Sectors not regions will be the way to outperform as US exceptionalism wanes, according to Pictet Asset Management.

Double-digit returns from US and global equities will be consigned to the history books as the factors underpinning US exceptionalism and high valuations dissipate, according to Pictet Asset Management.

Overall, global equities will deliver 7.6% per annum for the next five years, but the way to generate much higher returns going forward will be to choose the right sectors, said chief strategist Luca Paolini.

Technology, healthcare and industrials will benefit from innovation and artificial intelligence (AI), ageing populations, climate change and protectionism. These three sectors should outperform global equity benchmarks by a cumulative 20% over the coming five years, he said.

“These industries are pivotal in resolving some of our greatest long-term challenges, namely climate change, fraught geopolitics and growing labour shortages. In other words, in times of increasing uncertainty, we seek exposure to sectors that are the problem solvers,” he explained.

Pictet expects returns from growth and value strategies to be more evenly balanced over the next five years. Growth strategies will benefit from developments in AI but value strategies with a higher weighting to industrials will profit from onshoring, nearshoring and “muscular industrial policy”, Paolini added.

The markets that will do well

From a geographical perspective, Pictet is expecting annualised returns of 7.5% from US equities over five years – still around the world average but below its recent dominance. “Elements of US exceptionalism are rolling over,” Paolini said. He thinks low taxes and record amounts of government spending are unsustainable, while US leadership in AI and GLP-1 weight loss drugs will boost growth only marginally.

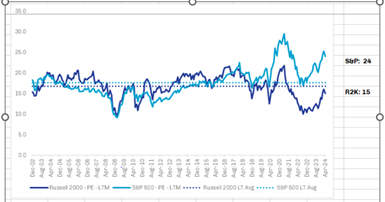

The S&P 500 is trading at a price-to-earnings (P/E) multiple of 21x compared to a long-term historical average of 16x. Paolini thinks a P/E multiple of 19x would represent fair value over the next five years and said the stock market’s current rich valuations will compress long-term returns.

US exceptionalism will not necessarily go into reverse but it will pause, giving other regions the chance to catch up, he predicted.

Emerging market companies in particular are getting better at translating economic growth into earnings growth and India is the world’s fastest growing region, he said.

Pictet expects emerging market equities to return 8.3% per annum in US dollar terms for the next five years and Latin American equities to do even better, returning 8.5%, as the chart below shows.

Five-year return forecasts in US dollar terms

Source: Pictet Asset Management, Refinitiv, Bloomberg

Inflation is a headwind for emerging market stocks – which explains their flat performance this year – but if inflation normalises and the global economy holds up, then emerging market equities should perform well, Paolini explained.

The UK and Europe are falling behind

Languishing at the bottom of the league table are UK and eurozone equities, which are projected to return 6.7% and 6.8%, respectively.

The UK is a defensive market full of well-managed, cheap companies but it does not have a vibrant or large technology sector so the market is “not very exciting”, Paolini admitted.

Arun Sai, senior multi-asset strategist, described the UK as a “stagflation play” because of its exposure to commodities. “You would need a peculiar macro set up for the UK to out-deliver on earnings versus global peers,” he noted. “The UK is essentially defensive value.”

A word on bonds

Turning to fixed income, total returns from 10-year US government bonds are forecast to be 5.6% on an annualised basis for the next five years, with 10-year Treasury yields settling at 3.75%. This means that equities will still outperform bonds, but by a relatively slim margin, as rising bond yields enhance the appeal of fixed income.

Paolini suggested that asset allocators move some money out of equities into credit, predicting a 6.3% annualised return from US investment-grade bonds. Returns from corporate bonds are likely to be on a par with equities, but with less risk and lower volatility as default rates remain benign.

Currencies and alternatives

Currency movements will assume greater relative importance going forward as they will eat into the muted returns that Pictet expects equities and most other asset classes to deliver.

Pictet predicts that the US dollar will weaken gradually by 2% per annum over the next five years, which will be a tailwind for local currency emerging market debt – an asset class that is forecast to return 8.9% per annum, beating hard currency emerging market debt and emerging market equities.

Meanwhile, Paolini believes investors should maintain exposure to alternatives and real assets but he acknowledged that these strategies are less attractive relative to listed assets than in the past.

In private equity, private debt and real estate, the gap between the best and worst performing managers is “massive” so manager selection is more important than asset allocation, he said.

The ultimate winners in the AI race have yet to be determined but the infrastructure needed to support AI, from data centres to semiconductors, is already experiencing a capex boom.

The rapid development of generative artificial intelligence (AI) tools has been a central concern of businesses and markets over the past three years. Demonstrated by the dominance of the ‘Magnificent Seven’, valuations reflect the widespread expectation that this will be an ongoing phenomenon.

Much of the discussion about AI technologies has focused on the hypothetical. Speculation is at fever pitch regarding the potential for AI to transform tasks as mundane as grocery shopping and as advanced as surgery. Yet, few tools have become mainstays of daily life.

Up until now, activity in the AI sector has focused on training models and machine learning. This has aimed to produce systems sophisticated enough to support complex requests and applications.

The significant transition that is only just beginning is for the technology to rotate from training to usage.

It is here that the outlook for the sector becomes murkier. The ‘winners’ in terms of both models themselves and their makers have not been determined.

However, capital expenditure has been – and continues to be – significantly ramped up in a bid to capture future markets. Companies such as Meta and Microsoft have staggering sums of money to spend, supported by their prodigious earnings growth from their existing businesses and cash-rich balance sheets.

In the first quarter of 2024, Microsoft’s capex rose 79% to $14bn, while Meta plans to increase its capex in 2024 overall by at least $5bn.

The question that most readily comes to our minds is: where is all that money going?

It is here that a more certain set of winners lies. AI may itself have a dramatic impact on our lives, society and physical world. The resources needed to support its evolution, though, are already experiencing – and creating – such an effect.

The expansion of AI requires significant infrastructure support – and that needs to be firmly in place before any transition can happen.

With this in mind, tangential operations such as data centres have become increasingly central to the AI revolution. Estimates suggest that AI-supporting data centres use two and a half times more energy than legacy data centres. With extra processing comes extra heat produced. As such, cooling technology has become a central requirement in the AI transition, accounting for up to 40% of that energy use.

Another example is memory. Devices will need to have additional memory capabilities to support the most challenging AI applications. As these functions come online, that hardware will need to be in place already.

As Nvidia’s meteoric share price rise demonstrates, semiconductors are a crucial component of this transition. This opportunity is investable via semiconductor producers themselves, through to the producers of the equipment used to manufacture the chips. The AI investing pool runs deep.

Indeed, down to the cabling required to carry so much additional data both within the data centres and around the world, a global supply chain is establishing itself.

Another question to ask ourselves though is: who will be the eventual winners among the AI service providers?

Ultimately, this is hard to forecast. One thing that seems certain is that our technology platform is likely to expand dramatically. Cisco has predicted that 500 billion devices will be connected by 2030, a rise from 13 billion in 2013.

This ultimately circles back to having the resources in place to support any applications that do come online. The demand for energy has already surged with the use of large language models. This exacerbated the increase in electricity use that was already coming from electric vehicles, heat pumps and other areas of the green transition.

The tension that this represents was most clearly reflected when Amazon purchased a data centre with its own nuclear power source earlier in the year.

With Western societies unused to energy needs increasing, this presents a significant challenge. However, among established energy producers, it also presents an opportunity.

Ben Lofthouse is the fund manager of Henderson International Income Trust. The views expressed above should not be taken as investment advice.

Experts discuss the departure of the manager and investment case for the fund.

Veteran manager Kevin Murphy will leave Schroders after 24 years at the firm to join his brother Dermot and former Jupiter Asset Management fund manager Ben Whitmore at the newly founded Brickwood Asset Management.

With the move, he will give up his role as co-manager of the Schroder Recovery, Income and Income Maximiser funds. Schroders has announced that Nick Kirrage, who currently leads the global value team, will join Andrew Lyddon and Andy Evans on all UK value portfolios, taking back a position that he held between 2006 and 2022.

A Schroders spokesperson said: “Continuity is key with the transition and succession being meticulously managed on behalf of our clients whose service and investment focus will remain unchanged.”

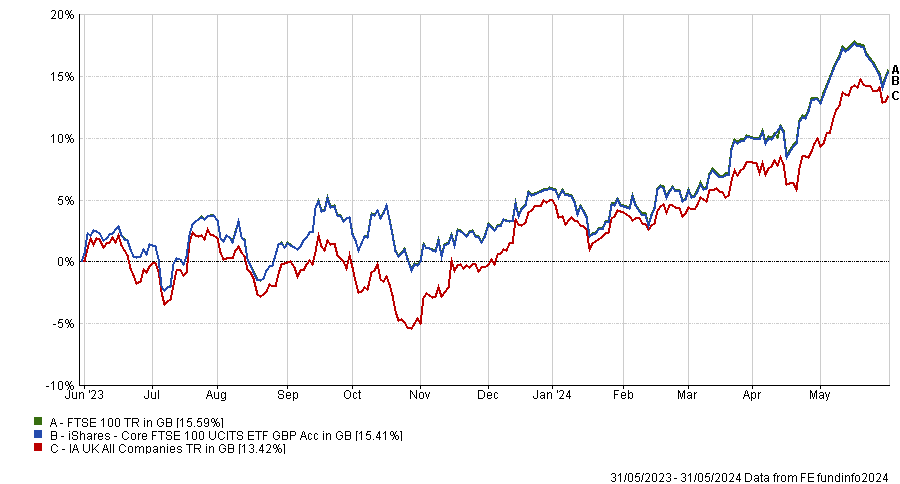

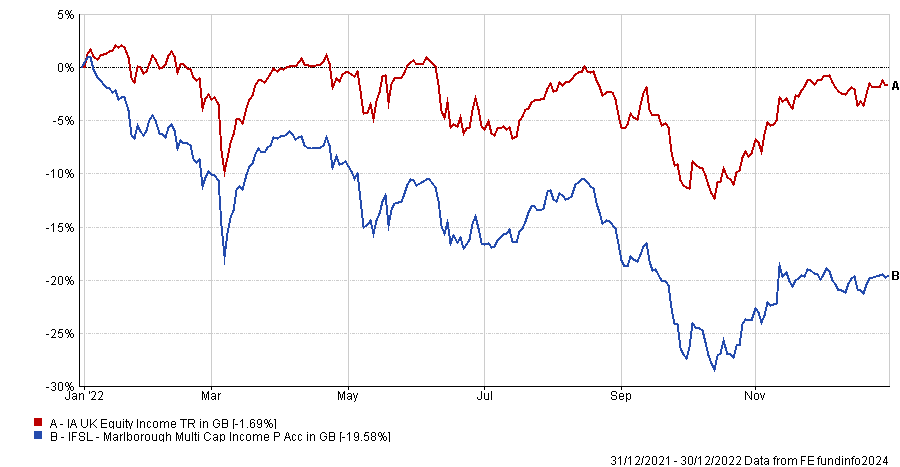

Performance of fund against sector and index since Murphy’s tenure

Source: FE Analytics

Murphy’s departing has dealt “a blow” to the Schroders team, according to Tom Green, fund analyst at FE Invest.

