Experts explain how different macro-environment conditions impact the UK blue-chip index.

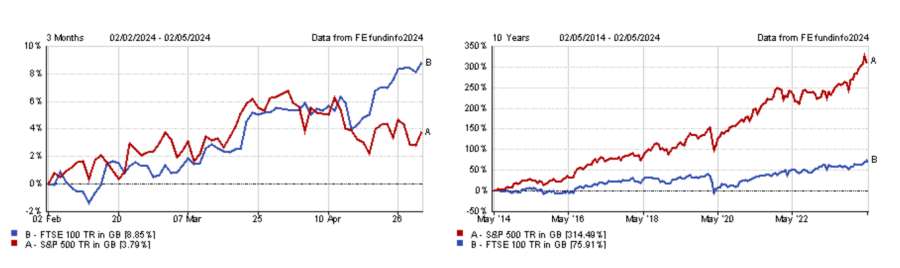

UK equities are having their moment in the sun, with the FTSE 100 recently reaching an all-time high and even outperforming the mighty S&P 500 over the past three months.

Although the UK stock market continues to grapple with a range of structural issues, the recent strong performance may herald brighter days for London-listed equities.

Danni Hewson, head of financial analysis at AJ Bell, said: “Can the FTSE 100’s run of form continue? Can the current momentum tempt more companies and more investors to look again at London?

“It seems churlish to speak of the woes the index has struggled with when there’s such optimism in the air, but there’s no better time to fix the roof than when the sun is shining.”

Performance of indices over 3 months and 10yrs

Source: FE Analytics

Signs of improvements in the UK economy may explain this recent exuberance, but the FTSE 100’s sectoral makeup – rich in energy, resources, pharmaceuticals and banking stocks – also played a role. This mix offers investors support during economic downturns, periods of uncertainty and times of risk aversion.

Jason Hollands, managing director of Bestinvest, said: “Other factors driving the FTSE 100 bounce are perhaps less cheery in nature. Heightened tensions in the Middle East with the risk of a regional war between Iran and Israel breaking out imminently, have propelled both oil and precious metal prices higher.”

The FTSE 100 also exhibits less sensitivity to the ‘higher for longer’ narrative that has recently resurfaced regarding interest rates.

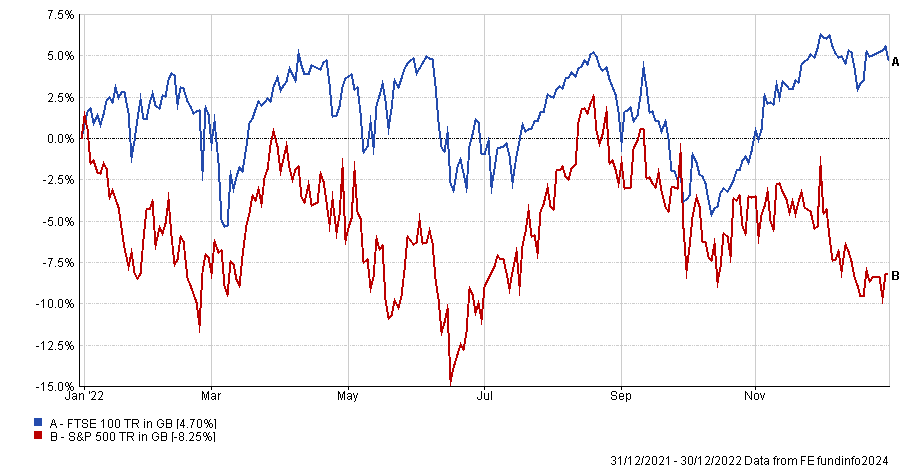

The UK blue-chip index already showed its ability to cope with higher interest rates in 2022 when it held its ground as inflation surged dramatically, forcing central banks to hike rates several times. In contrast, the US market, rich in long-duration stocks (such as the tech names), experienced a significant downturn.

Although rate hikes are still seemingly off the table, rate cut expectations have been tempered dramatically since the start of the year.

Dan Coatsworth, investment analyst at AJ Bell, explained: “Higher rates are negative when calculating the present value of future cash flows – put simply, investors suddenly lost their appetite for ‘jam tomorrow’ stocks and instead became hungry for ‘jam today’ stocks where the equity story is about making profits in the here and now, not about the sharp increase in profits expected in the future.

“The FTSE 100 has lots of ‘jam today’ style names such as tobacco producers and consumer staple businesses, hence why the UK market in this situation suddenly became more attractive than the US.”

