This US equity manager debunks a myth about investing in technology and resources.

When James Watt invented the steam engine, people marvelled at its efficiency, but as they used the new technology, they started to fear they would run out of coal.

British economist Stanley Jevons kept a cool head and predicted in his 1865 book, ‘The Question on Coal’, that increased efficiency would drive greater use of the technology and that far more deposits of coal would be found. History proved him right.

Economists call this the Jevons paradox, which happens when better efficiency leads to increased demand and a higher rate of resource use, contrary to mainstream expectations.

Applying this paradox to today’s markets can give investors an edge in recognising areas that are set to flourish, according to Cole Smead, manager of Smead US Value UCITS.

“There's the myth in our cultures that technology will cause us to do more by depriving ourselves. Technology makes us more efficient, but the Jevons paradox continues to play out,” he said.

“I hear time and time again people saying that technology will make our use of energy so much more efficient and therefore we're going to use less energy. The Jevons paradox says that's impossible, and it's also never happened historically.”

An example is gasoline demand, which has never been bigger in the United States, and the same goes for the number of miles driven.

Similarly, people thought the LED light bulb would save energy but instead, we quadrupled the number of light bulbs in our houses and energy demand continued to go up.

“It's a perfect picture of the Jevons paradox. You did not see a decline in consumption like people would have thought,” he observed.

How the Jevons paradox translates to investing

There is one area where demand is accelerating but supply is being cut, making it a great investment opportunity, according to Smead. That area is electricity production – in particular through fossil fuels.

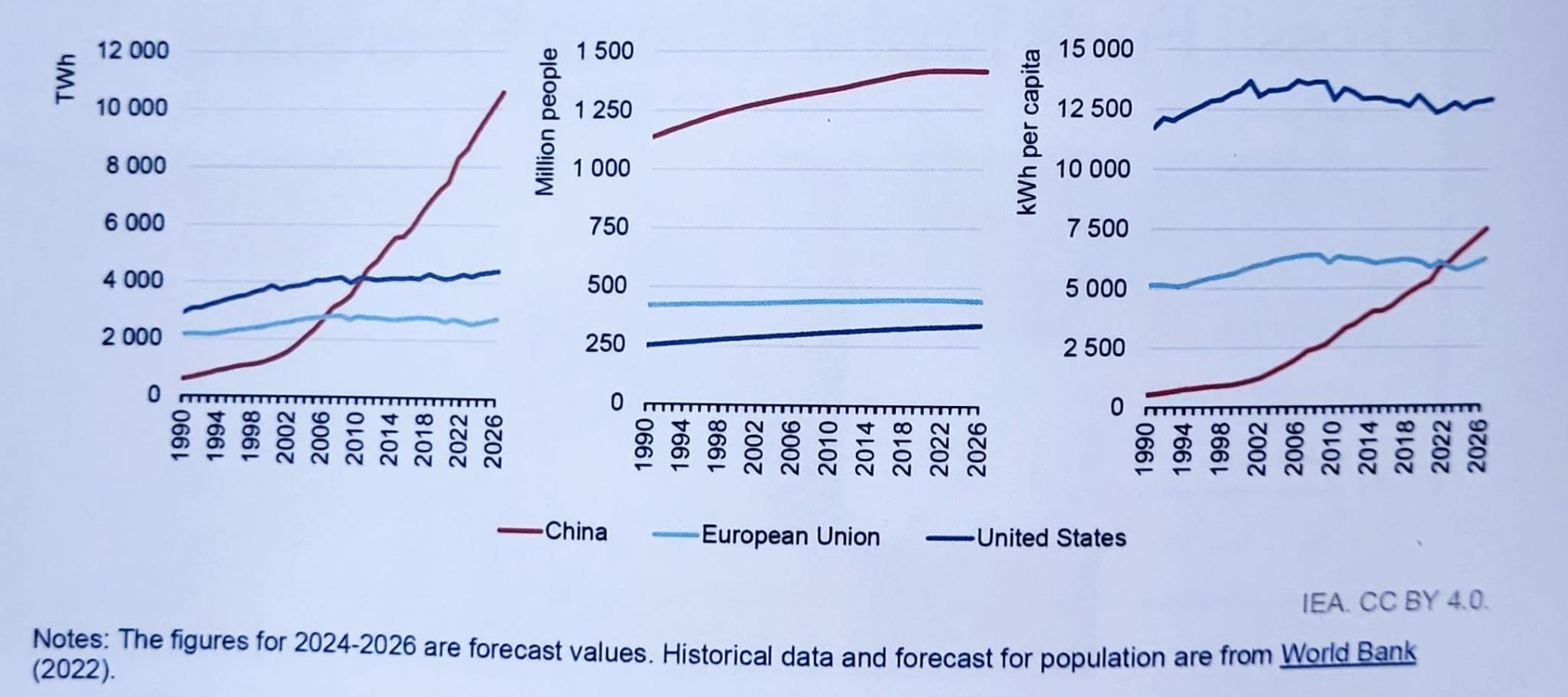

Total electricity demand (left), population (centre) and electricity consumption per capita (right)

Source: Smead Capital Management, International Energy Agency

“Technology causes us to do way greater things and become more efficient. But more efficient doesn’t mean that demand is going down, in fact the curve of electricity use is ever growing,” the manager said.

“And while natural gas has sucked up a bigger share of the total growth, we have slowly been moving away from coal, but move is not relevant whatsoever.”

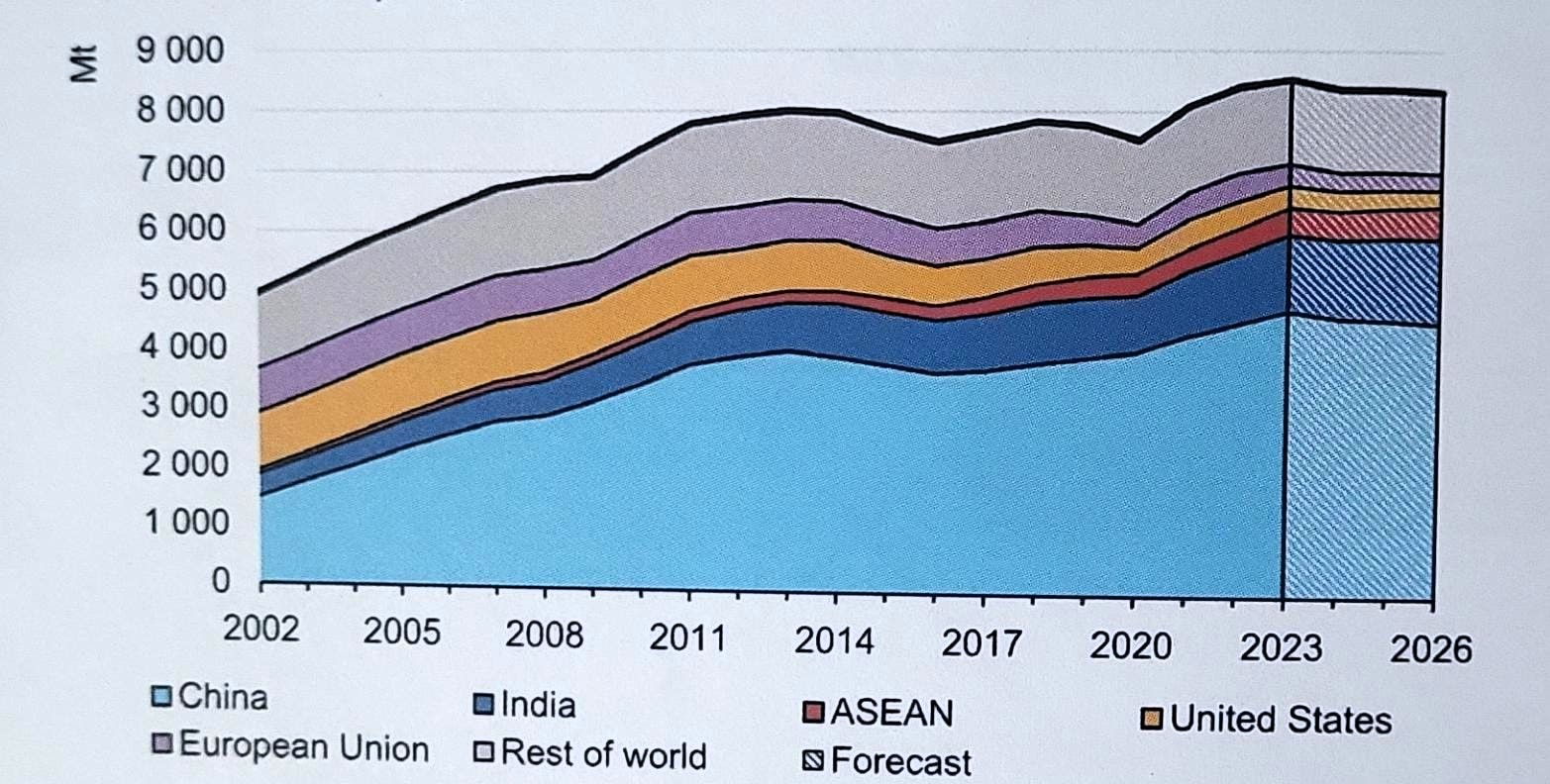

To illustrate this point, he showed the chart below.

Global coal consumption, 2002-2026

Source: Smead Capital Management, International Energy Agency

“About 13 years ago, the International Energy Agency predicted the world was at peak coal usage. So far, it’s 13 years off and growing. These organisations are wicked smart, but they can be very wrong,” he said.