“This is a blow to the team, as Murphy was one of the founding members of the value team and does a lot of the work around the evolution of the funds process,” he said.

The income fund has a “long-term, successful track-record in value investing” and was recommended by FE Investments for its ability to move into positions quickly when stocks sell off aggressively as well as the team’s contrarian positions, which historically paid off in the long term.

The exit doesn’t necessarily impact these strong points, according to Green, who retained his conviction.

“Other members of the team also work with Murphy and due to the very experienced wider team, we have fewer concerns than if this was a single-manager structure,” the analyst concluded.

Ben Yearsley, investment consultant at Fairview Investing, broadly agreed with Green.

“It's a slightly strange move [for Murphy], as it results in two big beasts of the value jungle [Murphy and Whitmore] together. Maybe the opportunity to work with Whitmore as well as his brother was a big draw,” he said.

“It’s a shame for Schroders, as Murphy and Kirrage have always made an excellent team. But long gone are the days when it was only the two of them – it’s a much broader team now, which will be headed up by Kirrage solely.”

As for how investors in one or multiple products run by the team should react to the news, Yearsley said that “those who were happy holders before have no reason to change that view”.

Also not changing their views were the analysts at Square Mile Investment Consulting and Research, who have an ‘A’ rating on the Schroder Income fund.

Senior investment research analyst David Holder said that while it is “disappointing” that the Schroders team has lost “such a seasoned value investor”, the main effect of the move is to “further enhance Brickwood’s credibility” within the value investing space.

As for the consequences for Schroders, the re-introduction of Kirrage into the team “should very much comfort investors”.

“The three-person sub-team overseeing all UK value mandates is very well placed in terms of collegiate understanding, depth of investment knowledge and experience in this area of the UK market,” Holder said.

“The strength and depth of experience within the team remains cohesive and strong and as such, Square Mile has retained the A rating on the Income fund as well as the Recovery and Income Maximiser funds.”

Alphawave Semi’s transition away from China has hit its earnings expectations.

Alphawave IP Group (known as Alphawave Semi) has been targeted by short-sellers after revising its earnings expectations downwards. The company, which provides high-speed connectivity solutions for data centres, artificial intelligence and 5G wireless infrastructure, revealed in mid-April that its 2023 earnings would fall below its original forecasts due to its “accelerated transition away from China”.

The company warned that its investments in research and development would have a negative impact on profits and that revenues from “long-term contracts in advanced nodes” would be lower than expected.

Alphawave Semi published its annual report a week later, on 23 April 2024, with revenues of $321.7m for 2023. This represented a 74% increase compared to 2022 but fell below the company’s original outlook of $340m to $360m.

JPMorgan Asset Management disclosed a short position in Alphawave Semi last month amounting to 1.4% of the latter’s share capital. Marshall Wace, GLG Partners and Kuvari Partners have placed smaller bets against Alphawave Semi, according to the Financial Conduct Authority.

These bets have catapulted Alphawave Semi into the 10 most shorted UK-listed companies, ranked by the percentage of their share capital in the hands of short sellers.

Alphawave Semi listed on the London Stock Exchange three years ago and its share price peaked at £4.52 on 6 August 2021. It fell to £1.80 by 5 November 2021 and has been fairly range-bound since then. It was trading at £1.36 at the time of writing on 3 June 2024.

Short-sellers have also increased their bets against Ocado, which was the second most-shorted stock last month and risks being ejected from the FTSE 100 in its imminent reshuffle.

Dan Coatsworth, investment analyst at AJ Bell, described Ocado as “one of the most Marmite names on the UK stock market”.

“Investors either love or hate the quasi grocery/technology group and some even change their mind on a daily or weekly basis,” he said.

“There is always a ‘will it, won’t it’ element in trying to second guess what Ocado is doing strategically. On paper, the business model is focused on winning more grocery clients to power its online shopping warehouses, while also trying to improve the performance of a joint venture with Marks & Spencer. In reality, progress has been lumpier than gravy in a school canteen,” he concluded.

Energy facilities company Petrofac remains the UK’s most-shorted stock, as the table below shows.

Source: Financial Conduct Authority

Don’t miss out on the possible resurgence of the domestic market, experts warn.

Momentum is gathering for UK stocks, which surged through record highs last month, and the upcoming elections are drawing even more attention to the domestic market.

Indeed the FTSE 100 peaked at 8,445.8 in May, almost 600 points ahead of its pre-Covid levels, although it remains some way below the likes of the US’ S&P 500 index (11.2% return year-to-date), with the UK large-cap index up 9% in 2024 so far.

Whether this resurgence will be enough for investors to reconsider their preference for global investments and return to the unloved UK market remains to be seen, but experts are becoming more vocal about the opportunities cropping up domestically.

Trustnet has recently asked whether it's time for a patriotic punt on the UK stock market and many commentators pointed out the favourable entry point due to cheap valuations, increased international merger and acquisition (M&A) activity, improvement in economic data, imminent rate cuts and “voracious” share buybacks.

On top of that, many UK stocks have surged past most of the magnificent seven, with very few people noticing.

Hal Cook, senior investment analyst at Hargreaves Lansdown, said there is a lot to like about the UK stock market.

“With mature industries such as banks, oil and gas and tobacco, the UK has been known as a good place to look for dividend income, but there are plenty of growth opportunities too – from big consumer goods companies selling their products globally to smaller businesses looking to grow into the giants of tomorrow,” he said.

“We think this combination and the discount on offer compared to other regions make the UK an attractive place to invest right now.”

The main way – and the cheapest – to invest in the UK are exchange-traded funds (ETFs), according to Cook, whose preference was for two iShares and one Vanguard solutions.

For investors who want to get exposure to the largest UK companies, he recommended the iShares Core FTSE 100 ETF, which tracks the performance of the FTSE 100 index.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“It does this by investing in every company and in proportion with each company’s index weight. This is known as full replication, which can help the ETF track the index closely,” he said.

The £2.2bn fund is passively managed by Blackrock, has achieved an FE fundinfo passive fund Crown-rating of five, and only charges 0.07%.

ETFs also offer access to income-paying stocks and Cook’s pick was iShares UK Dividend ETF, a low-cost option for tracking the performance of the FTSE Dividend UK+ index with a price tag of just 0.40%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

This £848m vehicle offers exposure to 50 of the highest dividend-paying stocks listed in the UK, while still making sure it’s diversified across multiple sectors. The trailing 12-month yield is currently 5.45%.

Finally, medium-sized companies enthusiasts should consider the Vanguard FTSE 250 ETF, which aims to track the performance of medium-sized companies in the UK as measured by the FTSE 250 index.

Performance of fund against sector and index over 1yr

Source: FE Analytics

FE Investments analysts highlighted this fund for its simple method of replicating the performance of the index by direct ownership of all the underlying securities as well as its usage of stock lending, a practice by which a select third party borrows a limited amount of the passive fund’s holdings in exchange for a fee.

This supplements fund returns and compensates for the trading costs involved with direct ownership of the securities.

Among the investment management houses, Hawksmoor has been betting big on a UK recovery. Chief investment officer Ben Conway said that a FTSE 250 tracker would be a good option to capture a broad spectrum of opportunities in the mid-cap space, but fans of active management can also consider Aberforth Smaller Companies and Odyssean.

Not everything will be smooth sailing for the UK, however, and work remains to be done in a number of areas. The finance industry has been advocating for a number of changes to get Britain back on track.

Chelsea Financial Services and FundCalibre managing director Darius McDermott examines the catalyst for continued outperformance from emerging markets.

The last decade has been challenging for investors who have backed the emerging markets (EM) growth story. In that time the MSCI Emerging Markets index has produced around a third of the returns produced by developed markets (73% vs. 213%)*.

There are plenty of reasons for this – many EM economies have suffered since the 2001-2010 boom, which was fuelled by the likes of China’s rapid growth and the commodities super cycle. This is because many had uncompetitive currencies and failed to reform, particularly among those who exported commodities. The US dollar has also been largely strong since 2014, hampering US-dollar earnings-per-share growth for EM companies. We’ve also seen commodities prices ease, China’s growth engine slow and intensified geopolitical concerns.

The start of this year saw the MSCI Emerging Markets index fall 4.7%, the largest fall since January 1998**. This was because investors believed the strength of the US economy would lead to the Federal Reserve holding rates at their peak for longer. But the expectation of loosening financial conditions (lower rates) across the globe has started to initiate a broader recovery, with riskier assets like EMs up 6.1% in the past three months alone***.

Could a recovery in earnings growth, resilience in the US economy and the potential peak in US interest rates be the catalyst for continued outperformance in EMs from here? Clearly there are still dangers, there are plenty of elections in the region this year (not to mention the US), while many believe there is a lagged effect from high interest rates which will drag on the economy.

Falling rates one of a number of reasons for optimism

Although more rate cuts were anticipated at the start of 2024, the expectation is they are not too far away now and they should benefit many EMs, particularly areas like Latin America. This is where the US dollar comes into play, as rates come down in the US the dollar should stabilise (it will not be as strong) and weaken against other EMs. History shows the positive impact of rate cuts on EMs – with equities in the region rising by an average of 14% in the initial 12 months following the first Federal Reserve rate cut****.

GDP growth in EMs is also accelerating at a time when it is slowing in the developed world. Figures from the International Monetary Fund project growth of 1.7% and 1.8% for developed world economies in 2024 and 2025 respectively (vs. 4.2 per cent for EM’s in both years)^. Part of this is because EMs came out of Covid later, meanwhile EM consumers were not supported by governments in the emerging world, this means the recovery for the consumer has taken longer.

