaxwell, who have “adeptly blended an ability to navigate the broader economic environment with astute fund selection”.

Based around capital preservation, one of the key features of this fund is its conviction-led portfolio that is built without reference to the peer group benchmark.

“Overall, we hold this team in high regard and consider this a strong offering for investors seeking a product run by experienced and proven investors, with a strong long-term record of managing multiasset fund-of-funds portfolios who have successfully delivered on the fund's expected outcome since launch,” Square Mile’s analysts said.

Source: FinXL

In second position, the L&G Mixed Investment 0-35% achieved an average alpha of 1.42 by investing in other L&G strategies with a 20-80% split between equities and bonds, of which 26% is developed government bonds, 29% developed corporate bonds and 14% high yield and emerging market debt. It is managed by Bruce White and Christopher Teschmacher.

At -1.76%, 7IM AAP Income had the lowest alpha – however, this passive range of strategies is highlighted by RSMR analysts for offering “consistency of process, return and volatility over the medium to longer term”.

The 7IM investment process focuses on finding value in both asset allocation and fund selection and places significant resource into the areas that they feel will produce the greatest levels of return.

The first fund to stand out in the IA Mixed Investment 20-60% Shares was VT Chelsea Managed Monthly Income, with its 3.36 of average alpha.

With £57.8m of assets under management, it is a small fund but stands out for its performance, achieving an FE fundinfo Crown rating of five.

It has a target weighting of between 40% and 60% in UK and overseas equities, although it under this at present (30%). Within its equities bucket, the fund has 42% invested in the UK, 23% in Europe and 18% in the US.

Alongside equities and fixed interest (31%), the fund also invests in alternatives (20%), including aircraft leasing, property (12%) and target absolute return strategies (3%).

Source: FinXL

Taking up the second and third position are two Invesco strategies: Invesco Distribution and Invesco Global Income.

The former is an absolute return strategy that outperformed the peer group in 90% of the periods measured and is rated by RMSR analysts for its “high-quality team in both fixed interest and equites, lower volatility and proven track record”.

“The process brings together two of Invesco’s strongest teams [equity and fixed interest] in what is a relatively conservative fund, its balance dictated by the fixed interest element,” they said.

“We would consider this as a good first step into the equity market for income seekers without increasing the risk of a portfolio by a significant amount.”

Also of note were the Premier Miton Diversified Income and Hawksmoor The MI Hawksmoor Vanbrugh portfolios.

The lowest scores were those of VT EPIC Multi Asset Balanced (-6.94), EF 8AM Cautious (-3.81) and HL Multi-Manager High Income (-2.89).

IA sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds.

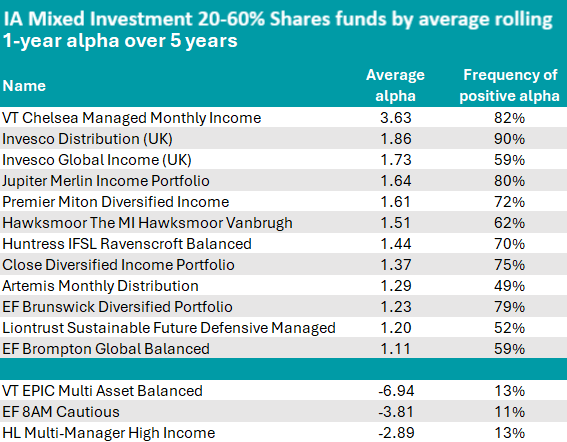

Trustnet looks at funds within the IA UK Smaller Companies sector that have been managed by the same manager since 2004 or earlier and have achieved top-quartile returns over the past three years.

Small-cap investing is where active managers should (in theory) shine. With fewer analysts covering stocks lower down the market capitalisation, savvy investors have more chance of finding hidden gems.

Those who have been in the industry a long time could have a leg up on their younger rivals, having been through many market cycles and seen all sorts of events in their careers.