“If you ever get into a world where supply is dwindling and demand picks up, you can make some fabulous money.”

The manager highlighted three stocks that he believes are poised to benefit from this supply/demand discrepancy.

The first is South African coal exporter Thungela – admittedly a cyclical business that has had periods of underperformance, but it comes with “a nice little buffer”, as 60% of the stock is in net cash.

This means firstly that the company would need to burn a lot of cash before investors make a loss, and secondly, that it can buy back its own shares. The impact of buybacks on return on equity (ROE) is “one of the most underappreciated ideas in the stock market”, Smead added.

If half of Thungela’s cash was used to finance share repurchases, its adjusted ROE could grow by 30%, he calculated.

Finally, the market is overlooking pure play Canadian oil sands producer Meg Energy and US oil company Ovintinv, Smead said. Jevson’s paradox is at play again, with capital expenditure on oil declining in the western world, shrinking supply for industry, butat the same time, demand is increasing.

REITs have historically been fertile ground for active managers.

Index investing reached a milestone in early 2024, with assets in passive investment vehicles surpassing those in actively managed strategies for the first time. On the surface, the appeal of index investing is compelling: passive exchange-traded funds (ETFs) offer lower costs.

And, in the case of broad-based equity and bond categories, active managers frequently fail to consistently outperform their benchmarks. But cheaper is not always better, and not all markets are alike.

Real estate is one area of the equity market that lends itself to active management. REIT managers who commit time and resources to understanding current property fundamentals, shifting market trends and factors that may affect listed equity performance can potentially spot pricing inefficiencies and rapidly implement plans to generate excess returns.

We believe this advantage is reflected in the performance of the largest active REIT mutual funds relative to passive investment vehicles, despite active funds typically having greater expense ratios.

The modern REIT market offers a diverse opportunity set

When investors think of commercial real estate, they may envision office buildings, malls, shopping centres and apartments.

REIT ownership of these kinds of assets exists, of course. However, REITs have become increasingly specialized in new property types since 2000, shifting the REIT market’s composition away from traditional sectors.

For well-resourced managers, these new sectors provide a broad selection of REIT-owned assets for constructing portfolios, many of which have secular growth drivers.

These include data centres, where companies rent by the kilowatt to connect cloud servers; cell towers that lease space to wireless carriers for 5G networks; high-tech distribution hubs that facilitate next-day shipping on e-commerce orders; climate-controlled food storage facilities; biotech research labs; and senior living centres, just to name a few.

Capitalising on distinct sector characteristics

REIT sectors and companies tend to respond to market conditions very differently depending on factors such as lease durations, types of tenants, economic drivers and supply cycles. These differences have historically resulted in wide dispersion of sector returns in any given period.

More economically sensitive sectors with short lease terms, such as hotels and self-storage, can adjust rents relatively quickly to capture accelerating demand in a cyclical upswing.

By contrast, longer-lease sectors such as net lease and health care have more defensive cash flows that may be more resilient during economic downturns. In 2023, returns between the best and worst sectors were separated by 38 percentage points. In other years, the dispersion has been considerably greater.

We have observed that the difference in returns at the security level within each sector is often similar to the variance at the sector level. We believe this dispersion highlights the opportunities active managers have to enhance returns through both sector and stock selection.

Navigating secular growth opportunities and challenges

As economic cycles progress, property types are likely to have different fundamentals. For instance, the pandemic upended retail, hotels and offices, but benefited technology-related REITs amid acceleration in e-commerce and working from home.

And many sectors and cities continue to feel the lasting effects of the pandemic as flexible work-from-home policies have changed how and where people want to work and live, creating an uncertain outlook for offices.

Consequently, high-quality offices may continue to see healthy demand, while lower-quality assets may experience soft demand for years to come – a distinction not likely to be reflected in passive portfolios.

Active managers can also add value by capitalising on regional differences and trends. Many US residents are moving from dense, high-cost northern and coastal cities to lower-cost markets in the sunbelt.

In global portfolios, REIT managers may assess geographic regions to understand local property supply and demand fundamentals, economic trends, monetary policy and other factors that may affect the operating performance of different real estate companies, as well as the markets valuation relative to other regions.

Anticipating secular trends such as these is a key component of active management since they can present opportunities for active managers to capitalize on diverging fundamentals. For example, the divergence in industrial and office properties.

By contrast, passive portfolios are, by design, not able to allocate assets to capitalise on potential secular growth opportunities, nor can they sidestep sectors that may be facing long-term headwinds. Of course, there is no guarantee that active management can successfully navigate these trends.

REIT managers may also invest based on relative value, seeking to allocate portfolio assets based on merit rather than market capitalization, as is often the approach for many passive index funds.

Investing outside the benchmark – participating in special opportunities such as recapitalizations, private placements, initial public offerings (IPOs) or pre-IPO investments – is another way for active managers to add value.

These activities are not within the scope of passive index-tracking strategies – a notable disadvantage in recent years due to the inability of passive vehicles to get out of the way of the secular declines in retail and offices.

Jason Yablon is head of listed real estate at Cohen & Steers. The views expressed above should not be taken as investment advice.

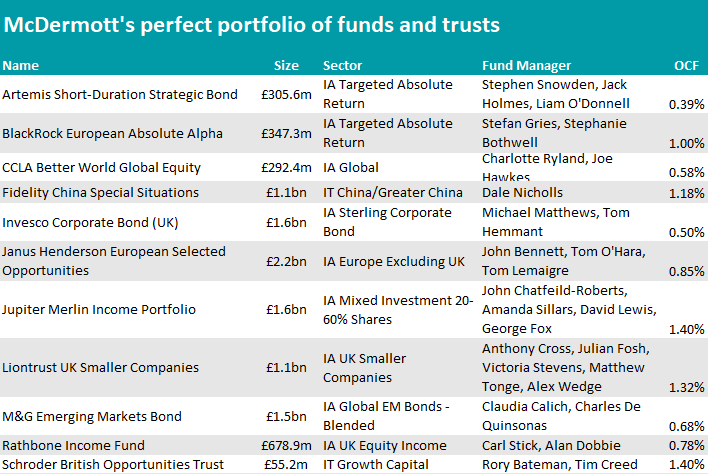

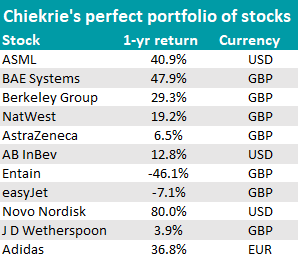

A perfect portfolio of funds and stocks to come out on top this summer.

In both football and investing, picking the best players doesn’t always make for the optimal team; the secret to success is how players’ skills complement each other.

Ahead of the UEFA Euro 2024 football championship, which kicks off on Friday, fund selectors have put themselves in the shoes of football managers to come up with a winning portfolio that strikes the right balance between defensive and offensive plays and has the best chances of coming out on top.

Defenders

Starting with the goalie, it’s all about capital preservation. The Artemis Short-Duration Strategic Bond fund should be able to pull the best saves, according to FundCalibre managing director Darius McDermott.

The fund adapts to changing market conditions by adjusting its allocation to government bonds, investment-grade and high-yield. The focus on bonds with five years or less to maturity “should make it less volatile than the wider bond market”, said McDermott, who also appreciated manager Stephen Snowden’s use of derivatives and futures to reduce risk and manage duration.

The fund has produced a positive return in four of the past five calendar years and also offers an “attractive” distribution yield of 5.21%.

Moving to stocks, Hargreaves Lansdown equity analyst Aarin Chiekrie said that “like the best goalkeeper in the world, it’s hard to see any opponent getting past” ASML, as the Dutch semiconductor company “has a monopoly on the most advanced type of lithography machines used to make the chips that power your phones, computers and even cars”.

As defenders, McDermott chose his back four with some bite.

First up is BlackRock European Absolute Alpha, a long/short pan-European equity fund with a focus on capital preservation and low levels of volatility, but which also managed to almost double the return of the average IA Targeted Absolute Return peer over the past five years, as the table below shows.

Performance of fund against sector over 5yrs

Source: FE Analytics

It is flanked by two bond funds, M&G Emerging Markets Bond and Invesco Corporate Bond, and aided by the Jupiter Merlin Income Portfolio, a “stalwart in the multi-asset sector” designed to provide “an immediate and growing income” as well as the potential for capital growth.

Chiekrie called four players to the pitch: defence company BAE Systems, which is “almost guaranteed to give you a solid performance”; building company Berkeley Group, which “sits on solid ground, despite the current shaky housing market”; NatWest, which convinced him for its new chief executive officer, strong balance sheet and a prospective 5.6% dividend yield; and AstraZeneca, which is seeking to debut 20 new medicines to help fuel growth by 2030.

Midfielders

Midfield is where matches are won and lost, according to McDermott, who turned to Rathbone Income, Janus Henderson European Selected Opportunities and CCLA Better World Global Equity for “goals, flair and bravery”.

The Rathbone strategy has “one of the best – if not the best – track records among open-ended funds for paying dividends,” he said.

“Manager Carl Stick is somewhat of a contrarian investor, so the fund may lag behind while his peers catch up with the news,” but all of its 30 to 50 holdings are chosen for their high quality and visibility of earnings.

The Janus Henderson portfolio is a jack-of-all-trades, mixing mega and large blue-chip holdings with some mid-caps to achieve additional sources of alpha.