Performance of indices in 2022

Source: FE Analytics

However, Rob Morgan, chief investment analyst at Charles Stanley, noted that this lack of ‘jam tomorrow’ in structural growth areas as well as the overrepresentation of economically sensitive sectors in the index could become a headwind if interest rates fall “in a more rapid and synchronised fashion than anticipated”.

As approximately three quarters of the index constituents earn revenue outside the UK, he also noted that a strong pound would negatively impact FTSE 100 companies with international operations. However, he stressed that a strong currency would also have positive implications for the domestic economy.

Bargain opportunity or value-trap?

Despite the recent outperformance, the FTSE 100 remains cheap compared to indices from other developed markets, which may be of interest to bargain investors.

Hollands said: “Although the UK’s blue-chip index is near a record high in point terms, this is certainly not an indication that UK-listed shares are now expensive. Far from it.

“A better measure is where shares prices are in relation to expected earnings and in this respect the market is cheap both compared to global equities – with UK shares trading at a price-to-earnings ratio around 37% lower than global equities – and their long-term median valuations.

“At such giveaway valuations, expect to see continued bids for UK-listed companies by overseas buyers – the number of takeovers of UK public companies reached the highest level in a decade last year – but cheap valuations are also spurring many companies to launch share buybacks, which should boost shareholder returns.”

However, Morgan warned that the cheapness of UK equities is a “double-edged sword”. While it presents "exciting" valuation opportunities for contrarian investors in the short term, the long-term outlook is more concerning as UK companies continue to move their listings abroad in pursuit of better valuations, and investors are selling domestic equities en masse.

For instance, outflows from UK equities reached £8bn in 2023, according to figures from Calastone. In March of this year, British investors withdrew another £823m, marking the 34th consecutive month of net selling for UK equity funds.

Morgan said: “In the long run, a shrinking pool of listed companies that is potentially biased towards less appealing businesses, and those that are simply too big to be swallowed up, is an unhealthy picture for investors.

“A potential longer-term risk is the UK market simply failing to maintain its significance to global investors. Continuing to attract companies to list in the UK and encourage investors to allocate capital is vital, but it remains in doubt.”

How to pair a FTSE 100 tracker

For investors tempted to give domestic equities another chance, a FTSE 100 tracker is likely to be the first port of call. However, due to the concentration of the index and the overrepresentation of specific sectors, they might want to pair it with an active fund to get greater diversification and potentially better long-term returns.

For that purpose, Alex Watts, investment data analyst at interactive investor, suggested Fidelity Special Values, managed by FE fundinfo Alpha Manager Alex Wright.

Watts explained: “The flexible mandate permits bottom-up stock selection across the FTSE All-Share, allowing a 20% overseas allocation. Manager Alex Wright looks for undervalued companies and is willing to take contrarian positions where a company is out of favour. Accordingly, the aggregate valuation across the portfolio of 11.5x earnings is lesser than valuations of the broader market.”

While the manager holds well-known FTSE 100 names such as Aviva, Imperial Brands and Reckitt Benckiser, the portfolio has a small- and mid-cap bias, as this is the part of the UK market where Wright perceives the greatest degree of mispricing.

Performance of investment trust over 10yrs vs sector and benchmark

Source: FE Analytics

For similar reasons, Rob Morgan picked Man GLG Undervalued Assets, managed by FE fundinfo Alpha Managers Henry Dixon and Jack Barrat.

The fund also follows a value-oriented approach, buying undervalued stocks with the anticipation that their merits will be recognised over time, resulting in a positive re-rating of their share prices.

Morgan said: “The fund has an established, disciplined process with an emphasis on financial strength, good cash generation and operational momentum to avoid potential ‘value traps’. As well as diversification from a tracker it could provide a good-quality standalone fund for UK exposure.”

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Finally, Ben Yearsley, director of Fairview Investing, explained there are two possible paths to explore when looking to pair a FTSE 100 tracker.

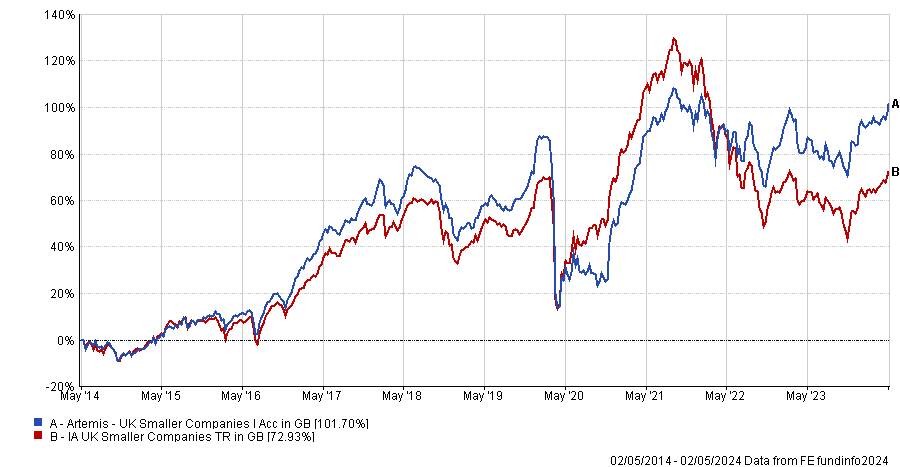

One is to take the plunge and look at opportunities in the small-cap space. In which case, he recommended Artemis UK Smaller Companies, a top quartile fund over 10, five and three years.