The third point is the ripple effect of China’s underperformance on EMs. Having fallen over 40% since February 2021, the re-rating of its equity market has been indiscriminate – and that has created plenty of valuation opportunities in the region for active managers^^.

Then there is earnings growth and valuations across the board. Consensus earnings growth for EM in 2024 and 2025 stands at 19% and 15% respectively, compared to 11% and 13% in the United States**. Meanwhile valuations look compelling, with EMs trading on a price-to-earnings multiple of 12x, compared to 18.9x for the developed markets and 21.9x for the US**.

Dispersion the order of the day

As we know many of these markets have different drivers supporting their growth today, so dispersion across countries and sub-regions is likely to be rife. Research from S&P Global indicates growth may moderate for many countries that outperformed in 2023 (such as Brazil, Mexico, and India) but remain relatively strong. By contrast those who underperformed last year (Colombia, Peru, Thailand, Hungary, Poland and South Africa) will grow modestly faster this year^^^.

When you add in the long-term demographic tailwinds and the rise of the middle-class, EMs do look attractive at this point, but you have to accept those bumps in the road. You also have to have a view on China and the impact it has on the wider region, but there are now plenty of different ways to invest across the region without being tied to one specific theme.

Those looking for exposure to the asset class might want to consider the likes of the JPMorgan Emerging Markets Investment Trust, which invest in around 60-100 high quality business, with the average investment held for 10 years. An alternative high conviction name would be the FP Carmignac Emerging Markets fund, a high conviction portfolio of 35-55 large and mid-cap firms.

Those who want a reasonable exposure to China may want to look at the FSSA Global Emerging Markets Focus fund, managed by Rasmus Nemmoe and Naren Gorthy, which currently has a third of its exposure in the country with names like Tencent, Tsingtao Brewery and JD.com sitting in its top 10 holdings^^^^.

By contrast, those who are wary of China might look to the likes of the Jupiter Asian Income fund, with manager Jason Pidcock citing political concerns as the main reason for not investing in China. He sold his last remaining mainland China stocks, as well as one Macau-based business, in July 2022, but had been underweight China for some time, due to his low expectations of corporate profitability relative to the rest of the region. Pidcock aims to yield 20% more than the respective benchmark. The portfolio is typically high conviction with between 30-50 stocks held. The focus on large companies with reliable returns, makes it an attractive defensive option.

*Source: FE Analytics, total returns in pounds sterling, from 30 May 2014 to 30 May 2024

**Source: Lazard, Outlook for Global Emerging Markets, April 2024

***Source: FE Analytics, total returns in pounds sterling, from 27 February 2024 to 27 May 2024

****Source: Franklin Templeton, 8 January 2024

^Source: International Monetary Fund, World Economic Outlook, April 2024

^^Source: FE Analytics, total returns in pounds sterling, from 1 February 2021 to 30 May 2024

^^^Source: S&P Global, Economic Outlook Emerging Markets, 26 March 2024

^^^^Source: fund factsheet, 30 April 2024

Darius McDermott is managing director of Chelsea Financial Services and FundCalibre. The views expressed above are his own and should not be taken as investment advice.

Experts explain the differences between Scottish Mortgage and Ark Innovation and share their preference.

Cathie Wood’s ARK Invest recently launched three of its exchange-traded funds (ETFs) in Europe, including the firm’s flagship strategy ARK Innovation ETF.

The latter is an aggressively-managed fund aiming to identify businesses that can be transformational and have the potential to generate exceptional long-term growth.

As a result of this investment process, the ARK Innovation ETF has proven to be volatile and has struggled in risk-off markets when the growth investment style fell out of favour.

This description may remind UK investors of a fund they are perhaps more familiar with: Scottish Mortgage.

Alex Watts, fund analyst at interactive investor, said: “There are some similarities in philosophy and positioning. Both funds take unconstrained approaches to investing in disruptive businesses that are driving innovation and are at the helm of cutting-edge and growing themes.

“This naturally leads them to invest in higher-multiple growth stocks, compared with more conventional and benchmark conscious peers.”

Despite their similar high growth approach, ARK Innovation and Scottish Mortgage differ in many ways too. As an investment trust, Scottish Mortgage has access to additional tools, such as the ability to leverage its portfolio and hold unlisted assets. It is also subject to a premium/discount mechanism, offering investors the possibility to buy assets below their net asset value. As an exchange-traded fund, ARK Innovation does not have access to these instruments.

They also diverge in their respective investment strategies: ARK employs a more active trading approach, whereas Scottish Mortgage uses a buy-and-hold strategy.

At the portfolio level, there are also significant differences between the two funds. For instance, Tesla is the only common stock in both funds' top 10 holdings, although the two portfolios share a few other names such as Shopify, Roblox, and Moderna.

Dan Coatsworth, investment analyst at AJ Bell, said: “One could argue that ARK’s portfolio is higher risk than Scottish Mortgage’s, certainly judging by the top 10 positions. For example, it offers exposure to cryptocurrencies via Coinbase and Block. It also holds web conferencing platform provider Zoom whose share price soared during the pandemic and crashed soon afterwards when people started returning to work in offices and Microsoft’s Teams system became more widely used, and has flatlined for the past two years.

“In contrast, Scottish Mortgage has quite a few well-established businesses which are giants in their industries including Nvidia, Amazon and ASML. Its stake in PDD is also interesting as the Chinese company’s latest results show a highly profitable business that is growing fast, helped by the runaway success of its e-commerce platform Temu, which is the talk of the town in the retail industry.”

ARK is also less diversified in terms of the number of holdings as well as geographic distribution. The ETF only invests in 30-50 holdings compared to approximately 100 for the more diversified Scottish Mortgage.

The investment trust is also more global, with sizeable allocations to Europe and the emerging markets in addition to North America. In contrast, ARK Innovation is significantly US-centric, with 95% of its portfolio invested in the US.

In terms of cost, Scottish Mortgage boasts a lower ongoing charge figure of 0.34%, whereas ARK Innovation charges more than double those fees at 0.75%.

As for performance, the British investment trust has done significantly better than its American ETF rival since 2014, with the outperformance being even more striking over five years.

Performance of funds since October 2014 and over 5yrs

Source: FE Analytics

However, ARK Innovation long had the upper hand until late 2021 when inflation and interest rates started picking up. Although both funds suffered from this dramatic change in the macroeconomic environment, the ETF was even more impacted.

What are experts’ preferences?

When asked to pick a favourite between the two, most experts voted for Scottish Mortgage. Darius McDermott, managing director at Chelsea Financial Services, prefers Scottish Mortgage’s buy-and-hold approach, although he recognised that there have been some misses.

He said: “We like Scottish Mortgage’s desire to run its winners, however there have been occasional instances, such as with Moderna at its peak, where the team missed opportunities to take profit.

“Overall, Scottish Mortgage's core strategy demonstrably aligns with a long-term mindset. Also, we believe the trust’s private market exposure continues to be a significant advantage.”

Another expert speaking in favour of Scottish Mortgage was Gavin Haynes, co-founder of Fairview Investing, who holds the investment trust.

He said: “Whist it has had some tough times the long-term returns have been impressive. I like the trust structure which allows access to unlisted companies and the competitive charging structure.

“Although the glory days were largely under previous manager James Anderson, I believe that Tom Slater is now making his mark on the portfolio and the returns over the past year have been encouraging.”

As for Watts, he highlighted that Scottish Mortgage features in interactive investor’s Super 60 rated list but finds it "encouraging" to see new participants in the UK market offering investors access to disruptive growth strategies.

“It’s exciting to see Cathie Wood, who has such a following in the US, bring a highly active strategy via an active ETF structure to the UK market,” he said.

He warned, however, that there is a significant key-person risk with ARK Innovation as Wood is simultaneously the founder, chief executive officer and chief investment officer of ARK.

Global equities have delivered an annualised return of about 4.9% since 2000. Not bad, but when investors can lock in coupon payments at yields close to historical equity returns we think we are in a new golden age for bonds.

Corporate bond yields began climbing rapidly at the start of 2022, creating difficulty for many market participants. However, the rise in yields sets the stage for bond investors to reap higher levels of income than previously available.

This is because the average European investment grade corporate yield is around 3.9%, as measured by the Bloomberg Pan-European Corporate Bond Index. Meanwhile, high-yield corporate bonds yield around 7.7%, as measured by the Bloomberg Pan-European High Yield Index. This compares to a dividend yield for the MSCI World Index of around 1.8%.

Critically, many corporate issuers have funding costs well below current market yields, so have been insulated from the rise in rates. That’s because 63% of investment-grade corporate bonds and 69% of high-yield bonds were issued before 2022.

While a bond investor should care about yield and not typically make issuance year a focus, this dynamic provides some cushion to bond investors as corporate funding costs are only rising slowly as bonds mature and need to be refinanced.

This sets up a win-win for bond investors and the companies in which they invest: a win for the investor because they can harvest today’s higher yields from high-quality companies, and a win for many corporations as they can comfortably service their debts at pre-2022 coupon levels.

With rate cuts nearly upon us, the rates environment should become friendlier for corporate refinancing in the years ahead.

Exploiting market inefficiencies

Given where we are in the economic cycle, plus the political landscape, we expect volatility to increase, which should create plenty of market dislocations to exploit.

The rise of passive investing in the past decade has dramatically reduced the cost of investing in bonds, but it has also created significant inefficiencies for active bond investors to exploit, as comparatively less active money has been available to arbitrage away relative or absolute value opportunities.

A key risk for passive bond investing is that fixed income benchmarks are fundamentally flawed in a way that equity indices are not. Unlike equity indices, bond indices tend to apply weightings based on debt outstanding. This can mean passive bond investors are unintentionally overweight and overexposed to more heavily indebted companies.

An active investor can generally seek to avoid this scenario, particularly in an environment where growth may be challenged, calling into question the creditworthiness of the most indebted borrowers.

Who stands to benefit?

We believe an active approach to bond investing allows investors to take more intentional tilts in favour of bonds backed by companies with strong credit characteristics and those at an attractive valuation, among other risk factor tilts.

A savvy bond investor can exploit the many inefficiencies that arise from large index-tracking strategies that are focused on closely tracking a benchmark, rather than risk-adjusted return generation.

Consider, for example, actively managed multi-sector fixed-income strategies that offer yield and some shelter from volatility. Additionally, a strategy focused on a single sector such as high-yield bonds can offer equity-like returns with a lower risk profile than stocks.