As such, below, Trustnet looks at the three funds managed by the same person since at least 2004 that have produced top-quartile returns over the past three years – showing they remain at the top of their game.

One of them is Aberforth UK Small Companies, which has been managed by Euan Macdonald since 2001, but who has since been joined by Peter Shaw in 2016, Jeremy Hall in 2018, Sam Ford in 2019, Rob Scott Moncrieff in 2022 and Rowan Marron last year.

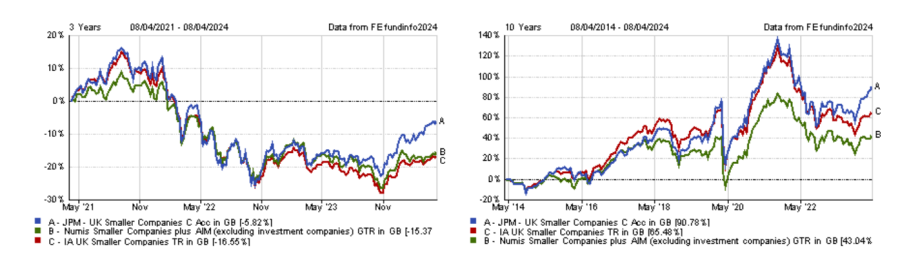

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

The fund is known for its value approach, with Macdonald and his colleagues looking for UK small-caps trading below their intrinsic value. As a result, the fund has benefited from the rotation to value in recent years.

M&A activities have also been a tailwind for the fund, as private equity firms and US companies have taken advantage of the low valuations within the small- and mid-cap segment of the UK equity market.

However, Aberforth UK Small Companies sits in the sector’s third quartile over 10 years, as the value style of investment has been out of favour for most of the past decade.

Moreover, the fund may not be for the fainthearted, as it has been the most volatile portfolio in the sector over the same timeframe.

Another UK small-cap fund managed by a veteran manager that has made top-quartile returns over three years is JPM UK Smaller Companies.

Georgina Brittain has been at the helm of this fund since 2000 and was joined by Katen Patel in 2015.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

Unlike Aberforth UK Small Companies, the fund has lost money over three years, but to a much lesser extent than most of its competitors, explaining its presence among the sector’s top quartile performers during this time.

The past three years have been challenging for UK smaller companies, as the sector is down 16.6%, suffering from higher inflation and interest rates, as well as being part of an unloved market.

A further argument is that UK equities have been left without natural buyers and thus no valuation support, as British pension funds have favoured global equities since they are not required to hold any specific allocation to domestic equities.

The long-term performance of JPM UK Smaller Companies longer-term performance has been strong nonetheless, as the fund also sits in the top quartile over five and 10 years.

It has been one of the most volatile funds in recent years but has delivered some of the best risk-adjusted returns, with the fund’s Sharpe and information ratios both in the sector’s top 10.

Finally, Catherine Stanley, manager of the CT UK Smaller Cap Fund, is the last of the veteran managers of UK funds to have delivered top-quartile returns over three years.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

Stanley has been managing the fund since 2004 and was joined by Patrick Newens in 2019. They are growth investors, looking for UK small-caps exhibiting above average growth rates or good growth potential.

Just as the JPM fund, CT UK Smaller Cap Fund has made a loss over three years, but is still the 11th best performer over the period.

Over the long term, performance has been good as the fund has delivered second-quartile returns over 10 and 15 years, but it has rarely sat in the sector’s top quartile.

Yet, the fund has been one of the least volatile in the sector and has had one of the lowest drawdown – price drops from peak to through – over the past decade. This has also been true over the past three years.

Previously we looked at the IA UK All Companies sector, where there was only one veteran manager to achieve the feat.

The Liontrust UK Growth fund is on the hunt for businesses with intangible assets such as intellectual property that competitors can’t copy.