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

The other way is to go global with either a global tracker or an active fund such as Blue Whale Growth to counterbalance the “value” bias of the FTSE 100.

The platform’s clients continue to buy into growth and tech funds in April.

Hargreaves Lansdown has called on investors to check the US tech exposure in their portfolios and consider diversifying into other parts of the market.

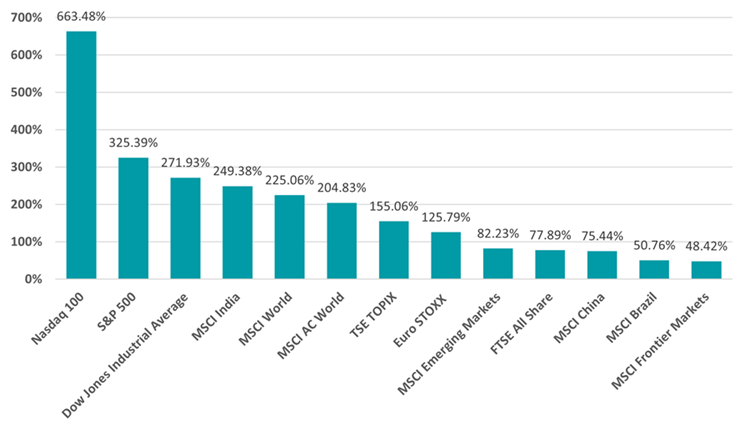

The growth investing style – especially US large-cap tech stocks – has dominated the market for most of the past decade thanks to ultra-low interest rates after the 2008 financial crisis and, more recently, the rise of artificial intelligence.

This is made clear in the chart below, which shows that the Nasdaq – the US index with a high concentration of technology companies – has made a total return more than three times greater than the broader MSCI AC World index over the past 10 years.

Performance of indices over 10yrs

Source: FinXL

Over the same period, the MSCI AC World Growth index has gained 282.6% while its value counterpart is up just 134.3%.

However, Hargreaves Lansdown has cautioned investors against blindly pouring more money into these stocks despite their strong returns in 2024 as well.

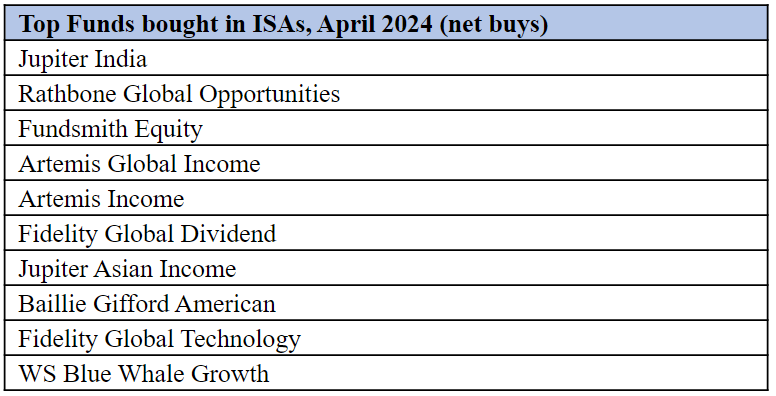

The platform’s fund sales figures for April show tech funds remain popular with its investors, as Fidelity Global Technology appears in the most-bought funds among ISA, Junior ISA and Lifetime ISA clients.

In addition, growth funds such as Rathbone Global Opportunities, Fundsmith Equity, Baillie Gifford American and WS Blue Whale Growth – which have US tech giants among their top holdings – are found in the most-bought funds.

Source: Hargreaves Lansdown

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, said: “While it is good to see some diversification in these selections, there is still a definite growth-bias and tech funds feature across all the different ISA wrappers.

“This is an area of the market that has driven returns in the past 18 months. Momentum is often a key determiner of retail fund flows, but we would encourage investors to be mindful not to double down on portfolio biases.

“Check your existing exposure to the US and tech; it has likely grown as those markets and sectors have outperformed and rather than adding new money to these allocations, look to diversify by geography, sector or asset class depending on your investment goals, horizon and attitude to risk.”