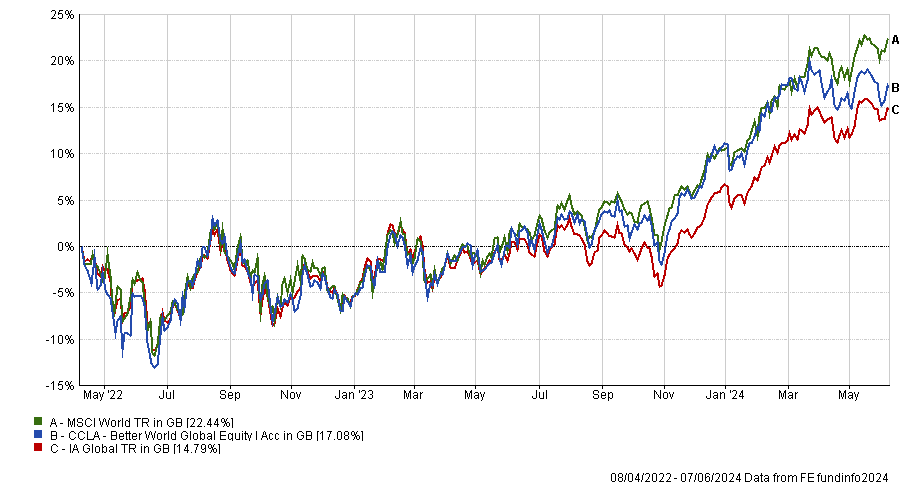

Rising star CCLA Better World Global Equity was launched in 2022 but has proved “very successful since then”, as the chart below illustrates.

Performance of fund against sector and index since launch

Source: FE Analytics

Over in the stocks tournament, Chiekrie put his faith in Belgian drinks company AB InBev, which owns fan-favourite beers such as Budweiser, Corona and Stella Artois.

“Like a midfield maestro dictating the tempo of the game and spraying passes out to all teammates, the group’s diverse portfolio of drinks brands means it has something for everyone this summer,” he said.

The analyst also chose UK-listed Entain, which owns betting houses such as Ladbrokes and Coral.

“It’s been under plenty of pressure from regulators and overall performance has been underwhelming recently, but still, you wouldn’t bet against them turning their form around and making a positive contribution.”

Finally, easyJet looks well-placed with a portfolio of slots at some of Europe’s most valuable airports. It is trading at a cheap valuation despite increased passenger numbers, so there’s scope for this airline to become a fan favourite in the near future, Chiekrie said.

Attackers

For high-octane performance, McDermott has been warming up Fidelity China Special Situations.

Having fallen over 40% since February 2021, the re-rating of China’s equity market has been “indiscriminate”, which has created “plenty of valuation opportunities”.

“With a bias towards smaller and medium-sized companies, this trust is not for the faint-hearted, but manager Dale Nicholls has consistently outperformed his peers and the trust is on an attractive 10% discount,” he said.

For his final two choices, McDermott stuck with recovery plays, this time in the UK.

Liontrust UK Smaller Companies and Schroder British Opportunities Trust should benefit from the recovery of smaller companies, which, coupled with attractive valuations and an increasing number of mergers and acquisitions, could be a compelling opportunity from here.

Source: FE Analytics

“Backed by a market-leading team, the Liontrust fund has a very clearly-defined investment process based on intangible strengths. Every stock in the portfolio must have intellectual property, a strong distribution network or recurring revenues,” the fund selector said.

Investing in both public and private businesses, Schroder British Opportunities targets ‘high growth’ and ‘mispriced-growth’ companies.

“Although performance has held up well relative to its peers sentiment has been hit hard, with the trust at a near 35% discount.”

Performance of trust against sector over 5yrs

Source: FE Analytics

Completing the stock squad are strikers J D Wetherspoon and Adidas.

According to Chiekrie, Wetherspoons’ low-value proposition means that “it's well-placed to block out the noise of an unsettled economy and just focus on its own game”, having already scored a like-for-like sales rise of 5.2% last quarter.

On the way home from the match, fans are more likely to pick up an original shirt from Adidas, after host country Germany announced fines of up to £4,000 for supporters caught wearing fake shirts.

“After a challenging 2023, which saw revenue and profits wide of the post, Adidas could be poised to score impressive growth this year,” the analyst concluded.

Source: Google Finance

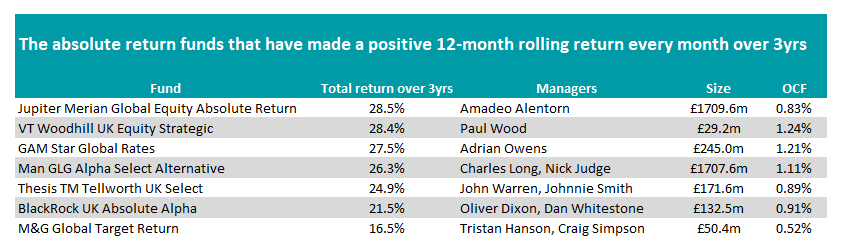

Trustnet looks at the IA Targeted Absolute Return sector to see which funds have achieved positive returns for investors.

Targeted absolute return funds aim to give investors the smoothest ride possible, making a positive return while mitigating volatility. But in the past three years just seven of the 78 funds in the IA Targeted Absolute Return sector have consistently achieved positive gains, according to data from Trustnet.

We looked at the 12-month track record for these funds in each of the past 24 months – the same metric used by the trade body Investment Association to compare the funds’ performance.

Source: FE Analytics

Two behemoths of the sector appeared in the list. First is the £1.7bn Jupiter Merian Global Equity Absolute Return fund managed by Amadeo Alentorn.

A market neutral long/short portfolio, the managers invest in 466 global companies using the team’s systemic equities approach, which tilts the portfolio between different investment styles depending on the trends within the market.

This is coupled with 318 short positions, which are used to mitigate the volatility of market and gives the managers more ways to generate returns. It has been the best performer of the group, returning 28.5% over the past three years, as the below chart shows, and has the second-lowest fees with an ongoing charges figure (OCF) of 0.83%.

Performance of fund vs benchmark over 3yrs

Source: FE Analytics

The other giant of the sector on the list is the £1.7bn Man GLG Alpha Select Alternative fund managed by Charles Long. It invests primarily in UK stocks but, like the Jupiter fund, takes advantage of short positions to add alpha.

With an OCF of 1.11%, the portfolio is more expensive than its Jupiter rival and performance has lagged slightly, with the fund returning 26.3% over the past three years.

The second best performing fund on the list over the period was VT Woodhill UK Equity Strategic managed by Paul Wood, which made 28.4%, just 10 basis points below the Jupiter fund.

With £29.2m in assets under management it is by far the smallest in the group and has the highest fees, with an ongoing charges figure of 1.24%.

It is a UK equity fund, with top holdings including Shell (7.5%), AstraZeneca (7.1%) and HSBC (5.8%). Wood dampens volatility by hedging the portfolio, including being able to “fully hedge” the fund, protecting investors from downside risk. The fund has been hedged in 75% of its days since inception, according to the fund’s factsheet.

GAM Star Global Rates, run by FE fundinfo Alpha Manager Adrian Owens, was in third position with a total return of 27.5%. Unlike the strategies above, it focuses on investing in the currency and fixed income markets with no allocation to equities.

Conversely, TM Tellworth UK Select, run by Alpha Manager John Warren and Johnnie Smith, as well as BlackRock UK Absolute Alpha, headed by Oliver Dixon and Dan Whitestone, also made the list. Both are long/short strategies focusing on the UK stock market.

Analysts at RSMR recommended both funds. On the former, they said: “The fund has been managed in a pragmatic, risk aware manner, allowing returns with no market correlation since moving to Tellworth. The accurate monitoring of potential factor risks has been important to this outcome and the team has generated alpha through stock selection.”

On BlackRock UK Absolute Alpha, they noted: “The fund is run by a specialist long/short hedge fund manager who has developed a strong record in this specialist space. His flexible approach to beta (market exposure), varying net long and net short positions has also added value.

“The manager’s experience, together with the strength of the BlackRock research platform, suggest this fund should be capable of delivering positive returns in most market conditions.”

M&G Global Target Return – run by Tristan Hanson and Craig Simpson – made the lowest return of the group but still achieved the feat of making consistently positive returns on rolling 12-month periods.

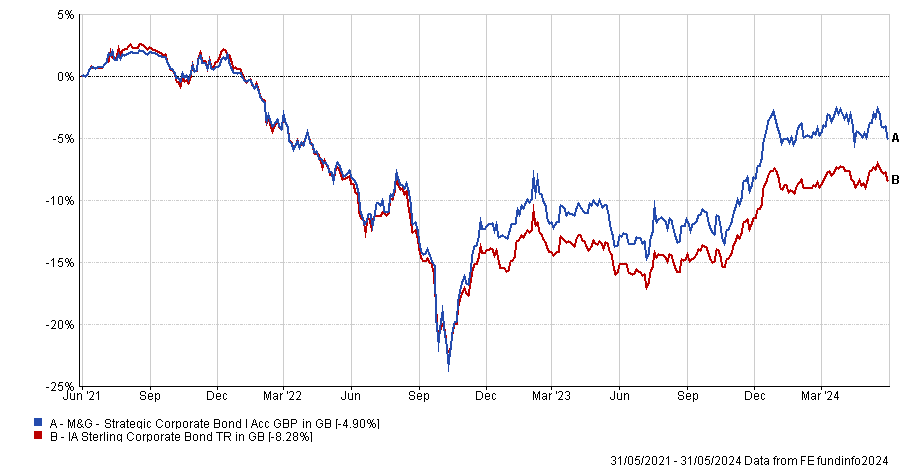

Trustnet looks at funds within the Sterling bond sectors that have been run by the same manager since at least 2004.