People adopting a healthy lifestyle by drinking and smoking less is arguably a good thing but it put a dent in the Liontrust UK Growth fund last year. Shares in British American Tobacco and Diageo fell 23% and 20%, respectively, in 2023 and cost the fund 1% of performance each.

Anthony Cross, head of the Economic Advantage team at Liontrust Asset Management, is keeping faith with Diageo. He looks for companies with intangible assets such as large-scale distribution networks that are hard to replicate and favours international consumer goods companies such as Diageo and Unilever. The big unknown for Diageo is how widespread the take-up of American diabetes and weight loss drugs will be, given that people who take these drugs consume less alcohol.

The fund’s strongest recent performers are companies that specialise in data and software tools. Sage, which provides accounting software and cloud-based services, was on a tear last year climbing 61%, while RELX, which supplies analytics and decision tools for the medical, legal and government sectors, rose 39%.

Cross manages the £1bn Liontrust UK Growth fund with Julian Fosh, Matt Tonge and Victoria Stevens. The large-cap iteration of the Economic Advantage investment process, it has achieved top-decile performance for the past decade, earning Cross and Fosh a nomination for FE fundinfo’s Alpha Manager of the Year award.

Cross told Trustnet why he doesn’t think he can add value by making macro calls and why intangible assets drive long-term returns.

What is the UK Growth fund’s investment process?

The process starts with the hunt for businesses that have strong barriers to competition through intangible assets. Three intangible assets are the gateway into any of our funds: intellectual property, distribution and high recurring revenues (more than 70% of a company’s income should be recurring).

Stocks must have at least one of these factors but several of our holdings have two or three. Sage is rich in intellectual property and data-driven distribution and more than 90% of its turnover is recurring income.

Once stocks are through the gateway, we look at other intangible assets such as brands, customer relationships, franchises, licences and culture, which are difficult for competitors to copy and give companies pricing power.

Our companies have an average 12% cash flow return on invested capital versus 7% for the broader market. It’s a really nice test for us as to whether those barriers to competition are actually working.

Finally, when we buy these businesses for the first time, they need to be cheaper than the market on a number of standard measures, such as free cash flow yield, dividend earnings and price-to-earnings ratios, to make sure we’re skewing the odds in our favour.

Why should investors buy the UK Growth fund?

This is the fund to own if you want large-cap exposure. The UK Growth fund has 70% in the FTSE 100, 20% in FTSE 250 stocks, 7% in small-caps and 3% in cash.

There are 44 positions in the portfolio. Most companies go in at 2% plus their index weight so some of our holdings can be quite big. We own 8% in Shell and AstraZeneca, 5-6% in BP and 4% in Diageo.

What you’re going to get with this fund is a quality footprint and compounding. It also has a nice international flavour if you’re a bit bearish about the UK, given that 82% of our companies’ sales come from overseas versus 76% for the FTSE All Share.

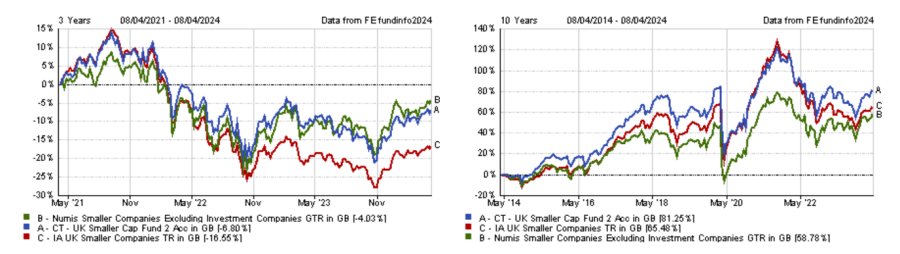

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Which stocks were your best and worst performers last year?

Shell, Sage, BAE Systems and RELX each added 1% of performance to the fund last year. With RELX and Sage, not only were they delivering on earnings but you’ve got that general data excitement going on, so they enjoyed an increase in their price to earnings ratios.