A similar trend can be seen among Fidelity International’s Personal Investing clients, as Fidelity Global Technology and L&G Global Technology Index are among the platform’s most-bought funds in April.

Ed Monk, associate director at Fidelity International, also struck a cautious note about investors backing large-cap US tech stocks in the expectation that all of them will continue to outperform.

“The top seven companies, known as the Magnificent Seven, have been driving much of the gains for the year – but returns from the group are not evenly spread between them, with losses being registered by Tesla and Apple so far in 2024,” he said.

Global, US and European equities are in, emerging markets and the UK are out.

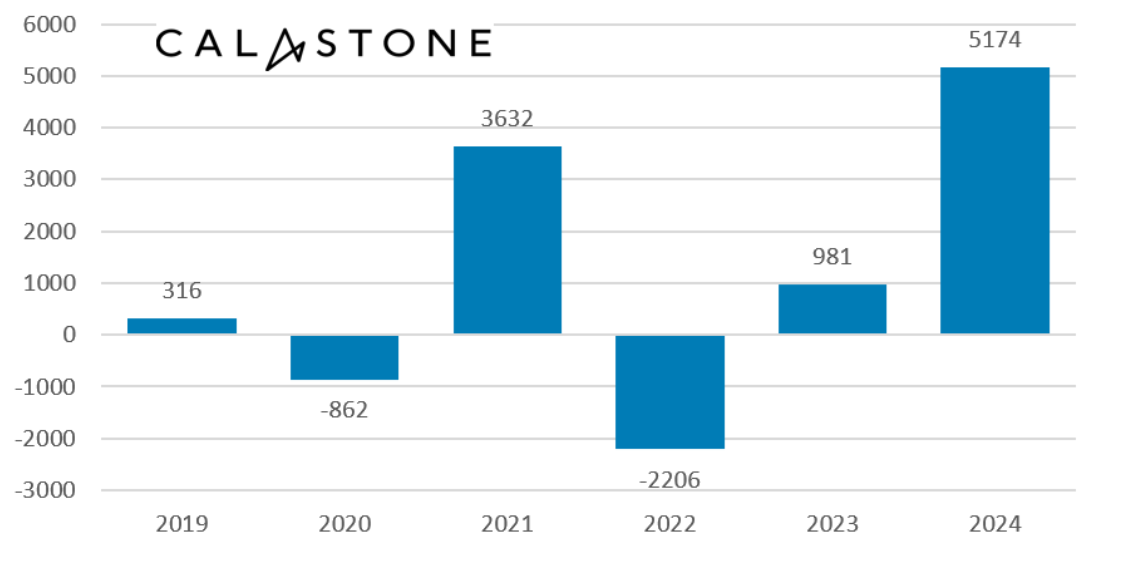

Equity funds raked in £5.2bn this ISA season (from 15 February to 5 April 2024), more than five times their 2023 intake (£981m), making 2024 the best year of ISA investments recorded by Calastone.

During the month of April, investors poured £1.9bn into equity funds, the 13th highest month in Calastone’s nine years of data. This followed a record first quarter with £7bn of equity inflows.

Passive funds tracking US and global equity indices were the main beneficiaries of investors’ renewed appetite for risk. This is a consistent trend as investors have favoured indexing for 16 consecutive months, having earlier shown a marked preference for active funds in 2021 and 2022.

Passive equity funds have garnered £14.9bn since January 2023, while active equity managers have suffered outflows of £7.3bn.

Net equity inflows during ISA season (£m)