The fixed income space has proven to be a difficult area for long-serving managers to excel in recent years.

Indeed, only two ‘veteran’ managers – those who have been at the helm since 2004 or earlier – have made top-quartile returns over the past three years across the IA Sterling Strategic Bond, IA Sterling Corporate Bond and IA Sterling High Yield sectors, according to data from Trustnet.

One of those two experienced managers who have stood the test of time is FE fundinfo Richard Woolnough, who has been at helm of M&G Strategic Corporate Bond since February 2004.

The fund – which Woolnough has been co-managing with Ben Lord since 2021 – has fallen 4.9% over the past three years (to the end of May). Nonetheless, it still ranks 23rd out of 90 in the IA Sterling Corporate Bond sector over that period.

Performance of fund over 3yrs (to last month end) vs sector

Source: FE Analytics

Long-term performance has also been commendable, as the fund sits in the sector’s top quartile over 10 and five years.

Although the M&G Strategic Corporate Bond fund belongs to the IA Sterling Corporate Bond sector, its mandate allows Woolnough and Lord to invest up to 20% in government bonds. Additionally, high-yield bonds should not account for more than 20% of the portfolio.

Analysts at FE Investments said: “The investment process begins by agreeing on a view of the global economic environment and how this will affect inflation and interest rates, particularly in the UK. This helps the managers define the appropriate risk level to employ in the fund and identify sectors and asset classes offering most value.

“Credit analysts at M&G study issuing companies across the UK, Europe and the US in order to identify pockets of value, and the portfolio managers combine these recommendations with their macroeconomic views to finalise portfolio positioning.”

They also noted that, historically, the fund has outperformed peers when credit markets rallied, as was the case in 2017 or the second half of 2020, but lagged during sell-offs, such as in 2018 and March 2020.

The other top-performing fixed income fund manager is Eric Holt of Royal London Sterling Extra Yield Bond in the IA Sterling Strategic Bond sector.

Holt has run the five-crown rated fund since April 2003 and was joined by Rachid Semaoune in 2019. Together, they aim to achieve a gross redemption yield of 1.25 times the gross redemption yield of the FTSE Actuaries British Government 15 Year index.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Chart

Source: FE Analytics

According to the fund’s latest factsheet, unrated bonds and bonds rated BB or below account for 32% and 42.6% of the portfolio, respectively. This suggests a higher exposure to issuers with poorer credit quality, but also higher compensation due to the associated default risk.

In terms of maturity, half of the bonds in the fund are due to mature within 0 to five years, while 31.6% of the securities have a maturity of more than 15 years.

Over the past three years (to the end of May), the strategic bond fund has returned 12.4%, ranking fourth out of 80 in its sector.

Longer term performance has been even stronger, as Royal London Sterling Extra Yield has been the top-performing fund in the IA Sterling Strategic Bond sector, roughly 16 percentage points ahead of runner-up AXA Framlington Managed Income.

Finally, no veteran manager met our requirements in the IA Sterling High Yield sector.

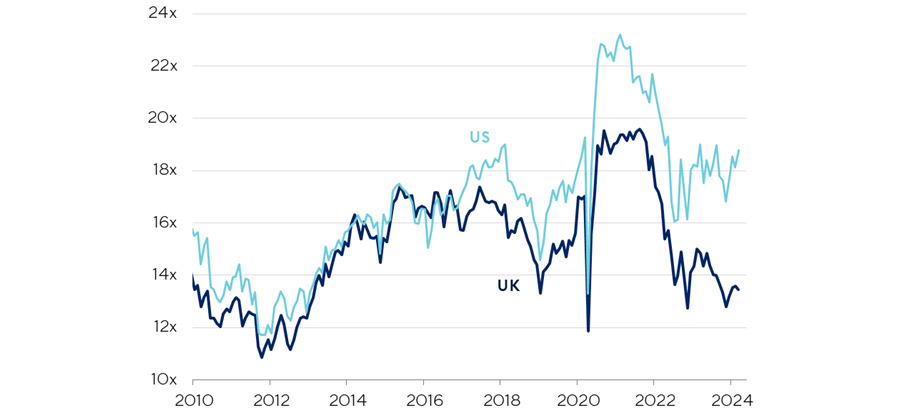

The Rathbone Global Opportunities fund manager explains why the gap between the strongest companies and the rest of the market will widen.

When FE fundinfo Alpha Manager James Thomson took over the Rathbone Global Opportunities fund in 2003, he wanted a simple but repeatable process that would enable him to scale up the fund over time.

This approach has proved successful, as the fund has returned 1,106.8% under Thomson’s 20-year tenure, ranking second out of 94 funds in the IA Global sector since November 2003.

The fund has amassed £3.9bn of assets and continues to be popular with investors. It was one of the top 10 funds for SIPPs on the Fidelity Personal Investing platform in May and was the tenth most-viewed fund on Trustnet during the three months to 20 May 2024.

Performance of fund under Thomson’s tenure and over 10yrs vs sector

Source: FE Analytics

Yet, Thomson believes that equity markets will generally be less rewarding going forward. However, he still sees glimmers of hope, for instance in artificial intelligence.

Below, he explains why the strong will get stronger, why the US is the ultimate growth market and why he avoids Japan and emerging markets.

Could you explain your investment process?

We want as many voices in the room as possible when we're generating investment ideas. We will use our internal analysts, but also a global network of external brokers and analysts. That's how we create a 360˚ view of the investment case. That feeds into our secret sauce analysis, which is a screen of qualities that we look for and qualities that we actively avoid.

The next step is to meet company management and try to understand the drivers of growth, the risks and the strategy and how they change over time. We want an ongoing relationship to understand where promises are being kept and where strategies are being changed and adapted.

Then we think about valuation, timing and suitability. Valuation has to be reasonable given the growth prospects. In terms of timing, we don't want an investment case that takes many years to come to fruition, we want a company that's firing on all cylinders now.

We also want to be able to manage risk effectively. That means having a defensive bucket of weatherproof equities. These are companies that have a more resilient defensive growth profile that's less linked to the economic cycle. That provides a buffer for the rest of the portfolio.

What differentiates you from your peers?

I think there are fewer than 100 UK-domiciled global equity funds that have been in existence for the past 20 years and I believe I am one of the few managers who have been in place for that time period.

Another thing that differentiates us is our willingness to admit that there are areas where we don't have skills and expertise. For example, we avoid investing in emerging markets or Japan. They are important parts of the equity market, but I don't have the skills nor the expertise to do it credibly. I think clients would be better off going to a dedicated emerging markets or a dedicated Japanese equity fund manager.

What have been your best-performing stocks over the past 12 months?

There's been a lot of market concentration around the Magnificent Seven, but I'm pleased that we've had a much broader contribution to our performance over the past 12 months. We own Nvidia and Amazon, but I would also point to businesses such as Costco, Boston Scientific and Amphenol.

Performance of stocks (in sterling) over 1yr

Source: FE Analytics

Outside the US, some of our best performers have been companies like Schneider Electric, which is a play on electrification, digitisation and upgrading electric networks, as well as Partners Group, which is a private equity business that has bounced back very strongly from the malaise in 2022 as rates were rising.

Next, the clothing and apparel retailer, has been a significant outperformer in a pretty soggy UK equity market.

Performance of stock over 1yr

Source: FE Analytics

And the worst-performing stocks?

It’s been primarily defensive, consumer-staple companies such as McDonald's, Coca-Cola, Mondelez and Heineken. It is not a surprise since the market has been looking for cyclicality, recovery in earnings potential and beneficiaries from falling inflation.

Performance of stocks (in Pounds Sterling) over 1yr

Source: FE Analytics

I would also highlight some of our China-exposed businesses such as LVMH, which has really struggled, particularly in its spirits division, and cognac company Remy Cointreau, which we have sold.

What is your view on equity markets hitting all-time highs?

I hope that's a precursor to earnings moving higher to reflect that. Valuation is often a poor predictor of future performance and expensive doesn't necessarily mean overvalued. Often, valuation is reflective of the quality of the earnings you are getting.

The US market is admittedly expensive, but you're paying for resilience, repeatability, adaptability and higher growth. So you're paying a premium in the US because you're getting premium growth credentials. The US really is the home of the growth investor.

What are the main investment themes in your fund?

I would put AI right at the top of my list of investment themes. The computer is no longer just instruction-driven, it is now intention understanding. It’s still early but we are already seeing applications. AI is used for drug discovery and development. Shopify told me that 30% of its coding is being done by generative AI. Video games are going to be produced in record time thanks to AI.

We're all probably going to have some sort of personal digital assistant that helps us with mundane tasks through generative AI.

One of my analysts thinks that AI is going to drive half of incremental GDP over the next decade and will represent 20% of global GDP by 2032. If that's correct, then this is the start of a new industrial revolution.

We have a broader theme called ‘the strong getting stronger’, which is about the increasing concentration of dominance, particularly in technology.

There’s going to be $275bn worth of capital expenditure within technology over the next year, but $200bn is being done by four companies alone.

