After a tough couple of years for sustainable investing, the firm identifies several stocks with the potential to make a lot of money whilst having a positive impact on the world.

Sustainable and impact investment strategies have had a rough few years from a performance perspective, leading investors to question whether it is possible to make money and do good at the same time.

Anna Väänänen, head of listed impact equity at AXA Investment Managers (AXA IM), said investors have “burnt their fingers” in the past two years. “The whole industry has a big issue with performance.”

Investors and clients used to be worried about greenwashing but now they ask more questions about performance. “Now it’s about performance, it’s about tracking error, it’s about the predictability of the performance,” she said.

Some impact investment strategies became unstuck because they invested in small companies that were insufficiently robust to cope with supply chain disruptions following the Covid-19 pandemic, then peak inflation and interest rate hikes.

“They could not swim because they did not have what it takes and they ended up having zero impact,” she observed.

Performance, therefore, was Väänänen’s priority when she joined AXA IM from Mirova in September 2023. She introduced strict minimum criteria for stocks to ensure they fulfil the dual mandate of impact and performance.

Companies must exhibit structural growth, a strong competitive position, operational leverage, a solid balance sheet, proven execution, growing profits and cash flow, a high quality management team and an “interesting” valuation.

Ultimately, she wants to invest in innovative companies that are driving change and are leaders in their sector, be it drug research, precision agriculture or batteries. “We try to identify the leaders of the transition,” she added.

Väänänen helms the People and Planet Equity strategy, which collates the best ideas from three thematic funds: Energy Transition, Social Progress and Biodiversity.

Below, she describes some of her high conviction holdings – companies that have the potential to change the world for the better and at the same time, make a lot of money for their shareholders.

John Deere

The agriculture industry causes 80% of deforestation and uses 50% of habitable land, yet food production needs to increase 50% by 2050 to keep pace with the world’s growing population.

There is a pressing need for agriculture to become more efficient, sustainable and environmentally friendly, and tractor manufacturer John Deere is at the forefront of this.

John Deere has placed cameras in its tractors that take pictures of the ground in real time which are uploaded to the cloud. Artificial intelligence (AI) is used to identify weeds and then the tractor’s sprayer is programmed to target the weeds alone, reducing herbicide use by 70%.

This initiative is creating regular software revenue for John Deere that diversifies its income from sales of large farming machinery. Its tractors can also analyse the quality of soil and then provide nutrients or irrigation in a precise way.

Digital twins

Another theme in the portfolio is the creation of digital twins, enabling anything from medicine to infrastructure to be tested in the digital sphere.

Dassault Systèmes is using a digital replica of the human brain to test neurological medicine and improve its understanding of Alzheimer’s and Parkinson’s disease.

Bentley Systems creates models of the natural environment including ecological data, which it uses to test whether its bridges can withstand extreme weather events. The company also uses its models to research the impact of infrastructure on the natural environment, for instance how would chopping down a forest affect local water levels.

National Grid

National Grid may be listed in the UK but more than half its business is on the US east coast, where the grid network is suffering from years of under-investment. National Grid is upgrading the grid system to protect it from natural disasters and to incorporate renewable energy.

SAP and tech exposure

About 30% of the People and Planet Equity strategy is held in IT and software but that is a broad church. “I don’t want to go too much into any one theme but the truth is that IT is driving change at the moment,” Väänänen said. “If you want to have impact then IT, healthcare and industrials will be the core three elements.”

SAP is an example of a tech stock in the portfolio with sustainable credentials. It provides software to help companies with nature-based reporting and it is a leader in enterprise resource management. SAP has been moving its licences to the cloud and has enhanced its growth prospects by cross-selling products.

The level of the credit spread, which represents the premium for taking on additional risk of default, is eye-wateringly low.

High yield and investment grade credit markets continue to look very attractive on a multi-year horizon. In fact, we find the market as attractive as it has been in nearly two decades. High yield looked great at the tail end of 2023 with the yield-to-worst on the Bloomberg US High Yield Corporate Index pushing over 9%.

At end of March 2024, it was 7.7%, which is still above 15-year averages. Likewise, yields in investment grade credit also look appealing. The yield-to-worst on the Bloomberg US Corporate Investment Grade Index is above 5%, again a multi-year high. This still represents a good starting point and is also one of the main reasons we are positive on bonds this year.

Spreads are skinny, which may become an issue if we don’t achieve the immaculate disinflation

Within credit markets however, the level of the credit spread, which represents the premium for taking on additional risk of default, is eye-wateringly low. Looking at the Bloomberg US High Yield Corporate Index, credit spreads sit at 320bps, which is the lowest that it has been in the past 15 years.

In an asset class such as high yield, this is important as it is the asset class at most risk of defaults. The picture is exactly the same when we look at investment grade credit.

This differentiation between yields and spreads has been very topical in the past 12 months. We realize that the attractiveness of fixed income is the all-in starting yields. It is important to be aware, however, that of this headline yield, credit spreads now represent a smaller proportion compared to history.

To put it in perspective, credit spread is only 42% of the overall yield that we can now extract from the high yield market and the rest is from government bonds. And the picture is even more stark in investment grade credit, where spreads are just 17% of the overall index yield.

Why does this matter?

We are not bearish on the economic outlook per se. In fact, we think growth will be reasonable going forward. However, we are aware that corporate credit is a ‘mean reverting’ asset class. There is a minimum amount of default risk that needs to be baked into credit spreads in order to compensate us as investors for that risk.

We never know what the future holds, but we know that when we see these levels of credit spreads, the cushion that we have in credit markets against any sort of exogenous shocks is minimal. In other words, it could take very little in the news for the market to suddenly wake up and panic and for credit spreads to sell off.

Furthermore, at current spread levels, we think that the market is pricing in an immaculate disinflation ahead of us, the Federal Reserve manages to achieve the perfect soft landing, and inflation lands at 2% in the next year, while employment and growth remain resilient.

This certainly is one of the possibilities. In fact, this scenario has increased in probability exponentially over the past 12 months. However, it is not the only scenario and there are a few more possible paths that the global economy can take.

Not all of them have the same probability of occurring. What is important, however, is that any other economic scenario ahead of us could prove that either government bonds, high yield or investment grade credit (if not all) are incorrectly priced at current valuations.

Possible scenarios – four scenarios among many in 2024:

Being very flexible is key to capturing attractive bond yields while navigating pitfalls. When we look at the bond market, we see multi-year wide index level yields. However, we also see multi-year tight credit spreads that could sell off in all but one scenario.

This makes us want to: 1) definitely be exposed to bond markets in order to extract that yield that we have not seen in decades but, 2) we want to be exposed to the part of the markets that looks cheaper (yields), while minimizing exposure to the part of the market that looks like it has little further room to outperform (spreads) at this point in time.

For this reason, in our strategic bond strategies, we maintain a headline yield of near 7% in the portfolios but have tactically reduced our credit risk exposure at the moment. We do not have an immediate catalyst for a spread sell-off, however we know that one always comes.

We stand ready to increase our credit risk once we see better compensation for default risks, while in the meantime we continue to enjoy the overall high income that we can now extract from bonds.

Alex Pelteshki is co-manager of the Aegon Strategic Bond fund. The views expressed above should not be taken as investment advice.

For investors who believe there is more room to rally, there are some options worth looking at, says Kate Marshall.

Japan’s stock market has been on a trajectory of new heights, with the Nikkei 225 index hitting an all-time record high this year – the first time it has achieved this in 34 years.

Yet much of the returns have been in local currency thanks to the weakening of the yen. Indeed, over two years, the TSE Topix index – another popular Japan equity benchmark – has been the best performing major market in local currency terms, as the below chart shows.

Its 49.2% gain is almost double that of the much ballyhooed US S&P 500 index, while the European Euro STOXX index took second place, up 31.4%.

Performance of indices over 2yrs

Source: FE Analytics

For UK investors the returns have been more muted. In sterling terms, the Japan index drops down the pecking order substantially.

Indeed, Euro STOXX is top with a return of 33.4%, followed by the S&P 500 (26.6%) and the broader MSCI World (24.2%), which is largely dominated by the US names. The TSE Topix sits in fourth with a total return of 22.2%.

Despite this, returns have still been strong. Kate Marshall, lead investment analyst at Hargreaves Lansdown, said investors will now have to ask themselves whether they’ve missed the boat or if Japan’s market has further to go.

“Like the US, which has been led by the ‘Magnificent Seven’, Japan has benefited from a narrow group of stocks performing well, dubbed the ‘Seven Samurai’. This includes some of Japan’s largest companies, including car maker Toyota and semiconductor companies such as Tokyo Electron,” she said.

“In some cases, their valuations have become stretched. But this doesn’t apply to the entire market. Small and medium-sized companies, on average, currently look better value. And, as a whole, Japan’s market still looks good value compared with other global markets and its own history.”

There could be more catalysts for future growth ahead. For example, Marshall highlighted the end of negative interest rates earlier in 2024 could be followed by another rate hike later in the year if inflation remains around 2% and wages continue rising.

“This could be good news for economic activity, partly because there’s a huge amount of savings in Japan, most of which hasn’t been earning anything in interest. Higher rates could change this, boosting spending and stimulating the economy,” she said.

“However, higher rates could mean that cash becomes more attractive relative to equities for local investors, as we have seen in the UK in recent years – it is a fine line that the central bank will have to navigate.”

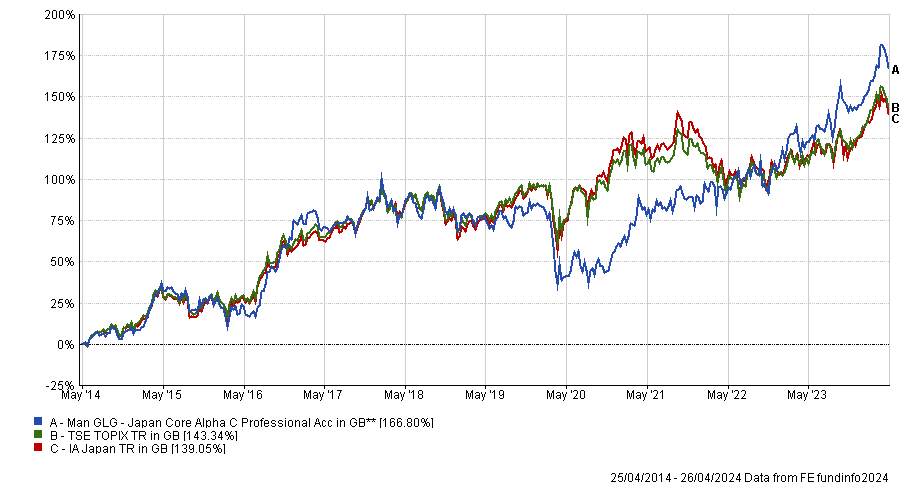

For those wishing to get in now, Marshall highlighted three potential fund options. The first is Man GLG Japan Core Alpha managed by Jeff Atherton and Adrian Edwards alongside recently appointed co-managers Emily Badger and Stephen Harget.

