Experts explain how the lack of enthusiasm of UK equities is indirectly affecting investment trusts.

UK equities have been notoriously out of favour with both domestic and international investors for several years. Although the FTSE 100 has rallied in recent times, it is difficult to tell whether the tide is finally turning.

All we know for now is that investors have been consistently withdrawing money out of UK equities, with £8bn of outflows in 2023 alone.

Given that investment trusts are listed on the London Stock Exchange, investors might wonder whether – and if so, how – it impacts their holdings.

For Anthony Leatham, investment companies research analyst at Peel Hunt, the lack of popularity for UK equities particularly affects the 92 investment trusts that make up part of the FTSE 250, the UK mid-cap index.

He explained: “They can be affected by flows into passive vehicles such as trackers and ETFs, which are often more pronounced during volatile periods, when the index swings sharply in one direction and can sweep all stocks along with it.”

UK small- and mid-caps have been more affected by the exodus out of UK equities than their large-cap peers, which has caused some to worry that the asset class may be incrementally disappearing.

Leatham believes, nonetheless, that the share price of investment trusts should reflect the performance of their holdings in calmer market conditions, regardless of the underlying asset class.

However, Emma Bird, head of investment trusts research at Winterflood, warned that the decrease in global asset allocation towards UK index tracker funds will continue to act as a headwind for investment trusts, which together account for roughly 8% of the FTSE All Share.

Investment trusts have a different natural investor base compared to ‘normal’ UK equities, predominantly composed of domestic retail investors. This nuance means that they have not been as adversely affected by the shift away from the domestic market by UK pension schemes and the lack of interest in UK equities among foreign investors.

James Carthew, head of investment companies at QuotedData, said: “What we don’t have is a general problem of UK investors wanting to asset allocate away from the UK, because the investment companies market is set up to allow them to do that.

“Neither are we suffering from overseas investors shunning the UK, as they were never buyers of investment companies in the first place. One of the great failures of our EU membership is that there was never a proper single market for investment – so Brexit made no real difference to the investor base for investment companies.”

Yet, Bird stressed that UK-focused investment trusts, which account for nearly 10% of the investment trust sector’s net assets, will be more impacted by the unloved nature of UK equities.

Carthew also pointed to an issue specific to investment trusts and unrelated to their listing location, namely the competition of ETFs, open-ended funds and large partnership structures.

While discounts should, in theory, incentivise investors to favour investment trusts over other pooled investment vehicles, this is not what is happening in practice.

Carthew said: “We can only speculate as to why, but we feel that it is a lack of awareness of the opportunity amongst retail investors, the cost disclosure issue amongst professional investors (which we are hoping that the government/FCA will address) and the consolidation of wealth managers.”

The later factor means that most investment trusts have become too small and not liquid enough for wealth managers.

For instance, investment management firm Quilter Cheviot recently revealed having a preference for investment trusts with at least £250m of assets under management and considering anything below £200m as sub-scale.

According to data from Peel Hunt, it means that 120 out of approximately 300 investment trusts are technically uninvestable for Quilter Cheviot.

Carthew added: “Some investment trusts have tried to address this through mergers but we feel it is likely to be insurmountable, unless the clients of those wealth managers feel that they are missing out on opportunities and take their business elsewhere.”

Bird concluded that it is still unclear what the catalyst for a re-rating will be, but she expects M&A activities, interest from private equity firms and regulatory development incentivising increased investment into the UK stock market to play a positive role.

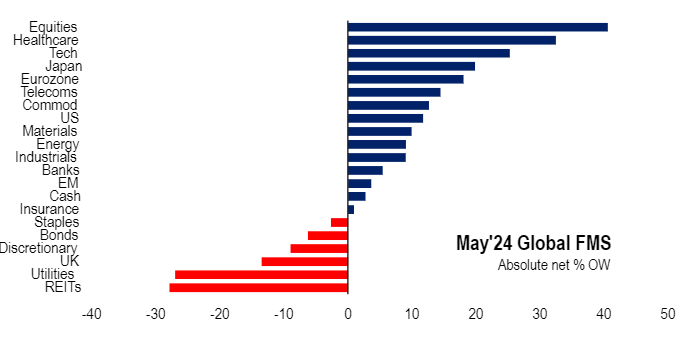

Managers are overweight equities, technology, US large-cap growth, Europe and commodities, but underweight real estate, the UK and China.

Fund managers are at their most bullish since November 2021 in anticipation of imminent rate cuts. Equity allocations have hit their highest levels since January 2022 while cash allocations at 4% are down to a three-year low, the latest Bank of America Global Fund Manager Survey found.

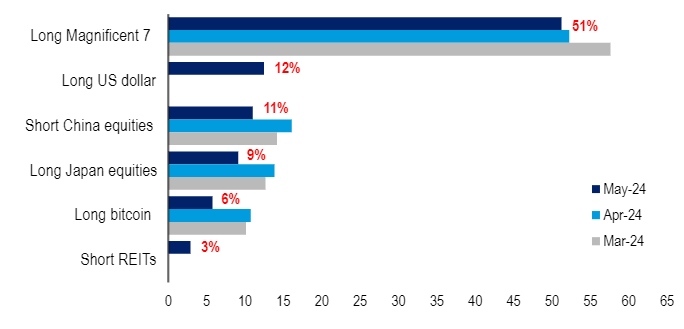

The most crowded trade by far is going long the Magnificent Seven (cited by 51% of respondents). Fund managers are overweight US large-cap growth stocks and technology in general, with 38% of respondents saying they expect large-cap growth to continue leading the US bull market.

Fund managers’ views of the most crowded trades

Source: BofA Fund Manager Survey

A minority (16%) expect US equity market leadership to rotate towards large-cap value, while 14% are banking on small-cap value and 13% favour small-cap growth stocks.

Fund managers have also gone overweight European equities.

Looking at sectors, fund managers are overweight healthcare as well as technology, while May saw a modest rotation into staples from industrials.

Managers are overweight equities, healthcare and tech

Source: BofA Fund Manager Survey

Net percentage of fund managers who are overweight equities

Source: BofA Fund Manager Survey

On the other side of the table, allocations to real estate are at their lowest since June 2009.

Managers are also underweight utilities, Chinese and UK equities, and bonds. Almost half (47%) of global fund managers expect bond yields to fall due to interest rate cuts.

The vast majority (82%) of fund managers polled expect the US Federal Reserve to cut rates in the second half of this year, while 78% are anticipating two or more cuts during the next 12 months.

Soft landing remains the consensus forecast (56%), while almost a third (31%) predict no landing and just 11% anticipate a hard landing.

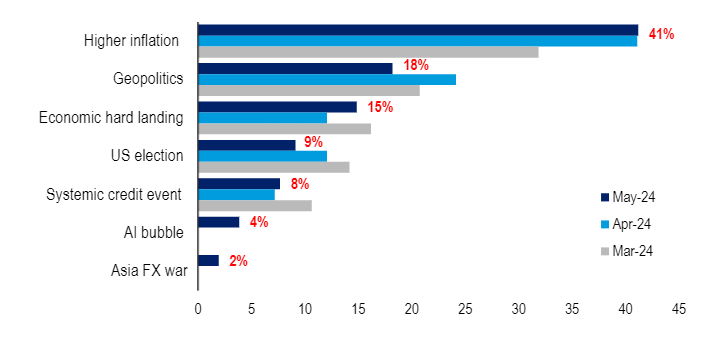

The greatest risk that fund managers foresee is higher inflation, which concerns 41% of respondents, followed by geopolitics (18%). Fund managers are at their most overweight commodities since April 2023, reflecting these two tail risks.

Fund managers’ perceptions of the biggest tail risk

Source: BofA Fund Manager Survey

Global growth expectations have fallen for the first time since November 2023 with a net 9% of managers anticipating that the global economy will weaken during the next 12 months. By contrast, just last month, a net 11% of managers said the economy would strengthen.

Nonetheless, fund managers remain bullish overall. BofA measures sentiment by looking at allocations to stocks and cash as well as economic growth expectations and on that basis, confidence is high, as the chart below shows.

Fund manager sentiment most bullish since November 2021

Source: BofA Fund Manager Survey

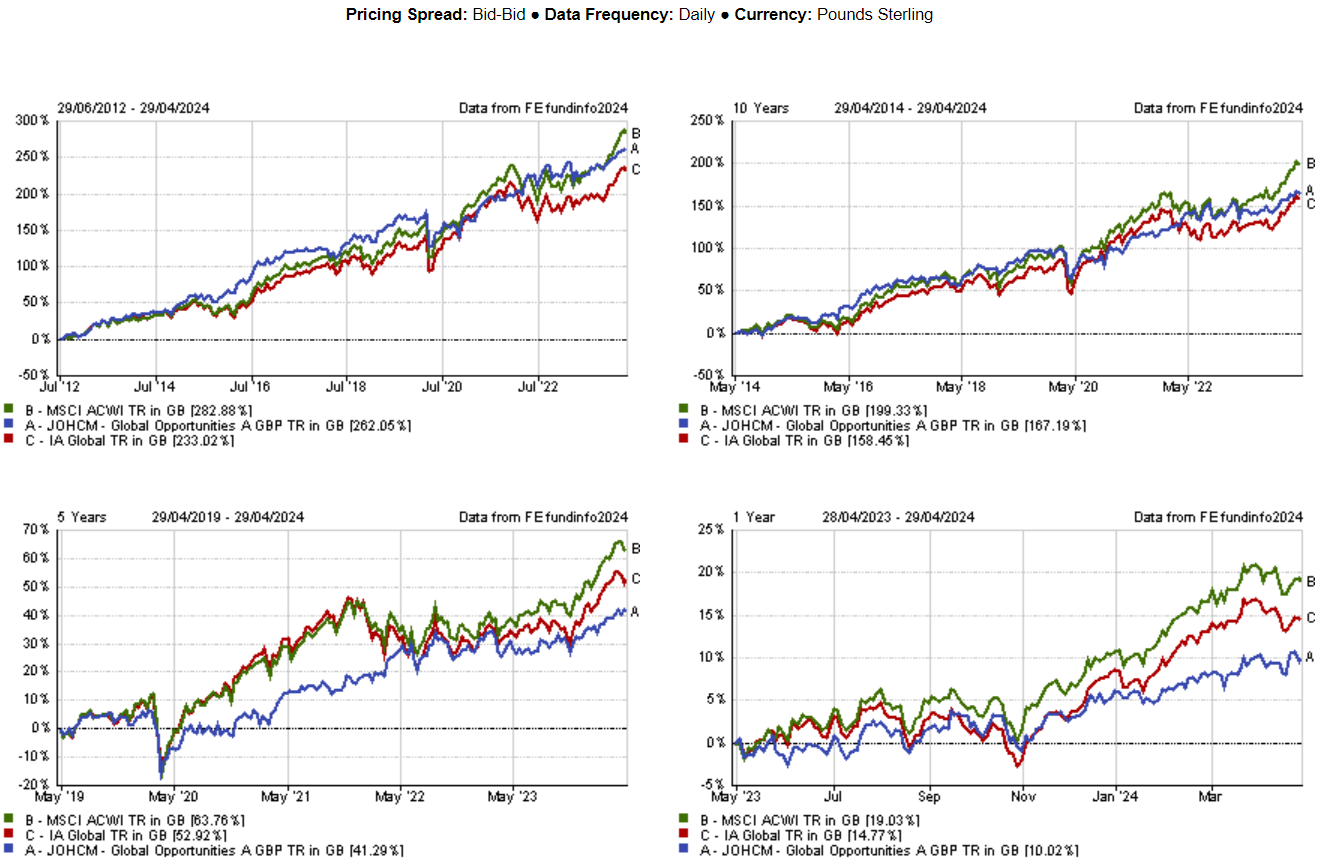

The last exceptional company in the UK was ARM Holdings, says Aegon’s Douglas Scott.