It’s probably the most important theme we are running. In a world of slower and more inconsistent growth, we think the strong will get stronger.

In 2022, we changed about 20% of the portfolio and repurposed it into the stronger players. We sold some of the earlier stage companies with more expensive financing and an unpredictable demand picture.

We feel they will struggle to outperform in the current market, which is probably leading us toward a two-speed economy.

What do you do outside of fund management?

I have two daughters, so I help my kids to be as well-rounded, stimulated, happy and successful as possible.

I enjoy sitting on the sidelines of sporting events and I like playing tennis. The golf clubs seem to be attracting quite a lot of cobwebs and dust, but hopefully they will come out of the basement when the girls are a bit older.

Trustnet editor Jonathan Jones explores the impact rate cuts will have on markets.

This week, the European Central Bank took the lead on monetary policy by becoming the first of the big three central banks to cut interest rates.

It was the first time in five years the ECB has cut rates, with the Bank of England (BoFE) expected to join its peer from the continent in the coming months.

The big question is what the Federal Reserve will do. After all, experts have warned that the BofE and ECB can’t go too much further without the Fed doing the same, or risk currency fluctuations that would be prohibitive to their inflation targets.

Next week, the US central bank will meet for the fourth time this year, but there aren’t many signs it is gearing up for a rate cut.

Most expect the result to be the same as the previous three meetings: no change in the headline Fed Funds interest rate of 5.50%.

The CME Fedwatch service has a 2% chance of a Fed surprise drop of interest rates, which feels pretty conclusive.

Russ Mould, AJ Bell investment director, said: “As such, the wait for the first, elusive reduction in headline borrowing costs continues, especially as financial markets began 2024 expecting six rate cuts from the Fed, down to 4% by the end of the year, with the first of those coming in March.”

This has been scaled right back, with markets now predicting just two cuts in 2024 down to 5%, with the first one coming in September. Yet, even this is far from given.

“The Fed has to acknowledge that unemployment is low at 3.9% and inflation, as measured by the consumer price index, is 3.4%, still some way above its 2% target,” Mould said.

“The Atlanta Fed’s Sticky-Price CPI index is up 4.4% year-on-year, to suggest the central bank has more work to do, especially as producer prices and the Fed’s own preferred measure, the Personal Consumption Expenditure index, are showing fresh signs of heating up, rather than cooling down.”

As such, most predict the Fed is a few months away from starting its rate cutting cycle – as is the Bank of England, which could hold off to move in lockstep with its US counterpart.

For investors, it means the discount rate applied to growth stocks will remain higher for a little while longer, but there is still a general trends lower.

In the coming months, the likes of the big tech names should start to face an easier time of it from a macroeconomic perspective – as if they needed the help.

Cash rates will start to drop, although rates are not expected to plummet, which should mean they remain relatively attractive, while bonds too could thrive as yields start to drop.

In all, it could be a strong period for investors, who will have a litany of options to choose from to make money. At least that’s the theory.

In practice, these things are never straightforward and other shocks could derail any sort of stabilisation from the macro picture. Solid research and decision making will remain key, even if it seems as though the future looks bright.

Experts stick with the multi-boutique house despite some of its funds underperforming.

Having a consistent investment process is key in asset management, and a good manager will stick to their approach even when it is out of favour.

This has been happening to some of Liontrust Asset Management’s funds recently, particularly in UK small- and mid-caps, but experts agreed that the group’s overall offering remains strong.

Liontrust can be described as a “multi-boutique” whose teams have their own distinct processes and franchises, and its business model is based in part on strategic growth through acquisitions.

One thing the firm has got right with this model is retaining key talent, said FundCalibre managing director Darius McDermott.

Historically, Liontrust’s flagship has been the Economic Advantage team, which manages a range of UK equity funds, including Special Situations, UK Growth, UK Smaller Companies and UK Micro Cap.

The long-term track record of these funds is strong, with the UK Smaller Companies fund being the top performer in the 40-strong IA UK Smaller Companies sector over the past 10 years.

Over five years, UK Growth and Special Situations have fallen into the second and third quartile, respectively; Special Situations stayed in the third quartile over the past one and three years.

Historically, small and mid-cap stocks contributed strongly to the Economic Advantage funds, but weak investor sentiment towards these areas has impacted their performance in the past few years.

A Liontrust spokesperson said that the team remains “passionate believers” in the long-term compounding potential of the entrepreneurial, high-quality smaller companies in which they invest – and so did McDermott.

He emphasised the “excellent” long-term track record under FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, who have returned more than 100% to investors over the past decade. McDermott said this is “concrete proof that the process of targeting companies which must have intellectual property, a strong distribution network or recurring revenues holds up well over the long-term.”

Jason Hollands, managing director at Bestinvest, agreed: “I’ve long been a fan of the overall approach, which has delivered very consistent performance. Liontrust UK Growth is also a Bestinvest top pick for the UK market.”

A prime example of Liontrust’s multi-boutique and inorganic growth strategy is the 2017 acquisition of Alliance Trust Investments, now the Liontrust Sustainable Investment team, which manages the Sustainable Future range of strategies.

For this range, 2022 was the most challenging year since inception in 2001. Only the Corporate Bond and the Monthly Income Bond funds managed to buck the downward trend, while the European Growth fund has been anchored to the bottom quartile of performance and Global Growth steadily fell from the second to the third, then the fourth quartile – as shown in the table below.

Source: FE Analytics

According to a Liontrust spokesperson, this was due to a series of headwinds, including an abrupt change to the macroeconomic backdrop, higher bond yields and weakness among the growth-focused and quality stocks in which the team invests.

Nonetheless, stocks in the Sustainable Future funds “delivered growth despite the low growth economy”, he said, which is “testament to the structural nature of the themes the team invests in, which the managers believe have strengthened, such as energy security, innovation in healthcare and environmental efficiency”.

For Hollands, the Liontrust Sustainable Future Growth fund’s underperformance “isn’t a surprise” and is “not problematic either”. Most environmental, social and governance (ESG) funds have underperformed, given they missed out on the rally in energy and commodities, he explained.

Hollands still regards the Sustainable Investment team as a jewel in Liontrust’s crown.

The Sustainable Future multi-asset offerings have also faced challenges, said McDermott, but are backed by “one of the most experienced and well-resourced teams in the game”.

“We retain confidence in their ability to deliver long-term growth, especially considering the continued relevance of the themes the team invests in – energy security, healthcare innovation and environmental efficiency,” he concluded.

Some funds attached to other investment hubs within Liontrust have also underperformed, including the Global Smaller Companies and US Opportunities funds, as shown below.

Source: FE Analytics

The US Opportunities fund is managed by Hong Yi Chen, who joined Liontrust when it acquired Majedie Asset Management in 2022. The fund has just been moved into the new Liontrust Global Equities team headed by Mark Hawtin. Its investment process has evolved to focus on companies with the potential to exploit change and with catalysts to unlock value.

But the area where Hollands was most sceptical was emerging markets.

Liontrust’s China strategy came 30th out of 36 funds by 10-year performance and has been relegated to the third quartile over the past one, three and five years; the Latin America strategy was the bottom fund in the nine-strong sector over five years.

But Hollands was more concerned about Liontrust Emerging Markets, which came to the group in October 2019 via the acquisition of Neptune Investment Management.

“It is a tiny fund at £9m and appeared in Bestinvest’s last Spot the Dog report as a serial underperformer. At such a small size and with its recent track record, I doubt it is viable,” he said.

Liontrust said most of the underperformance derived from its overweight positions in large-cap technology shares during 2021 and early 2022, which were costly due to a downturn in the semiconductor industry.

Additionally, Brazil dragged on performance as the team’s expectations of recovery initially proved too optimistic – although during the past year, Brazil’s recovery has been a positive contributor to performance.

Asset managers previously covered in this series are Jupiter Asset Management and Schroders.

After election-related volatility settles, consumption stocks are expected to benefit from new populist policies while infrastructure spending could slow down.

India’s election results have surprised everyone, unleashing a week of volatile swings in one of the world’s most expensive and most-watched stock markets.

Indian equities hit an all-time high on Monday 3 June in anticipation of Narendra Modi’s Bharatiya Janata Party (BJP) achieving a majority. The stock market then plummeted as results from the early vote count rolled in. A coalition government now appears the most likely outcome.

Peeyush Mittal, who manages Matthews Asia’s India strategy, expects “volatility to continue as the next government takes shape”.

The new coalition government is likely to introduce more populist policies to drive consumption but will probably hit pause on infrastructure spending, which had been a priority for Modi, Mittal said. As a result, he expects sectoral leadership in the stock market to change in favour of consumption stocks, away from capex-led themes.

“We think capital goods and infrastructure-related sectors spanning industrials and materials will face headwinds in the near term and associated stocks will likely be negatively impacted. There are grey areas, such as power and defence, which should be less affected as these are less sensitive to partisan issues,” he said.

“But it will be consumption-related sectors like consumer staples, traditionally strong areas like pharmaceuticals, and other areas that may be more favourably looked upon by an evolving coalition that could fare the best in the coming weeks.”

Mittal pointed out that consumption growth has been weak in India despite strong GDP expansion during the past two years, which he said indicates there are not enough employment opportunities for lower income groups.

“Post-Covid, the economic recovery in India has been K-shaped, with some sectors and socio-economic groups bouncing back while others have struggled and experienced a loss of savings, particularly citizens on lower incomes and those in rural areas,” he said.