Performance of shares vs FTSE 100 in 2023

Source: FE Analytics

We bought Sage five years ago on a free cash flow yield that was larger than the market. Everyone had given up on Sage at that point; people thought its customers would move to competitors.

Sage has a strong base of clients using its accounting software who are unlikely to change providers. We thought the stickiness of its distribution network would enable the company to migrate to more cloud-based products, which is what happened. Sage is delivering high-single-digit to double-digit organic growth. If growth slows down it could underperform so we have taken profits and trimmed our exposure.

In terms of detractors, British American Tobacco and Diageo each cost us 1% in 2023. The jury is still out with Diageo. It performed well during the successive lockdowns but since then people are drinking less and there has been a cost-of-living crisis.

Diageo also had a stocking problem in Latin America, where the wholesale market was overstocked and demand was not pulling through. This led to a profit warning with a brand new set of management.

Invidior cost us 0.8% last year but it has performed strongly this year, adding 0.5% to the fund already. Invidior had some dangling liabilities and litigation issues which were biting last year and it faced pressure from competitors, but this year the business has performed well and it has dealt with the litigation.

Invidior vs FTSE 100 since 1 Jan 2023

Source: FE Analytics

What are your highest conviction investments?

We have most conviction in some of the small-cap stocks from a valuation perspective. Gamma Communications provides phones and conference call systems to small and medium-sized businesses. It has gained some larger enterprise and government clients and is expanding into Europe, which is quite underdeveloped when it comes to cloud-based telephone systems.

Market research provider YouGov has faced a tough backdrop with declining media spend but it has a strong brand and terrific data sets and could grow a lot more in America.

Future, a mid-cap digital publishing business, is trading on a price-to-earnings ratio of 5x and has a double-digit free cash flow yield. Its magazines, from Country Life to TechRadar, earned revenues from affiliate marketing during lockdown, but since the pandemic, purchasing habits have changed and revenues have dropped.

How much attention do you pay to the broader macroeconomic backdrop?

We don’t attempt to predict where inflation, interest rates or foreign exchange are travelling because we don’t think we could add any value doing that.

Our companies themselves are always thinking about interest rates, currency movements and political upheavals in the countries they are supplying. One has to rely on businesses themselves doing their homework in terms of where they want to be exposed and what the dangers are.

What do you do outside of fund management?

I live near Perth in Scotland and I have a cottage further north. I’m a big believer in having a hinterland to put things back into perspective so I go fishing, which is a head-clearer and I enjoy skiing.

Many look to the FTSE 100 for income, but there could be an even better option.

Investing for income can be a priority for many investors, whether it be to supplement a salary, earn a living entirely or to keep comfortable in retirement.

The UK is perhaps the market most synonymous with income, thanks to its higher-than-average dividends and yield. Unlike countries such as the US – where companies focus more on growth and reinvesting their spare cash – UK stocks have long history of returning excess money to shareholders.

Many will look at the FTSE 100 as the best place for this, with big payers such as the oil giants, miners and banks all residing at the top of the domestic market.