Targeting inefficiencies effectively means casting a wide net across the fixed income universe, including corporates, governments, municipals, mortgage-backed securities, global bonds, emerging markets, and structured credit, and combining the best opportunities with precise risk scaling.

As economic growth is expected to slow, managers also need robust credit analysis capabilities, not just across corporate bonds but all forms of bonds, which requires extensive resourcing commitments.

Market inefficiencies are often durable but not large. Most notably, the risk premium available on individual bonds can be inefficiently priced, allowing credit-focused managers to target multiple security selection opportunities.

Unfortunately, some strategies might be just too large to implement a meaningful security selection position based on the volume of bonds outstanding. As a result, we find the largest bond funds are often overly reliant on duration positioning, which can be very volatile.

We believe managers need to be resourceful enough to find inefficiencies across the whole fixed income universe, such as employing credit analysts across the globe to cover issuers in their local market.

However, they also need to be nimble to have any hope of exploiting them, for example, by managing strategies small enough to take a security or sector selection position that can have a meaningful impact on performance.

Bonds might lack the glamour and buzz of many of the investment trends of the past decade, but they have the income, return, risk profile and staying power many are seeking. Welcome to the new golden age of bond investing.

Peter Bentley is co-manager of the BNY Mellon Global Credit fund and deputy CIO of fixed income at Insight Investment. The views expressed above should not be taken as investment advice.

Trustnet reveals where investors should have put their cash last month.

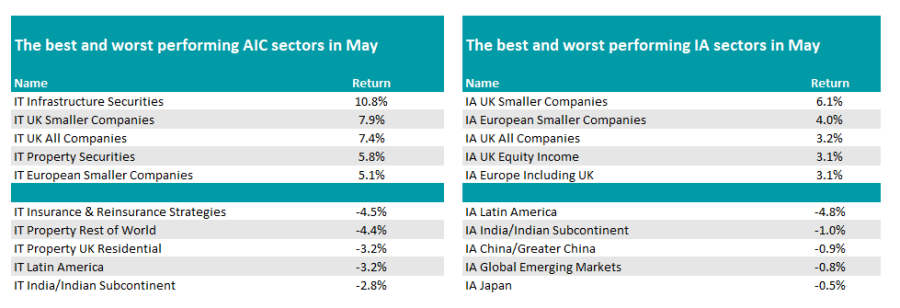

Domestic funds dominated the leaderboard in May, with all three major UK equity sectors in the Investment Association universe among the top five peer groups over the course of the month.

IA UK Smaller Companies topped the billing, with the average fund making a 6.1% total return. IA UK All Companies and IA UK Equity Income were in third and fourth place, making 3.2% and 3.1% respectively.

Splitting the UK sectors was IA European Smaller Companies (up 4%) while IA Europe Including UK rounded out the top five (3.1%).

It was a similar story in the investment trust sphere, where the average trust in the IT UK Smaller Companies sector marched 7.9% higher, while IT UK All Companies constituents made an average gain of 7.4%.

They were topped, however, by specialist strategies in the IT Infrastructure Securities sector (10.8%).

Source: FE Analytics

The month was a busy one for the UK, with prime minister Rishi Sunak shocking the nation with an early general election in July.

Ben Yearsley, director at Fairview Investing, said: “The polls look like it’s a one way bet, with Keir Starmer the next prime minister. However, the parties are yet to publish their manifestos which may contain some surprises. Unfortunately, most of the surprises will probably cost money although both parties are being very careful to rule out tax rises.”

Perhaps Sunak’s rationale centred around economic data, where official UK inflation was 2.3% in April, down from 3.2% the prior month.

Meanwhile, the UK has exited recession with growth of 0.6% in the first quarter beating forecasts of 0.4%. “Was it this that pushed Rishi into his election gamble or was it that household confidence is at its highest for three years?,” asked Yearsley.

Both the UK’s FTSE 100 and US’ S&P 500 indices hit new highs last month, yet it was the domestic funds that benefited the most.

“It is slightly odd when you consider all three main US indices hit new highs in May, however the US dollar was weak knocking returns to most UK investors,” said Yearsley.

At the foot of the table was Latin American funds, with the IA sector down 4.8%, while both China and India stocks also fell.

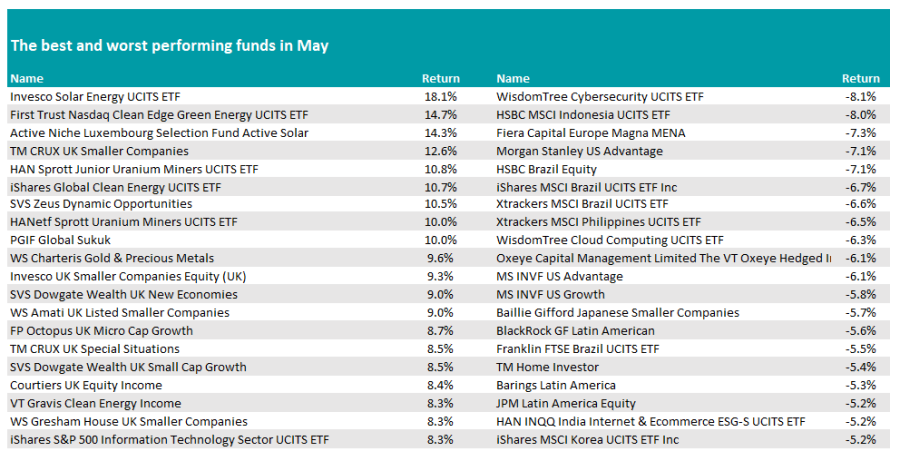

Turning to individual funds, there was a resurgence for renewable energy portfolios, with the top three - Invesco Solar Energy UCITS ETF, First Trust Nasdaq Clean Edge Green Energy UCITS ETF and Luxembourg Selection Fund Active Solar – all making 14% or more.

TM CRUX UK Smaller Companies, managed by Richard Penny, was the top domestic fund, with the £7.8m fund up 12.6%. It was joined in the top 20 by peers Invesco UK Smaller Companies Equity, WS Amati UK Listed Smaller Companies, FP Octopus UK Micro Cap Growth, SVS Dowgate Wealth UK Small Cap Growth and WS Gresham House UK Smaller Companies, while its larger stablemate TM CRUX UK Special Situations also made the top performers list.

Source: FE Analytics

Yearsley said: “Following on from April’s new FTSE high, May has continued the same trend. The UK market finally appears to be garnering attention. Takeovers and M&A are almost a daily occurrence now. Some are rebuffed like BHP’s attempt at Anglo and the PE approach for Hargreaves Lansdown, while others go through.

“It’s fascinating though that UK small-cap is also joining the party topping the performance charts in May – the rally is spreading. Despite this, the UK still looks cheap offering good yields and defensive characteristics - the only thing missing is proper growth stocks.”

In terms of losers, there were many individual emerging market ETFs under pressure last month, with Indonesia, Brazil, Korea India and the Philippines all represented in the bottom 20 funds. Worst of all however was WisdomTree Cybersecurity UCITS ETF, down 8.1% in May.

Among active funds, Fiera Capital Europe's Magna MENA was the bottom of the pile, down 7.3%, while Morgan Stanley US Advantage lost 7.1%.

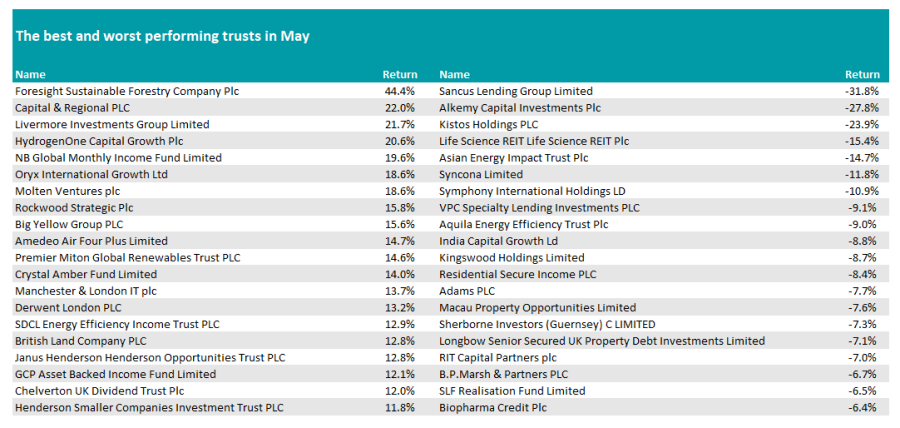

In the trust world, Foresight Sustainable Forestry topped the list after it received an offer from another Foresight managed product, making a return of 44.4% over the month. Yearsley asked: “Is it only time before all specialist trusts under say £200m in size get bought out?”

Source: FE Analytics

At the foot of the table, Sancus Lending lost 31.8% after the firm announced it would make a loss of around £10m for 2023 due to write-downs on legacy loans.

Fund managers highlight four common pitfalls in fixed income investing and reveal strategies to safeguard against them.

Bond funds have been in the spotlight since the major central banks ended their rate hiking cycle last year, as investors and fund managers endeavoured to lock in historically high yields and position themselves to make capital gains when yields started to fall.

In light of renewed investor interest, as well as the volatility seen in bond markets during the past couple of years, Trustnet asked fund managers to highlight some of the risks involved with fixed income investing and to suggest ways to mitigate them.

Don’t get too greedy

Credit spreads are tight, which means that corporate bonds are not offering investors much compensation for taking additional credit risk, said Nicolas Trindade, who manages a range of short duration strategies for AXA Investment Managers.

On the other hand, sovereign bonds yields, particularly in the US, have repriced significantly higher this year in reaction to sticky inflation data. “Treasury yields are 50 basis points higher on a year-to-date basis and the market has gone from expecting six interest rate cuts from the US Federal Reserve at the end of 2023 to two. So, it is amazing to me that risk assets have barely reacted at all,” he said.

“Credit spreads tightened substantially at the end of last year because the market thought the Fed would cut a lot. Now no-one thinks the Fed will do that, but credit spreads haven’t really widened to reflect that significant change of view.”

Therefore, Trindade warned investors to remain cautious, given that inflation could still surprise to the upside.

“The risk – the thing that will finally break the market – is that the Fed opens the door to interest rate hikes. That is not our central scenario, but investors must have it at the back of their minds. Investors should not get greedy in an environment like this. Yields have come right back up after the sell-off, so you don’t need to take big risks to get a good return.”