Source: Calastone Fund Flow Index

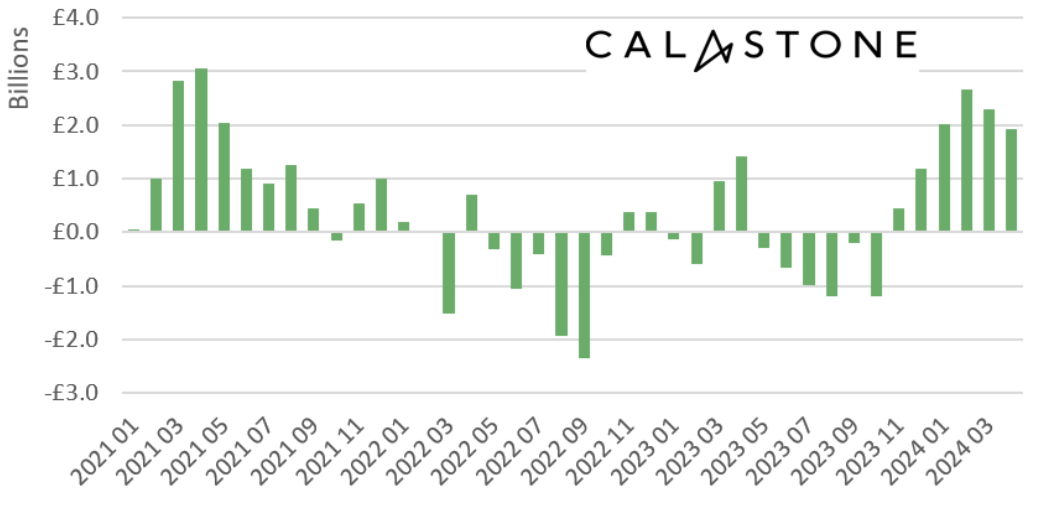

Global equity funds enjoyed £1.5bn of inflows in April. US portfolios, which make up the lion’s share of global indices, took in almost as much as global funds, with £1.3bn of inflows. European equity funds received £471m. UK and emerging market portfolios were out of favour, however, shedding £665m and £162m, respectively.

Investors have been relentlessly selling down UK equities, which have been in outflow mode for 35 consecutive months, losing a cumulative £21.3bn.

April marked a reversal of fortunes for emerging markets funds, however, which had been gathering inflows for 18 months.

Equity funds’ monthly net inflows

Source: Calastone Fund Flow Index

Meanwhile, investors pulled £100m out of safe-haven money market funds as they gravitated towards riskier equities, marking the first month of net selling since January 2023. Mixed asset funds started to take in money after 11 months of outflows but property funds were subjected to continued selling pressure.

Investors also added £422m to fixed income funds in April, despite poor performance.

Edward Glyn, head of global markets at Calastone, said: “The bond markets had another rough month. The benchmark US 10-year yield rose relentlessly during April, ending the month at 4.68%, up by half a percentage point since the end of March, setting the tone for bond markets around the world. Investors are nursing losses on the £1.7bn of bond-fund purchases they made between November and March.

“Meanwhile inflows to bond markets show that steady and accumulating losses are not deterring new capital – this is not unreasonable as there are substantial gains to be made when interest-rate expectations turn a corner and high yields mean investors can lock in historically high income levels now for the long term.”

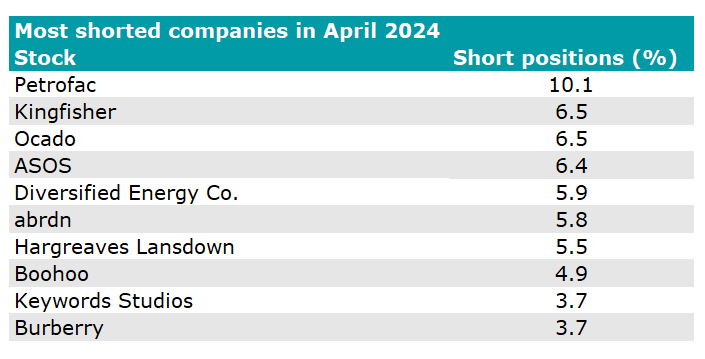

Hedge funds expect AI to disrupt Keywords Studios, which provides services to the video games industry.

A new company has entered the list of the UK’s 10 most shorted stocks: Keywords Studios, which provides creative services to the video games industry, including art and audio recording.

GLG Partners, Gladstone Capital Management, Marble Bar Asset Management and SFM UK Management are all betting against the stock, according to the Financial Conduct Authority.

Keywords Studios’ share price fell off a cliff last year. Although it started to recover in late December and January 2024, it subsequently resumed its downward trajectory, as the chart below shows.

Share price performance over 5yrs

Source: FE Analytics

The Hollywood actors’ strikes dealt a $20m or 2.6% blow to Keywords Studios’ revenues last year.

Currency fluctuations also had a negative impact on revenues. Keywords Studios was established in 1998 in Leopardstown, a suburb of Dublin, but it has grown by acquisition and now operates in 26 countries. It completed five acquisitions in 2023 alone.

Fears that artificial intelligence might disrupt Keywords Studios’ business also weighed on the share price.

Despite all of these factors, the company’s annual results, announced in March 2024, were upbeat. Chief executive officer Bertrand Bodson said: “In what was a difficult year for the industry, we delivered resilient performance in 2023 and we continued to grow our market share and industry leadership position.”

It joins long-time targets abrdn and ASOS among the 10 most shorted UK-listed companies, while Petrofac remains the most shorted stock, as the below table shows.

Source: Financial Conduct Authority

The market’s obsession with the Magnificent Seven is short-sighted, Alpha Managers warn.