The UK market is failing to attract new investors because there is a distinct lack of ‘unique’ companies, according to Douglas Scott, manager of the Aegon Global Equity Income fund.

His fund has just 5.7% in UK names, a figure that is closer to 2-3% stripping out international names and focusing purely on domestic stocks.

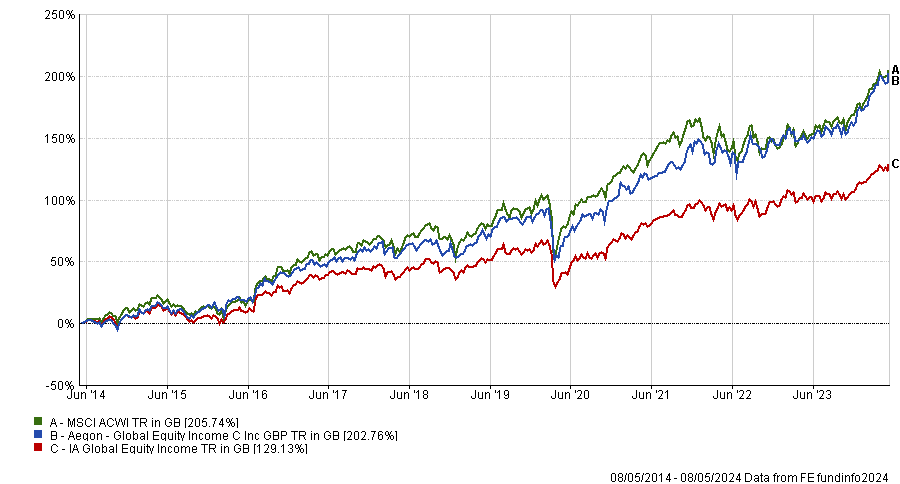

This has been a good call for the $805m fund over recent years, propelling it to the top quartile of the IA Global Equity Income sector over one, three, five and 10 years.

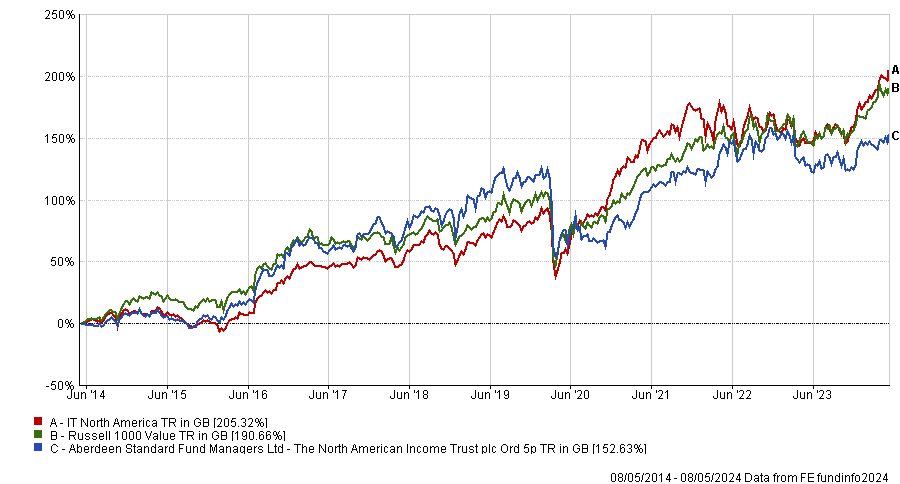

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The dire situation for the UK market will not change in the near term, he warned, as there is nothing to excite investors, who have pulled money out of UK funds in 35 consecutive months and last month removed a further £665m.

“The UK stock market is dominated by oil, mining and banks. It has no unique companies. The last one we had that was really unique in my eyes was ARM Holdings. We have nothing,” he said. ARM was taken private in 2016 by SoftBank, then acquired by NVIDIA four years later.

“We have some good companies – Experian, AstraZeneca – which are good growth companies that can do well in their field, but they are not unique,” he concluded.

Abby Glennie, manager of the abrdn UK Smaller Companies fund, agreed with Scott when it comes to larger companies.

“I think the point is probably quite correct in the large-cap space. It’s not that companies are not unique – it’s that they’ve been the same companies for a long time. When you are a large-cap, the changes you make to the business are like turning around an oil tanker. They never really change the business that much,” she said.

However, she argued the picture was different in small-caps, where companies can pivot quickly and tend to have more dynamic business models.

Thomas Moore, manager of the abrdn UK Income Unconstrained Equity and abrdn Equity Income Trust, took a different tack. He does not believe it actually matters whether or not the UK has any unique companies.

“That comment smacks of growth investing. Uniqueness is a nice high level theme but I would say the basics of investing are more important than touchy feely language,” he said.

Instead, investors should focus on a company’s cashflow, which in turn will dictate how much it can reinvest in the business, its share buybacks and its dividend payouts.

“How unique a company is doesn’t pay the dividends, whereas cashflows do. If you’re a growth investor looking for the next ARM or Darktrace, that is what you spend 90% of your time doing,” said Moore.

“As an income investor it’s knowing what will happen from one year to the next in terms of identifying cashflows. If the company surprises on growth, fantastic, that’s positive. That gives me the valuation re-rating. But it is all about the building blocks of generating a return.”

Despite Scott’s criticisms of UK plc, he is positive on certain stocks such as mining giant Rio Tinto, property firm London Metric, housebuilder Taylor Wimpey and asset management group Phoenix, although these are “the smallest holdings in the fund”.

But he warned that one option mooted by politicians to improve the prospects of the UK market – to force pension funds to up their exposure to UK companies – would likely fail.

In the early 2000s pension funds had as much as 40% in domestic stocks, a figure that has plummeted to just 4% today. Scott thinks this shift to global portfolios was “a great idea”.

“What you are buying? Although it might be quite cheap, the UK is not providing you with anything different as such,” he said.

As a result, pension funds have been doing the right thing by diversifying to other countries, Scott argued, adding that even if the government tried to force them to invest domestically, this would be met with serious pushback.

Audrey Ryan, manager of the Aegon Ethical Equity fund, had a different view and argued the government needed to go further. She said it should do more to attract new investors, warning that if it did not, companies would either continue to re-list overseas – a trend that has been ongoing for the past 18 months – or be taken out by private equity and other buyers.

“It would be lovely to see increased focus by leaders to encourage capital to the UK market and certainly encouraging companies not to relist. We have started that journey but I would love to see more impetus,” said Ryan.

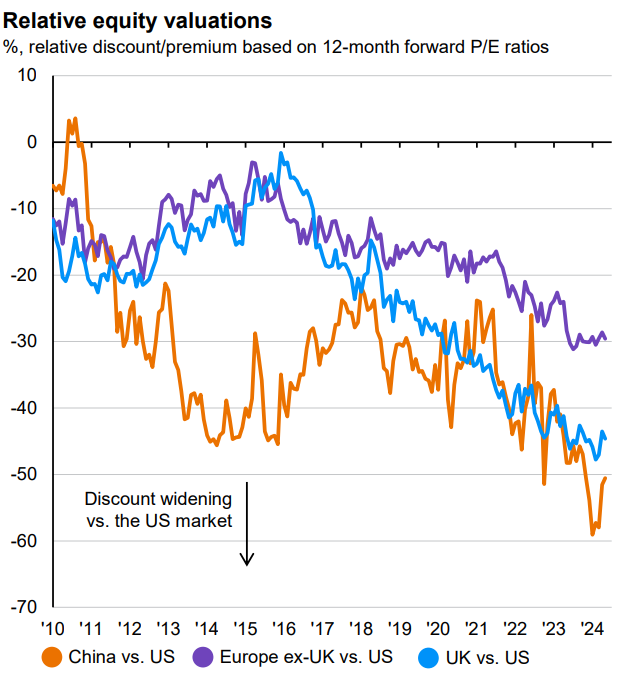

Even so, there a number of reasons to be optimistic on the UK, she added. Given UK equities have been so “unfashionable”, Ryan argued that valuations are now “very compelling” both against their own history and relative to overseas markets.

She added that mergers and acquisitions – predominantly in the small- and mid-cap space but also now creeping into larger names – are evidence of this.

“For me that underpins my view that UK equities are mispriced and if we don’t as investors take advantage of that the external market will, whether that be private equity or other trade buyers,” she said.

“A number of companies I invest in are acknowledging the value is not reflective of their businesses and are increasingly doing more share buybacks, which is providing a degree of support for the market. And the UK is delivering one of the highest dividends out there globally, if income is something you are striving for.”

The asset manager warns that the average EMEA investor is still underweight Japanese equities.

Japanese equities rose from the ashes last year, with the Nikkei 225 index reaching levels unseen in 34 years and hitting an all-time high in March 2024.

As a result of this return to form, international investors are coming back into Japanese equities while domestic savers now have incentives to invest in their own stock market.

Yet BlackRock found that investors in Europe, the Middle East and Africa (EMEA) remain significantly underweight Japanese equities.

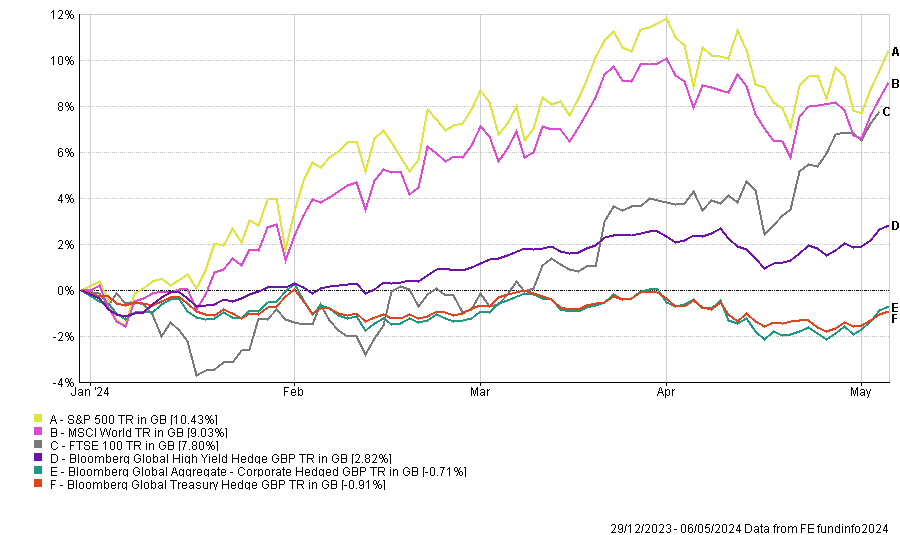

Performance of indices (in local currency terms)

Source: FE Analytics

According to BlackRock’s research, the average allocation to Japanese equities is 3.6% within the equity sleeve of moderate risk multi-asset funds domiciled in EMEA, or 1.6% of the whole portfolio (based on an average 45% allocation to equities). That compares to Japan’s 5.4% weighting in the MSCI All Country World Index.