The £2.2bn fund focuses on larger Japanese companies, using a contrarian approach often known as 'value investing'. They buy out-of-favour companies and gradually sell them as they recover.

“The fund could work well in a global equity portfolio designed to provide long-term growth. Its focus on large companies means it could sit well alongside a Japanese equity fund focused on medium-sized or smaller companies,” she said.

The Man GLG fund has been a top-quartile performer in the IA Japan sector over one, three, five and 10 years and was the third best performer since April 2021.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

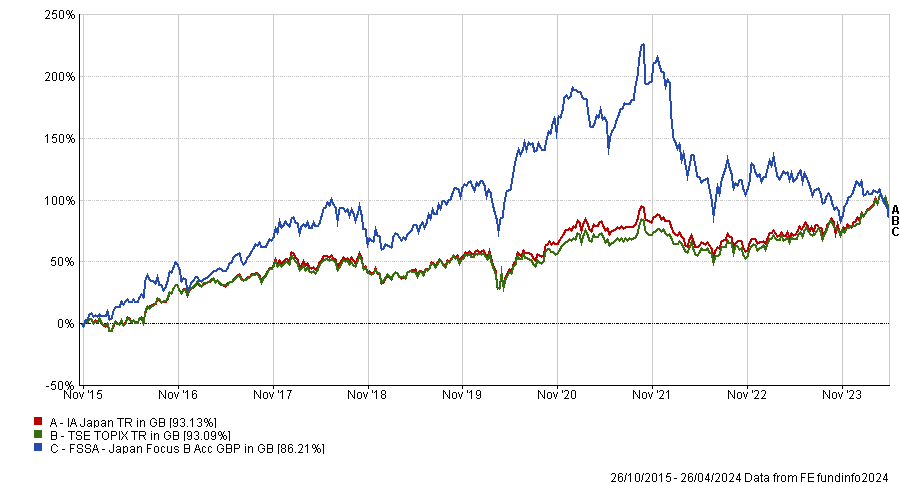

Second is FE fundinfo Alpha Manager Martin Lau and Sophia Li’s FSSA Japan Focus fund. At £81.6m it is much smaller than its Man GLG rival.

It invests with a quality-growth style across the large and mid-cap range of the market, as well as backing more domestically focused Japanese businesses.

“The fund could help diversify a global investment portfolio. Its focus on high-quality companies with the potential for above-average earnings growth means it could work well alongside other value-focused funds,” said Marshall.

It’s performance however has not been so sharp. Indeed it has been a bottom-quartile performer in the IA Japan sector over one, three and five years. Much of this has been over the short term, with the fund down 9.6% in just the past month.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Over three years it has lost 31.3%, although since launch in 2015 it has done slightly better, climbing to the third quartile of the sector. A year ago, the fund had been the fourth best performing fund in the sector – before its recent fall from grace.

Lastly, for those unwilling to take the risk with an active manager, iShares Japan Equity Index is Marshall’s preferred option for simply tracking the market.

“It provides low-cost exposure to large and medium-sized companies in Japan and aims to track its benchmark, the FTSE Japan, by investing in every company in the index,” she said.

“An index tracker fund is one of the simplest ways to invest. This fund could be a great, low-cost starting point to invest in Japan in a portfolio aiming for long-term growth.”

Alpha Managers Peter Rutter, Nico de Walden and James Clarke are setting up shop together, having generated top-quartile returns for RLAM.

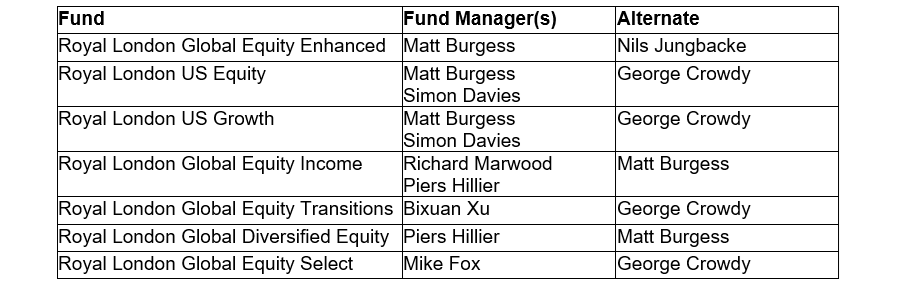

Peter Rutter, head of equities at Royal London Asset Management (RLAM) and an FE fundinfo Alpha Manager, is leaving to start his own business. Four RLAM equity fund managers are joining him: Alpha Managers Nico de Walden and James Clarke, along with Chris Parr and Will Kenney.

Piers Hillier, RLAM’s chief investment officer, will take over from Rutter at the helm of the global equity team. In this capacity, he will be supported by three senior colleagues: Matt Burgess, head of quant strategies; Richard Marwood, co-head of UK equities; and Mike Fox, head of sustainable.

Rutter, Clarke and Kenney manage the £4.9bn Royal London Global Equity Diversified fund and the £803m Royal London Global Equity Select fund. Both funds have generated top-quartile returns over one, three and five years. They have FE fundinfo Crown Ratings of four and five, respectively, in recognition of their high alpha, low volatility and consistently strong performance.

De Walden manages the £1.2bn Royal London Global Equity Income fund, which is a top-quartile performer over one and three years with a five-crown rating (the top score), while his £1.2bn UK Equity Income fund is top quartile over one, three and five years with a four-crown rating. He also runs the Royal London £1.3bn UK Dividend Growth fund, which is a top-quartile performer over one and five years but second quartile over three years.

Parr runs the £369m Royal London US Growth Trust, another fund that is top quartile over one, three and five years, as well as RLAM’s US equity strategy.

RLAM announced leadership changes to some of its funds as a result of the departures.

Hillier will take over the popular Global Equity Diversified fund from Rutter, Clarke and Kenney, with Burgess as his deputy. The Global Equity Select fund has been handed to Fox, with George Crowdy as back-up. A full list of manager changes is below.

Hans Georgeson, RLAM’s chief executive, said: “We remain committed to offering a first class equity capability and will continue to invest in the team. Piers brings huge experience to the leadership of our global equities capability, supported by an extremely talented team that also bring many years of expertise in equity markets.”

China, India, South Korea and Indonesia all received votes.

If you had to invest in just one country, which one would you pick and why?

Trustnet posed this question to the nominees for the FE fundinfo Alpha Manager awards in the emerging markets and Asia Pacific (ex-Japan) category. All four managers and teams who answered picked a different country but what they had in common was an emphasis on finding high quality but underappreciated companies.

Invesco’s Charles Bond: South Korea

“Given our contrarian and valuation-focused approach, we would choose South Korea as our favourite market,” said Charles Bond, who co-manages Invesco Global Emerging Markets. The fund has more than 15% in South Korea (a 4% overweight versus the benchmark).

“South Korean shares are some of the cheapest in the world, with both world leading businesses (e.g. Samsung and Hyundai) and domestic sectors (financials) trading at steep discounts to peers elsewhere in the world,” he explained.

“Many of our South Korean holdings trade on fractions of book value, often with underappreciated asset values (cash, land or stakes in affiliates) and dividend yields of 6%-plus. Dividend yields are compelling, not because pay outs are high but because valuations are low, with plenty of room for dividend growth if pay outs continue to rise, as they have been in recent years.

“Perceptions of lower corporate governance standards are the main reason for this extreme cheapness in our view. However, we believe minority shareholder rights have been improving over the last decade, with the government’s recently unveiled ‘Corporate Value-Up’ programme providing a significant stimulus for this trend.

“Emulating measures in Japan, the South Korean government is seeking to improve corporate returns on equity following the growth of domestic equity ownership, which should boost stock market valuations.”

GQG Partners: India

GQG Partners Emerging Markets Equity has a 30% allocation to India, held in 18 companies spread across eight sectors.

Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, who run the fund, have been overweight India for some time, reflecting their belief that many companies in India are exhibiting “a high potential for durable future earnings growth while trading at attractive valuations”.

“We believe India is in the early stages of credit, property and infrastructure cycles that will drive economic growth, improve the country’s competitiveness on the global stage and increase the earnings power of select companies,” they said.

Fidelity International’s Nitin Bajaj: Indonesia

Nitin Bajaj, who manages Fidelity Asian Smaller Companies and Fidelity Asian Values, said he does not pick countries and that regional allocations in his funds are just an outcome of stock selection. “My process is to construct a portfolio bottom-up, owning a bunch of good businesses, run by good (competent and honest) management teams at a good price that offers ample margin of safety,” he explained.

However, he is finding a lot of opportunities in Indonesia, where the stock market “provides the best mix of growth, quality and valuations” that are integral to his investment approach. “As a result, the fund’s exposure to Indonesia is at its highest over 10.5 years of my management tenure.”

Bajaj has invested in a “mix of banks and select consumer companies that offer fairly high and sustainable returns while being available at reasonable valuations”.

“Indonesia has some of the strongest banking franchises with conservative underwriting culture. They have stable asset quality and benefit from structural growth as penetration levels are increasing from low levels,” he explained.

“The consumer companies we own in Indonesia are also high-quality franchises with market leadership. This gives them strong pricing power and ability to generate margins that are higher than global peers over the long term.”

AllianceBernstein’s Sammy Suzuki: China

Sammy Suzuki, head of emerging market equities at AllianceBernstein, picked China.

“While we do not expect a quick recovery at a macro level, China is home to over 700 listed companies only counting those in the MSCI index. The question for us is whether we can find attractive companies. With significant pessimism, the market offers very attractive yet overlooked investments,” he explained.

The AB Emerging Markets Low Volatility Portfolio, which he manages, is modestly overweight China.

“The transition towards green energy perversely should be positive for energy and materials given restricted supply. This would benefit commodity exporting countries. At the moment, we believe that investing in those commodity-exporting countries offers better risk/reward than investing in commodity companies,” he said.