Generative artificial intelligence (AI) has the potential to create huge growth opportunities but the tricky part for investors will be discerning which companies stand to benefit the most – and they may not necessarily be the Magnificent Seven.

To that end, Trustnet asked some of the best performing US equity managers (all of whom have been nominated for the FE fundinfo Alpha Manager of the Year awards) whether the market got too carried away with AI hype and whether they are finding better value elsewhere.

AI has torn up the rule book

Tom Slater, who manages Baillie Gifford American and Scottish Mortgage, said generative AI has created new rules and new business models, which for investors will require new ways of evaluating stocks.

“A technology’s architecture can determine the strategies and business models open to a company. This dynamic is often underappreciated,” he said. The cloud and mobile internet era favoured a small number of dominant giants but going forward, “AI dictates a new set of rules regarding what is possible”.

“We have yet to determine the limits of this technology or how quickly it will continue to improve. The applications and the impacts will get more dramatic the longer we stay on the current trajectory of progress. For the growth investor, things are just starting to get interesting,” he observed.

“Where we find signs of traction, we must be prepared to embrace ‘growth at an unreasonable price’. This means that for the eventual winners, the opportunity will be massively underestimated, and the others will have been vastly overpriced.”

To find those winners, Slater is looking for companies that are still run by their founders, as they can react in ”radical ways” if they believe it is in their long-term interests, he said.

“Tobias Lütke at the e-commerce platform Shopify pivoted from building an infrastructure for online deliveries to focusing on AI within Shopify’s core products, to ensure it remains competitive. David Bazucki at gaming platform Roblox is growing its population rapidly, helped by real-time AI-powered translation removing communication barriers amongst users worldwide.”

Within healthcare, several companies are using technology to provide better standards of care to patients while lowering costs to healthcare systems, he continued, highlighting Moderna and Inspire as two portfolio holdings with significant potential.

Slater thinks excessive attention has been paid to the Magnificent Seven, making this “a particularly rewarding time to search for growth outside of the noise.”

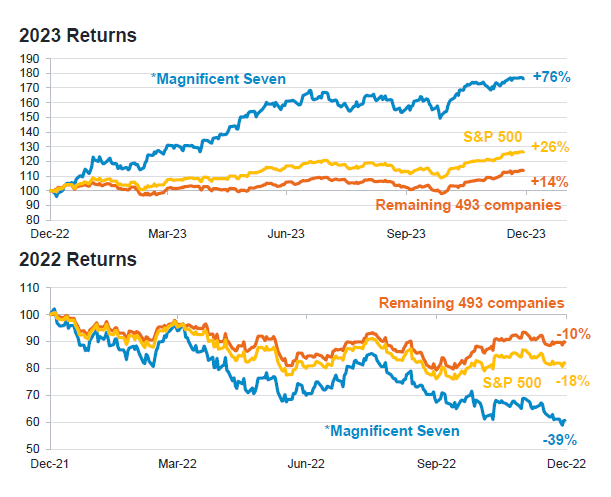

The hallowed seven are only ‘magnificent’ if you pretend 2022 didn’t happen

Aziz Hamzaogullari, founder, chief Investment officer and portfolio manager of the Growth Equity Strategies team at Loomis, Sayles & Co., said investors have become too short-termist when it comes to the Magnificent Seven, noting their performance last year was on the back of a disastrous 2022.

“The market’s obsession with the Magnificent Seven over the past year is emblematic of the pervasive short-sightedness that characterizes much of our profession. Their 2023 price performance was only magnificent if you pretend 2022 didn’t happen,” he said.

In 2022, the shares of each of the seven names declined between 26% and 65%, meaning that over the entire two-year period, an equal-weighted portfolio made up of just the select few US stocks would have made a cumulative return of just 8%.

“Of course, most investors did not experience even this return, because they define risk in terms of price volatility. As a result, we saw many of our peers sell those names in 2022 only to add back higher after much of the rebound had occurred in 2023,” he said.

Loomis, Sayles' Growth Equity Strategies team owns six of the seven (it has never owned Apple) but these are long-term investments with an average holding period of 12 years.

“We believe their strong and sustainable competitive advantages, attractive industry dynamics, compelling cash flow generation, visionary management teams and secular growth drivers will enable them to remain leaders,” he explained.

Returns from the Magnificent Seven in 2022 and 2023

Sources: Fidelity International, LHS Goldman Sachs Global Investment Research, returns in dollars.

There is life beyond the Magnificent Seven

Rosanna Burcheri, manager of Fidelity American Special Situations, said the US equity market has broadened out since the start of this year and a whole range of companies look attractive.