However, BlackRock believes that investors should double their allocations to Japanese equities to 7.3% to make the most of their attractive risk/return profile and diversification benefits. Japanese equities have a sub-50% correlation to most other regional stock markets, the manager pointed out.

“Even with the return of foreign investors in 2023, years of persistent selling means that we are only just seeing benchmark allocations returning to neutral in both iShares flow and foreign institutional investor flow," BlackRock stated.

“As Japan’s weighting in indexes rebalances in line with its higher market capitalisation, passive investors will need to continue to buy Japanese equities if they are to maintain their allocations.”

For investors looking to increase their exposure to Japan, BlackRock expects broad passive exposure will be the most popular route and suggested the iShares MSCI Japan UCITS ETF.

For alpha-seeking investors, BlackRock recommended opting for active managers who can exploit the Japanese equity market’s frequent rotations in style leadership: “Funds that combine bottom-up and top-down thematic approaches may be well-positioned to identify the winners from economic shifts. Given that Japan is a highly macro-sensitive market, a balanced and risk-controlled approach is crucial, in the pursuit of stable alpha.”

One reason for BlackRock’s bullish sentiment towards the land of the rising sun is ongoing corporate governance reform.

With the Tokyo Stock Exchange ordering companies with a price-to-book ratio below one to come up with credible plans to improve amidst the threat of a forced delisting, Japanese corporations have been prompted to either return excess capital to shareholders or to invest it.

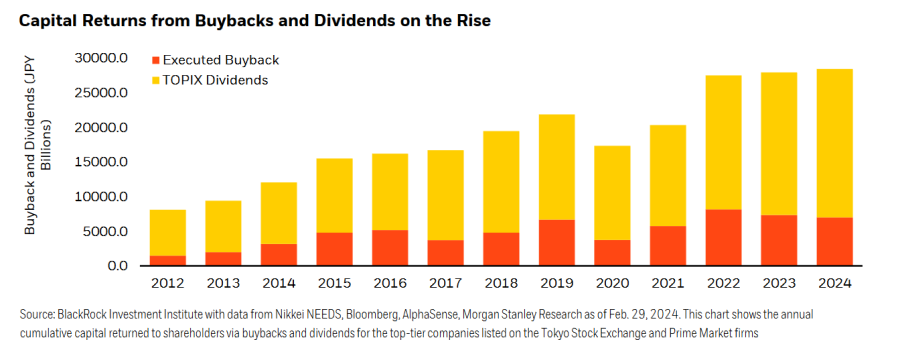

BlackRock explained: “Returning capital through share buybacks also bolsters the asset side of household balance sheets, producing a wealth effect that supports consumption. The sum of buybacks and dividends for 2023 came in at an all-time high of ¥28trn, with projections for 2024 even higher.”

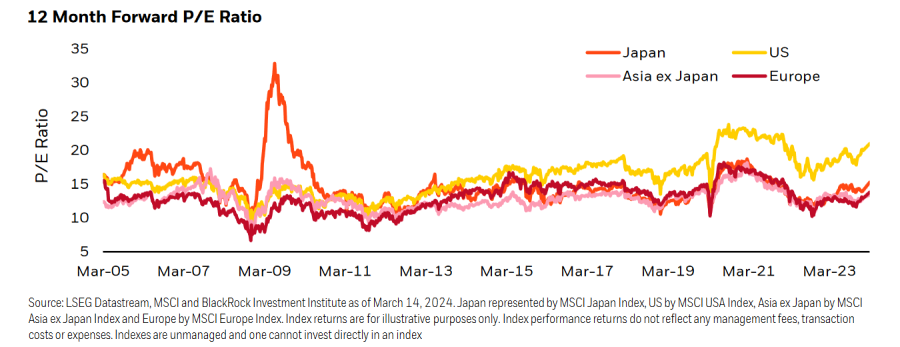

Despite Japan’s recent outperformance and resulting concerns around valuations, BlackRock believes that Japanese equities are still not expensive relative to their own history and to US equities.

The asset manager is also unconcerned about the $475bn holdings of the Bank of Japan (BoJ) in domestic assets.

“It seems unlikely to us that the BoJ would start unwinding these positions at such a pivotal moment in Japan’s economic turnaround. Our base case is that following the cessation of the BoJ’s ETF purchasing programme, it will look to gradually unwind its positions over the coming years or even decades.”

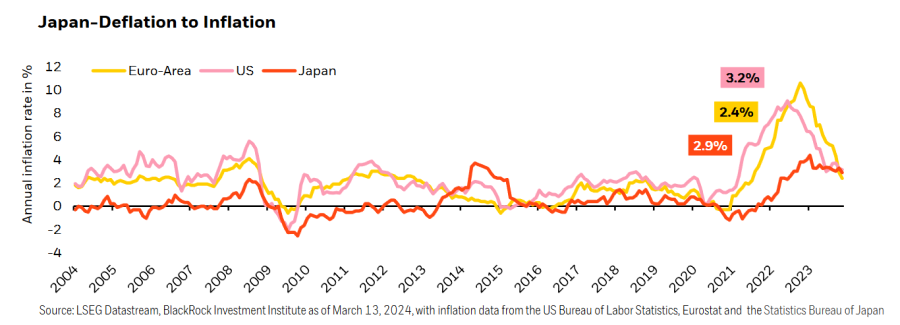

Another reason for the asset manager’s enthusiasm on Japan is the country’s macro-environment, as the BoJ is the only major central bank to have stuck to its expansionary monetary policy, driving its currency lower and attempting to embed higher inflation after decades of price stagnation.

“Now the question becomes whether the BoJ will be successful in creating a virtuous cycle between wages and prices. Signs of a meaningful structural shift are becoming more apparent as the pass-through between wages and prices strengthens, as evidenced in the most recent annual wage negotiations.

“Given such a meaningful move towards a more inflationary environment, the BoJ has ended the world’s last negative interest rate by hiking for the first time since 2007. In addition to setting the short-term rate between 0-0.1%, it also ended the yield curve control program and ceased purchases of ETFs,” the firm noted.

“BlackRock Investment Institute views this shift as a hard-won return to inflation and thinks the BoJ is unlikely to now sabotage this progress by aggressively tightening policy.”

The BoJ’s exit from the long-running negative interest rate policy may bring about an appreciation in the yen and drive volatility higher.

Yet BlackRock is comfortable with this prospect, explaining that the market has already priced it in, that the BoJ had pledged to keep monetary policy accommodative and that US rates are likely to stay higher for longer anyway.

“Most importantly, the end of negative interest rates isn’t reflective of an inflation fight. Instead, we believe it’s reflective of inflation success. With inflation showing signs of embedding closer to the 2% target, we think nominal interest rates are likely to be higher than they were during the period of deflation. We expect real rates to remain negative in Japan, in contrast to other markets.”

Therefore, the asset manager encouraged investors to look at unhedged exposures to Japanese assets and to search for opportunities away from large-cap exporters.

Finally, domestic investors also have a role to play, as their large savings could provide a structural tailwind for equities.

BlackRock explained that sustained inflation and a steepening yield curve should reduce demand for cash and low-yielding government bonds and nudge savers into the stock market. The Nippon Individual Savings Account, a tax-free investment programme that came into effect in January 2024, is a further incentive.

According to data from the BoJ, private individuals in Japan held nearly $14trn in assets at the end of March 2023. Cash and savings comprised 54%, but equities only 11%.

“Getting to comparable levels seen in the European Union of nearly 33% of individual assets in shares could see more than $1.7trn flowing into equities in coming years,” the manager estimated.

Fund managers believe a Trump victory is more of a concern for European markets than for US equities.

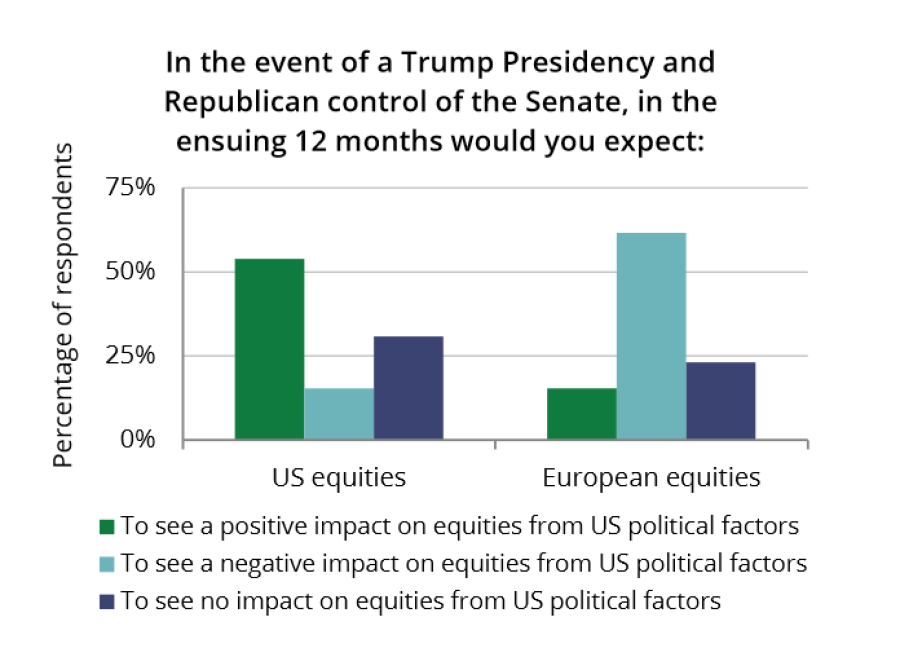

Donald Trump’s return to power would be more problematic for European markets than for US equities, according to a Quilter Investors survey of 21 fund managers.

Indeed, 61% of the fund managers polled believe a Trump victory would be a significant blow for European markets.

Those views echo the sentiments of European Central Bank president Christine Lagarde, who said in January that the Republican candidate is “clearly a threat” to Europe.

Lindsay James, investment strategist at Quilter Investors, said: “A Trump victory in November brings about a lot of uncertainty for Europe. While the US will likely see existing tax cuts extended and further ‘onshoring’ of manufacturing and production, Europe is likely to experience volatility from Trump’s ‘America first’ policy.

“Having already imposed tariffs on EU steel and aluminium in 2018, which have since been paused by the Biden administration, Trump is now promising a universal 10% tariff on all imports into the US, and has spoken about rates of 60% on Chinese goods.

"His uncertain support for NATO at a time of Russian aggression is already prompting European countries to increase defence spending, adding further pressure to government budgets. Trump has boasted in the past about ending the conflict in Ukraine in 24 hours, with the strong suggestion he would end all funding support, raising the risk that Europe would become more involved.”

Fund managers are not as pessimistic when it comes to US equities, with only 15% of them seeing Trump’s return to the White House as a negative for the asset class.

In fact, more than half of respondents believe a Trump presidency would be positive for US equities, including if Republicans also win control of Congress.

Source: Quilter Investors

However, the best US election outcome for markets would be a second term for Joe Biden, but with Republican control of the Senate, according to the surveyed fund managers.

A split in power was generally favoured over one-party dominance. Some managers explained that a unified US government may result in a higher budget deficit through higher spending and/or tax cuts, exacerbating concerns around US government debt levels.

Other respondents predicted that a Republican-controlled Congress would pave the way for deregulation, especially in financial services, energy and corporate mergers.

Nonetheless, many professional investors do not expect the US election to have a significant impact on US stock market prospects.