He thinks consumption growth needs to improve for GDP growth to be sustainable.

Mittal also warned that small and mid-cap stocks are likely to experience prolonged volatility given their elevated valuations.

Amol Gogate, manager of Carmignac Portfolio Emerging Discovery, was more bullish about India’s prospects, even though managing a coalition could slow down the government’s pace of execution.

“While the election results are certainly a dampener for the markets and sentiment in the short term, they also showcase that India is a true democracy. And with Modi at the helm, it seems likely the next phase of economic development will proceed and the long-term investment case for India, for now, remains solid,” he said.

Investment into India’s bond markets is set to spike as a result of India’s inclusion in JP Morgan’s emerging markets government bond index this month and Bloomberg’s emerging market local currency index in September 2024. These events could bring in up to $40bn of foreign investment, which Gogate thinks will have a ‘halo’ effect on Indian equity markets as international investors become more familiar with the country.

“This capital boost, combined with Modi’s pro-business stance and a well-managed domestic financial system means Indian markets are poised to continue their upward march. However, with valuations already high, and a less certain political landscape, volatility may increase, so selectivity is becoming more important,” he explained.

His outlook for the stock market differs from Mittal’s. “In our view, small and mid-cap firms will benefit from a likely capex upcycle, as well as the financial services, high-end manufacturing and real estate sectors. The most disruptive businesses, with the highest potential for rapid growth will emerge on top thanks to a highly supportive ecosystem for budding companies,” Gogate said.

John Pattullo, co-head of global bonds at Janus Henderson, plans to retire in March 2025, leaving Jenna Barnard as sole head of the team.

Janus Henderson Investors’ co-head of global bonds, John Pattullo will retire in March 2025 after 27 years with the firm.

Jenna Barnard will assume sole leadership of the global bond team and retain portfolio manager responsibilities for the funds she runs alongside Pattullo, with whom she has worked for 20 years.

They both co-manage the £2.3bn Janus Henderson Strategic Bond fund and the £1bn Janus Henderson Fixed Interest Monthly Income fund, among others.

Nicholas Ware, who has been a fixed income portfolio manager at Janus Henderson since 2012, will become a named portfolio manager on all Janus Henderson’s strategic bond and developed world bond funds as part of the firm’s succession planning.

Analysts at RSMR said the Strategic Bond fund is a core option for conservative investors, with an emphasis on quality, capital preservation and consistent returns. Performance has trailed the sector average over five years, as the chart below shows, but RSMR’s analysts said this fund tends to perform better in risk-off markets.

Performance of fund versus sector over 5yrs

Source: FE Analytics

Barnard and Pattullo employ a thematic macro framework, looking at the structural drivers of economies such as excessive debt, inequality, globalisation, demographics and technology. “This approach results in more of a holistic view of what the managers term the ‘climate’ of investing and provides a framework which excludes a lot of the short term market noise,” RSMR explained.

Barnard and Pattullo describe their philosophy as “sensible income”, with the goal of delivering consistent returns via an understandable investment approach.

“The ‘sensible’ theme results in a large proportion of the investment universe being screened out,” RSMR analysts said.

“As you might expect, the screen removes highly cyclical and operationally and financially leveraged issuers and it also excludes industries and companies that fail to consistently generate value. The team is essentially looking to invest in quality credits and avoid unstable, risky sectors and companies.”

The recent rally may be a taste of things to come for the UK’s smallest companies.

The role of AIM stocks in tax mitigation is well-established; however, in recent years, with AIM impacted by broad disillusionment with the UK stock market, it has been harder to make the investment case. This has resulted in the valuations of many AIM companies hitting all-time lows, but there are several catalysts now evident that should help improve the performance of the index.

The UK’s smallest companies have been widely unloved. They have been on the front line of negative sentiment towards UK stocks and seen as more vulnerable to weakness in the domestic economy. They have been on the wrong end of a general flight to safety among investors. Rising interest rates have also been a headwind, with the valuations of smaller growth companies regarded as more sensitive to higher borrowing costs. However, markets tend to overshoot, and we see real value emerging today.

Operationally, many of the AIM businesses in which we invest have proved sound. They have continued to deliver strong growth despite a more difficult economic environment and have proved resilient in the face of higher interest rates. The combination of weaker share prices and stronger earnings has left many companies looking attractively valued, relative to their larger capitalisation peers.

A contributing factor has been a widespread misunderstanding of the relative risk of AIM companies. While there is certainly higher risk associated with speculative companies within the index, there are also plenty of well-established companies with strong business models, low debt and clear visibility on earnings.

An example of the latter is James Halstead, which manufactures and supplies flooring for commercial and domestic use. Its end markets include defensive sectors such as health and education, reducing exposure to the broader economic environment. It has cash on its balance sheet and the Halstead family still has a significant share of the ownership.

Valuations

Hardened investors understand that markets can often take time to reach a turning point and recognise that even cheap stocks can get cheaper before they recover.

The UK entered a technical recession at the end of 2023, which will do little to draw investors to its smaller quoted companies. Nevertheless – applying the caveat that stock picking rather than market timing is our strong suit – we are starting to see some green shoots.

While the economic environment remains lacklustre, it is slowly improving. Inflation has come down significantly and is likely to fall further over the next few months.

Previous peaks in inflation, such as those in 1975, 1980 and 1990, have been followed by remarkably strong performance from the UK’s smallest listed companies. In the three-year period following each of these peaks, total returns were 219%, 111% and 74%, respectively. (These statistics are based on the Deutsche Numis UK Smaller Companies index, the bottom 10% by size of listed companies, as it has a far longer track record than the AIM index.)

The Bank of England has hinted that rate cuts are on the horizon, even if it has been circumspect on the extent and timing of any cuts. AIM companies have shown inverse correlation with UK gilt yields; as interest rates rally, so gilt yields decline and the performance of the AIM index starts to revive.

We believe that as bond yields start to drop, it should help reverse some of the negative sentiment that has weakened the AIM market.

IPOs and M&A

There are also tentative signs of renewed optimism in the initial public offering (IPO) market. Last year was a fallow one for IPOs, but there have been encouraging signs of renewed activity over the past four months.

We've seen some interesting companies joining AIM; from disruptive fintech companies to England’s leading winemaker, which is starting to broaden our investment opportunities.

There has also been a revival in merger and acquisition (M&A) activity. While big deals such as those for Currys and Direct Line gather headlines, there is plenty of activity at the smaller end, with private equity and strategic acquirers buying up higher-quality companies at lower prices.

Political support

We also see a growing cross-party recognition that the UK isn’t doing enough to encourage investors to support British business. Most recently, this has been acknowledged by the introduction of a British ISA, which extended the tax-free allowance for investment in UK-listed companies.

There are also moves to encourage UK pension funds to invest more in UK equities (including AIM), starting with a disclosure regime. In the longer-term this may galvanise investment into smaller listed companies.

The recent rally may give a taste of things to come for the smaller end of the market. We believe a renewed optimism around the prospects for smaller companies will start to be reflected by the AIM index.

Of course, good stock selection is essential. The AIM index is a broad church, with a rich diversity of sectors and companies. Of the top 10 holdings in the index, only two are from the same sector.

The highest sector weighting in the index is in industrial goods and services at 15%, but technology (14%), consumer products and services (12%) and travel and leisure (10%) also make up a meaningful chunk of the companies.

There are over 650 companies currently listed on AIM, with up to £2.4bn in market capitalisation and many paying attractive and growing dividends.

There will always be companies that fail, or that struggle to manage costs effectively. However, careful stock selection can filter out the problematic companies, while focusing instead on those high-quality businesses with strong balance sheets and high returns on invested capital.

Overall, the quality of AIM stocks is as high as it has ever been, and we continue to find a wealth of choice for all our portfolios.

Simon Moon is co-manager of the Unicorn UK Smaller Companies fund. The views expressed above should not be taken as investment advice.

As anticipated, the European Central Bank has cut interest rates ahead of the Federal Reserve.

The European Central Bank (ECB) has lowered interest rates by 25 basis points, moving ahead of the US Federal Reserve in initiating cuts. As a result, , the ECB’s deposit facility rate stands at 3.75%, marginal lending facility at 4.5% and the main refinancing rate at 4.25%.

This cut was widely anticipated as the 2% inflation target in the Eurozone seems to be within reach.

Lindsay James, investment strategist at Quilter Investors, said: “While this news was well expected, it will no doubt provide relief to consumers and businesses on the continent. Ever since Russia’s invasion of Ukraine, Europe has struggled to combat the economic shock this produced, but signs are now improving, although uneven across the continent.

“While inflation has ticked up in recent months, the economic recovery is beginning to play out. This puts the ECB in a good position to cut further into a slowly improving picture, although the messaging is likely to remain restrained and cautious. As such, there may be some pauses on the way back down for rates in order to limit the scope of any divergence with the Federal Reserve.”

Yet, Neil Birrell, chief investment officer at Premier Miton Investors, warned that the path to further cuts will not be predictable or smooth, as inflation in the Eurozone is proving resilient.

For instance, the ECB has upgraded its economic projections, now forecasting inflation at 2.5% in 2024 and 2.2% in 2025, compared to the previous estimates of 2.3% and 2%, respectively.

Gurpreet Garewal, macro strategist, global fixed income at Goldman Sachs Asset Management, agreed. “The future trajectory of easing remains uncertain, given positive momentum in recent inflation and activity indicators, alongside cautious commentary from the ECB. We expect policymakers to maintain a data-dependent approach,” he said.