Suzuki has a positive outlook for emerging markets more broadly as the twin headwinds of rising global rates and a strong US dollar moderate.

“Many emerging market companies are capitalising on structural trends such as innovation in artificial intelligence (AI) and digitisation, deglobalization and reshoring, changing consumption behaviour and the energy transition – often at lower valuations than their developed market counterparts,” he pointed out.

“Broader emerging markets should also be supported by low inflation that could drive more supportive central bank actions, while Asian markets should benefit from a mix of domestic policies and broad AI tailwinds.

“In the long run, as the global economy continues to shift toward a knowledge-based economy, we believe that companies with intangible assets such as network effects, human capital, research and development, and brands will continue to perform well. The portfolio continues to have a strong emphasis on these types of companies – those that are resilient to fluctuations in the global economy but at the same time have robust business models that allow them to earn healthy profit margins.”

In addition to the managers above, Schroders’ Robin Parbrook is also nominated in the emerging markets and Asia Pacific category of FE fundinfo’s Alpha Manager awards. He runs Schroder Asian Discovery and Schroder Asian Total Return.

Alpha managers represent the top 10% of managers running funds available to UK retail and wholesale investors, based on their ability to consistently beat their benchmarks and deliver risk-adjusted alpha (using the Sortino ratio).

The five highest scoring managers in each asset class category were nominated for an award based on their investment performance throughout their careers. Winners will be chosen based on 2023 performance alone and will be announced the week commencing 13 May 2024.

Experts suggest funds to complement the Invesco EQQQ Nasdaq 100 UCITS ETF.

The Nasdaq 100 has been one of the best performing stock market indices worldwide over the past decade, as it benefited from the meteoric rise of US tech.

Therefore, Invesco EQQQ Nasdaq 100 UCITS ETF, which aims to replicate this particular index with the exclusion of its constituents from the financial sector, has been an exceptionally rewarding investment.

In fact, it is the fourth best-performing fund in the whole Investment Association universe over 10 years, just behind Fidelity Global Technology, L&G Global Technology Index Trust and SSGA SPDR MSCI World Technology UCITS ETF.

However, the fund remains inherently risky as it is extremely reliant on the fate of the US tech sector, with Costco being the only outlier in the top 10 holdings. Moreover, some individual names, such as Microsoft and Apple, have a heavy weight in the fund, as each account for 8-9% of the portfolio.

Although Nasdaq took action to address overconcentration risks last July with its ‘special rebalance’, the fund remains nonetheless a bet on US big tech.

Rob Morgan, chief investment analyst at Charles Stanley, said: “The exposure of the fund is concentrated towards the US tech mega caps and makes the fund a potentially volatile holding.

“When things are going well for this band of companies, as has been the case for the past year and a half, then it will reflect that. However, as 2022 illustrated, there can be large drawdowns. The fund fell around 24% in that calendar year.”

Due to the overreliance on the technology sector, high concentration in a handful of stocks and the lack of geographical diversification, investors in Invesco EQQQ Nasdaq 100 UCITS ETF may want to complement it with other funds offering something entirely different.

US value

Morgan suggested pairing the Invesco ETF with a value-focused fund such as Premier Miton US Opportunities, which takes a multi-cap approach and tends to be diversified across different sectors.

Performance of fund over 10yrs vs sector

Source: FE Analytics

“Being significantly different to the S&P 500 index and being more valuation-focused has meant the managers have had to paddle hard to deliver anywhere near market returns over the past 10 years, but going forward it could lend balance to any portfolio that may have become overweight in the big US names,” he said.

Another way to get exposure to US value stocks is to buy an S&P 500 ETF applying an equal-weight methodology. For that purpose, Alex Watts, investment data analyst at interactive investor, pointed to iShares S&P 500 Equal Weight UCITS ETF, which was launched in 2022.

He explained: “It attempts to invest the same in each of the S&P 500 constituents. This means that its price-to-earnings ratio is a bit lower than the broader S&P 500 market, at 21x compared with 26x, according to BlackRock.”

Since last Autumn, several wealth managers have moved away from market-cap weighted S&P 500 ETFs, preferring equally-weighted equivalents instead, due to concentration and valuation concerns.

Performance of fund since launch vs indices

Source: FE Analytics

Energy

Andy Merricks, portfolio manager at IDAD, noted there is “virtually no exposure” to energy in the Invesco EQQQ Nasdaq 100 UCITS ETF. As a result, investors may want to “cover their bases” against future energy price spikes as geopolitical risks emanating from the Middle East are escalating.

Therefore, he suggested pairing the tech-heavy ETF with iShares S&P 500 Energy Sector UCITS ETF.

Performance of fund over 5yrs vs sector

Source: FE Analytics

“Being US focussed, the iShares S&P 500 Energy Sector UCITS ETF is extremely concentrated as it does not hold the BPs, Shells and Totals that global energy funds hold. Therefore it fits geographically if that is how you allocate,” Merricks pointed out.

“Alternative energy sources were all the rage a couple of years ago and remain highly represented in the fund universe, but rightly or wrongly clean energy is finding widespread adoption more difficult to achieve than was first expected.”

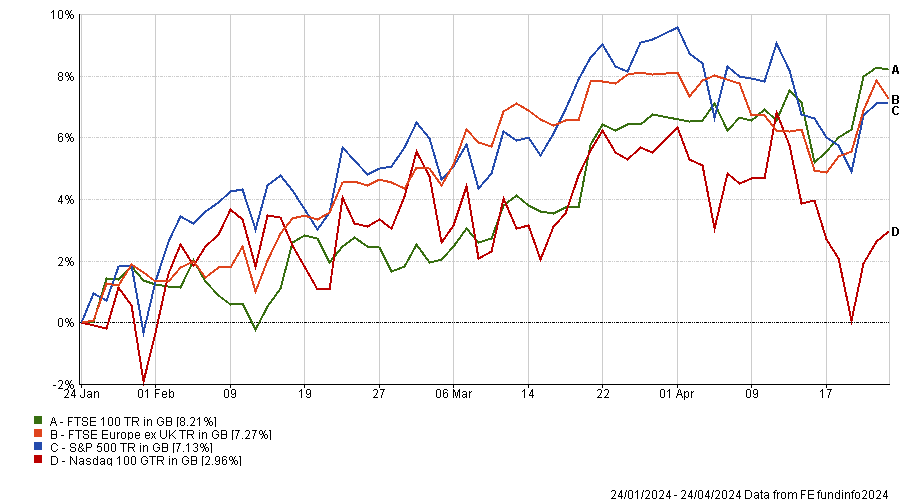

UK and Europe

Laith Khalaf, head of investment analysis at AJ Bell, suggested looking at regions that have less exposure to tech stocks, such as the UK and Europe.

He mentioned Lyxor Core UK Equity All Cap ETF and Vanguard FTSE Developed Europe ex UK ETF as potential candidates for investors interested in diversifying away from technology.

Performance of funds over 5yrs

Source: FE Analytics

As GDP has been weakening across the pond in recent times while inflation has been proving stickier, both UK and European indices are ahead of the Nasdaq 100 and the S&P 500 over three months.

Dan Coatsworth, investment analyst at AJ Bell, said: “A sluggish GDP figure mixed with a rise in inflation has created a toxic cocktail, causing investors’ jaws to crash wide open and their eyes to pop out of their heads. The message is as clear as one of the giant billboards over Times Square – Welcome to Stagflation. No investor wants this scenario. It’s the worst of all worlds.

“It means the UK and US stock markets are now almost on the same level in terms of performance so far this year. It’s been a while since that’s happened as investors were getting used to the UK permanently lagging the US.”

Performance of indices over 3 months

Source: FE Analytics

The manager of the Stonehage Fleming Global Best Ideas Equity fund explains why quality has a price and why he does not believe in value investing.

Everyone makes mistakes and has regrets, which is true of even the most seasoned investors such as FE fundinfo Alpha Manager Gerrit Smit. His greatest career regret is not having paid up for high quality businesses such as Apple, because he thought they were overvalued at the time.

From this experience, Smit has concluded that growth investors should be prepared to pay rich valuations at times to participate in some of the world’s most promising companies.

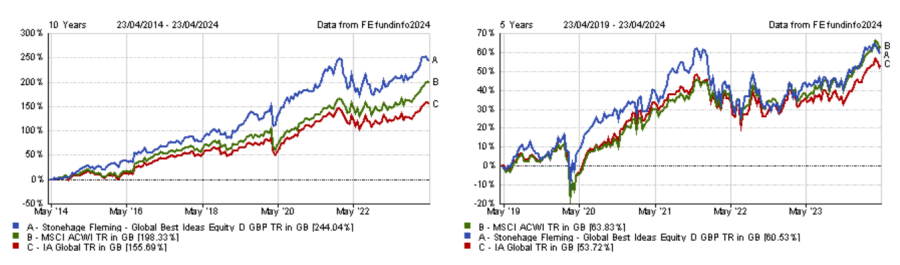

Smit has managed the Stonehage Fleming Global Best Ideas Equity fund since its inception in August 2013. The fund strongly outperformed the MSCI All Country World Index over the past decade but has delivered benchmark-level returns in more recent years. Overall however, the fund has comfortably beaten its sector and benchmark by buying quality companies and holding them over the long term.

Performance of fund over 10yrs and 5yrs vs sector and benchmark

Source: FE Analytics

Below, Smit dissects his performance and explains why investors have to accept that quality has a price.

Could you explain your investment strategy?

We aim to hold the world's best of breed, highest quality businesses. Each one has to have a strategic competitive edge. Lastly, they have to be attractively valued.

We emphasise having conviction in the quality of the management team. We spend a lot of time trying to understand the culture of a business and how management is orientating the business for sustainable growth over the long term.

In essence, we look to buy and hold the world's best businesses for an indefinite period.

That makes the fund a strong candidate for any investor looking for a conservative equity exposure that can be held continuously.

How important are top-down considerations in your investment process?

Our process is completely bottom up: we identify good companies that can keep growing. However, that growth depends on what happens in the world.

So it’s a combination of looking for the right company and understanding the macro-economic environment.

Along with that, we try to understand capital markets to identify when it would be a good time to buy a business and when not.

The fund has outperformed the MSCI World index over 10 years, but not over five. Why is that?

The fund is not always going to outperform. Over the past five years, the technology sector has done exceptionally well. We're not a technology fund, so we didn't keep up with that. However, when technology is underperforming for a certain period, the chances are that we will be outperforming.