Several names have a return on invested cash flow above 25% including Aon, Lowe’s and McKesson. Companies with earnings per share growth for 2024-25 above 25% include Intel and Baker Hughes.

“The message is that there is life beyond the Magnificent Seven and there are an amazing amount of companies you can invest in,” she said.

A value strategy such as Fidelity American offers diversification against the concentration of the benchmark in mega-cap tech, she suggested. Buying stocks at more attractive valuations also bakes in a margin of safety in case the market falters.

Arriving late to the party is risky

James Bullock, portfolio manager of the Lindsell Train North American Equity fund, believes technological advances will create wealth for investors but it is impossible to know the full impact of AI yet.

“History suggests that when a small number of stocks have driven performance, arriving late to the party is risky. Like the pandemic-induced shift to digital in 2021, AI has been the engine of optimism for many of these companies over the past year, though it is easy to forget that 18 months ago it was feared as a ‘Google-killer’,” he pointed out.

“As longer-term investors, we wonder whether it really was, or is, possible to know AI’s eventual impact, evolution and regulation.”

Bullock has found plenty of companies outside the Magnificent Seven that are benefitting from technological advancement.

“We view ownership of differentiated intellectual property and data as one of the more predictable ways to profit from its increased use. Fund holdings Adobe, Intuit, Verisk, S&P Global, CME, Visa, Equifax, Amex and PayPal all possess unique, industry-leading datasets serving important and growing end markets,” he explained.

Tech stocks will continue to benefit from strong tailwinds

Like Lindsell Train and Loomis, Sayles, the GQG Partners US Equity fund has a substantial technology allocation and is also overweight in the communication services sector. The fund’s managers, Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, expect companies in these sectors to continue benefitting from “fundamental improvement, increasing product demand and upside from recent advances in generative artificial intelligence (AI) applications”.

They are also overweight utilities as they believe “demand for power is inflecting higher in certain areas of the US due to increased consumption”.

Schroders’ global value team is increasing its exposure to the US, where it has found a range of ‘deeply out of favour’ companies at ‘exceptionally attractive’ valuations.

Schroders’ global value team has an explicit mandate to invest in the cheapest parts of the global equity market so it may seem counterintuitive that the team has doubled its US exposure in the past two years. The US is arguably the most expensive region in the world and has been one of the best performing markets.

America’s rally has, however, been concentrated in a handful of headline-grabbing stocks and below the surface are some “genuinely cheap businesses,” said Simon Adler, who co-manages the £818m Schroder Global Recovery fund.

“US markets have been dominated by a small handful of companies and the companies we’ve been buying have performed horribly. Horrendous performance. And we've been buying shares on very, very attractive valuations. We bought a number of US businesses that are deeply out of favour,” he said.

Adler and his colleagues have invested in several US companies on single digit Shiller price-to-earnings (P/E) ratios. The Shiller P/E ratio consists of the share price divided by the average of 10 years of earnings, adjusted for inflation. It is designed to smooth out short-term earnings volatility.

Even so, the fund’s US exposure is still fairly low at 30%, compared to 71% for the MSCI World index.

This year, Adler has invested in the US department stores Best Buy and Macy’s, La-Z-Boy reclining chairs, computer retailer HP and healthcare stocks Pfizer and Bristol-Myers Squibb. Last year, he bought shares in recruitment firms Adecco and Manpower, as well as Sally Beauty.

“Whilst the US looks very expensive at aggregated market levels, beneath the surface there are a lot of companies that have been really difficult performers and have done terribly, that we've been able to buy into at exceptionally attractive valuations. We think on our five-year average holding period we can make great returns for our clients,” he said.

These stocks have fallen out of favour for a variety of reasons. “The healthcare companies we're in have got some really popular drugs that are losing exclusivity and the stock market can be very short term about that,” Adler explained.

With Best Buy and Macy’s: “Store-based retail is clearly not as popular now when everyone buys things online. Those businesses have got quite difficult outlooks but that is more than compensated for by the share price. So it's not that we're deluded and think that everyone's going to shop in department stores for the rest of their lives, but we think the stock market has dramatically exaggerated the decline of those stores.”

Adler hopes that the American companies in which he has recently invested will go through a similar renaissance to his Japanese portfolio.

“Two or three years ago, we bought a bunch of Japanese companies that were deeply out of favour and they have come dramatically into favour. We were buying them at some of the cheapest valuations we've ever seen” he said.

“We bought Nippon TV at an extraordinarily attractive valuation, it was almost unbelievable. Now it's doubled since then, but that’s because it was coming from such a low base. It doesn't mean it's necessarily expensive today.”

In addition to Schroder Global Recovery, Adler also co-manages Schroder Global Equity Income and Schroder Global Sustainable Value Equity. All these funds have between 10% and 15% in Japan.