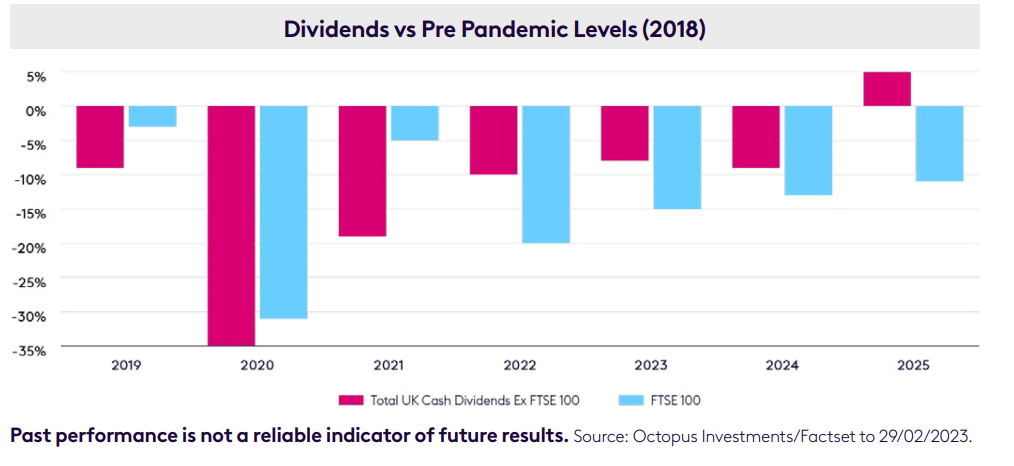

Yet those that rely on these mega companies are putting their eggs into an increasingly small basket. More than half (57%) of all dividends in the index are paid by just 10 companies, with the remaining 43% coming from the other 90 names, according to data this week from Octopus Investments’ ‘Dividend Barometer’.

What’s more, the traditional income sectors might not be the best areas of the market to invest in going forward from a total return perspective.

Investors can get much more diversification further down the market. On average, the 10 largest dividend-paying companies in the FTSE 250 accounted for just 22% of the total paid out by constituents of the mid-cap index, Octopus found. This rose slightly to around a third of FTSE Small Cap companies and 36% of the amount from those quoted on AIM.

But this is not the only reason why mid- and small-caps might be a better option for income seekers than their larger counterparts.

Among the four indices mentioned, companies in the FTSE 100 have the lowest dividend cover, a measure of a stock’s earnings relative to the amount of money paid out to shareholders each year.

Additionally, while investing as a whole took a big hit during the pandemic in 2020 as companies held back cash to cover shortfalls, the lower parts of the market have been quicker to recover. While FTSE 100 dividends are still some way from their pre-pandemic levels, companies outside of large-cap status are much closer.

And this is set to continue. Octopus forecast FTSE 100 dividends to remain 11% behind 2018 levels by the end of 2025, while the rest of the market will overtake previous highs by the end of next year.

Of course, mid-caps are not going to be right for everyone. Smaller stocks tend to be inherently riskier and therefore may not suit retirees, for example.

But even this is a double-edged sword as they also have the potential for higher gains as they have more room to grow. And this is a crucial part of income investing that many forget.

Buying stocks where the share price should in theory rise more quickly (as is the case with mid- and small-caps) creates a double-whammy for investors.

Now this is by no means a reason to sell all of your large-caps and move lower down the market, but if you do need income, it is worth considering putting a sleeve of your portfolio into stocks further down the cap spectrum.

The Bank of England may cut rates before the Fed.

UK GDP rose 0.1% in February thanks to improvement in the services and production sectors, according to data from the Office for National Statistics.

Although GDP growth last month slightly dipped compared to the 0.3% rise recorded in January – which was revied up from 0.2% in the latest reading – the UK is now on track to exit the technical recession it entered at the end of last year.

Stephen Payne, portfolio manager on the global equity income team at Janus Henderson, said: “Industrial production was stronger than expected, continuing its recent pick-up, whilst construction activity was hampered by the very wet weather.

“Growth for the first quarter is now set to come in stronger than the Bank of England’s anaemic forecast, but it is still only a modest recovery that does not threaten the on-going disinflation in the economy.”

As a result, Payne believes that the stage is set for the Bank of England (BOE) to start cutting rates, as base rates remain “comfortably” above the rate of nominal GDP growth.

As such, the UK appears to be in a better position than the US to start its interest rate cut cycle, as inflation across the pond came in higher than expected earlier this week, dampening hopes for rate cuts in June, while more bearish market participants wrote off any rate cut in the US in 2024.