However, an important point to make is that the fund has added value over the index after costs, with a level of risk below that of the market over the long term, because it is made of very high quality companies.

What have been the best and worst performing stocks in the portfolio over the past 12 months?

There are two ways of putting it: the stock that had the best performance and the stock that made the greatest contribution.

In terms of the best performance, it was Amazon, but in terms of contribution, it was Alphabet.

Alphabet and Amazon were the fund’s second and fourth largest holdings as at 31 March 2024, worth 7% and 5.5% of the portfolio, respectively. Alphabet rose 54% during the 12 months to 24 April 2024, while Amazon is up 72.2%.

The worst performer on both fronts has been Estee Lauder, which is down 40.4% over the past year.

Performance of stocks over 1yr

Source: FE Analytics

What is your outlook for the global equity market for the next five years?

Clearly, companies are sensitive to the economic and geopolitical circumstances, but I do believe that businesses make the economy rather than the economy making the business.

What’s more, this is the asset class that exposes you directly to the ability of humankind to create. There are not many other asset classes for which we could make that point.

Over the longer term, equities have delivered about an 8% per annum compounded return. I cannot find many reasons to believe that cannot continue to be the case, on the condition that you identify the winners. You cannot simply believe all equities will give you that type of return.

What are the greatest risks facing the equity market?

I perceive myself to be an optimist, but I do worry a lot, so I'm a very conservative optimist.

If I had to condense my concerns into a single issue, it would be the level of US inflation and the level of US interest rates. I emphasise the US, because capital markets anywhere in the world follow what happens in the US.

Also, one has to take geopolitical issues into account. One cannot ignore what's happening in the Middle East.

Along with geopolitical issues, there are developing sanctions in different sectors and industries and between certain countries.

As an investor, what are your biggest sources of pride and regret?

My biggest pride is that, despite being a conservative investor, the fund has been able to do better than the index. At times that has meant making difficult calls. For example, last year, the world thought Google was going to find it difficult to grow because of new competition from Open AI. We trusted the management and made the call to do nothing.

Most of my regrets involve not having been willing to pay up for some high quality businesses because I thought they were overvalued. From that, we've learnt that you cannot expect to get a good business at a low valuation. You have to be realistic and you have to be willing to pay for a good business.

For example, we missed Apple 10 years ago because we thought it was fully valued, but it has done well since. We still do not hold it. We have some reservations about the sustainability of the top line growth. It is probably one of the best managed businesses, but for four quarters in a row last year, the top line didn't grow. It's difficult for a management team to keep increasing the earnings if the top line doesn't grow.

Does that mean you don’t see any merit in value investing?

In a low growth economic environment, the typical value stock, let’s say tobacco, is not going to grow. It's trading at a low multiple and a higher dividend yield.

So the question may be: why not buying this tobacco stock for the dividend yield? We're not convinced that this dividend can grow forever and therefore inflation may erode the income that you think you're getting. That's the main issue.

If you buy something because it’s cheaply valued and, therefore, seems to be attractive, chances are that there's something wrong in the business.

What do you enjoy doing outside of fund management?

I'm fond of travelling and music and I read a lot. Very often, the three of those go together.

Earnings results: Alphabet and Microsoft shine through the macro uncertainty.

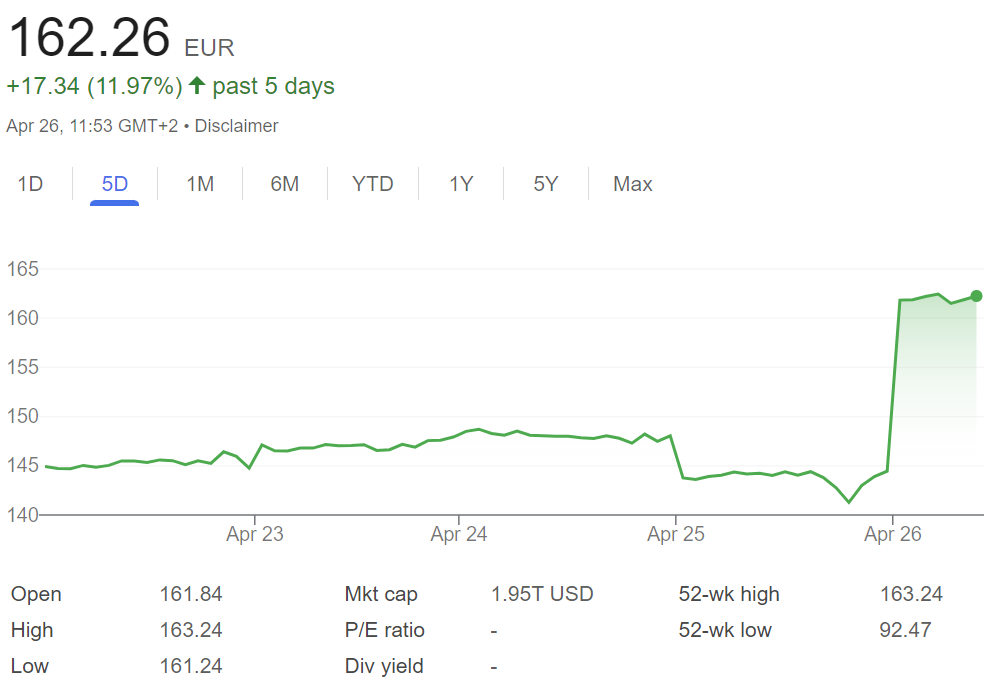

The share price of Google parent Alphabet jumped 10% in today’s pre-market trading, following the best set of overall results it has ever released and the announcement of a dividend program of $0.20 per share.

According to Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, this development “proves the company’s stature as one of the quality leaders in the global digital revolution”.

“With its advancements in generative artificial intelligence (AI) already showing improved engagement and advertising performance, the business is firing on all of its many cylinders, resulting in constant currency revenue growth of 16%. It is also pleasing to see the 28% revenue growth in Google Cloud with a multiple increase in profitability,” he said.

“Within a rapidly changing digital environment, it has been able to increase group profitability with a 4% increase in operating margin. Our long-held view that Alphabet can later become a dividend stock also got validated.”

Alphabet’s share price

Source: Google Finance

Microsoft also filed strong earnings and shot up 4% in after-hours trading, reliably delivering well on both organic growth and profitability, as Smit noted.

“The main features are its AI demand resulting in Azure Cloud growth of 28% and a further 2% basis points increase in profitability,” he said. “We perceive Microsoft as the staple of the digital world.”

The tech giants' surge injected a much-needed boost after Meta's cautious forecast failed to inspire confidence, SPI Asset Management’s Stephen Innes noted.

“Tension was taut following a rough day for Meta, which unnerved investors with its cost outlook and capex plan, both of which underscored just how expensive building the future is likely to be,” he said.

Another disappointment had come from the US GPD reading for the first quarter but despite prevailing macroeconomic unease, Alphabet and Microsoft's earnings reports shone through.

"Alphabet, for instance, experienced its most robust top-line growth in two years, announcing not only its inaugural dividend, but also a $70bn stock buyback,” said Innes.

“This news exceeded the expectations of even the most discerning ears.”

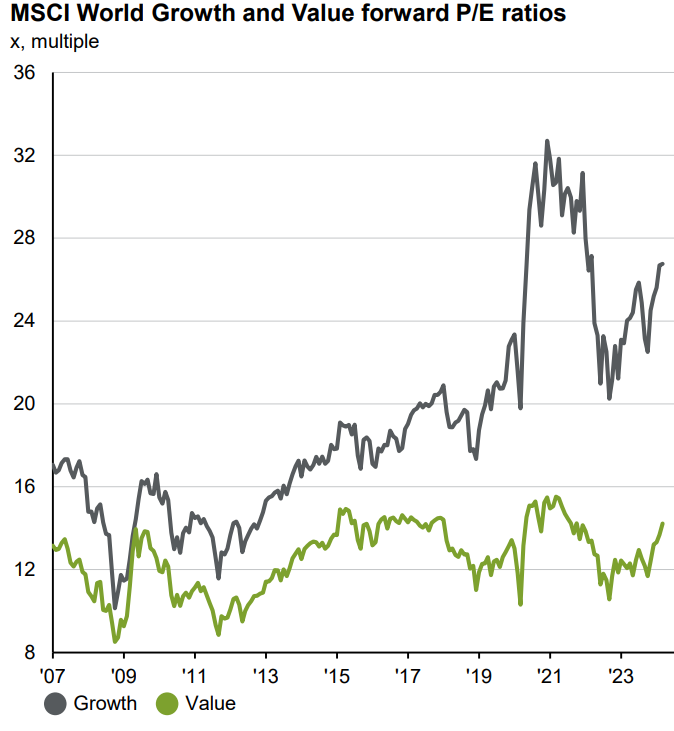

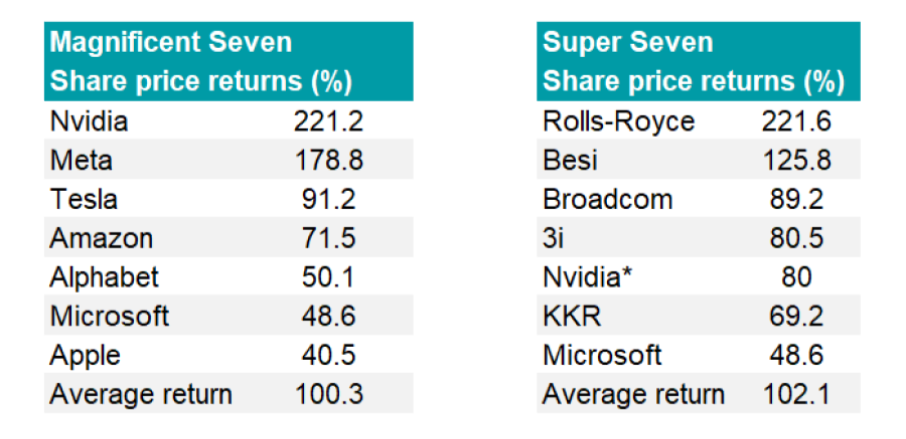

After a decade out in the cold, will value managers get their moment in the sun?