One manager explained: “History suggests that equity markets tend to see lower average returns and higher volatility in US election years versus non-election years. But these averages are skewed by events that have coincided with elections, notably the bursting of the dot-com bubble, the global financial crisis, and the Covid-19 pandemic.

“What’s happening in the economy tends to be much more important for markets than what’s happening in the White House.”

Fund managers identified geopolitics as a key risk, citing tensions between the US and China as a potential trigger for market instability.

James said: “At a time when global growth is decelerating, we are seeing a number of threats that risk the global order that we have become familiar with.

“However, despite the conflicts that have erupted of late, it remains the relationship between the two economic behemoths, US and China, that concerns investment professionals.”

One respondent also highlighted that markets haven’t priced in any risk premium reflecting this increase in geopolitical risk.

Nearly half of the surveyed fund managers believe a return to a 2% inflation target across developed economies is “unreasonable” or “totally unreasonable” due to the surge in geopolitical tensions.

One respondent concluded: “The world is focused on security over the medium to long term. National security, energy security, supply-chain security, and food and water security.

“All this will require capital and fiscal spend, which means inflation will be higher than we’ve been used to in the post-global financial crisis period.”

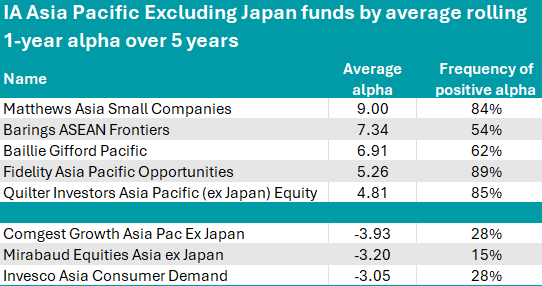

Matthews Asia funds have excelled at beating their benchmarks.

Shrewd investors keep a vigilant eye on their funds’ returns to make sure that their active managers are justifying their fees by delivering solid results above their benchmarks.

A high alpha score (a measure of outperformance) is usually interpreted as a sign that a skilful manager is at the wheel and driving returns, rather than just being along for the ride alongside the rest of the market.

For this research, Trustnet selected funds investing in Asia with a complete five-year track record, measured their alpha scores over 61 year-long periods from January 2018 to December 2023, and averaged them – showing which funds have consistently achieved above-average returns and are therefore delivering more bang for your buck.

In the IA China sector, the fund that was most successful at beating its index was Matthews China Small Companies. With an average alpha of 16.35, this $208m strategy isn’t widely available in the UK, but can be accessed on the 7IM, AJ Bell and Transact platforms.

Co-managed by Andrew Mattock and Winnie Chwang, it returned 24.4% in the past five years, against steep losses of -29.7% for the MSCI China Small Cap index.

Source: FinXL

FSSA All China came in second place, with an average return of 6.63% above its index, the MSCI China All Shares.

The fund has a bias to mid and small-cap companies and is focused on secular growth businesses which trade at attractive valuations.

Rayner Spencer Mills Research (RSMR) analysts consider this fund “one solution to access both onshore and offshore Chinese equity markets”.

“Performance since launch has been strong, driven by stock picking and the fund has delivered outperformance in the majority of down periods in the market,” they said.

“The fund’s record, combined with the overall strength of the China team at FSSA, justify an RSMR rating with the strong research resource on China equities likely to continue to deliver good returns going forward.”

A steep step below, with half the average alpha, was the Allianz All China Equity fund, which is another good option for investors who want access to both mainland and offshore Chinese companies.

RSMR described it as a one-stop-shop fund to gain exposure to China “with a greater emphasis on the domestic economy and consumption story than traditional offshore China mandates”.

Struggling the most at beating their benchmarks were the Invesco PRC Equity and the GAM Star China Equity funds, which were relegated to the bottom of the table.

Another fund from Matthews Asia was the best performer within the IA Asia Pacific Excluding Japan sector. Managed by Vivek Tanneeru, the Matthews Asia Small Companies strategy led the table, albeit with a lower average alpha than its Chinese sibling (9 instead of 16.35). It achieved a FE fundinfo Crown Rating of five.

Source: FinXL

At 7.34, the high-conviction bottom-up mandate Barings ASEAN Frontiers came second best.

“The fund is an interesting satellite choice for investor portfolios, offering exposure to economies in the region with a still undeveloped and fast growing consumption story,” RSMR analysts said.

“The assets managed in the strategy allow scope to exploit opportunities in under researched mid and small-cap names. The experience of the managers, combined with a strong investment process, make the fund a useful addition to investor portfolios.”

Close behind was the popular £3.3bn Baillie Gifford Pacific, which has outperformed the MSCI AC Asia ex Japan index by an average 6.9% since 2018.

This is another “very distinctive” portfolio, according to RMSR researchers. Managers Roderick Snell and Ben Durrant focus on buying companies early and holding them for the long term, so that they can accelerate revenue growth by scale and network effects.

“An approach such as this is always likely to result in lumpy performance and the team is not trying to deliver consistent incremental index outperformance on a year by year basis,” RSMR said.

Comgest Growth Asia Pac Ex Japan, Mirabaud Equities Asia ex Japan and Invesco Asia Consumer Demand were unable to add value on top of their indices and had negative alpha of -3.9, -3.2 and -3.1, respectively.

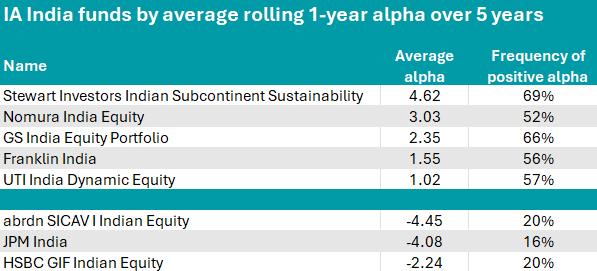

Moving over to India, active investment decisions only paid off for one-third of Indian equity funds in this study.

Stewart Investors Indian Subcontinent Sustainability, Nomura India Equity and GS India Equity Portfolio were the best performers.

Source: FinXL

FE fundinfo Alpha Manager David Gait helms the Stewart Investors fund, which was highlighted by Square Mile analysts for its absolute return mindset and for the team’s “passionate belief that the monies entrusted to them should be invested in the highest quality companies run by responsible management teams”.

“They pay particular attention to the owners and management teams in charge of such companies as they believe that a firm's ability to deliver longterm sustainable returns is closely correlated with the company's management culture,” the analysts said.

“The impact of business practices on the local community and environment is important, but the team will consider a range of factors such as the quality of a company's financial positioning and sustainability of cash flows.”

The Nomura fund is much larger, with $1.8bn of assets under management. Manager Vipul Mehta has been at the company since 2004 and in the past five years doubled investors’ money, while in the same timeframe, the average peer returned 80%.

Active decisions enabled the fund to exceed its benchmark by 3% on average in each of the rolling 61 year-long periods measured.

For abrdn SICAV I Indian Equity and JPM India, stock picking was detrimental to the funds’ performances, with negative average alphas of -4.45 and -4.08, respectively.

Finally, leading the IA Japan sector with an average alpha of 7.03 was Fidelity Japan, which was also able to maintain a positive alpha in 60 of the 61 periods in consideration.

Source: FinXL

Managed by Min Zeng, the five crown-rated strategy made investors 85% over the past five years, compared to 40.7% for the sector as a whole.

Outperforming the Russell Nomura Mid-Small Cap index by an average of 6.7%, M&G Japan Smaller Companies was the second fund to make the list. Alpha Manager Carl Vine has been in charge since September 2019. During his tenure, the fund has outperformed the average peer by 48 percentage points.

In third position was another fund with a small-cap focus, Janus Henderson Horizon Japanese Smaller Companies, led by Alpha Manager Yunyoung Lee. It had an average alpha of 4.05.

Struggling to keep up with the competition, FTF Martin Currie Japan Equity and Invesco Responsible Japanese Equity Value Discovery remained at the foot of the table.

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds, balanced and adventurous funds, European funds.

Talib Sheikh, who recently took over Fidelity’s multi-asset income funds, believes the global economy has entered a new regime.

Talib Sheikh has spent 2024 moving Fidelity International’s $7.4bn multi-asset income portfolios out of government bonds, going overweight Europe and enhancing the investment process, after replacing Eugene Philalithis at the start of this year.

One of the first moves Sheikh made was to reduce interest rate risk and duration from three and a half years to one year in the $5.5bn FF Global Multi-Asset Income fund and its stablemates. “All we have left is short-dated plays,” he said.

Government bonds are expensive and risk additive, he explained. As a result, diversification has become harder during the past 18 months because “government bonds and investment grade credit haven’t really been that safe”. Currencies can be a useful diversifier, he added.

In the fixed income portion of his portfolios, Sheikh favours corporate hybrids in Europe. He has invested in contingent convertibles (CoCos), also known as additional tier 1 (AT1s) bonds, which sit at the bottom of the debt stack above equities and pay attractive yields in the region of 7.5% for two years of duration.

He has modest exposure to infrastructure using investment trusts, which have had “a pretty torrid time” in recent years due to rate hikes. They offer high free cash flows and high dividend yields, many of which are inflation-linked, he said.

Equity exposure is at the top end of his funds’ permissible ranges, at 40% for FIF Multi Asset Income, 60% for FIF Multi Asset Balanced Income and 80% for FIF Multi Asset Income & Growth.

Sheikh, who joined Fidelity from Jupiter Asset Management in October, has been increasing his exposure to core developed market equities where growth is expanding, with an emphasis on continental Europe. “We’re trying to buy more value plays where there is a cushion, where we can see the earnings start to increase from here,” he explained.

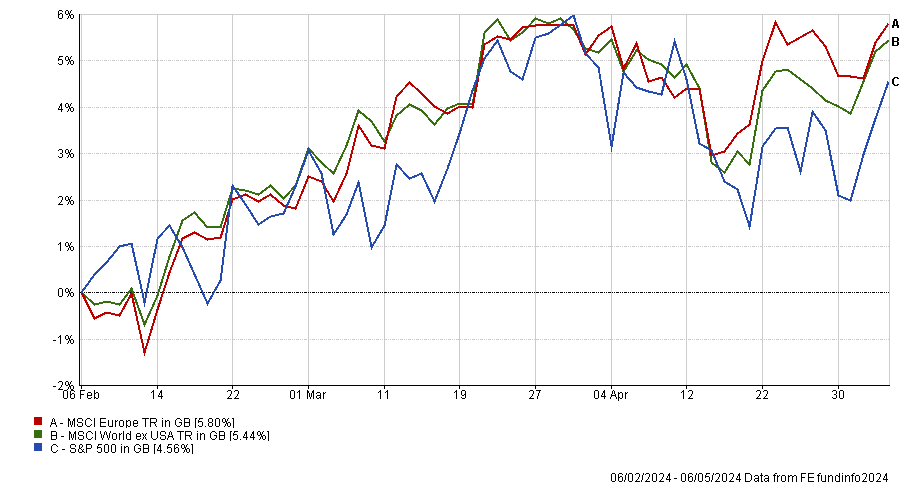

Performance of fund year-to-date vs sector

Source: FE Analytics

Sheikh has adjusted the investment process to be more responsive to changing economic scenarios so that the fund is always “relevant”, whatever the macroeconomic outlook.

These changes resulted in Square Mile Investment Consulting & Research removing the Multi-Asset Income fund’s A rating as its analysts would “prefer to see how the combination of the changes to the team and approach progresses over time”. Rayner Spencer Mills Research reaffirmed its rating.