“We are closely monitoring inflation expectations, wage trends and services inflation. These are key indicators of inflation persistence that will determine the pace and scope of the ECB's rate cutting cycle. The Fed’s decisions and the euro's trajectory may also influence ECB policy in the second half of the year. We currently expect the ECB to adopt a gradual, quarterly easing strategy.”

However, Harry Richards, investment manager for fixed income at Jupiter Asset Management, believes that further cuts will be required as policy is still too restrictive, considering the likelihood that weak growth will persist and inflation will continue its "slow march" towards the target.

“We do not expect a 'one and done' scenario but, instead, believe we are on the brink of a full rate cutting cycle which should help to underpin returns within the fixed income space over the medium term,” he added.

Richards also believes that the Fed will follow suit in the coming quarters, as the labour market is softening, consumer weakness becoming apparent and shelter inflation fading.

“They may also fear unleashing the dollar wrecking ball if they do hold rates higher for too much longer whilst other developed market central banks are easing,” he said.

Finally, Quilter Investors’ James expects that today’s ECB decision may influence the Bank of England which is set to meet on 20 June 2024.

“The major central banks will not want to diverge too far from one another, and with political risk being ratcheted up, they also won’t want to be seen as too influential,” she concluded.

All three UK equity sectors are now among the highest returning of the year, Trustnet finds.

UK smaller companies funds have jumped to the top of the 2024 performance charts thanks to “sellers’ exhaustion”, a recovering economy and increasing mergers and acquisitions (M&A).

According to FE Analytics, the average fund in the IA UK Smaller Companies sector made a 10.8% total return over the first five months of 2024 – making it the highest-returning peer group.

The average smaller companies fund is even beating the IA Technology and Technology Innovations and IA North America sectors, which have been buoyed by the continued strength of the Magnificent Seven stocks.

The IA UK Equity Income and IA UK All Companies sectors hold fourth and fifth places year to date, with respective average returns of 8.5% and 8.1%.

Average return of Investment Association sectors over 2024 so far

Source: FinXL. Total return in sterling between 1 Jan and 31 May 2024.

This is a stark turnaround from earlier in the year, when the three UK equity sectors were much lower down in the performance tables, and is down to some strong returns from the UK in May.

Simon Evan‑Cook, fund manager on the VT Downing Fox multi-asset range, said: “The asset class has been so hated, and therefore heavily sold, that there are just fewer disillusioned souls left to sell them down.

“This is borne out by talking with our fund managers, who tell me that stock prices are no longer being eviscerated if the company reports slightly disappointing results. This had been the norm for the last few years, and this change in behaviour has the ring of sellers’ exhaustion to it.”

Source: FinXL

Rob Morgan, chief analyst at Charles Stanley Direct, added: “This rally has been a while coming. The area has long been cheap but what it lacked was a catalyst to break through persistent negative sentiment and reverse the flows out of UK assets that had been depressing share prices.”

He said a number of factors have combined to “tentatively” turn the performance of UK funds around, one of which is an improvement in the domestic economy. Although the UK’s economic numbers are “still not great”, they are better than many feared and support improving sentiment.

“When things seem very negative, a bit of good news goes a long way,” Morgan said.

He also pointed to positive trends at a company level. FTSE 100 companies with international-facing businesses have benefitted from the strength of the US dollar, which increases the sterling-dominated earnings and has led strong company results. Meanwhile, sectors such as energy, mining and defence, which are big constituents of the UK market, are benefiting from rising demand.

Snapshot of UK equity market over 2024 so far

Source: FinXL. Total return in sterling between 1 Jan and 31 May 2024.

Both Evan‑Cook and Morgan credited increased M&A as a positive for the UK. Years of underperformance from UK stocks has left them attractively valued when compared with international peers, leading to a series of approaches.

“In UK small-cap world it’s become common to hear the refrain ‘they’re so cheap that if you don’t buy them, somebody else will’,” Evan‑Cook said. “Turns out that was true, because all of a sudden corporate and private equity buyers are snapping up UK companies like it’s the end of an episode of The Apprentice.”

Morgan also argued that this creates a halo effect that bolsters sentiment towards the whole market, not just the target businesses themselves.

While all these factors are supportive of UK equities, they may have had a disproportionate impact on smaller companies.

“As the most undervalued parts of the market, UK small- and micro-caps have risen the most as sentiment has turned,” Morgan explained. “It’s also where liquidity is more limited so even a little bit of an uplift in interest can have a big impact.”

But whether the recent rally has legs is a more difficult question.

Morgan expects the M&A theme to continue to underpin valuations, but said it may not boost all stocks equally. Buyers such as private equity investors look for very specific characteristics in a target company, so the main beneficiaries would likely be active managers who are seeking the same qualities and who thereby end up owning natural M&A targets.

“Meanwhile, more extensive than expected interest rate cuts is a tide that would lift all the boats. Unfortunately, it isn’t that likely, but the gradual impact of lower interest rates further out should still help,” he finished.

“Finally, for UK small-caps the performance of the domestic economy is influential. Expectations are pretty low, so continued growth, albeit at a sedate pace, would create a benign environment.”

Retail investors in the UK continue to shun their domestic stock market despite its strong performance.

UK equity funds suffered their second-highest outflows on record in May, with domestic retail investors withdrawing £1.1bn despite strong performance since late February, according to the latest Calastone Fund Flow Index.

Calastone attributed these outflows to profit taking after the recent rally. Edward Glyn, head of global markets, said: “While buoyant markets usually attract new capital, many investors have seemingly chosen the UK rally as an opportunity to jump ship rather than a moment to reappraise the UK’s prospects.

“The election announcement made no difference to selling patterns during the month – this is a long-term trend of selling, not a news-driven flurry.”

On the other side of the Atlantic, US equity funds took in £826m in May, which was six times the long run average but one-third lower than April’s inflows.

Equity funds with environmental, social and governance (ESG) principles garnered £581m in May, with most of this money going to North American strategies.

“The heavy weighting of many US tech stocks in ESG funds helps explain why this is happening,” Glyn said.

“If we exclude North America, ESG-compliant funds have continued to suffer outflows in recent months. So what is going on? Investors can obviously buy funds that only invest in technology stocks though these are small in size, but they may be picking North American ESG-compliant funds as an alternative route to tech exposure.”

Global equity funds raked in £1.4bn and European equities attracted £462m in May.

Meanwhile, fixed income funds were hit by outflows for the first time since October 2023 as inflation data in the UK and US disappointed markets, rate cut expectations were pushed out further and bond yields remained high. Net outflows of £643m marked bond funds’ worst month since March 2020 and second-worst month during Calastone’s almost 10 years of data.

“The prospect of interest rate cuts in the US and the UK has receded yet again, with only the European Central Bank likely to move in the short term. Bond yields are approaching once more the post-global financial crisis highs they reached in late 2023, pushing down bond prices as they have climbed,” Glyn said.

“If you are confident rates will fall, then it’s possible to lock into these high yields for a very long time through fixed income funds, but the see-saw of hopes and fears over rates has finally led some investors to call time and withdraw capital for the first time in months, choosing instead to take refuge in cash or money markets.”

Indeed, investors moved £143m into safe-haven money market funds in May to access the relatively high yields on offer before central banks cut rates. Mixed-asset funds, however, suffered outflows of £531m.

The platform highlights stock market winners and losers from a potential Labour victory.

What impact the UK’s forthcoming general election will have on portfolios is a question that many investors are asking and AJ Bell investment analyst Dan Coatsworth has some answers.

Housebuilders, building materials suppliers, nuclear engineers and renewable energy specialists should perform well if the Labour party wins the election, while rail operators, outsourcing providers and UK oil and gas producers would flounder, he said.

Below, he addresses these sectors one by one, giving examples of companies whose activities complement Labour’s policies.

Industries and stocks that would prosper under Keir Starmer’s Labour

First up, housing. Coatsworth expect Labour to implement changes to the planning system and put greater emphasis on building affordable homes.

“This could be good news for companies involved in the provision of materials to the property sector and for housebuilders,” he said.

“Labour has pledged to upgrade draughty homes and help residents to stop wasting heat by it escaping into the great outdoors. That implies a boost for construction workers, engineers and electricians.”

There are multiple companies on the UK stock market that might benefit from Labour’s housing strategy, for example Travis Perkins, Wickes and B&Q/Screwfix-owner Kingfisher, all of which “could see higher demand from tradesmen and homeowners eager for the bits and bobs needed to spruce up flats and homes”.

But the list of companies that could get busier goes on to include construction groups such Morgan Sindall and Kier, ventilation specialist Volution and housebuilders, for example Vistry and MJ Gleeson.

Moving on to energy, where Labour’s Great British Energy initiative foresees the introduction of tougher measures on fossil fuel producers and a windfall tax on oil and gas projects to rack up £8.3bn. These proceeds will be directed towards wind, solar, hydrogen and carbon capture and storage technologies.

Some of the UK-focused oil and gas operators (such as Serica Energy and Harbour Energy) have already begun reducing their exposure to the UK North Sea, but others have doubled down on their exposure. Ithaca Energy, for instance, has purchased UK assets from Italy’s ENI.

Coatsworth highlighted specialists listed in the UK including Costain, which advises on energy transition work, and environmental services group Ricardo.

But an expected push for nuclear power would also play into Rolls-Royce’s strengths.