Meanwhile, the European Central Bank (ECB) opted to maintain its rates unchanged yesterday, with President Christine Lagarde confirming the ongoing disinflationary process. Therefore, the ECB may consider rate cuts at its next meeting in June should inflation persist in its downward trajectory.

Neil Birrell, chief investment officer at Premier Miton Investors, said: “With inflation tracking back, the BoE might be persuaded to start cutting rates sooner rather than later and after the CPI data out of the US and the ECB meeting over the last week, we could well see the Fed being the last of the three to take any action on rates. That would be quite a shift over a period of a few months.”

However, Danni Hewson, head of financial analysis at AJ Bell, warned that there are a few “wildcards” in play that could impact the UK economy in the coming months. That includes tensions in the middle east, which have recently pushed the price of oil over $90 a barrel, and the fact UK shoppers will have a few more pennies thanks to the cut in National Insurance contributions and the rise in the National Living Wage.

Ed Monk, associate director at Fidelity International, also sees a contradiction in having a recovering economy and the relief of lower rates at the same time.

He explained: “If today’s reading is positive for growth overall it may end up being bad news for both borrowers and financial markets, in the short-term at least. Both are waiting for the Bank of England to cut rates but wage rises and now better performance in parts of the economy are adding to inflationary pressures.

“Expectations of rate cuts this year have softened and markets now expect only two cuts before 2025.”

Nonetheless, both the FTSE 100 and FTSE 250 were up at the market open, as the positive GDP figure gave investors hopes that the UK is on its way out of recession.

Russ Mould, investment director at AJ Bell, said: “Housebuilders and supermarkets were in demand as investors took the view that a stronger economy will give a boost to consumer confidence and provide a better backdrop for spending.

“Miners also helped to give the FTSE 100 a lift as copper prices continued to climb thanks to the twin engines of supply fears and brighter demand prospects.”

Polar Capital and Fidelity are among the most consistent providers in these sectors.

Polar Capital and Fidelity International offer the most reliable actively-managed thematic funds. Their technology, healthcare and financial services strategies performed consistently well during the past decade, data from FE Analytics showed.

Funds run by Polar Capital and Fidelity topped the tables by outperforming the most common benchmarks in the Investment Association Healthcare and IA Financials and Financial Innovation sectors since 2014.

A noteworthy exception was technology, where passives took the lead.

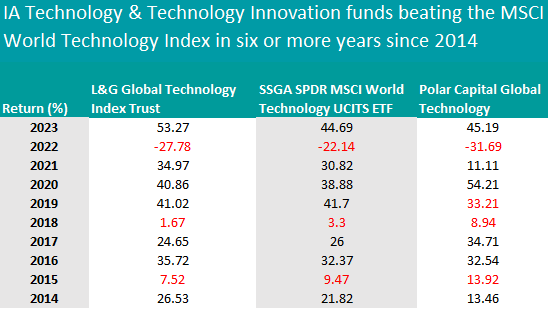

Amongst the 32 funds in the IA Technology & Technology Innovation sector, only 13 vehicles have a 10-year long history and were therefore part of this study.

Only two funds managed to beat the MSCI World Technology Index (the most common benchmark for the peer group) in seven of the past 10 years – the L&G Global Technology Index Trust and the SSGA SPDR MSCI World Technology UCITS ETF.

Both are passive vehicles, which benefitted from the Magnificent Seven’s relentless growth last year.

This burgeoning of just a few companies, particularly in the past year, left active managers who scan the market for underappreciated opportunities behind.

With £2.8bn of assets under management, the L&G Global Technology Index Trust is a popular option for investors. It tracks the FTSE World Technology Index and returned 53.27% last year, charging a mere 0.32%.