Sheikh said he approaches multi-asset investing in a similar way to his predecessor Philalithis. “The way I think about the world is very connected to the way Fidelity thinks about it,” he explained. “They definitely wanted someone who thought in a similar way to how Eugene built portfolios.”

Nonetheless, he also wants to bring his 25 years of experience to bear. “I’m not just going to copy what Eugene did. I want to try and enhance the process and bring my own experience. Most of that is to do with the idea that we’re in a new regime.”

Sheikh believes the global economy has entered a new regime of regional desynchronisation, higher government deficits and stickier inflation. He thinks inflation will move symmetrically around central banks’ targets, so “sometimes we’ll worry about inflation, sometimes we’ll be worrying about deflation”. The macroeconomic backdrop is oscillating between reflation, where commodities do well, and goldilocks, where equities outperform, he observed.

Between the financial crisis and the Covid pandemic, the global economy moved in sync but more recently, regional economic cycles have become desynchronised. Europe and the UK have experienced mild recessions, China has had “a terrible time” and US economic resilience has surprised on the upside.

This has created greater divergence and therefore more opportunities for asset allocators. “If you’ve been ignoring Europe, long the US, long Japan and short China, you’ve had an amazing three years,” he observed.

Sheikh’s approach to asset allocation is to form a structural view – his outlook for the next six to 12 months – then a shorter-term cyclical view covering six to nine months, which guides tactical shifts. He then analyses what his structural and cyclical forecasts mean for asset prices.

“I think of macro forces as being like a wave going across the global economy. It’ll hit one asset class then another asset class, then another asset class,” he explained. “So what we’re trying to do is think forward how those macro forces are going to be priced across various asset classes.”

The multi-asset portfolios are built using Fidelity funds alongside third-party funds, leveraging recommendations from the in-house manager research team. He also uses derivatives to adjust the asset allocation efficiently and cheaply.

Sheikh’s funds have three objectives: income first, as well as downside protection, plus the prospect of capital growth. He is aiming for volatility to be half that of the equity market and described the investment process as “stable, repeatable and sensible.” His multi-asset funds will not beat returns from equities over 10 years, but “we’re a different animal”, he pointed out. “We’re taking half the risk. There is no free lunch. We’re trying to smooth the ride for investors.”

European high yield has outperformed the US this year, which is pretty rare, but the factors driving those returns are even more intriguing.

With an impressive 12.29% return, high-yield bonds were the best-performing sub-sector of the fixed income universe in 2023. To investors’ delight, that relative momentum has been maintained into 2024 despite spreads being tight and there are signals of further good news ahead.

The high-yield market has behaved similarly to global equities (if you strip out the outlier performance of the ‘Magnificent Seven’) benefiting from the shift towards risk-on, fuelled by signs of falling inflation and the prospect of rate cuts – even if they are delayed and fewer in number than originally expected.

But the most fascinating element of high yield as we move into spring is the increase in differentiation between the US and Europe.

US high yield is essentially flat on the year. Within that, B and CCC-rated bonds rallied strongly over the first quarter of 2024 but have since sold off, along with the rest of US high yield as the effects of interest rate uncertainty have impacted US credit generally.

In contrast, dynamics in European high yield have become very interesting. Over 12 months, Europe has outperformed the US by 1.8%, which in itself is a pretty rare occurrence. But what’s even more unusual is that the European market has outperformed despite the fact that it has more BB bonds in its universe.

Indeed, BBs have led the European market year-to-date, up 1.86%. BB-rated bonds have generally outperformed their US counterparts and have not sold off to the same extent in the second quarter of this year.

The driver of this differential comes from the different expectations around interest rate paths for Europe versus the US. A first cut in the summer remains likely for Europe, while later this summer or even further out is looking more plausible for the US.

As an active manager, it’s good to see the return of differentiation between rating categories that are classically more interest-rate sensitive like BBs, and those more influenced by factors like idiosyncratic risk, which is the case for CCCs. This creates potential value-add opportunities across geographic allocations and credit selection.

On a global view, the high-yield market was yielding 8.11% at the end of April. While this is a touch off the 9-10% that we view as an automatic ‘buy’ signal, strong coupon generation is keeping performance motoring and is only likely to increase as rates remain higher for longer.

Despite the market largely pricing out early interest rate cuts, performance has been maintained by a healthy underlying economic environment for credit. Tailwinds include limited supply, thanks to lots of names refinancing early, as well as multiple ‘rising stars’ moving back up to investment grade. Additionally, you’ve got investors looking to deploy cash, both from coupon income and new allocations.

It would be remiss not to mention that we’ve seen a couple of headline-grabbing negative credit events recently, but these have resulted from idiosyncratic stories around very large-cap structures struggling against poor results and refinancing issues.

Overall, the first quarter results season left corporates on firm footing with the asset class supported by healthy tailwinds, which should set it up for continued positive performance. When we see firm signs of rate cuts coming through, that should provide an extra boost to risk appetite.

In our portfolios, we’ve been adding coupon risk as we see that as the best way of generating returns within high yield as we tread water ahead of rate cuts. The US offers greater coupon return potential and has the stronger underlying economy, but that must be weighted up against the return of differentiation in Europe, which we would expect to outperform given the more benign growth and inflation environment.

We think a quality stance in Europe with a little bit more interest rate sensitivity is probably a good thing versus the US, because you've got at least one rate cut coming from the European Central Bank in the next couple of months, as reflected in the outperformance of BBs. Investment flexibility around regional allocations allows us to make top-down decisions based on where we see macro drivers and pressures, while we’re giving significant weight to bottom-up research in the current environment to avoid idiosyncratic risks.

Andrew Lake is head of fixed income at Mirabaud Asset Management. The views expressed above should not be taken as investment advice.

The research company’s Academy of Funds has several new entrants and two departures.

Square Mile Investment Consulting and Research has released its latest Academy of Funds round-up today, announcing the departure of two funds and a number of new entrants.

It has expelled PIMCO GIS Dynamic Multi-Asset and abrdn Europe ex-UK Income Equity from its Academy of Funds due to changes in leadership. Managers Geraldine Sundstrom and Stuart Brown are about to leave PIMCO and abrdn, respectively.

“While Square Mile acknowledges PIMCO’s strong resources and team approach, the fund’s rating was largely predicated on Sundstrom’s experience of managing dynamic multi-asset strategies,” Square Mile’s analysts said.

“As for the abrdn fund, it has lost its two portfolio managers within a relatively short period, with the previous co-manager Tom Dorner departing in September 2023, and Square Mile would like time to monitor the strategy and its investment team after the announced new manager, Charles Luke, will have stepped in.”

These defections were compensated by several additions to the fray.

Premier Miton secured a quartet of new ratings for its Diversified Growth range, with the Diversified Cautious Growth, Diversified Balanced Growth, Diversified Growth and Diversified Dynamic Growth funds all gaining an A rating as they enter the Mile Academy of Funds.

The flagship fund in the range, Diversified Growth, has delivered strong risk-adjusted returns for more than a decade, while the other three funds have achieved this since their launch over five years ago.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

“Key to the strategies' success are the views of the specialist investment teams at Premier Miton, which are responsible for the underlying sleeves which collectively make up the funds within the range,” the analysts said.

“These funds are a robust option for investors seeking a range of growth-orientated actively managed multi-asset portfolios.”

One of the cheapest active funds in the IA North American sector, the HSBC US Multi Factor Equity fund also received an A rating thanks to the managing team’s ability to “consistently provide alpha across a range of strategies since July 2006”.

The fund offers core exposure to US equities, targeting an ex-ante tracking error of 2.5% per annum from the S&P 500 and focusing on value, quality, momentum, low risk and size factors.

In the closed-ended space, the Mercantile Investment Trust also joined the list with an A rating. The strategy is led by the “experienced” Guy Anderson, who is part of a “well-resourced” team at JPMorgan Asset Management.

The trust predominantly focuses on high-quality and fast-growing UK equities listed outside of the FTSE 100. It convinced Square Mile for its “repeatable, efficacious” investment process, its liquidity as a £1.7bn investment vehicle, and its yield which has grown each year over the past 10 years and is currently at 3%.

Finally, the Vanguard Global Corporate Bond and Global Short Term Corporate Bond index funds were given Recommended ratings, which are awarded to funds that “meet the highest standards in their fields but cannot be readily differentiated from their direct peer group, such as passive vehicles”.

The former tracks the Bloomberg Barclays Global Aggregate Float Adjusted Corporate Index Hedged and the latter the Bloomberg Barclays Global Aggregate Corporate 1-5 Year Float Adjusted Index Hedged.

“Both funds’ benchmarks are structured in such a way that the largest constituents will be companies with the highest absolute levels of debt. While this could create a concern from a credit risk perspective, it is difficult to avoid given the size of the investment universe,” the analysts concluded.

Strategies admitted to the Academy of Funds

Source: FE Analytics

The investment platform is rolling out a range of passively-managed multi-asset solutions in response to the rising popularity of cheap trackers.

Hargreaves Lansdown is launching four multi-asset model portfolios using passive funds and exchange-traded funds (ETFs) managed by BlackRock.

The new passive range follows last year’s launch of HL Managed – a suite of model portfolios using active funds as building blocks.

The investment platform is offering a range of cheaper passively-managed solutions in response to the popularity of trackers amongst its clients, said chief investment officer Toby Vaughan. In the past two years alone, the number of Hargreaves Lansdown clients using passive funds as their main investment has increased by 80%.

“Our new ready-made multi-index investment portfolios are an easy cost-efficient solution for those looking to get started with investing,” he added.

The HL Multi-Index portfolios come in four flavours. The adventurous portfolio will have 100% in equities, while the moderately adventurous offering will have an 80/20 split between stocks and bonds, with 70-90% of equity market volatility.

Balanced investors will have 60% in equities and the rest in bonds, with 50-70% of stock market risk. Finally, HL Multi-Index Cautious will have just 30% in equities and 70% in bonds with 30-50% of the volatility of global equity markets.

Within that framework, Hargreaves Lansdown fund managers David White and Ziad Gergi will make country and sector allocation decisions, which they will implement using BlackRock’s passive funds and ETFs.

White is the lead manager for the new multi-index fund range as well as for HL Growth, the platform’s workplace default fund. He joined Hargreaves Lansdown in 2022 from Nationwide and before that ran institutional multi-manager portfolios at BMO Global Asset Management.

Gergi joined Hargreaves Lansdown last year from Barclays Wealth, where he was head of multi-asset portfolio managers. He is a co-manager of HL Multi-Manager Balanced Managed Trust, the HL Multi-Manager Equity & Bond Trust and the HL Multi-Manager Special Situations Trust.

The new multi-index model portfolios will start trading on 6 June 2024 and Hargreaves Lansdown is offering a £1 per unit fixed offer launch price until 11.59pm on 5 June 2024. The minimum investment is a £100 lump sum or £25 monthly commitment. The ongoing charges figure is capped at 0.3% but Hargreaves Lansdown charges its platform fees on top, which go up to 0.45%.

Promotion of Natalie Bell follows the hire of a new manager in the Liontrust Economic Advantage team.

Natalie Bell has been promoted to named manager on the £1.1bn Liontrust UK Smaller Companies and £146m Liontrust UK Micro Cap funds.

Bell has been part of Liontrust’s Economic Advantage team – which runs the funds – since August 2022 and has been supporting on the day-to-day management of the funds, building her knowledge of the holdings and contributing to investment decisions.