“Rolls-Royce has been among the best-performing shares on the UK stock market in recent years as investors bought into its recovery story,” he said.

“Being in a strong position to capitalise on small modular reactors looks like fortuitous timing for Rolls-Royce if Labour gets elected and could potentially act as another catalyst for its share price.”

Calls for the nationalisation of UK railways are creating a “major overhang” for FirstGroup, but ticket seller Trainline should come out of this situation intact, according to Coatsworth. The Labour party has said that it would not revive the Conservatives’ plan for a national retailing app for train tickets.

“Trainline’s shares have already experienced a wobble over potential changes to the UK rail system, but they’ve started to recover,” the analyst noted.

Industries and stocks unlikely to cheer for a Labour victory

Labour was responsible for the previous outsourcing boom and now it might be the architect of its demise, said Coatsworth.

“Starmer wants to bring public services back into government hands, suggesting that waste collection, cleaning, catering and maintenance services and more will no longer be a ripe opportunity for the UK’s army of outsourcing specialists,” he added.

“A lot of people think Conservative politicians awarded lucrative contracts to their friends and associates, and now Labour wants to bring an end to this questionable practice.”

If this is enforced, Serco, Mitie, Babcock and Capita all look vulnerable.

Retail, leisure and hospitality would also struggle. These industries have all benefited from immigration as a source of workers, but both the Conservatives and Labour favour stricter rules on immigration.

“Brexit has already made it harder for certain foreigners to find work in the UK and companies have faced a smaller pool from which to recruit, which has pushed up wages. Consumers have shouldered the brunt of these additional labour costs through higher prices,” Coatsworth said.

“This situation could be exacerbated if Labour wins the election and changes the zero hours contract system. It wants to ban ‘exploitative’ zero-hour contracts as part of a broader initiative to boost wages, make work more secure and support working individuals.”

Frasers is among the names on the stock market to have made full use of zero-hours and any change to the system means it has less flexibility for its workforce.

This scenario extends into other places such as the support services industry, with Mitie among the potential losers from a ban on zero-hours.

Finally, Rishi Sunak’s party looks ready to pass the baton onto Labour in its war on smoking and vaping – bad news for big companies in this sector such as British American Tobacco, Coatsworth concluded.

Passive funds tracking the FTSE 100 will be forced to sell St James’s Place, Ocado and RS Group.

Wealth manager St. James’s Place has been relegated from the FTSE 100 to the FTSE 250 index after regulatory pressure and fee changes prompted investors to jettison the stock. Online grocer Ocado and industrial services company RS Group have also left the UK’s large-cap index.

Meanwhile, Darktrace, LondonMetric Property and Vistry Group have been promoted to the FTSE 100 as part of FTSE Russell’s annual review. Darktrace, which specialises in cyber security using artificial intelligence, is being acquired by US private equity group Thoma Bravo.

The FTSE 250 Index has six additions and the same number of deletions. As well as the companies moving between the mid- and large-cap indices, Alpha Group International, Renew and XPS Pensions Group are joining the FTSE 250, while Ferrexpo, Mobico Group and Octopus Renewable Infrastructure Trust are leaving.

The changes will be implemented at the close of business on 21 June 2024 and will take effect from the start of trading on 24 June 2024. They will impact the portfolios of investors who own passive and exchange-traded funds tracking the UK’s large and mid-cap indexes.

St James’s Place’s (SJP) share price peaked in December 2021 and January 2022 but has plummeted since then, as the chart below shows.

SJP share price total returns over 5yrs

Source: FE Analytics

SJP scrapped its controversial exit fees last year in response to the Financial Conduct Authority’s Consumer Duty legislation. Fee changes had a detrimental impact on profit margins, according to David Cumming, manager of the BNY Mellon UK Income fund, who recently sold the position in St James’s Place he had inherited when he took over the fund two years ago. Not selling it sooner was a “mistake”, he admitted. “The management were more optimistic than things turned out and we probably stuck with it too long.”

SJP halved its dividend this year and held back £426m in provisions to refund clients who paid its ongoing advice fees but did not receive an “acceptable standard” of service, according to its full-year results.

Chief executive officer Mark FitzPatrick said: “A combination of the provision we have established and an expected decrease in the level of profit growth in the next few years as we transition to our new charging structure, reduces our ability to invest for long-term growth in our business over the next few years.”

Meanwhile, short sellers have been anticipating Ocado’s fall from grace, with the online broker becoming the UK’s second most-shorted stock last month. BlackRock, Millennium International Management and D1 Capital Partners, among others, are betting against the online grocer.

At the other end of the spectrum, LondonMetric Property and housebuilder Vistry joining the FTSE 100 augurs well for the property sector. LondonMetric Property merged with LXI REIT in January to create one of the largest publicly-traded property companies in the UK.

Vistry recently issued guidance that its annual and six-monthly profits would be ahead of last year. Dan Coatsworth, investment analyst at AJ Bell, said: “Investors like what they’re hearing and Vistry’s shares have steadily ticked up since last October with a 38% total return year-to-date (as of 29 May 2024). That makes Vistry the best performing housebuilder in the mid-cap index and the 21st best performing FTSE 350 stock so far in 2024.”

Experts suggest UK and global funds from Evenlode, Guinness, Fidelity and others.

Retired investors often have a specific income target and an aversion to losses. Bonds, therefore, make up a significant part of their portfolios but equities have a role to play as well by providing dividend income and capital growth.

Equity income funds tend to hold up better than bonds during periods of inflation, said Richard Parkin, head of retirement at BNY Mellon Investment Management.

He thinks actively-managed funds make more sense than passive trackers, “if you buy into the idea that retirement isn’t about maximising returns, it’s about avoiding losses”. Although most active managers struggle to keep up with raging bull markets, the best are adept at cushioning investors from bear markets and avoiding “howlers”, he said.

Jason Hollands, managing director of Bestinvest, recommended prioritising managers who focus on income growth potential, rather than trying to maximise current yields. “If you are going to supplement your retirement income through equity income funds, you will probably want to avoid erratic payouts but will also need to see both capital growth and income growth over time, so that payouts can keep pace with inflation,” he explained.

To that end, Trustnet asked fund selectors to recommend equity income funds that combine downside protection with growth potential.

Martin Currie UK Equity Income

Tom Stevenson, investment director at Fidelity International, argued for an allocation to UK equities.

“For investors looking to achieve a high and growing income stream in retirement, a UK equity income fund might fit the bill. The UK is traditionally a good source of equity income and today our domestic market stands at an attractive valuation discount to many other markets,” he said.

FTF Martin Currie UK Equity Income was Stevenson’s first choice. It is managed by FE fundinfo Alpha Manager Ben Russon, Colin Morton, Joanna Rands and Will Bradwell, who Stevenson said “have good experience in finding companies that can pay sustainable and growing dividends”.

The fund is relatively focused with 48 holdings, including Shell, BP, Unilever, AstraZeneca, National Grid and Imperial Brands.

BlackRock UK Income

Hollands suggested BlackRock UK Income because it “balances the need for stable, growing payouts with continued capital growth”. Managers Adam Avigdori and David Goldman have produced attractive returns with an above-market yield and the fund has held up well in difficult markets.

“The focus is on companies able or with the potential to pay a growing dividend alongside rising capital, rather than investing in businesses paying a high but stagnant yield. The managers are nimble and are able to move the portfolio around depending on the market environment and valuations,” Hollands said.

Performance of UK equity income funds vs benchmark over 10yrs

Source: FE Analytics

Evenlode Income and Evenlode Global Income

Hollands also recommended Evenlode Income, managed by Hugh Yarrow and Ben Peters. “The team has a clear and consistent investment philosophy, focused on high-quality companies with strong free cash flow that can support dividend growth and with a high return on capital. The managers prefer capital-lite businesses where shareholder capital isn’t constantly being drained by the need to reinvest heavily in things like plant and machinery,” he said.

“The fund may tend to lag in rising markets, but it has historically delivered strong and consistent outperformance.”

The fund’s global sibling is another solid choice for retired investors, according to Kamal Warraich, head of fund research at Canaccord Genuity Wealth Management. Evenlode Global Income focuses on generating attractive total returns, dividend growth and a sustainable income, he said.

“The portfolio is biased towards quality companies that generate high and consistent levels of free cash flow. Importantly, the hallmarks of this process tend to provide protection on the downside,” he explained.

JPMorgan Global Growth and Income and JPM Global Equity Income

Samir Shah, fund research analyst at Quilter Cheviot, said the JPMorgan Global Growth and Income trust is a good option for retired investors because it provides growth plus a 4% yield.

“The fund selects from only JPMorgan Asset Management’s firm-wide highest conviction ideas that offer superior earnings quality with a faster growth rate. In addition, it pays a dividend set at the beginning of each financial year equivalent to 4% of net asset value, which is funded by a combination of revenue and capital reserves,” Shah explained.

“Along with a strong track record of returns, the ability to pay a market-leading yield while also providing their best ideas from a total return perspective is attractive.”

The trust was trading at a discount of -1.1% as of 3 June 2024 and has £2.7bn in total assets. It is run by FE fundinfo Alpha Managers Helge Skibeli and Timothy Woodhouse along with James Cook.

Juliet Schooling Latter, research director at FundCalibre, recommended another JPMorgan AM strategy managed by Skibeli – JPM Global Equity Income, which takes a value-oriented approach. “The fund's experienced management team prioritises risk management, seeking to deliver a compelling yield without compromising growth potential,” she explained.