Marginally cheaper, with an ongoing charges figure (OCF) of 0.3%, and significantly smaller (£497.4m), the SSGA SPDR MSCI World Technology UCITS ETF tracks the MSCI World Information Technology Index Capped 35/20 instead. It stood behind our reference benchmark in 2022, 2018 and 2015, as the table below shows.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

In the active space, the most consistent strategy was the $6.6bn Polar Capital Global Technology fund, co-managed by Ben Rogoff, Nick Evans, Fatima Iu and Xuesong Zhao, who were highlighted by Square Mile analysts for their skill at “identifying changing industry trends and the companies that are poised to benefit as a result”.

“A plus for the fund is the experience of the managers, who have witnessed first-hand a plethora of seemingly promising businesses that have fallen by the wayside, alongside the gains that can be generated through companies that succeed in sustaining the growth of their business,” they said.

“We believe this is an attractive fund for long-term investors who are looking for exposure to rapidly growing technology companies.”

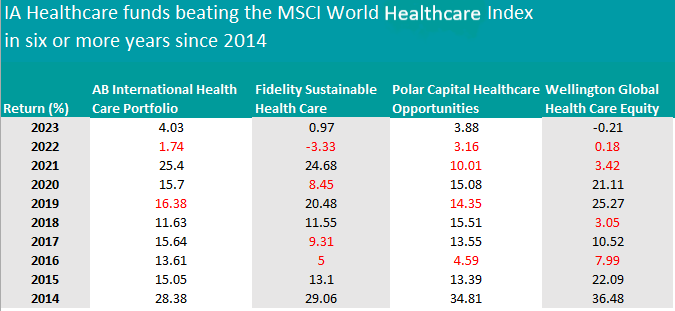

Moving on to the IA Healthcare sector, where only seven of 22 funds qualified for this study, the £3.1bn AB International Health Care Portfolio stood out with eight years of outperformance against the MSCI World Healthcare index in the past decade.

The fund is managed by John H. Fogarty and Vinay Thapar, who focus on companies that are expected to attract healthcare spending through the introduction of new treatments and therapies or by offering customers cost reduction opportunities.

Their top holdings are Eli Lilly (8.1%) and Novo Nordisk (7.5%), which are among the most successful pharmaceutical companies of the recent past and contributed to the fund’s performance in an otherwise difficult period for healthcare funds.

The portfolio is concentrated in 43 names and the top 10 holdings constitute 55% of its assets.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

Fidelity Sustainable Health Care, Polar Capital Healthcare Opportunities and Wellington Global Health Care Equity also stood out having outperformed the benchmark in six of the past 10 years.

The Fidelity and Wellington funds are similar – both invest almost exclusively in healthcare and they have a correlation of 87% – whereas Polar Capital Healthcare Opportunities is more diversified across sectors, with biotechnology and medical making up 47% of the portfolio, healthcare 25.2%, medical products 11.8% and pharmaceuticals 15.72%.

All three funds have more than £1bn in assets.

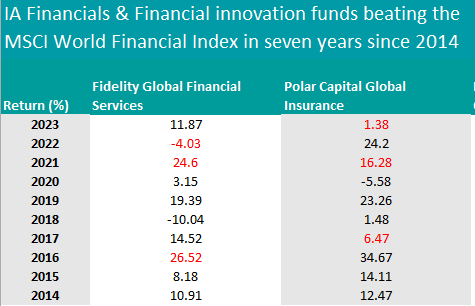

We conclude with the IA Financials & Financials Innovation sector. Here, eight funds out of 14 had a 10-year track record and the largest of them were also the most consistent.

Fidelity Global Financial Services (£1bn) and Polar Capital Global Insurance (£2.2bn) had seven strong years. Fidelity’s fund slipped up in 2022, 2021 and 2016, while Polar Capital struggled in 2023, 2021 and 2017, as the table below shows.

Source: Trustnet. The red highlight represents underperformance against the reference benchmark.

The Polar Capital fund is managed by Dominic Evans and Nick Martin, who are the chief reason why Square Mile analysts favour the vehicle. They also like the “sensible” strategy that emphasises well-managed and proven insurance companies that have high returns on equity and good underwriting records.