She joined Liontrust in 2021 as part of its Responsible Capitalism team, where she led engagement with investee companies across the full suite of the firm’s funds. Prior to joining Liontrust, Bell worked in corporate governance and policy at EY and the Confederation of British Industry (CBI).

Anthony Cross, head of the Liontrust Economic Advantage team, said: “Since moving across into fund management, Natalie has consistently impressed us with her diligence and skill in analysing companies.

“She has quickly become an integral member of the team and her recent tenacity in leading our efforts to lobby for government support for the UK equity market has been especially notable. Natalie’s promotion to become a named manager of the UK Smaller Companies and UK Micro Cap funds is richly deserved and a natural step in her continued career progression.”

Performance of funds vs sector over 5yrs

Source: FE Analytics

Bell will continue to work on the other Economic Advantage funds with their existing named managers. Her promotion comes after a new fund manager was hired by the team.

Alexander Game joined Liontrust last month from Unicorn Asset Management where he worked for almost a decade and was a named manager on the Unicorn UK Growth fund, Unicorn UK Smaller Companies fund and the Unicorn AIM IHT and ISA portfolio service.

Cross commented: “Alex is a natural fit for our team, bringing with him a strong track record of identifying attractive long-term investment opportunities and an investment ethos that is closely aligned to the Economic Advantage process.”

Liontrust said Bell’s promotion and Game’s appointment are “very positive milestones” in the evolution of the Economic Advantage team.

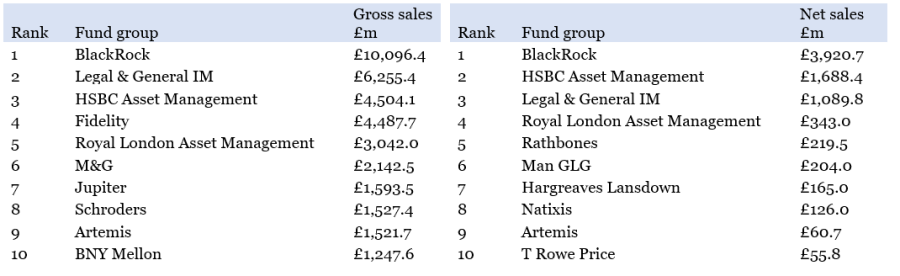

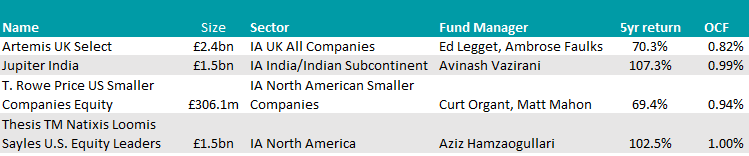

Quarter-over-quarter and year-over-year fund sales have grown in all major asset classes.

UK fund groups have opened 2024 with elevated inflows compared to 2023, the latest Pridham report released today has shown.

BlackRock, Legal & General Investment Management and HSBC Asset Management were the main beneficiaries thanks to their passive offerings, which accounted for 74% of all new flows.

But active managers also benefitted from recent growth trends, with seven houses moving into positive sales territory – most notably Jupiter Asset Management, Artemis and Rathbones, as the tables below show.

Most popular asset managers in Q1 2024

Source: Pridham report

Compared to 2023, BlackRock’s leadership position was further strengthened this year, with gross retail flows into its UK domiciled open-ended investment funds surpassing £10bn for the first time since the final quarter of 2020.

HSBC also moved up one ranking on the back of its passive funds.

In the active cohort, Artemis entered the top-10 best-selling gross and net sales rankings with strong demand for its equity funds, especially Artemis UK Select, which was its top retail seller.

Jupiter moved up two spots for gross new business and has seen growth in three consecutive quarters. The Jupiter India fund received the most retail attention, placing it within the quarter’s best-selling retail funds.

The popularity of US equities among UK-based investors also gained Natixis Investment Managers and T. Rowe Price a spot in the top 10 best-selling net new business rankings – Natixis Loomis Sayles U.S. Equity Leaders and T. Rowe Price US Smaller Companies Equity were the most bought strategies.

Source: FE Analytics

With equity markets buoyant and fixed income offering investors both yield and capital appreciation potential, the future looks bright for the

“Q1 retail sales showed that demand for high-performing active funds remains there. The active opportunity, however, is diverse, with fund groups often only seeing success in a limited number of investment categories at one time,” he said.

“As retail investors and their advisers adjust their portfolio allocations to reflect the outlook of higher for longer interest rates, opportunities will be created for fund groups to win new business.”

Fund selectors lose confidence in the AllianzGI bond strategy after Mike Riddell’s departure.

Experts are selling the Allianz Strategic Bond fund after its lead manager Mike Riddell jumped ship to Fidelity International.

Allianz Global Investors (AllianzGI) has appointed Julian Le Beron to take over with an “enhanced” team-based, co-led approach, which “will be beneficial in terms of expanding the inputs into strategies,” the firm said.

This development didn’t convince experts, who all agreed the fund is a sell.

Having shot the lights out in 2020, as 8AM Global’s Andy Merricks noted, Allianz Strategic Bond is “at least consistent now, achieving fourth quartile returns regularly”.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

“I would assume that those still holding it are doing so because of Mike Riddell in the hopes that he can recapture the spark of 2020. Now that he’s moved to Fidelity I would imagine Riddell supporters will follow him,” he said.

“For those who remain, it will be interesting to see whether the ‘enhanced’ investment process means that it will find a way of yielding even less than it does now compared to cash and eroding capital or whether they will stem the tide and see better performance in the coming months.”

Ben Yearsley, investment consultant at Fairview Investing, agreed with Merricks that the fund is “quite unique and very specific to Riddell”, making it “difficult to stay put after he's gone”.

Investors won’t be able to follow Riddell to Fidelity directly either, as he won't take over the Fidelity Strategic Bond fund until 2 January 2025 at the latest.

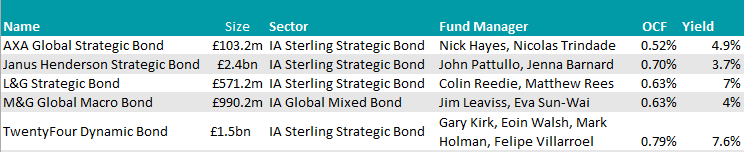

It’s also likely that the new AllianzGI managers will dial down the risk, according to Yearsley. He recommended that investors “sell now and go for a new choice”, possibly splitting the money between AXA Global Strategic Bond and the M&G Global Macro Bond fund.

“They blend well together as the AXA fund has core allocations to the main bond asset classes while the M&G’s product is more specialised, with currency returns being a big part of the decision making process,” he said.

It is managed by Jim Leaviss, who Yearsley considers “one of the premier bond managers”.

Jason Hollands, managing director of Bestinvest, also leaned towards selling, indicating the TwentyFour Dynamic Bond fund and the Janus Henderson Strategic Bond fund as two possible replacement candidates.

The former is a concentrated best-ideas fund with a flexible mandate to roam across the fixed income markets. It has performed “incredibly well” in a variety of very different market conditions.

“It is also able to use interest rate and credit derivatives to optimise exposure, as well as take short positions for hedging purposes,” he said.

On the other hand, the Janus Henderson vehicle invests across global bond markets focusing on total return rather than income.

“Managers John Pattulo and Jenna Barnard take a cautious approach to risk, not for example buy any emerging market bonds, only developed markets. They also have an aggressive selling mindset to protect the fund’s value, with company profit warnings or management change potentially triggering a review,” Hollands added.

Finally, Andy O’Shea, an investment director at Pharon Independent Financial Advisers, said he was never a fan of the AllianzGI fund as it did not provide enough risk diversification from equity exposure.

“There have been a number of funds that aim to provide a catch-all diversifier for clients through access to multiple sources of alpha, but using them all at once just introduces additional volatility with little quantifiable benefit. Therefore whilst Mike Riddell is undoubtably a very intelligent manager, I would not follow him across to Fidelity, nor stick with Allianz Strategic Bond,” he explained.

“I would suggest considering the L&G Strategic Bond fund instead. This fund slips under many radars but has provided IA Sterling Strategic Bond sector-beating performance and comprehensively outperformed the Allianz fund since the arrival of Colin Reedie in January 2019.”

Source: FE Analytics

Investors are unwilling to back smaller companies and other less liquid parts of the market, says the Henderson Opportunities Trust manager.

The collapse of Woodford Investment Management and the shuttering of his funds is still causing issues for other fund managers almost five years later, according to James Henderson.

The biggest consequence of the Woodford scandal, in which the disgraced fund manager invested heavily in unquoted or illiquid stocks – ultimately leading to the firm being unable to pay back investors who were trying to withdraw their money – is that investors now place a premium on liquidity.

This will cost them, however, when illiquid areas of the market such as smaller companies start to recover.

That’s what Henderson and co-manager Laura Foll are preparing for in their Henderson Opportunity Trust. It was hit harshly by investors’ attitudes turning sour towards the alternative investment market (AIM) three years ago, as the chart below shows.

Performance has dwindled somewhat in the past decade as well, with the vehicle slightly underperforming the rest of the IT UK All Companies sector over the past 10 and five years.

But Henderson is excited about the opportunities in AIM, as he explained below. He also discussed how much the economic backdrop impacts a company’s success and why there’s no such thing as a forever-stock.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

What is the fund’s process?

We invest in a diverse list of stocks that often aren't in the mainstream. We're looking for the forgotten, unloved stocks and this always brings in a medium- and small-company bias to the fund.

We use different valuation methods for different areas of the market. We have a recovery theme going on at the moment and for a recovery stock, we're looking for turnover and not wanting to pay much for it.

Another area is tomorrow's winners. These are the often small companies that we believe will be more substantial in the future, so we're looking at prospective turnover and how they're compounding their earnings.

Why should investors pick your fund?

It's meant to be a real mixer in people's portfolios. We don’t see it as a one-stop shop, but as complementary to other things investors hold, as there won't be much crossover with more index-orientated funds.

Admittedly, it's a difficult fund to choose. The alternative investment market (AIM) hit a brick wall three years ago, which hasn’t helped. There aren't many funds looking in that area anymore and since Woodford’s funds imploded, there has been a real pressure on liquidity.

People may be paying too big a premium for liquidity. In the investment trust structure, we can take a slightly longer view and buy some illiquid stocks, because that's where the valuation discrepancy is greatest. That's where the excitement is and the recovery will come through.

How much is the performance of recovery stocks linked to the economic recovery of the UK?

Companies can achieve great things even with headwinds. Last year, Marks and Spencer recovered despite the cost-of-living crisis. The recession was very mild, but it still would have been a headwind and being one of the biggest names on the high street, it could go against the general economic climate.

If you provide excellent services or products, the overall economy doesn't really matter, and that'd be very much the case with some of tomorrow's winners as well, for example alternative energy stocks.

Whatever happens in the economy, if you're beginning to answer the energy problem so that people can move away from fossil fuels, it doesn't really matter what happens to the overall economy or interest rates: you're going to have a good business.

However, a bank is more closely tied to the economy, obviously.

Does this mean there are inherently good companies that you could potentially hold forever?

The lifecycle of companies is getting shorter and people don’t stay at the top of the tree forever. I would be careful about paying high P/Es [price-to-earnings ratio] for companies that are performing well. It's a very competitive world and there will always be people taking on the person at the top.