Short-dated bonds are attractive from a yield perspective, he continued, and given that sovereign yield curves are inverted, there is little incentive to buy longer bonds.

“If inflation continues to surprise to the upside, particularly in the US, investors will get better protection from short-dated paper. Investment grade bonds at the front of the curve offer a nice combination of better yields, less duration and solid fundamentals.”

Credit investors can’t afford to ignore sovereign debt

Corporate bonds are priced off the government bond yield curve. Therefore, credit investors should check whether the equivalent government bonds of the appropriate currency and duration are correctly priced and reflect their view on interest rates, said Emma Moriarty, an investment manager at CG Asset Management.

By way of example, the duration of CG’s sterling corporate credit portfolio is two years, so Moriarty has been analysing two-year gilts, which are “probably fairly priced for our rate expectations so that’s a duration we’re comfortable to ride”.

She agreed with Trinidade that investors are getting less compensation for credit risk as spreads have tightened. CG has reduced its sterling corporate credit allocation over the past few months after making capital gains because there is “not much more room”.

Corporate bonds behave like equities in a crisis

In times of stress, corporate bonds – especially BBB-rated bonds – can become relatively illiquid and cease to provide diversification against equities, said Will McIntosh-Whyte, a fund manager in Rathbones’ multi-asset team.

“If you have lots of people running for the exits at the same time, these things can move to big discounts, particularly in a 2008-type scenario. They can then suddenly behave more like equities because they're not always the most liquid, and particularly when you get down into the BBB area. In really difficult markets, it can become quite difficult to sell them at all, unless you want to take a nasty haircut to the price,” he explained.

“I'm not saying you should never hold corporate bonds, but I think you just need to be wary of what they are.”

Rathbones’ multi-asset team classifies asset classes into three buckets: liquidity, equity-type risk and diversifiers. Corporate bonds belong in the equity risk bucket, while government bonds are in the liquidity bucket because “you can always sell them in any market at the market price”.

Government bonds are not necessarily low risk, however. “You don't really have that credit risk, but you can have volatility because you've got that interest rate risk and obviously, we saw that in spades in 2022.”

This is why Rathbones has a third bucket of uncorrelated return streams, such as a US rates volatility trend note and S&P 500 put options.

Avoid fallen angels

Corporate bond prices plummet when the company that issued them is downgraded, especially if it falls off the cliff from investment grade to high yield, said Adam Whiteley, head of global credit at Insight Investment.

Insight Investment uses a ‘landmine checklist’ to spot which issuers might get downgraded ahead of time. Companies that are taken private or that undergo management buyouts with an element of private equity funding raise a red flag because transactions are often financed with debt, he said. This can lead to ratings downgrades due to higher levels of debt on the company’s balance sheet.

The firm’s landmine checklist looks out for characteristics that might attract private equity acquirers, such as: a share price that is underperforming versus the peer group; a modest size so the whole entity can be acquired; and stable earnings and cash flow to pay off the debt used to finance an acquisition.

The next step involves digging into the bond documentation. Some bonds have a clause where they must be redeemed at par if the issuing company’s ownership changes hands. When corporate bonds are trading below par, a change of control can deliver some upside, he explained.

Trustnet looks at funds within the different multi-asset sectors that have been run by the same manager since at least 2004.

Only five funds managed by ‘veteran’ managers – those who have been at the helm since 2004 or earlier – have made top-quartile returns over the past three years across the IA Mixed Investment 40-85% Shares, IA Mixed Investment 20-60% Shares, IA Mixed Investment 0-35% Shares, and IA Flexible Investment sectors, data from Trustnet has revealed.

Among those five funds, three are from the Jupiter fund house and are managed by industry veteran and FE fundinfo Alpha Manager John Chatfeild-Roberts as well as Amanda Sillars, David Lewis and George Fox.

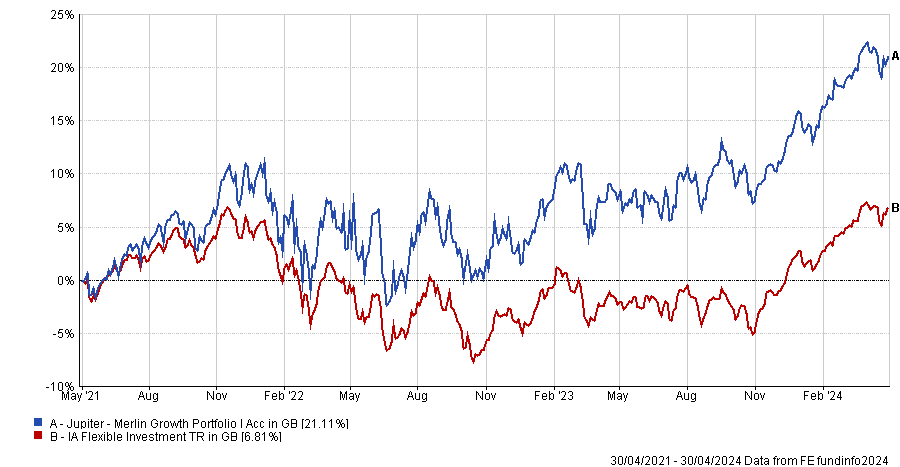

One of them is Jupiter Merlin Growth Portfolio, which is the only fund in the IA Flexible Investment sector that has matched our criteria. Chatfeild-Roberts was appointed manager of this fund in April 1997.

Over the past three years (to last month end), the fund has returned 21.1%, guaranteeing it a place in the sector’s top quartile.

Like the other Jupiter funds managed by Chatfeild-Roberts in our list, Jupiter Merlin Growth Portfolio uses a fund of funds approach, meaning that it invests in other funds, including both in-house Jupiter funds as well as funds from external providers.

Performance of fund over 3yrs vs sector

Source: FE Analytics

Analysts at Square Mile said: “The investment process starts with an analysis of the macroeconomic environment, which helps them formulate their investment strategy.

“By having an informed view on the broader economy and the market cycle, the team believe they are better placed to identify key turning points and thus make changes to the portfolio in a more timely manner.

“The team then focus on fund selection and seek strategies that are likely to benefit in the prevailing macroeconomic and market backdrop.”

The portfolio typically has 10 to 20 holdings, with Jupiter Global Value Equity, Jupiter UK Special Situations, WS Morant Wright Japan, Findlay Park American and IFSL Evenlode Global Equity currently the five largest positions in the fund.

The fund’s longer term performance has also been commendable, as it sits in the top quartile over five and 10 years.

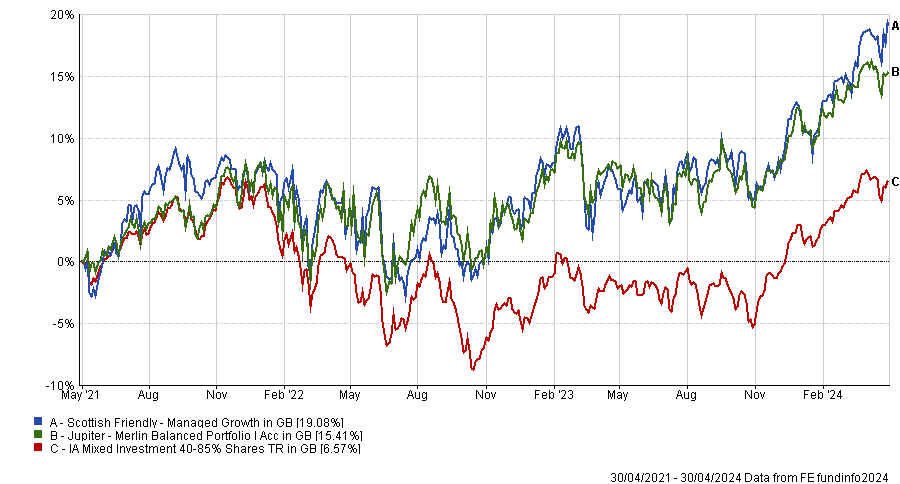

Jupiter Merlin Balanced Portfolio has achieved the same feat in the IA Mixed Investment 40-85% Shares sector. Chatfeild-Roberts took responsibility for this fund later in his career, as he was appointed manager in October 2002.

It is led by the same team as Jupiter Merlin Growth Portfolio and follows a similar investment process. A significant difference is that Jupiter Merlin Balanced Portfolio has a 10% allocation to fixed income and holds more alternative assets, whereas Jupiter Merlin Growth Portfolio is almost a pure equity play.

Performance of funds over 3yrs vs sector

Source: FE Analytics

Unlike in the IA Flexible Investment sector, Chatfeild-Roberts is not the only veteran manager to have shined over the past three years, as Colin McLean – who has been at the helm of Scottish Friendly Managed Growth since June 2004 – is also on a hot streak over the past three years.

In contrast to Jupiter Merlin Balanced Portfolio, Scottish Friendly Managed Growth does not use a fund of funds approach and directly holds a range of assets. It is currently predominantly invested in equities, although fixed income accounts for 10% of the portfolio.

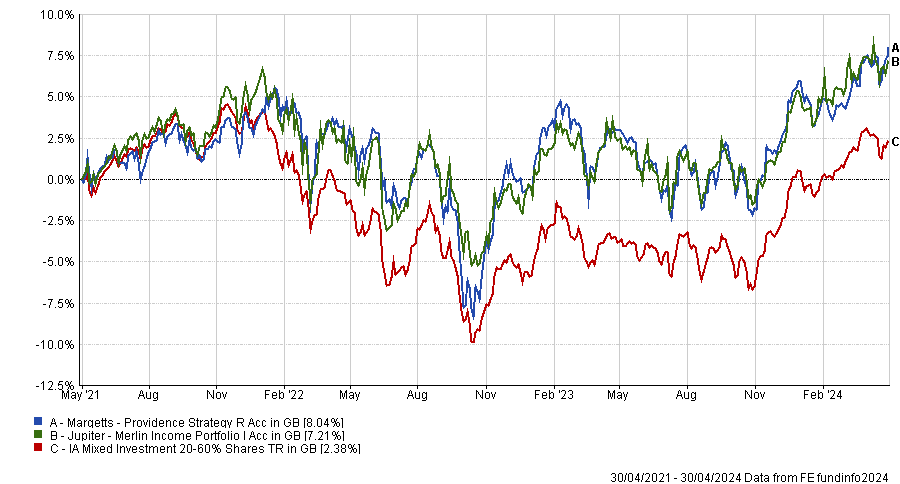

In the IA Mixed Investment 20-60% Shares Jupiter Merlin Income Portfolio also made it to the list, again with the same management team and investment approach, but with an even higher allocation to fixed income and alternative assets, accounting for roughly 30% and 9% of the portfolio respectively.