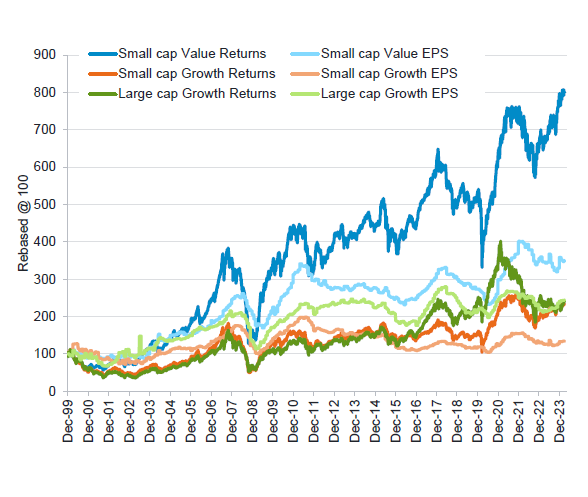

Value investing has outperformed growth over the very long term but has spent much of the past decade in the doldrums.

The difference between the valuations of growth and value stocks is more extreme now than at the height of the dot.com bubble, according to Simon Adler, who co-manages the Schroder Global Equity Income and Schroder Global Recovery funds.

Sources: JP Morgan Asset Management, LSEG Datastream and MSCI, data as of 24 Apr 2024

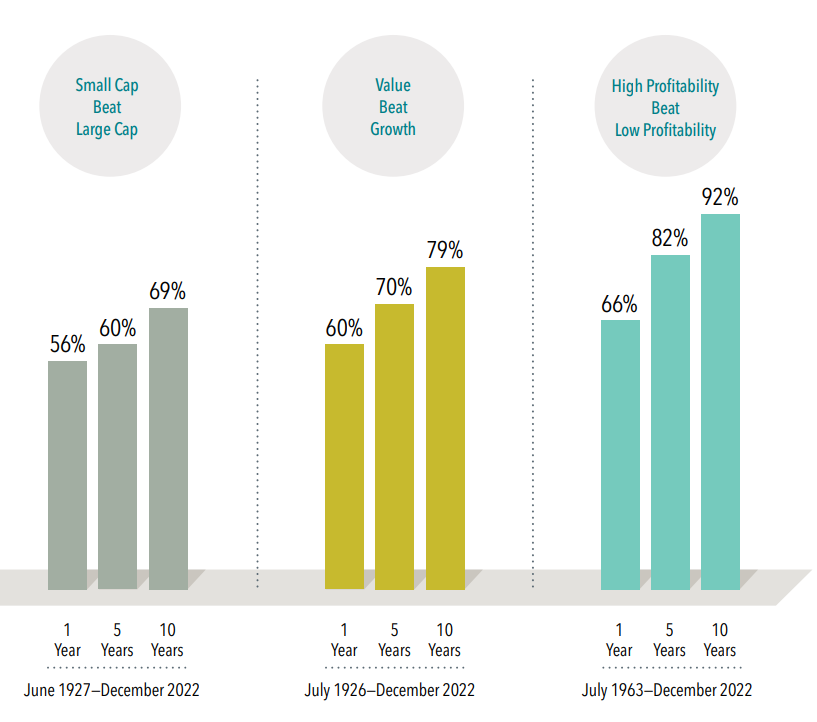

The undisputed fact that value stocks are deeply out of favour comes despite ample evidence that value beats growth over the very long term.

In fact, Dimensional Fund Advisors analysed a myriad of factors and styles going back decades and discovered that only three consistently work: value, the small-cap premium and high profitability stocks outperforming low profitability stocks.

Frequency of premium outperformance

Source: Dimensional Fund Advisors

That doesn’t mean value will beat growth every year or even every decade, as seen from the past 10 years.

Value vs growth over 10 years

Source: FE Analytics

The investment management industry – and human nature more generally – suffers from a recency bias. After watching growth stocks maintain the ascendancy for most of the past decade, it would take a brave investor to bet the farm on value. Not least because artificial intelligence (AI) and technological innovation, which favour growth stocks, are going nowhere.

This is true across most regions. FE fundinfo Alpha Manager Nitin Bajaj, who runs Fidelity Asian Smaller Companies and Fidelity Asian Values, said it has been a decade of “swimming against the tide” despite evidence that small-cap value stocks in Asia grow their earnings faster, as the chart below shows.

Asia ex-Japan: Earnings and returns by style

Sources: Fidelity International, LSEG DataStream, 19 Apr 2024

Nonetheless, fortunes have reversed, even in recent times. Growth sold off in 2022 as the rapid interest rate hiking cycle drove up borrowing costs and the tech sector endured a bear market. Value stocks proved more resilient through this torrid period for equities, highlighting the importance of style diversification, as the chart below shows. Value stocks also rallied sharply after ‘Vaccine Monday’ in October 2020.

Value vs growth over three years

Source: FE Analytics

Yet last year, AI advances put growth and tech firmly back on the agenda.

All this has left the prices of value-oriented stocks languishing in the doldrums. Adler argues that, from such a low starting point, there is plenty of upside potential on a five-year view and attractive valuations alone should justify the inclusion of a value fund in a well-diversified portfolio.

Adler believes it is futile to search for a catalyst that could trigger a value rally or to try timing the market because stock markets move so quickly that investors who wait on the sidelines are likely to miss the start of the next rally.

Other industry participants more inclined to look for catalysts claim that the current macroeconomic environment of high inflation, high rates and resilient growth should favour sectors typically considered the purview of value investors, such as financials.

Furthermore, the unloved UK stock market, whose sector composition (financials, energy and commodities) has more of a value bent to it than the tech-oriented US, seems to have finally turned a corner and hit record highs at the start of this week.

One benefit of all this for value managers – especially those focused on the still-cheap UK – is that they can snap up high-quality companies at egregiously low prices.

Jonathan Winton, co-portfolio manager of Fidelity UK Smaller Companies and Fidelity Special Situations, said: “As a value investor, you really do not have to sacrifice quality at the moment and that’s not something I think value investors have been able to say over the past few decades.”

The average company is his portfolio is trading at 9-10x earnings. “These are businesses that we think can grow and generate decent and improving returns,” he said. “And we're not having to take the balance sheet risk that you might have had to if you wanted to find things that were very cheap in the past.”

Ultimately, the take home for investors is to check the style biases of any equity funds they hold and ensure they have a balance of value managers – bargain hunters who invest in underappreciated stocks they hope will recover – and growth managers, who buy great companies they think will exceed expectations.

Of course, there are a multitude of styles falling in between those extremes (for instance GARP, which stands for growth at a reasonable price, in other words fund managers who want to own great companies but do not wish to pay too high a price for them).

But the message stays the same: combining managers with divergent styles puts investors in good stead to withstand unpredictable market movements and benefit from a mean reversion in style-based performance if and when it does eventually happen.

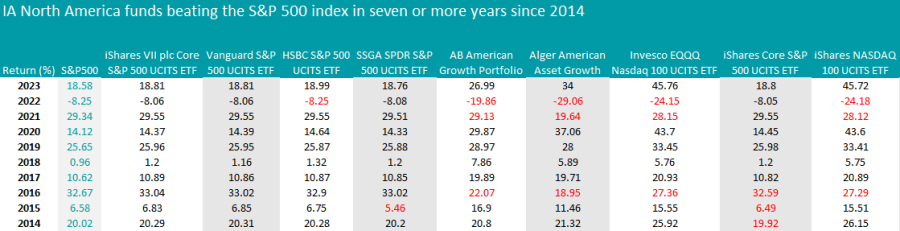

US equity ETFs have proved more reliable than active managers since 2014.

Investors who like steady strategies with predictable results should stick to exchange-traded funds (ETFs) when investing in US equities, data from FE Analytics shows.

Two trackers in particular – the iShares VII plc Core S&P 500 UCITS ETF and the Vanguard S&P 500 UCITS ETF – have outperformed the S&P 500 every year since 2014, something no other fund in the IA North America sector achieved

Being passive in nature, these ETFs are designed to replicate the S&P 500 so their tracking error is very small. However, their returns have been slightly better than the index every year and their fees are much lower than actively-managed funds.

This has been a decade in which the highly-concentrated S&P 500 – the most common benchmark in the IA North America sector – shot the lights out, making it a difficult hurdle for active managers to match. Large-caps have outperformed small- and mid-caps in recent years too, especially in 2023 when the ‘Magnificent Seven’ dominated – a factor that has gone against active mangers who tend to hunt for undiscovered opportunities lower down the cap spectrum.

Launched in 2010, the iShares portfolio is the bigger of the two passive giants, with £66bn of assets under management (AUM) compared to Vanguard’s £40bn.

The latter was recommended by FE Investments analysts for offering “great benefits” to end investors, including an ongoing charge of just 0.07%, made possible through Vanguard’s corporate structure and economies of scale, which facilitate heavy cost-cutting.

Both funds have a FE fundinfo passive Crown Rating of five – the highest score.

Source: Trustnet. The red highlights indicate underperformance against the specified benchmark.

Although the table above is full of passive strategies, AB American Growth Portfolio and Alger American Asset Growth are the exceptions and have outperformed in seven of the past 10 years.

The £5.7bn AB American Growth Portfolio is co-managed by Frank Caruso, John H. Fogarty and Vinay Thapar, who invest in 55 US large-cap companies and charge 0.94%.

The top 10 holdings make up 50% of the fund and include five of the Maginficent Seven stocks, leaving out Apple and Tesla. In the past 10 years, its performance has moved in tandem with the S&P 500 index 91% of the time.

Alger American Asset Growth is a much smaller vehicle (£307m) under the responsibility of Patrick Kelly, Ankur Crawford and Dan C. Chung.

Based in New York, the team focuses on companies with rapidly growing demand, strong business models and market dominance, or where the managers can find catalysts that could drive additional growth, such as new management, product innovation or M&A activity.

The fund charges a 1% management fee and was 90% correlated to the S&P 500 during the past 10 years.

Active managers achieved more success in the IA North American Smaller Companies sector, where CT American Smaller Companies and T. Rowe Price US Smaller Companies Equity beat the Russell 2000 index for eight of the past 10 years.

Run by veteran manager Nicolas Janvier, the £946m Columbia Threadneedle Investments (CTI) fund was recommended by FE Investment analysts for the lead manager’s experience, CTI’s extensive analytical resources in New York and Boston, and the focus on bottom-up stock picking.

Limits are placed on the fund’s sector and factor bets, which “allows for more consistent performance relative to the small and mid-cap market, regardless of the stylistic and macroeconomic environment”, FE analysts explained.