With the internet and things like price comparison websites, a company that starts to fail, doesn't have the best product, or is not giving the best service, is found out quicker than it used to. That's why we rotate out of the successes over time and into things that are more challenged, companies that are losing today that can recover.

How does this impact portfolios and turnover?

You need to be moving on a bit quicker than in the past. I can't envisage buying a share and thinking I'll never sell it. Turnover used to be about 15% and now it'd be closer to 25%. Average holding periods are also shorter, every five or six years we're turning things over. There are fewer forever stocks now.

Is Warren Buffett wrong then with his hold-forever philosophy?

In the English market, there aren't stocks like Coca-Cola. Every company that's been at the top in the UK has also declined over time. Vodafone was once a huge percentage of the UK index – while it’s still a very popular product, it's been dreadful for a long time.

However, even Coca-Cola wouldn’t be a forever stock. The world moves on even for it.

What were the best and worst calls of the past 12 months?

Our timing with Rolls Royce, which became the biggest holding in the fund, was lucky. It recovered much quicker than I thought it would. It was bought between £1.10 and £1.20 and the price now would be over £4.10. I've reduced it this week.

Our biggest drawdown last year was Zoo Digital, which does the dubbing for film productions. With the writer strike, it was hit big and then since it's opened up again, it hasn’t got back the amount of work it had before, as production companies do more in-house dubbing.

It has a good management team, but the area is much more difficult. The share price has been falling and we have cut it. The share price has fallen from £1.50 to £0.50.

What do you do when you’re not managing funds?

I’m very excited about getting into Bologna later in the month, as we've lent a picture to a show just outside Bologna on the pre-Raphaelites and Botticelli. They're showing how the Italian masters influenced English Victorian painters.

Multi asset funds have the potential to weather storms while making strong returns.

Picking when to get into stocks, bonds or alternatives is no easy feat. Market timing is notoriously difficult at the best of times but many think of it in the context of equities: when should I buy UK stocks or sell my US companies?

Now imagine trying to get the mix of assets right as well and it is easy to see how DIY investors can go disastrously wrong.

Sometimes investors can be overwhelmed by the choices on offer. Yet in investing, like many aspects of life, perhaps the simplest answer is also the most practical solution.

Multi-asset funds were designed to be a one-stop shop for savers who want to put their money to work but had no clue as to how to navigate financial markets. These funds typically invest in three core areas – equities, bonds and alternatives.

Research this week from Aegon Asset Management highlighted the fickle nature of markets, showing how varying asset class returns can be in each calendar year over the past decade.

It is a chart I have written about before, but thought worth mentioning again this time around for the inclusion of a multi-asset fund.

The fund selected in the below chart sits in the IA Mixed Investment 20-60% Shares sector, the second lowest risk multi-asset sector based on the potential amount the funds can hold in equities.

In theory therefore, investors would expect the returns to be far behind equities – given that this is the area that should make the most money over the long term. And this is true. Annualised returns over the 10-year period are far behind global equities.

But that is not the full story. Looking back over the past 10 calendar years, it shows that, more often than not, multi-asset funds can be in the top half of the performance ranking, beating global equities several times over the decade.

It also highlights that the annualised return matches the returns of UK stocks, while its risk-adjusted returns (the amount of potential loss versus potential gain) is pound for pound the same as global stocks.

In other words, although the returns have been lower, the volatility has also been dampened, meaning investors had a much smoother ride.

Source: Aegon Asset Management

The fund in question is the Aegon Diversified Monthly Income fund, which has been the seventh best performer over the past decade in its 104-fund strong sector.

Some may argue therefore that these figures do not represent the average fund and would require investors to pick one of the top performers – something which is incredibly hard to do without the benefit of hindsight.

Yet its five-year numbers are much closer to average. Even only looking over the past five calendar years, the portfolio has been above average in all apart from 2020, when Covid caused myriad issues for fund managers.

At my age (31 at the time of writing), I am in the somewhat advantageous position of only needing to put my money into equities. Most of my savings are for the long term, either retirement or as part of a rainy day fund that hopefully will remain untouched for several years.

But as I get nearer retirement (or needing the money for other reasons) and diversification and asset class selection becomes a much larger consideration – as will protecting my hard-earned savings – I will seriously consider moving my money to a multi-asset fund.

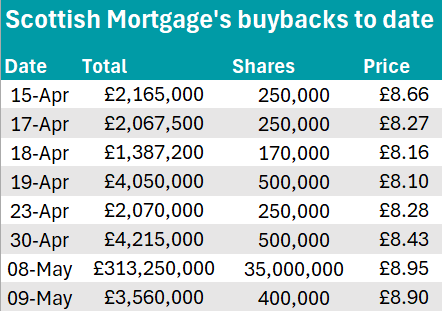

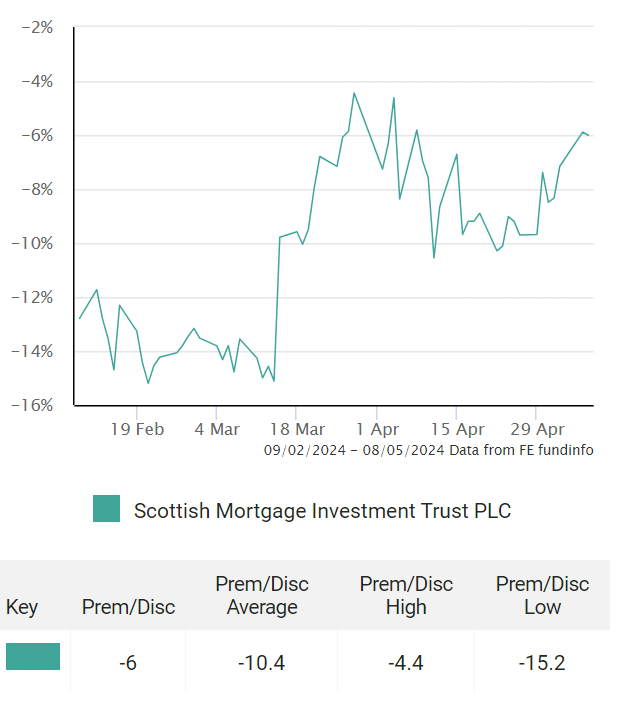

More than 94% of the trust’s share buybacks so far were carried out on Wednesday.

The Scottish Mortgage investment trust went on a shopping spree this week, buying £311m worth of its own shares in just one day – the largest buyback since its two-year budget of at least £1bn was announced in March.

Paying £8.95 per share, the company bought back 35 million shares on Wednesday, following up with a more modest £3.5m purchase on Thursday. Prior to this, the average purchase had only been worth approximately £2.8m per transaction.

The scale of this move means that 94.1% of the trust’s buybacks so far were carried out on this day, taking Scottish Mortgage approximately one-third of the way in its announced buyback programme.

Source: Trustnet, HMRC

The goal of this scheme is to narrow the trust’s discount, which was north of 14% in mid-March. Although the efficacy of buybacks has been brought into question by some, results seems to have arrived for the Baillie Gifford flagship trust, which is now trading at a 6% discount.

Scottish Mortgage’s discount

Source: Trustnet

Scottish Mortgage commercial director Stewart Heggie said the board and managers of the trust remain “resolutely committed” to facilitating trading around net asset value (NAV) and maximising returns for shareholders.

“Since the announcement of the buyback programme, the discount has narrowed by around 10 percentage points, which has contributed towards a share price return of 45% over the past year,” he concluded.

UK GDP grew by 0.6% in the first quarter of 2024.

UK GDP rose by 0.6% in the first quarter of the year, exceeding the Bank of England’s 0.4% expectations and indicating the end of the short-lived technical recession that gripped the country at the close of 2023.

This figure marks the UK's strongest quarterly GDP growth since before the pandemic and is also the first time in nearly three years that UK GDP has outpaced both the US and the Eurozone.

The service and production sectors rose 0.7% and 0.8% respectively in the first quarter of the year, spearheading the economic growth and offsetting the decline in construction.

As such, today’s GDP figures coupled with yesterday’s inflation numbers suggest the UK economy is turning a corner.

However, David McCreadie, CEO of Secure Trust Bank, stressed that growth forecasts anticipate the economy to plateau.

He added: “Attention now shifts to the Bank of England, given the sustained pressure on households and businesses stemming from elevated interest rates. A rate cut would provide an added impetus to the economy by reducing borrowing costs for businesses.”

However, Charles Hepworth, investment director at GAM Investments countered that the Bank of England may be less inclined to cut rates into an economy that is growing faster than expected. He explained that both inflation and wage growth dynamics will need to abate to make a June rate cut a “distinct likelihood”.

Danni Hewson, head of financial analysis at AJ Bell, added that although the figures are encouraging, the cut to National Insurance and the increase in the national minimum wage which took place in April have yet to come through to consumer spending and their impact remains to be seen.

She warned: “Those green shoots we’ve heard so much about since the start of the year have sprouted nicely, but it will only take one spring storm to damage the burgeoning flowers.”

Meanwhile, the FTSE 100 hit new all-time highs this morning, although it might not have much to do with domestic macro-economic factors.

Russ Mould, investment director at AJ Bell, concluded: “Given its international horizons, this has little to do with the UK’s better-than-expected GDP growth and is largely being driven by strength in the resources space where higher metals prices and the promise of M&A are helping to stoke share prices.

“The next key test of the index’s new-found vim and vigour will likely come next week in the form of US inflation figures.”