Performance of funds over 3yrs vs sector

Source: FE Analytics

Toby Ricketts, who has managed Margetts Providence Strategy since January 2001, is the other veteran manager in the sector to have made top-quartile returns over three years.

The fund also follows a fund of funds approach, as a minimum of 70% of the portfolio must be invested in collective investment schemes, providing an exposure to shares ranging from 30% to 60%.

Moreover, at least half of the portfolio must be invested in assets which are denominated in Pound Sterling or hedged back to this currency.

Equities currently account for 56% of the portfolio, bonds make up 40%, and the remainder is held in cash.

Is it finally time for UK equities to shine?

Uninspiring, underperforming and deeply unpopular. Just a few of the adjectives that spring to mind given the divergence in the fortunes of UK equities and their US peers over the past couple of years.

April ushered in the 35th consecutive month of net outflows from UK equity funds and, putting this into context, UK investors poured more money into North American equity funds in the four months ending March 2024 than in the previous nine years combined, according to Trustnet.

It feels as if we’ve banging the drum of UK equities for an age but is light starting to appear at the end of the tunnel? Quite possibly, if the recent performance of the FTSE 100 is anything to go by: the leading UK large-cap index hit a record high earlier this month.

So what’s behind this sudden reversal in fortunes? One of the key catalysts has been an improving macroeconomic environment. The UK has bounced out of one of the shortest recessions on record with better-than-expected GDP growth in the most recent quarter, while April saw output rise to its highest level in almost two years.

That said, Britons are nothing if not a self-deprecating bunch and gloomy business and consumer confidence had become increasingly divorced from improving fundamentals.

However, both measures ticked up in March and, although the Base rate is frozen for now, Bank of England governor Andrew Bailey recently announced that rate cuts were “likely” with inflation predicted to fall close to its 2% target in coming months. All this paints a more positive macroeconomic picture.

Turning to the stock market specifics, valuations remain attractive relative to global peers. The MSCI UK index is trading on a forward price-to earnings (P/E) ratio of 12x, compared to 21x for the MSCI US index (according to Yardeni, as at 15/05/2024).

The rationale is usually attributed to US stocks offering superior earnings growth (and this is undoubtedly the case in some instances) but this valuation gap looks stretched given forecast earnings growth for the FTSE 100.

The FTSE 100 may be (rather harshly) labelled the ‘Jurassic Park’ of stock markets due to the dominance of ‘old economy’ sectors such as mining, pharmaceuticals and financial services. But that overlooks the strong secular growth drivers of mega-trends including the soaring demand for commodities in the move to net-zero and the increasing reliance of an ageing demographic on the pharmaceutical industry, amongst others.

And, in actual fact, some of those ‘dinosaurs’ have delivered superior returns to their glitzier US counterparts. And let’s not forget that the FTSE 100 boasts more than its fair share of leading multinationals too, with more than 75% of revenue generated outside the UK.

Despite the recent bounce, valuations also remain well below long-term averages, particularly further down the market-cap spectrum. A good litmus test of valuations is the level of M&A activity, and bargain hunters have continued to hoover up UK companies.

Last year saw the acquisition of 10% of the UK small-cap index, with overseas buyers accounting for almost half of these transactions. This year has seen interest move up the market-cap spectrum, with bids for FTSE 100 mining giant Anglo American and packaging company DS Smith.

M&A activity has also proved a tailwind for active fund managers, particularly those with more concentrated portfolios, such as Rockwood Strategic. Manager Richard Staveley holds a portfolio of around 20 companies with a focus on sub-£150m companies to exploit pricing inefficiencies from a lack of research coverage.

As a result, acquisition premiums can provide a significant boost to returns and Staveley believes that 80% of the trust’s holdings will ultimately be acquired by a trade or private equity buyer.

Recent bids for portfolio companies include OnTheMarket, The City Pub Group, Finsbury Foods and Crestchic. These acquisitions have contributed to Rockwood comfortably topping the AIC Smaller Companies sector with a five-year net asset value total return of 88%, compared to a sector average of 29% (as at 14/05/2024).

A recent addition to the portfolio was Funding Circle, a leading UK and US lending platform to small businesses. Rockwood acquired a 3% stake in January, when the market cap was £110m and substantially below book value (with the company holding £170m in unrestricted cash, plus a further £110m in restricted cash and loans at that point).

The management team has announced a focus on the UK business going forward, together with a share buyback program, resulting in a year-to-date share price increase of 106% (as at 15/05/2024). Funding Circle’s market cap is now approaching £290m, demonstrating the value of stock-picking skills in an under-researched market.

Looking ahead, it may be too soon to say UK equities are finally out of the woods given the backdrop of uncertainty, but the pendulum certainly looks to be swinging back in their favour. Improving investor sentiment could prove the final catalyst to spark a sustained recovery and maybe, just maybe, month 36 of fund flows will mark a change in fortunes of UK equities.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.