“Martin has built a deep pool of company knowledge and is well informed as to the intricacies of investing in this sleepy sub sector of markets that is not widely covered, is perceived as complex and includes plenty of companies of variable quality,” they said.

“Evans’ promotion to fund manager in March 2022 was a natural progression for both him and the fund. We believe that the managers of this fund should be able to achieve their objectives over the long term.”

With exposure to distributors, healthcare, insurance and transport, Polar Capital Global Insurance is quite different to Fidelity Global Financial Services, which almost exclusively focuses on financials and combines a bottom-up fundamentals approach with top-down macroeconomic views. The two are only 57% correlated.

This article is part of an ongoing series on consistency. Find the previous instalments here: Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds, adventurous funds.

Kamal Warraich explains why he has increased exposure to the quality factor.

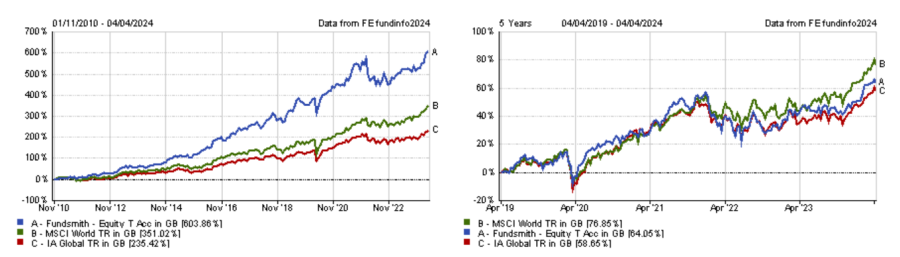

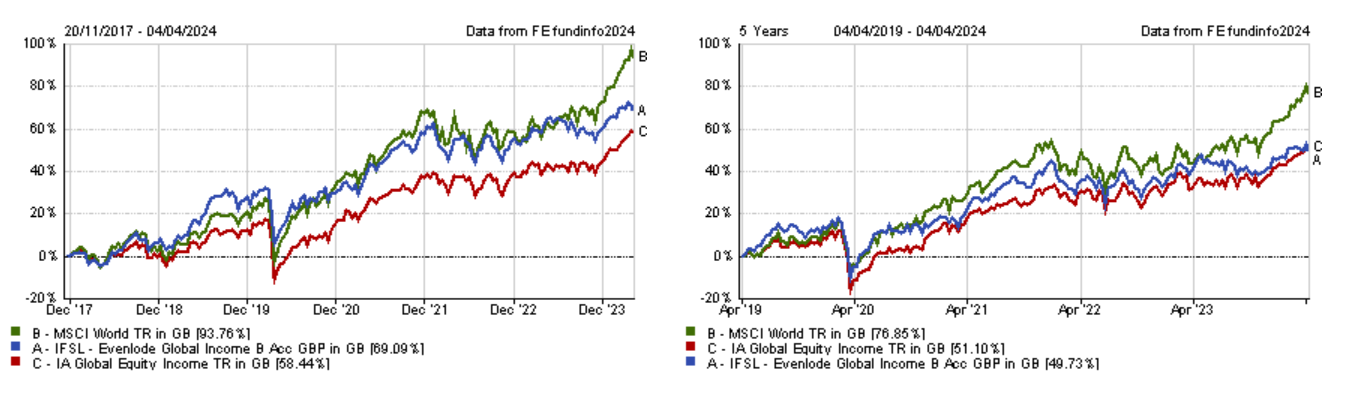

Canaccord Genuity Wealth Management has increased its weighting to quality stocks with the addition of Fundsmith Equity and Evenlode Global Income.

Kamal Warraich, head of equity fund research at Canaccord, explained that the stressed economic environment, recent technical recessions and the slowdown in global economic growth have led the wealth management firm to seek refuge in the quality factor.