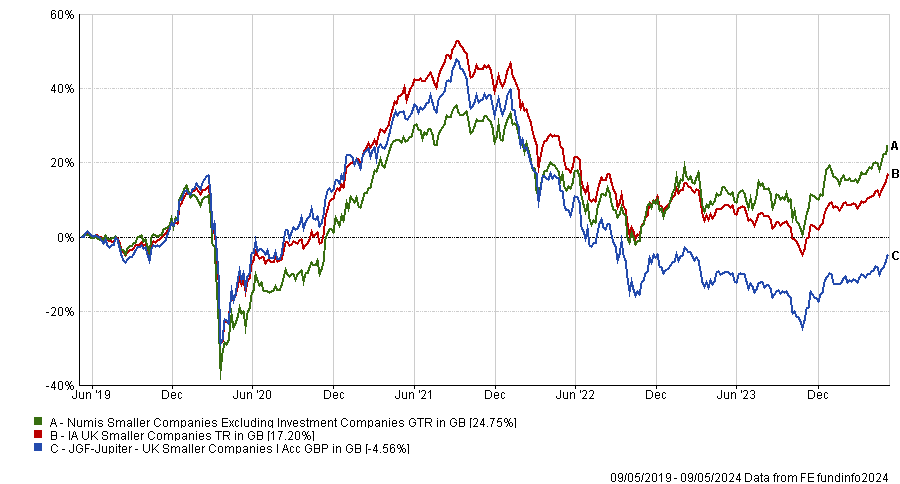

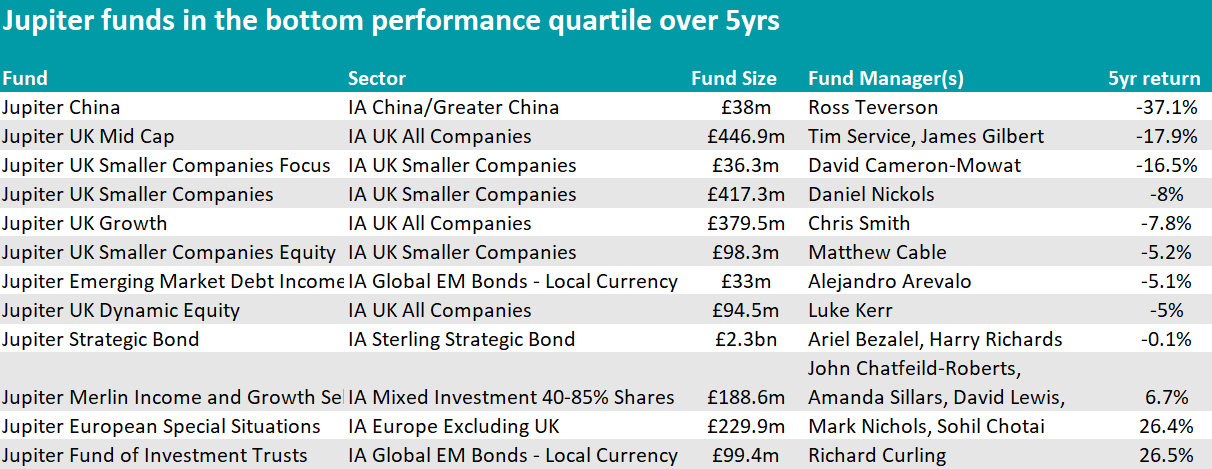

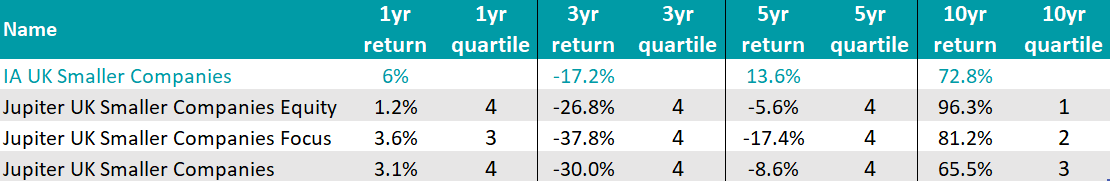

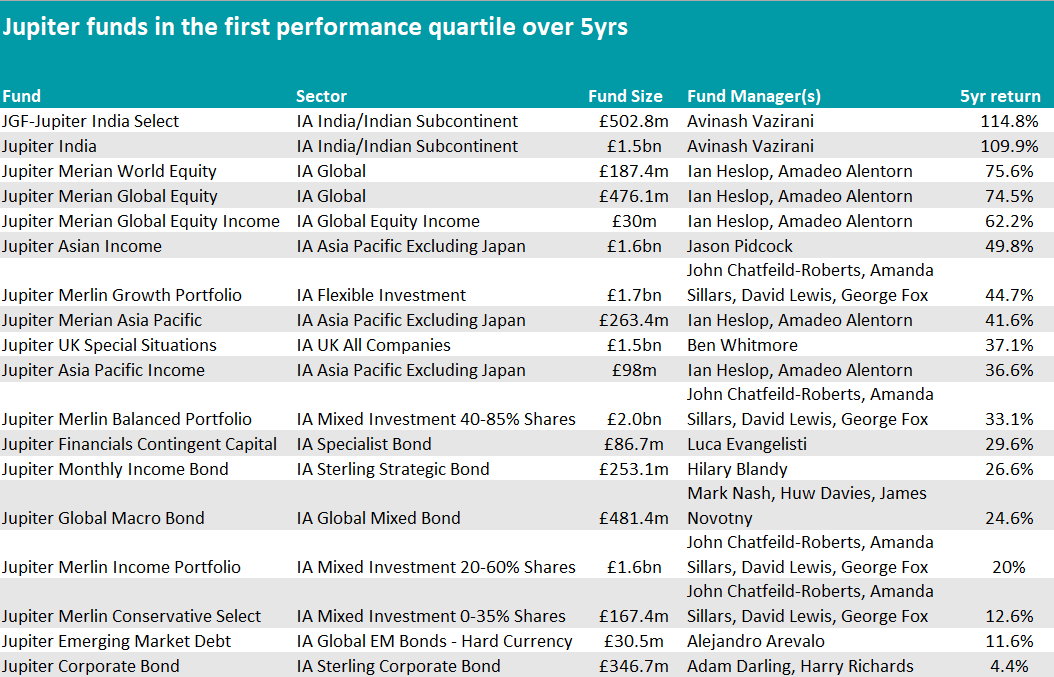

Dan Nickols, who leads Jupiter’s UK ‘smid’-cap team, will leave the firm on 30 June 2024.

Dan Nickols, head of Jupiter Asset Management’s small and mid-cap UK equities team, will retire on 30 June 2024. He is lead manager of the £426m Jupiter UK Smaller Companies fund and the £120m Rights and Issues Investment Trust and is an FE fundinfo Alpha Manager.

Matt Cable will replace him at the helm of both strategies. He has co-managed the Rights and Issues trust with Nickols since Jupiter won the mandate in October 2022. Cable joined Jupiter in 2019 and has more than 15 years of investment experience, garnered at M&G Investments and Schroders.

Tim Service, who has worked with Nickols for almost 20 years, will replace him as head of Jupiter’s ‘smid’-cap team and will be a supporting manager on the fund and trust. Service has been at Jupiter since 2007 and was previously a UK equity fund manager at Merian Global Investors. Earlier in his career, he was an analyst at JPMorgan and ABN Amro.

Nickols joined Jupiter in 2020 when it acquired Merian, where he led the UK small and mid-cap team. Before that, he worked at Albert E Sharp, Morgan Stanley and Deloitte and Touche.

Jupiter UK Smaller Companies has a strong long-term track record but has struggled during the past five years, trailing the IA UK Smaller Companies sector and the Numis Smaller Companies index. It peaked at £1.5bn in assets under management in September 2021 when it was the most popular fund in its sector but has been in outflow mode since then, shrinking to one third of its former size.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund suffered in 2022 as central banks rapidly hiked rates, putting the small and mid-sized growth-oriented companies in its portfolio under pressure.

As Bestinvest managing director Jason Hollands explained: “This was down to the strong growth style bias being hit hard during a period of rising interest rates and borrowing costs. It is also a relatively concentrated portfolio for a small-cap fund, with circa 56 holdings, which does leave it more vulnerable to stock-specific risk than more diversified products.”

Trustnet looks at funds within the IA Europe Excluding UK and IA Europe Including UK sectors that have been run by the same manager since at least 2004 and have achieved top-quartile returns over the past three years.

European equities may not be as popular as their North American peers, but they are proving to be a more fertile ground for seasoned managers. While no veteran manager in the IA North America sector has been able to make top-quartile performance in recent years, four have achieved this feat across the IA Europe Excluding UK and IA Europe Including UK sectors.

Below, Trustnet researched the European funds that have been managed by the same person since 2004 or earlier and have produced top-quartile returns over the past three years, showing those who have been through it all and continue to make top returns.

One of the two funds in the IA Europe Excluding UK sector reflecting our criteria is Artemis SmartGARP European Equity, which has been managed by Philip Wolstencroft and Peter Saacke since 2001 and 2002 respectively. The latter is leaving the firm at the end of June however to become a maths teacher.

The fund’s investment process is based on Artemis’s proprietary tool “SmartGARP”, which aims to help the managers spot reasonably valued companies with superior fundamental growth.

As such, companies matching the market capitalisation and liquidity requirements are assessed against eight factors, including macroeconomics, investor sentiment, growth, valuation, estimate revisions, momentum, accruals and environmental, social and governance (ESG) factors.

Each company is then assigned an overall score, with 100 being the highest possible mark. However, only those scoring above 90 will be considered for inclusion in the fund.

The result is that none of the benchmark's heavyweights are among the fund’s top 10 holdings. Moreover, GSK is the only 'Granolas' stock in the fund, also constituting an off-benchmark position as it is listed in the UK.

While the fund has shined in recent years, long-term performance has been strong as well, with the fund also sitting in the sector’s first quartile over five years and in the second quartile over the past decade. Yet, this has come at the price of a higher volatility than its peers.

Performance of funds over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

The second fund in the IA Europe Excluding UK matching our requirements is Waverton European Capital Growth, which has been steered by FE fundinfo Alpha Managers Charles Glasse and Chris Garsten since 2001.

They look for ‘wealth-creating’ companies, operating in favourable business environments and trading at attractive valuations.

The fund is concentrated, with the top 30 holdings accounting for 98% of the portfolio according to FE Analytics. The managers do not bet the house either on the Granolas as it just holds three of them (out of 11): Nestle, Novartis and Sanofi.

Long-term performance has been good as well, as Waverton European Capital Growth sits in the top quartile of the sector over five and 10 years.

It has also been one of the least volatile funds in the IA Europe Excluding UK sector both in recent years and over the past decade.

Two veteran managers in the IA Europe Including UK sector also outpaced their competitors over the past three years.

The first one is Laurent Nguyen, who has been at the helm of Pictet Quest Europe Sustainable Equities since 2002 and also delivered top-quartile performance over 10 and five years.

ESG factors are a core element of the strategy, with the manager seeking to invest in companies with low sustainability risks and to avoid those involved in activities that negatively impact society or the environment.

Unlike the two previous funds, Pictet Quest Europe Sustainable Equities takes a bigger punt on the Granolas, with Novartis, Novo Nordisk, L’Oreal and GSK all appearing in the top 10 holdings.

Both short- and long-term performance have not come at the expense of higher risk, as the fund has consistently been one of the least volatile in the sector. It also boasts one of the highest Sharpe ratio, indicating investors have been fairly rewarded for the amount of risk taken.

Performance of funds over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

Finally, Michael Barakos is another European veteran manager to have delivered top quartile returns over the past three years.

He has been managing JPM Europe Strategic Value since 2004 and was joined by Ian Butler in 2014 and Thomas Buckingham in 2017. Together, they look for attractively valued sound companies.

As such, the fund is currently overweight insurance, bank and automobiles & component sectors, with Mercedes-Benz being the latest addition to the portfolio. The decision was made as a result of the German car company’s announcement of a new share buyback.

Conversely, JPM Europe Strategic Value recently sold UK bank NatWest due to disappointing third-quarter results and financial year 2023 guidance last year.

While short-term performance has been good, the fund has suffered over the past decade, as the value-style of investment has been generally out of favour in that period. As such, it sits in the bottom quartile over 10 years and in the third over five years.

The fund has also been more volatile than its sector peers, both over the short- and long-term.

Toys, social media, gaming and music are all ways children can invest in the things that interest them.

UK savers have an infatuation with cash, particularly parents, the majority of whom are placing their children's Junior ISAs (JISAs) into cash rather than investing in stocks and shares.

In fact, more than 60% of JISAs are held in cash. This flies in the face of conventional wisdom, which suggests that people with long time horizons should put their money to work in riskier assets as they have more time to make money.

But there is a certainty with cash returns, while stocks can lose money. One way to help get over this hurdle is to encourage children to be interested in investing, according to Dan Coatsworth, investment analyst at AJ Bell.

This is crucial, as the more money built up for a child in their early years, the easier it should be financially for them to deal with some of life’s big milestones when they become an adult, he said.

He suggested a “spend some, save some” approach, as a “fair way to let the child deploy some of the cash while also subtly teaching them the importance of putting money away for another day”.

As they get older, Coatsworth said introducing concepts such as interest on savings and teaching them patience for bigger rewards will stand them in good stead for later money issues.