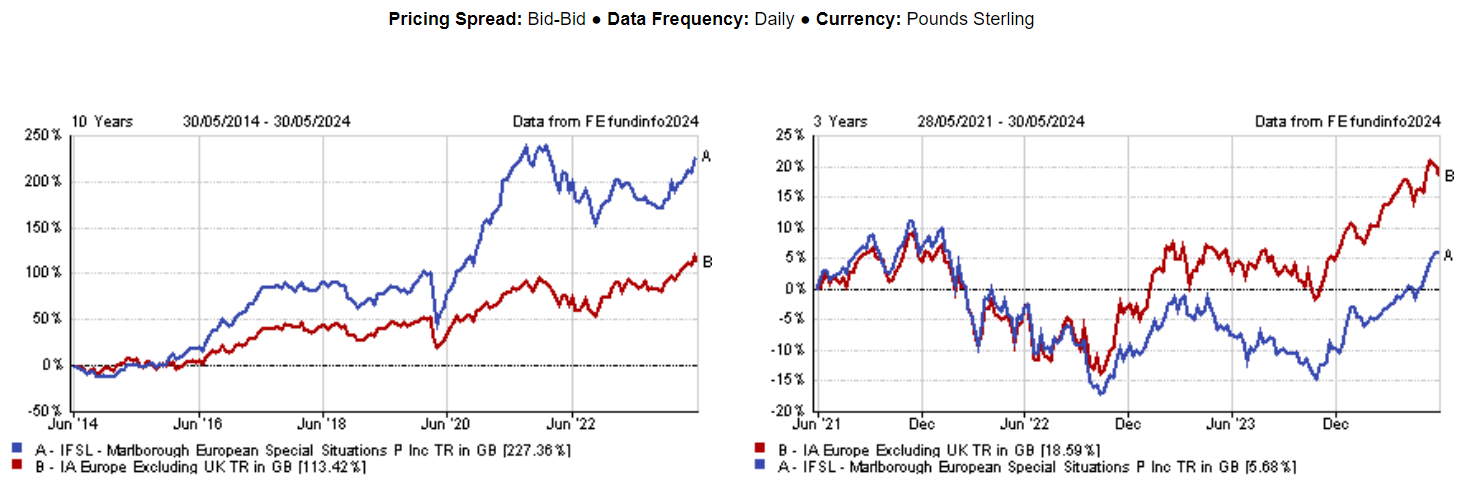

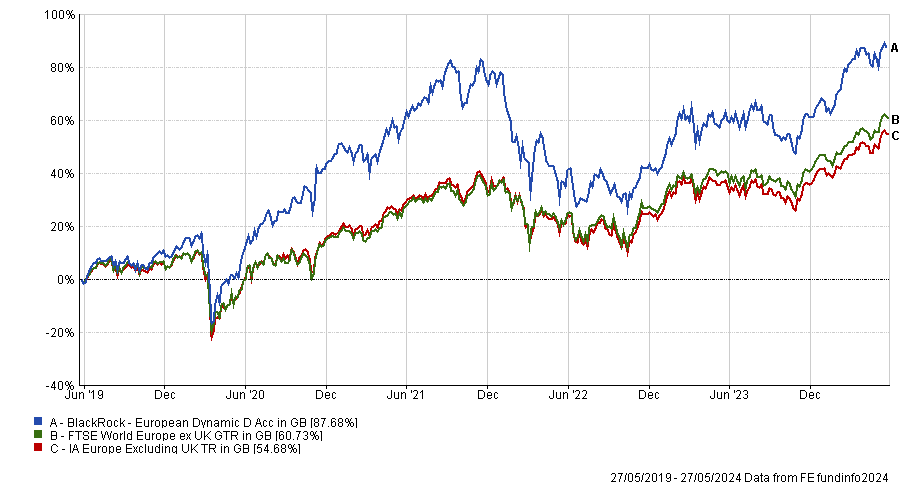

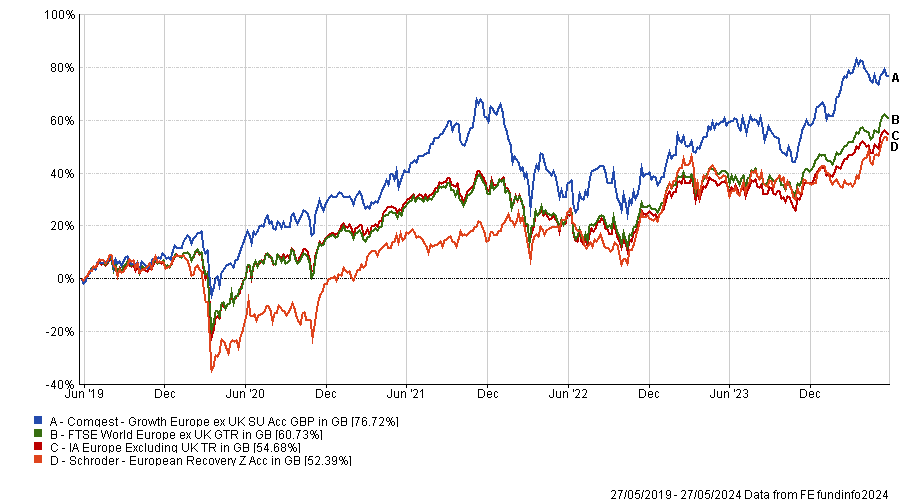

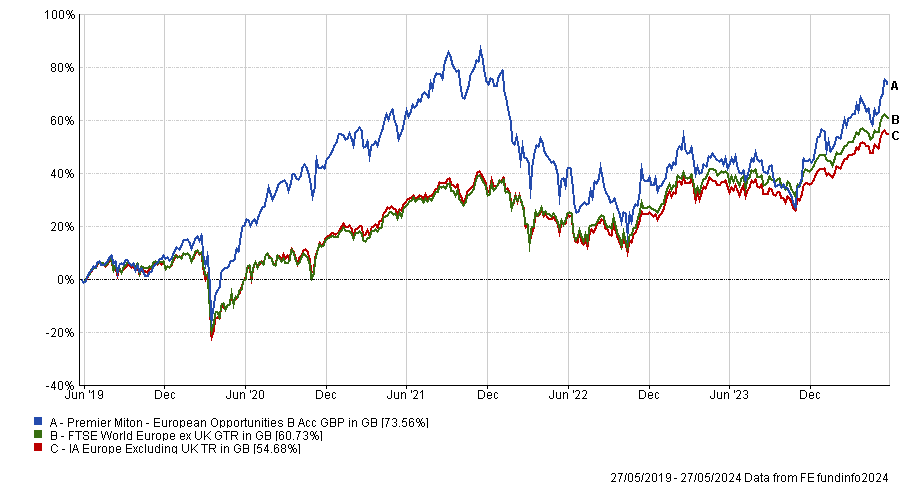

Newly named Hall of Fame Alpha Manager David Walton explains why European smaller companies are a better investment than UK and global ones.

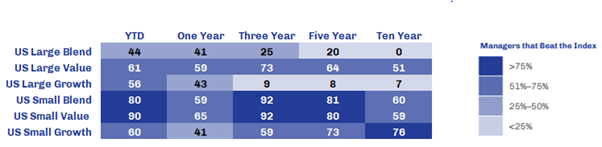

There is a lot of anticipation for smaller companies to recover after some painful years. However, investors should be aware that many large funds have commercial reasons to avoid the sector altogether, leaving returns on the table.

That’s where David Walton, manager of the IFSL Marlborough European Special Situations fund, who this year entered the FE fundinfo Alpha Manager Hall of Fame, steps in.

With £270.3m of assets under management, the fund is the right size to take advantage of many overlooked opportunities and has been the first performer over the past 10 years against the then 99-strong IA Europe Excluding UK sector, maintaining a first-quartile ranking over five years too.

Below, he explains why big funds are creating an investment “anomaly”, why European smaller companies are a better investment than UK and global ones, and why investing when the sky is cloudy leads to better outcomes than when it’s clear.

Can you summarise your investment process?

We invest in companies that are growing their profits at an above-average rate, have a good management team and whose shares are attractively valued, trading at price that’s not reflecting the company’s future growth potential.

We're not looking for loss-making or marginally profitable companies with a relatively unproven business model that promise to expand and earn huge profits. We are also not looking for companies in sectors that are appealing for investors at that time and focus instead those that are not on most investors’ radars, perhaps because they are small or somewhat obscure.

What type of companies does this correspond to?

We choose to look particularly at the small and micro-cap end of the market, where you can find the greatest under-valuations. Most managers of large funds won't look at companies below the £250m threshold because micro-caps don’t move the needle for them. It’s a perfectly rational, commercial reason, but it does create a market anomaly.

The size of this fund is such that we're able to take advantage of that anomaly and today, around 20% of the fund is in micro-caps.

Why should investors pick your fund?

If an investor is prepared to invest for at least five years, there is the potential to make good returns with this fund.

We're not in control of if and when share prices go up, so ours is a buy-and-hold strategy – it does take time for some of these companies to develop and grow. The fund can go through a number of years of fairly mediocre performance, but over a longer period, if we’re able to be patient with the holdings, we can get the benefits.

Why did the fund drop to the fourth quartile over three years?

The fund had strong gains in 2020 and 2021, when there was a boom in Europe, fuelled by Covid-era subsidies. With hindsight, we were too slow to take profits on number of Covid winners, for example, the Finnish sauna equipment maker Harvia. We were selling it on the way up and on the way down making good money on it, but we didn't take the chance to sell enough of it higher up.

There were a few other examples like that, which cost us on the way down in 2022.

Performance of fund against sector over 10 and 3yrs

Source: FE Analytics

Why are European small-caps a better investment than global or UK ones?

In Europe, you are investing in a market which is still somewhat underdeveloped compared to the UK and the US in terms of the equity culture. The size of the stock markets, compared to GDP, is also clearly lower in Europe.

On top of that, there are certainly headwinds which are affecting small companies now, but sometimes investing when the sky is a little bit cloudy can be better than when the sky is completely clear blue.

The war in Europe – obviously a human tragedy – is impacting the valuations of European equities, particularly the ones focused on domestic European economies. Most of these are smaller companies, which have got less diversification by geography compared to large-caps.

What stock was the best contributor to performance recently?

The fund’s biggest holding currently is Sarantis, a sort of Greek Unilever selling basic household goods. Its share price has gone up from €6.5 to €11 over the past 18 months, partly because of its aggressive growth plan.

It has expanded from Greece into the Balkans and Southeast Europe as bigger groups such as Procter and Gamble have retrenched from peripheral countries. Serrantis’ model is to acquire sales force in new countries and bring their products to the newly acquired retail customers, paired with some organic growth too.

We bought into it for the first time in 2016, a time when Greece was seen as a no-go zone for some investors. But the company itself had a good buying story behind it and we still hold it today.

What didn’t work as well instead?

A French company called Bilendi has been struggling but should be posed for recovery. It runs online research panels collecting data by asking any sort of questions to paid volunteers and then selling that data onto other companies who write market research.

The company did well for a period of time until last year, when its sales growth started to suffer, more than halving the share price. Today it’s at €17.9, down from €20.5 at end of December 2022.

We've held it because it didn't have any financial difficulties, it’s simply experiencing a headwind to its growth. One of its competitors however has recently become overly indebted because of a private equity buyout, so it might be an opportunity to gain some market share back.

What do you do outside of fund management?

I have a very full family life. I have four children so I'm often supporting their activities. Or I’d be hill walking with friends or family.

People have a shocking lack of understanding when it comes to their retirement savings.

Pensions are in the spotlight as both the Conservative and Labour parties draw their lines in the sand over what to do with retiree’s savings ahead of the general election in July.

It is probably the biggest dichotomy between the two main rivals in the financial sphere, with different opinions on the lifetime allowance and the ‘triple-lock’ scheme, with prime minister Rishi Sunak proposing ways for retirees to keep more of their state pension.

Even without this, however, there is a clear lack of understanding among people and their pensions. Data from AJ Bell found almost half (48%) of British adults under state pension age say they don’t know when they’ll receive it, for example.

Tom Selby, director of public policy at AJ Bell, said: “Millions of Britons risk sleepwalking into a retirement shock, with almost half of all adults under state pension age admitting they don’t know when they’ll receive their state pension.

“This likely in part reflects a lack of engagement with pensions, particularly among young people, and in part the lack of certainty that exists around state pension policy.”

So, let’s talk about pensions. They are crucial for people as the state pension alone may not be sufficient to maintain your desired lifestyle, even if the Conservatives do plan on supercharging the current triple-lock scheme.

At present, the state pension age is 66 years old for both men and women but this will start gradually increasing again from 6 May 2026. For those aged between 18 and 34, it will rise to 68 by the time they get to retirement.

The full level of the State Pension is £221.20 a week in the 2024/25 tax year, which produces an annual income of £11,502.40, although this can be lower depending on how many years you have paid national insurance (35 years is required for the full amount). It rises in line with inflation, wage growth or 2.5% – whichever is higher.

Daniel Chaplow, wealth planner at Succession Wealth noted however that this alone “may not be sufficient to maintain your desired lifestyle”.

As such, it is important for people to contribute to a pension plan, whether that be through a workplace pension scheme or a self-invested personal plan (SIPP).

The obvious benefit to putting into a pension today is tax relief: you will receive tax relief at the highest rate of income tax that you pay. The basic 20% tax relief will be added to each contribution, while higher or additional rate taxpayers will need to claim back the extra tax relief via their tax return. The maximum you can typically squirrel away each year is £60,000.

Yet, even here there is confusion. According to a survey by Hargreaves Lansdown this week, a whopping two thirds of respondents did not know their retirement savings were invested in the stock market.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown: “People have fundamental misconceptions about pensions. These findings are stark, but not altogether unexpected.

“We talk about saving into a pension rather than investing and so it’s highly likely people think their contributions are going into some kind of savings account rather than into the markets.”

When you invest in a workplace pension, the money will likely be put in a default fund, which will invest in a mixture of equity funds and bond funds with the weighting to each based upon your age and years to retirement. The younger you are, the more you will have in equities. The older, the more in bonds.

This is a great way for people with no investment experience to invest but is not right for all and can tend to be overly cautious the closer you get to retirement. It is always worth keeping track of what you are investing in and if it aligns with your goals – seeking financial advice if you are unsure.

If you know nothing about your retirement planning or where your pension is invested, now is the time to get looking at it.

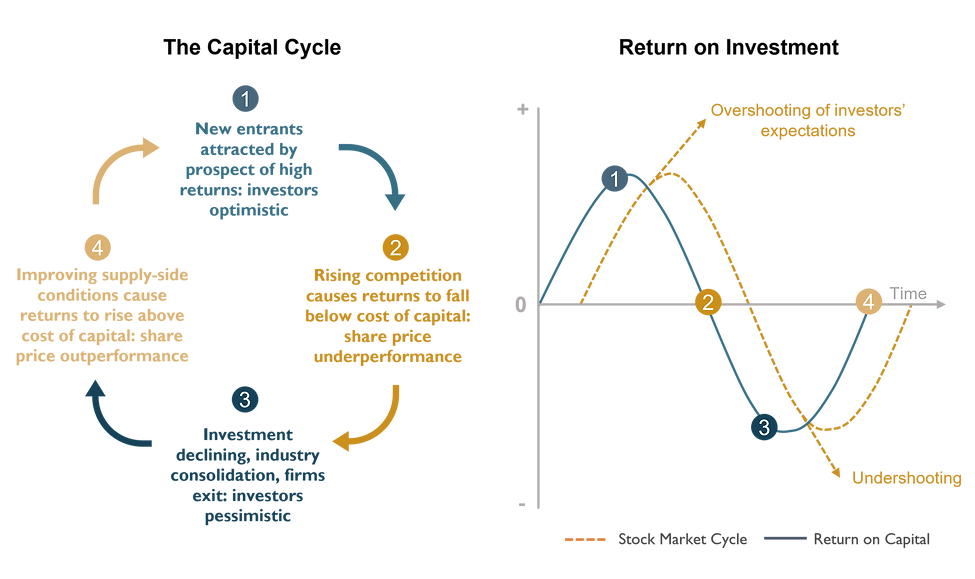

Following the capital cycle model, both sectors will have lower returns going forward.