Since 2021, the strategy has decoupled from its benchmark, the Russell 2500, and its average peer, keeping well ahead since then. It achieved a 249% return over the past 10 years against a sector average of 184.4%.

Its largest exposures are to industrials (19.9%), consumer products (17.9%) and telecom, media and technology (16.3%).

Source: Trustnet. The red highlights indicate underperformance against the specified benchmark.

The strategy shares the podium with the much larger £2.8bn T. Rowe Price US Smaller Companies Equity fund managed by Curt Organt and Matt Mahon.

While they prefer a slightly different sector allocation, favouring services (20.5%), media and tech (17.5%) and basic materials (15.3%), the two funds are 93% correlated to each other.

Another difference is T. Rowe Price’s small off-benchmark bet on European equities (1.4%), absent in the CT American Smaller Companies fund.

This article concludes our series on consistency. In previous instalments, we covered: Asia, Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds, adventurous funds, technology, healthcare and financials.

The risk/reward balance is still in favour of holding TSMC.

Filtering out noise and disregarding short-term headlines are among the hardest challenges facing investors, but it’s where the noise is loudest that skilled fund managers see opportunities instead of pitfalls.

One example of a good investment case undermined by an unhelpful narrative is Taiwan Semiconductor Manufacturing Company (TSMC), according to Paul Flood, co-manager of the £2.2bn BNY Mellon Multi-Asset Growth portfolio.

Investing in China and Taiwan is perceived as particularly risky due to geopolitical tensions in the region, but at the beginning of this year, Flood went against the grain and added to TSMC exactly at peak noise, which he identified as a good entry point.

“During the Taiwanese elections [in January 2024], the narrative around China invading Taiwan led to an opportunity as the valuation came back by a long way,” he said.

“While we are paying 30 times earnings for high-growth US technology companies, we can pick TSMC up for low-to-mid-teens multiples and we’re buying a company that creates most semiconductors that we find in all our products.”

The fund’s weighting to the company went from 1.3% at the end of 2023 to 1.9% as at the end of February 2024, with the position then being worth £41.3m. Since the beginning of the year, the stock has grown 32%.

Performance of stock over the year to date

Source: Google Finance

From Flood’s risk/reward perspective, the scale is still tilted in favour of TSMC.

Approximately 90% of the world's high-end semiconductor content is made in Taiwan. If geopolitical events cut off access to Taiwan’s advanced chips, everything from electric vehicles (EVs) to hedge trimmers would be impacted, as the scarcity at the high-end of the market would trickle down through the whole supply chain, including to lower-quality chips.

“If China does invade Taiwan, TSMC is going to be the least of our problems, it will impact all other companies that we invest in on a global basis,” he said.

“If you can't get semiconductor content, how are you going to build things? Apple won’t be able to build mobile phones, Microsoft isn’t going to build out the cloud, and Volkswagen will stop making cars. Semiconductor content powers the world.”

Taiwan’s flagship also stands to benefit from competition between the great powers to ensure the security of semiconductor supply.

“TSMC has tax benefits and subsidies around the world as the US, Japan and Europe need to power everything from EVs but also the military side of things as well,” he noted.

Earlier this month, the US government announced a $6.6bn grant to help TSMC build three factories in Arizona.

Another area where Flood is poised to take advantage of market noise is the US, particularly around the upcoming elections and the future of the Inflation Reduction Act, with its subsidies for US industry.

“We've seen a lot of noise about reducing or getting rid of the Inflation Reduction Act and there's a lot of being said about the differences between Donald Trump and Joe Biden, but there are also a lot of similarities,” he said.

“For example, they are both big spenders, so we don't think that the outcome of the election will change the fiscal debate in the short term. The same capital and the same spending would just be allocated somewhere else. But Republican states are some of the biggest beneficiaries of the Inflation Reduction Act and we think it could be quite hard to unwind that.”

In the US, Flood is particularly bullish on home builders, with the market having “massively underestimated the changing business model” in the sector, as he recently told Trustnet.

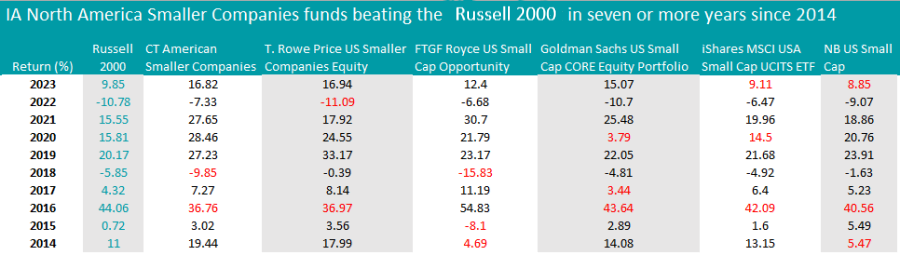

The ‘Super Seven’, a list of top-performing stocks from a range of industries, have more than kept pace with the ‘Magnificent Seven’ and provided a healthy element of diversification to boot.

On the face of it, events in 2023 seemed radically at odds with the notion that successful investing demands balance. Seven mega-cap technology stocks produced 60% of the S&P 500’s total return and accounted for almost a fifth of the MSCI World index in terms of size.

However, as recently as 2022, a different narrative dominated. Big tech giants such as Meta, Nvidia and Tesla experienced significant share price declines, highlighting the volatility that is typically inherent in concentrated investments.

This two-year contrast underscores the timeless adage: ‘Never put all your eggs in one basket’. Even today, with artificial intelligence cementing its status as a go-to theme, there is much to be said for diversification.

Particularly for global investors, who have the widest opportunity set to choose from, portfolio construction should still be a question of both quantity and quality. But amidst unprecedented market concentration, how do we get the balance right?

In search of a golden mean

The debate over diversification has raged for decades, with advocates on both ends of the spectrum.

On one side, we find proponents of the ‘all your eggs in one basket’ philosophy. This is currently en vogue in some circles, with advocates of the ‘Magnificent Seven’, or even a dynamic duo of only Microsoft and Nvidia, championing an unusually narrow focus.

At the other end would be a super-diversified portfolio of hundreds of stocks. Several studies have supported such an approach through the years, most notably in the early 2000s.

As with so many things in life, the ideal very likely lies somewhere between the two poles. It was originally outlined by ‘the father of value investing’, Benjamin Graham, in his two books, ‘Security Analysis’ and ‘The Intelligent Investor’, published in the 1930s and 1940s.

Graham advocated what is sometimes called 'concentrated diversification', which he described in The Intelligent Investor as “adequate, though not excessive”. This, he said, should translate into a portfolio of up to 30 holdings.

This argument is still relevant today. Too little diversification can invite unpleasant surprises, whereas too much can take investors into index fund territory, where the concept of beating the market surrenders to the concept of being the market.

Yet numerical balance is only half the story. Diversification within those holdings is just as crucial.

Casting a wide net

Graham’s stock-picking process was rooted in his defensive tests. He looked for companies characterised by adequate size, financial strength, earnings stability and growth, an established dividends record and moderate price-to-earnings and price-to-assets ratios.

Crucially, the ability to withstand rigorous scrutiny extends beyond the realm of big tech or even the technology sector as a whole. A company does not need to boast a trillion-dollar market capitalisation to be a solid investment.

Consider Tractor Supply Company: founded in 1938, it is a US retail chain specialising in agriculture, gardening and home improvement products, boasting a market capitalisation of around $25bn.

Or take Azelis: established in 2001 and based in Belgium, it has a market cap of around $4.6bn. It provides innovation services in the specialty chemicals and food ingredients industry.

We initiated or strengthened positions in both these holdings in late 2023. Why? Ultimately, we search for good businesses capable of contributing to a portfolio that is not reliant on any given theme, factor or macroenvironment.

In essence, balance in this context comes from giving due thought to different sectors, geographies, market caps and other considerations.

The proof is in the pudding

Of course, the argument for balance would seem lacking if a select group of theme-centric stocks were to constantly outperform. However, the events of 2022 dispelled that notion.

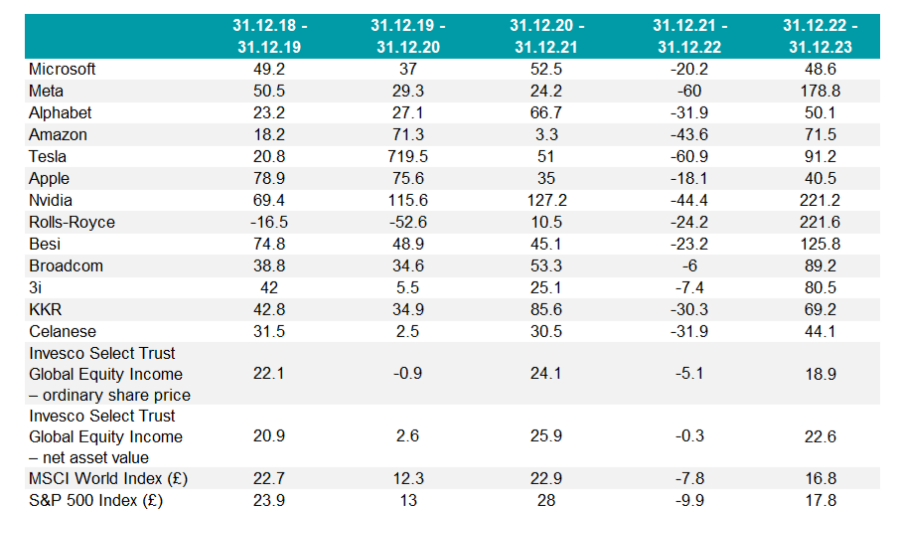

Perhaps it’s time for reflection. Collectively, the seven best-performing holdings in the Invesco Select Trust plc Global Equity Income share portfolio in 2023 – our very own ‘Super Seven’ – more than kept pace with the Magnificent Seven in terms of total shareholder return, as the tables below shows.

Naturally, big tech was represented in our line-up. Yet it was just one element among a much broader – and, in our opinion, much healthier – mix of industries, regions, capitalisations and investment styles.

Magnificent Seven versus Super Seven in 2023

Source: Bloomberg, data to 31 Dec 2023 in sterling terms

Source: Bloomberg, data to 31 Dec 2023 in sterling terms

* Nvidia was held in the portfolio from the summer of 2022 to April 2023

Magnificent Seven versus Super Seven – rolling 12-month performance

Source: Bloomberg, data to 31 Dec 2023

Source: Bloomberg, data to 31 Dec 2023

Stephen Anness is lead manager of the Invesco Select Trust plc Global Equity Income share portfolio. The views expressed above should not be taken as investment advice.