What do investments focused on the green economy and those buying into artificial intelligence (AI) have in common? They are both due to generate disappointing returns going forward, according to Django Davidson, portfolio manager at Hosking Partners.

In Hosking’s global equity strategy, Davidson’s goal is to deploy a capital-cycle approach to find hidden gems and at the same time avoid market bubbles. His verdict on green investments and AI – both are bubbles and best avoided.

The green capital deployment cycle fits the bubble description, said the manager, as it's been driven by predictions of future demand, government regulation and diktats, generating a very significant supply response.

“It all goes back to that idea of demand stories and supply facts. Investors in the green energy transition sector have been sold a cake-and-eat-it story: you can have higher returns and do good for the planet,” he said.

“But as per capital cycle theory, when management teams raise money and deploy it in the stock market, seeing valuations of two to five times the invested capital, the result is capital misallocation.”

While it goes without saying that we all want future generations to inherit a planet in the best shape it can be, capital cycle investors such as Davidson are “hardwired” to be highly sceptical of demand-based stories such as this.

The main point that he made is that, with all else being equal, the more cash goes into an industry, the lower returns will be for that capital within that industry due to more competition, which drives down prices and lowers returns.

Cash is then pulled out, which leads to pessimism and consolidation. Then the newly-reset supply side sets up a more exciting supply-side venture and returns improve, he explained.

To further illustrated his point, the manager used the chart below, where the blue line represents the industry return on capital and the yellow line is the stock market's interaction with the underlying return on capital.

The capital cycle and returns on investment

Source: Hosking Partners

“The stock market is terrific at amplifying these cycles all the way up and on the way down and management teams are the great accomplices in this tool,” Davidson said.

“If you can deploy $1 of capital and have it valued at two or three or four times that, the incentive is to deploy capital.”

Following this model, the manager is predicting woes for three areas in particular – electric vehicles (EVs), offshore wind, and AI.

An example of the capital-cycle approach in action is what’s happening in the EV space, which Carlos Tavares, chief executive officer of automaker Stellantis, called “a bloodbath” by looking at Tesla car prices and the competitive response in China.

This is also something that has concerned Douglas Scott, co-manager of the Aegon Global Equity Income fund, who said if there was one member of the US’ ‘Magnficent Seven’ that would be under pressure it would be Tesla.

“China has 100 electric car companies. It’s a big number. China is not going to displace Microsoft or Amazon. Nvidia would be very difficult given the position it is in. Google no. Apple maybe a little bit.

“[Tesla has] 100 competitors out there and a product that the man in the street can’t afford. They just can’t afford $50,000 for a car. If you give them something similar for $20,000 they’ll take it.”

Davidson noted Chinese manufacturer BYD sells its Seagull model for even less than this – just $10,000 in China, referring to it as the “Volkswagen Polo of the EV world”.

“Even if we put on 100% tariffs, that is still $20,000 – pretty good value compared to what the original equipment manufacturers are offering,” he said.

“It's highly likely that the very significant proportion of the capital deployed into the EV space is going to see a prolonged period of lower returns as per capitals cycle theory. That's why we can see these car parks of Chinese EVs clogging up European ports,” the manager concluded.

A similar misallocation of capital went on in offshore wind companies such as Danish energy company Oersted, which was a symbol of the European green transition and at its peak was valued at 13 times sales.

That was “a terrific environment” for Oersted to raise capital, according to the manager, with the subsequent 75% fall in share price “demonstrating the value destruction that can happen because of these demand-led, futurology investment waves”.

Stock price of Oersted A/S over the past year

Source: Google Finance

That’s what investors should prepare for in the AI space as well. In fact, the increase in the level of capital being deployed by the cloud hyper-scales is “extraordinary” – a perfect run-up to disappointment.

In 2019, the invested capital of the four large hyper-scalers in cloud computing was $180bn; by the end of this year, with rolled-forward capex plans, it will be $75bn, the manager explained.

“More capital, with all else being equal, means lower returns, even in AI. Now, the response to that will be: ‘but it's a great market, there aren't very many hyper-scalers, and they'll be able to effectively collude on pricing’. I don't believe that,” Davidson said.

“I would also point out that in China, no one makes any money with cloud. It's working well for the large US companies today, but there is no preordained structure that means you must make a lot of money in this industry.”

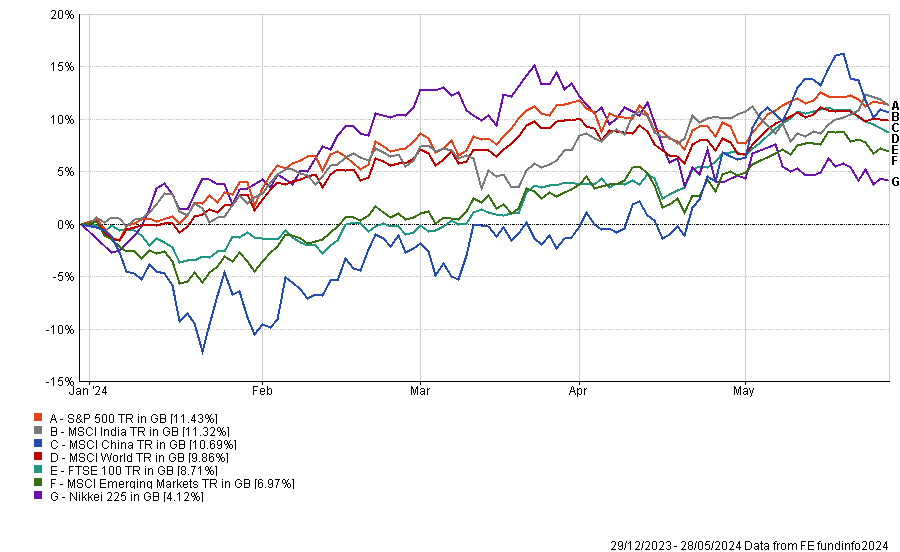

Experts ponder whether the recent rally in Chinese equities is sustainable.

Chinese equities have recently staged a comeback after three consecutive calendar years of significant negative returns, linked to regulatory crackdowns, a crisis in the property sector and questioning around the country’s growth trajectory.

Since the beginning of the year, the MSCI China index has outperformed the MSCI World and MSCI Emerging Markets, although it has lagged the S&P 500 and its emerging markets rival, MSCI India.

George Efstathopoulos, multi-asset portfolio manager at Fidelity International, attributed China’s rebound to a combination of factors.

“The ‘national team' [state-backed financial companies] has stepped up their involvement in markets after the capitulation earlier in the year,” he said.

“The growth outlook appears to have improved – GDP growth recently surprised to the upside, leading many analysts to raise year-end growth estimates and causing some foreign investors to cover underweight positions. Policy support has also increased recently, with the ailing property sector the latest recipient.

“Meanwhile, Chinese companies have carried out more buybacks recently and earnings beats are being rewarded in this earnings season, which hasn't been the case in the last few years, a further indication that the capitulation period is over.”

Performance of indices year-to-date

Source: FE Analytics

The question for investors now is whether this rebound is sustainable or merely a dead cat bounce.

Sandy Pei, deputy manager of the Federated Hermes Asia ex-Japan Equity fund, argued that the bounce has been “very modest” so far and that absolute and relative valuations remain attractive. She believes that investors in China have huge upside potential if Chinese equities re-rate to “normal” multiples.

David Townsend, managing director of Value Partners’ business in Europe, the Middle East and Africa, is also bullish on China and argues it is in the early stages of a U-shaped recovery.

He said: “From a fundamental perspective, we maintain our investment thesis that the stock market has reached an inflection point, supported by the recent strong market performance.

“We anticipate the start of a longer-term market upturn, supported by strong fundamentals such as healthy corporate balance sheets and large household deposits, which could sustain China’s long-term growth story.”

“From a technical perspective, it also looks like the market rally could continue for some time, especially given the very light / underweight positions for many investors in China. It does look as though some capital is starting to come back to the market to reduce the underweight exposure of many long-only investors.”

Yet, others believe it is still too early to tell whether Chinese equities are back on track.

For instance, Efstathopoulos stressed that earnings will need to deliver for the bounce to prove sustainable and this will require an improvement in the currently fragile consumer sentiment in China.

Rob Brewis, co-manager of the Aubrey Global Emerging Markets Opportunities fund, also warned that the property market is still in the doldrums, monetary growth subdued and deflation remains predominant. He also believes that geopolitics and trade frictions are going to increase ahead of the US election, while a trade war between China and Europe seems to have started.

For example, ministers of Germany, France and Italy called for a common front against China’s expanding export power last week during a G7 meeting. Moreover, the European Union is investigating a range of Chinese products, including electric vehicles, to assess whether they are receiving unfair subsidies from the Chinese government or being sold below cost.

Another risk highlighted by Pei is an unexpected reversal of the monetary policy stance, which is currently centred around monetary easing, consumption stimulus and being capital friendly.

Therefore, Townsend stressed that investors will need to keep an eye on the ‘Third Plenum’ in July 2024.

He explained: “In addition to further supportive measures for the property market, the structural reform agendas – traditionally a focal point of the ‘Third Plenum’ – are worth watching as they may be necessary in navigating both cyclical headwinds and demographic challenges.

“A key risk could be that if the communication disappoints the market, in the sense that investors begin to feel that the government is starting to turn its attention to focussing on things other than the economy, there may be something of a pull back.”

Nonetheless, GQG Partners’ investment team believes that things are unlikely to get meaningfully worse from here for China.

“There is a bevy of earnings coming out of some of the largest weights in the benchmark and in our view, earnings remain like gravity and it will be individual company execution rather than macro noise that will ultimately drive the attractiveness of select Chinese equities,” GQG analysts concluded.