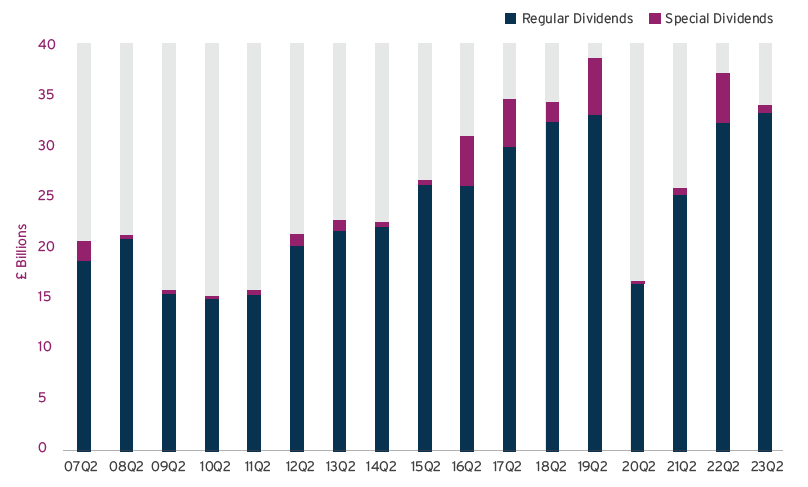

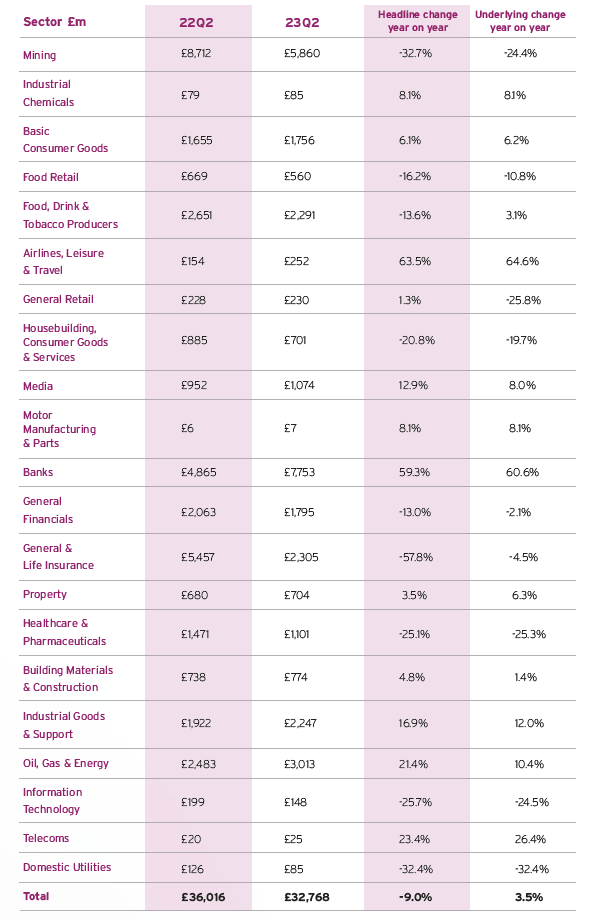

One-off payments will drive dividends in 2024, according to Computershare’s latest Dividend Monitor.

UK dividends increased 4.9% to £15.6bn in the first quarter of 2024, the latest Computershare Dividend Monitor report revealed.

However, most of this growth was driven by one-off payments. Underlying dividend growth remained steady at 2% – a “healthy but unexciting” trend, which will continue for most sectors throughout the year, reflecting a sluggish global economy, Computershare said.

With prospective yields on UK equities stuck at 4%, income-seeking investors may gravitate towards higher-yielding bonds and cash, said David Smith, manager of the Henderson High Income Trust.

“The UK equity market is attractively valued but cash and bonds are now greater competition for investors’ capital. The advantage that equities provide is inflation protection through dividend growth, but that is likely to be relatively low this year,” he said.

But there is light at the end of the tunnel for equity income investors. Things are expected to improve throughout the second half of this year as cost pressures ease, interest rates are cut and economies start to recover, driven by real wage growth and a more buoyant consumer.

Computershare experts upgraded their headline forecast from £93.9bn to £94.5bn in total payouts for 2024 – a 4.3% year-on-year increase against the previous forecast of 3.7%.

Most of this will be driven again by special dividends, which Computershare expects will be significantly larger than in 2023. Regular dividends are expected to be worth £89.5bn, up 1.5% year-on-year on a constant-currency basis.

UK dividends 2023

Source: Computershare Dividend Monitor

Mark Cleland, chief executive of issuer services for the UK, Channel Islands, Ireland and Africa at Computershare, said: “This modest growth in dividends reflects the earnings picture: cost pressures have eased for many businesses, but the cost of capital has risen sharply, and economic growth is sluggish at best in the UK and in much of the world. This makes it difficult for companies to build earnings momentum, which influences how much boards decide to return to shareholders in the form of buybacks or dividends.”

In the first quarter of this year, oil and pharmaceutical companies were among the highest payers, but the strong pound was a hindrance and, in the case of Shell and BP, offset the per-share dividend increases declared by the companies.

For the full year, oil dividends are likely to be roughly flat to slightly ahead, the report read.

“A more modest 2024 for the oil sector removes a significant engine of dividend growth from the UK market this year, after it made a major contribution during its recovery from the cuts made early in the pandemic. However, surplus capital will likely continue to be returned through share buybacks.”

Sterling strength also brought the value of pharmaceutical dividends down 2.9% in the first quarter as AstraZeneca held its payout flat in dollar terms.

Telecoms were also major contributors, but the largest payers, Vodafone and BT, didn’t increase their dividends.

Dividends by sector £m – Q1

Source: Computershare Dividend Monitor

Banks are likely to make the largest contribution to dividend growth in the UK for the third year running, Computershare experts noted.

Virgin Money was the only bank to make a payment during the first quarter, although its payout was reduced due to the impact of rising credit impairments on profits.

Nonetheless, Smith remained positive towards the banking sector. “Having been forced to stop dividend payments during the pandemic, it’s good that banks’ dividends have been restored and grown back to pre-pandemic levels. We expect further dividend growth this year given the rise in profits from higher interest rates have yet to fully flow through to earnings,” he said.

“Despite banking dividends now being better covered by earnings and strong capital positions in the sector, dividends yields are high, offering income investors an attractive opportunity. We believe those dividends should be sustainable, absent a severe recession in the UK.”

Banks have been buying back their own shares extensively, a practice that can have a negative impact on dividend payouts in the short term but should bring long-term benefits, according to James Lowen, senior fund manager of the J O Hambro UK Equity Income fund.

“Over the long term, the anticipated effect is to amplify dividend growth, as there will be fewer shares in issue for a set amount of dividend to be spread across. This is a powerful second derivative effect of buybacks for long-term dividend growth, which we see in numerous stocks.

“Fund dividend forecasts incorporate a shift towards lower dividends and increased buybacks from 2024, signifying a short-term dip but projecting higher returns in the medium term.”

The Rathbone Greenbank Multi-Asset Portfolios avoid companies or issuers that harm people or the planet and proactively invest in companies that do good.

The US government’s high defence budget has caused it to fall foul of Greenbank’s sustainability screens, while only two of the ‘Magnificent Seven’ technology stocks – Microsoft and NVIDIA – made it through the firm’s stringent negative and positive screening process.

Microsoft has a strong sustainability story, with a target to be carbon negative by 2030, said Will McIntosh-Whyte, who manages the Rathbone Greenbank Multi-Asset Portfolios. Furthermore, it plans to remove enough carbon by 2050 to account for its historic emissions.

“It is meeting increased demand for IT infrastructure with more environmentally friendly and energy efficient solutions and it is quite innovative, so it has been trialling having one of its data centres underwater to help with cooling. And it is very good in terms of benefits and employee development programmes,” he said.

When the Rathbone Greenbank Multi-Asset Portfolios were launched in March 2021, NVIDIA was not eligible for inclusion because it derived a large part of its revenues from cryptocurrency mining and gaming.

NVIDIA’s business model has changed since then and it now focusses on advanced chip design, which aligns more naturally with two of Rathbone Greenbank’s eight sustainable investment themes: innovation and infrastructure, and decent work.

If McIntosh-Whyte and co-manager David Coombs want to invest directly in a stock, they have to recommend it to their colleagues at Greenbank (the ethical, sustainable and impact investment team of Rathbones Group) for further analysis and screening. McIntosh-Whyte put Alphabet forward but it failed Greenbank’s tests.

Alphabet has historically had issues with sexual harassment, allegations of discrimination and other employment issues, he explained. In particular, there was severe controversy over allegations of hiring discrimination concerning software engineers in California and Washington. Rathbones also has concerns about digital rights and the responsible management of content.

Alphabet was reluctant to engage with Rathbones when approached to discuss its concerns, which was a red flag.

Rathbones’ core multi-asset funds invest in Amazon and Apple but McIntosh-Whyte decided against including them in the sustainable range because they have not always been at the forefront of positive employee relations.

With Meta, he said it would be difficult to argue how Facebook’s parent company could align to Greenbank’s sustainable investment themes or to the UN Sustainable Development Goals.

“Tesla is slightly different because obviously, from a product perspective, you can see how it might align with sustainability given it is very focused on electric vehicles,” he noted. “We’ve actually always been a bit wary of Tesla from a governance perspective and also from a business model perspective. It’s just not one that we particularly want to own.”

The firm also shies away from US Treasuries. Instead, he has bought dollar-denominated debt issued by supranational institutions such as the European Investment Bank, which behaves in a similar way to US Treasuries. Dollar-denominated 10-year supranational bonds are paying yields north of 4.5%, he said.

Governments must pass three out of four metrics to enable Rathbones’ sustainable funds to buy their bonds: corruption, civil and political liberties, environmental performance and defence spending. The three-year global average defence spend is 2% of GDP, so countries spending more than that are ruled out.

Not only is the US defence budget too high but it also scores poorly on environmental metrics, although its green credentials are improving under the current administration, he added.

The UK passed these tests with flying colours and scored well on the environment as it pushes for a net-zero economy.

Experts compare and contrast the strategies of Smithson and Edinburgh Worldwide and reveal their preferences.

Fundsmith Equity and Scottish Mortgage rank high on investors’ buy lists due to their impressive performance over the past decade.

As a result, fans of the two global large-cap portfolios might also be interested in their small-cap siblings, Smithson and Edinburgh Worldwide.

In theory, small-caps should outperform larger businesses over the long term, although that hasn’t worked out in practice over the past 10 years.

Jason Hollands, managing director at Bestinvest, said: “The past few years have been relatively tough for smaller companies given the disruption of the pandemic, which has been followed by the headwinds of rampant inflation and rising borrowing costs. Small-caps have also been overshadowed by the dominance of US mega-cap growth stocks.”

Performance of indices over 10yrs

Source: FE Analytics

However, with inflation and interest rates past their peaks, now could be a good time to reconsider small-caps. A lower rate environment should boost investors’ appetite for riskier assets, reduce borrowing costs and improve access to capital, all of which bode well for smaller companies.

Below, experts compare Smithson and Edinburgh Worldwide, explain which one they would choose and look at other options in the IT Global Smaller Companies sector.

Two different investment philosophies

Although both Smithson and Edinburgh Worldwide belong to the same sector and share a bias to growth stocks, their investment strategies have little in common.

Smithson follows a quality growth strategy, underpinned by Fundsmith’s mantra: “Buy good companies, don’t overpay, do nothing”.

Key characteristics that the trust’s managers Simon Barnard and Will Morgan look for are high returns on invested capital, high cash conversion and healthy profit margins.

By comparison, Edinburgh Worldwide has a greater focus on earlier stage, faster growth companies and holds a significant proportion in private companies, whereas Smithson has none.

In summary, Smithson favours sustainable growth, whereas Edinburgh Worldwide is more of a high risk, high reward strategy.

Smithson is not a pure small-cap strategy as it includes mid-cap stocks, whereas Edinburgh Worldwide typically holds companies with a market capitalisation of less than $5bn when the investment is made.

Matthew Read, senior analyst at QuotedData, noted that Edinburgh Worldwide is the “most small-cap focused by some margin” in the IT Global Smaller Companies sector, whereas Smithson stands at the opposite end of the spectrum, with the strongest bias to mid-caps.

Another reason why Smithson hunts for opportunities higher up in the market cap spectrum is due to its larger size. Despite being the youngest of the two investment trusts, it has a market value of £2.1bn, while Edinburgh Worldwide has £528m.

“Smithson had a very successful IPO and, through a combination of decent performance and further issuance, it is now the largest fund in the IT Global Smaller Companies sector by some margin,” Read observed.

“Although its closed-end structure allows it to hold the same kind of stocks as Edinburgh Worldwide, for these to make a meaningful impact, Smithson needs to hold much bigger positions and it is easier when trading in less liquid stocks to move the market against yourself.

“It therefore makes sense that Smithson holds larger stocks, but it may miss out on some opportunities as a result.”

Read also noted that Smithson is the most expensive of the two funds, in spite of its larger size, which should be conducive to economies of scale. As of 23 April 2024, Smithson had an ongoing charge figure of 0.9% versus 0.7% for Edinburgh Worldwide.

Another difference is that the small-cap declination of Fundsmith Equity is not geared, whereas Edinburgh Worldwide has a net gearing of 14.8%. This may explain why the Baillie Gifford trust has been more volatile over the past five years.

In terms of performance, both have lagged the MSCI World SMID Cap index over the same period, but while Smithson is still in positive territory from an absolute return perspective, Edinburgh Worldwide is down 26.5%.

Performance of investment trusts over 5yrs vs sector and benchmark

Source: FE Analytics

Which one should you pick?

Due to their distinctly different philosophies, each trust will cater to the needs of different investors.

Hollands said: “Edinburgh Worldwide is more of a ‘punt’ with potential significant upside if the likes of SpaceX IPO at some point, whereas Smithson offers access to a portfolio of high-quality companies that can compound returns over time and would therefore be a more core play in the global small and mid-cap space.

“Which one to invest in therefore depends what type of investor you are, but for me it would be Smithson of the two.”

James Yardley, senior research analyst at Chelsea Financial Services, also prefers Smithson, which his firm uses in the VT Chelsea Managed Aggressive Growth and VT Chelsea Managed Balanced Growth funds.

“Smithson has much better diversification across different sectors and has still delivered a good share price return of over 40% since its IPO, despite a severe headwind to its style in recent years,” Yardley said.

“The trust has had a tough time recently but we think the shares offer very good value at a 10% discount. We believe Simon Barnard and Will Morgan are strong managers and have a good process.”

While he deems Edinburgh Worldwide to be an “interesting” trust, he stressed that it comes with a high degree of risk, with severe drawdowns when things don’t play in its favour. Furthermore, it is heavily exposed to healthcare, biotech and software.

However, QuotedData’s Read prefers Edinburgh Worldwide as he believes it has greater long-term potential due to its exposure to artificial intelligence (AI).

“The market embraced the potential of generative AI last year and this has continued year-to-date and looks like it could be a structural trend for some time,” he noted.

“Edinburgh Worldwide has a significant focus on areas such as technology and healthcare and should be well positioned to benefit as the market’s focus widens beyond the initial large-cap beneficiaries. Smithson should benefit as well but perhaps to a lesser extent.”

Another option for small-cap exposure

Read proposed The Global Smaller Companies Trust as a more neutral option for conservative investors.

The small-cap version of F&C Investment Trust, it does not have any particular investment style or sector bias. It has a broader portfolio and a modest level of gearing, which has historically ensured more stable returns, while offering a small yield of 1.6%.

Read concluded: “The Global Smaller Companies Trust is arguably the safe bet within the global smaller companies space (it has one of the lowest NAV volatilities) but seems less well exposed to the technology-related trends that look like they might be driving markets for some time.”

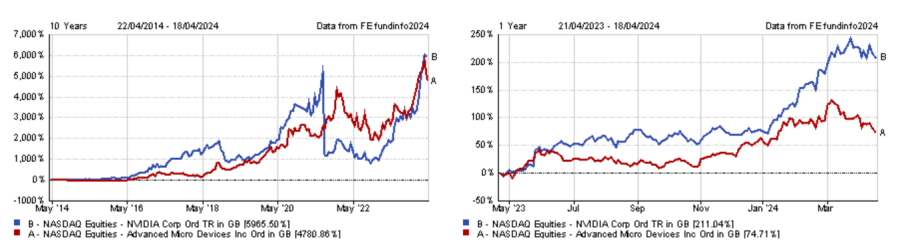

Experts ponder whether AMD could dethrone its larger rival.

Nvidia has been the poster child of the artificial intelligence frenzy, spearheading the accompanying stock market rally.

The stock fell back last week, however, along with the rest of the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Tesla).

But does this sudden change in fortunes mark a turning point for the graphics processing units (GPU) market leader?

The company is due to reveal its cards on 22 May when it will publish its results for the first quarter of 2024-25. Depending on the figures, this may or may not reassure the market that Nvidia can live up to the high expectations surrounding it.

Over the long term, possible threats to the company’s hegemony might include the emergence of a competitor in the GPU market, such as Advanced Micro Devices (AMD).

Zehrid Osmani, head of the Global Long-Term Unconstrained team at Martin Currie, said: “AMD is seen as an alternative company to Nvidia in the GPU segment and could potentially expand its market share from currently c.5% in data centres to 20% over the longer term.”

So should investors consider taking profits from Nvidia and investing in AMD?

Not so fast, said Chris Ford, co-manager of the Sanlam Global Artificial Intelligence fund. While AMD may well gain market share, it remains a “distant second player” to Nvidia, he said.

One of AMD’s issues is that it is spread thinly across both the GPU and central processing units (CPU) markets, where it trails behind Nvidia and Intel, respectively.

AMD is smaller than Nvidia, which means its research and development capacities are more limited, he continued. AMD is also constrained by the necessity to compete with Intel in the CPU space.

These dynamics have “led to a persistent capability for Nvidia to deliver significantly superior operational performance from their chips compared to AMD”, Ford concluded.

Dom Rizzo, portfolio Manager of the T. Rowe Price Global Technology Equity fund, added that chips from Nvidia and AMD are not interchangeable without “a noticeable degradation in performance”.

AMD is still the new kid in town, yet to gain recognition, he continued. “AMD’s product offering is relatively new to the market, so it has to go through testing. It is at a different stage in terms of adoption and acceptance, so it is difficult to make a direct comparison between the two.”

Nvidia has built a software and services ecosystem on top of its chips, which is something AMD lacks, as it has been focusing on a wider range of products.

Performance of stocks over 10yrs and 1yr

Source: FE Analytics

For Allan Clarke, investment manager at Aegon Asset Management, the GPU market bears resemblance to the smartphone market in the late 2000s with Apple and Samsung.

While Apple built an entire software ecosystem attached to the iPhone, Samsung didn’t and ran Google’s Android on its phones.

Clarke said: “That made a huge difference to the way the two companies were able to monetise the mobile market: shareholders in Samsung would have done fine since the start of the smartphone era, whereas shareholders in Apple have done very nicely indeed. Apple managed to extract something like 80% of the value of the mobile-era of computing, with other players fighting over the remaining 20%.

“Nvidia will be looking to achieve something similar from this next era of computing. If it achieves that (and it currently is), then AMD will be among a number of players fighting for the remaining 20%.”

In spite of this, Rizzo believes the GPU segment is growing fast enough to accommodate both companies and that capturing 10% of the market share would be enough for AMD to thrive.

“AMD has forecast the market to grow from $45bn to $400bn between now and 2027. If AMD were to secure 10% of the market in 2027 that is still significant room for them to grow,” he said.

Furthermore, once generative AI moves from training large language models – which requires fast computing power, and therefore heavy use of GPUs – the application of these models (inference) will depend less on fast-compute. This could lead to more extensive use of CPUs, which would play to AMD’s strengths, Osmani explained.

However, he disputed this thesis. “We believe that inference is also very data intensive and therefore will still require fast computing power and fast processing microchips. Therefore, the market might come to realise that the significant need for GPUs is sustained for longer than expected, which would favour Nvidia,” he explained.

While Nvidia has no obvious competitors apart from AMD in the GPU market, it could face external threats, such as from application-specific integrated circuit (ASIC) manufacturers.

Ford said: “They’re designed to address a very particular computational problem and deliver a silicone solution that addresses it.