The Japanese companies he owns were cheap because they had “enormous cash balances and enormous cross holdings in other companies that they'd held for many years and the perceived wisdom was that would never be returned to shareholders”.

However, the Japanese government and the Tokyo Stock Exchange have enacted reforms to improve corporate governance and increase shareholder returns, and their efforts are starting to bear fruit.

“The businesses that were moribund for decades and everyone had given up on are now flavour of the month,” Adler concluded.

Companies that build things in the real world (rather than the digital one) are set to thrive.

If software has been the pre-eminent source of growth over the past 20 years, perhaps physical hardware will replace it as the main source of growth for the next two decades.

We believe that gritty, physical companies that build things in the material world – gravel producers, plastic pipe makers, electrical contractors – are poised to thrive as advanced economies confront the urgent need to reconstruct everything from highways to power grids.

We also think there will be an epic swing towards the material world as the US legislates for a jaw-dropping $2.2trn to be spent over the coming decades upgrading the country’s tired infrastructure.

Eaton, an electrical contractor, typifies the opportunity. In a recent update, the American-Irish company totted up all the building projects announced in 2022 in the US and Canada. It came up with a total of $860bn in planned megaproject spending – about three times the normal rate. We think this is a 10-year-plus period of abnormally high growth for the likes of Eaton.

The unusual level of growth is already putting strain on a limited supply of skilled labour. Comfort Systems USA employs roughly 15,000 people and installs heating, ventilation and air conditioning systems.

Historically, about half of the Houston-based company’s revenue was booked by the start of the year. That has surged to 90% as customers pay upfront to ensure access to Comfort’s highly trained workforce.

Other key shortages are developing in raw materials, which also brings opportunities. An example is Martin Marietta Materials, an owner of quarries that produce construction aggregates, such as sand and gravel. As builders scramble for supply, prices for those aggregates are soaring at their fastest rate in decades.

Yet Martin Marietta doesn’t have to worry about new competition emerging any time soon because getting permits to develop a new quarry typically takes five years, and that is before you even start constructing the quarry – it’s probably seven to 10 years before you actually begin to produce materials.

Look closer and it’s not just traditional building materials that should get a lift from the infrastructure boom. Innovators, including Advanced Drainage Systems, should also benefit. The Ohio-based company has developed plastic storm drains that are lighter and faster to install than conventional concrete ones.

Advanced Drainage is one of North America’s leading plastic recyclers and makes storm drains that last 100 years. It’s a faster, cheaper, greener alternative that could be a winner over a long infrastructure boom ahead.

To put the scale of that projected spending in perspective, it is helpful to look to historical precedent. The Marshall Plan was a world-shaping US initiative to rebuild post-war Europe’s shattered economic infrastructure. It was worth about $170bn in today’s money. In comparison, the $2.2trn stimulus laid out in the past few years of legislation amounts to the equivalent of 13 Marshall Plans.

A good chunk of this massive outlay will go towards fixing the US’s crumbling roads, bridges and water systems. In its most recent assessment in 2021, the American Society of Civil Engineers said 43% of US public roadways were in poor or mediocre condition. It noted that somewhere in the US, a water main breaks every two minutes on average.

Much of the current installed base was built during the boom times after the Second World War. It is badly in need of renewal.

However, it’s not just the need to patch up the disintegrating legacy of the past that is propelling today’s infrastructure boom. It also reflects how Washington wants to re-orient the US economy.

Covid-19 exposed the fragility of global supply chains. It demonstrated how easily a crisis could shut down far-flung manufacturing networks and cause shortages of crucial components.

US policymakers on both sides of the House are now determined to make their national economy more resilient. They want to encourage industries to make products domestically rather than relying on China as the go-to manufacturing destination. Increasing friction between Washington and Beijing has added a further note of urgency.

Notably, the US no longer wants to depend on Taiwan as the sole source for many key computer chips – the island’s proximity to an increasingly militant China makes it just too vulnerable.

The Inflation Reduction Act adds a further large sum of money for green energy. It aims to foster the installation of more wind turbines, solar panels and electric vehicles. That, in turn, boosts the need for smarter, more adaptable electrical grids to connect new power sources to homes and factories.

Could a change of administration in Washington disrupt this happy course? We believe that a spending U-turn is unlikely. Much of the recent legislation passed with bipartisan support.

Furthermore, the need for infrastructure spending is based on long-term trends difficult for any administration to ignore, such as the need to replace ageing roads and the shift to green energy.

Moreover, we see many of the same trends playing out in Europe and argue that an infrastructure boom could also happen there. Investors searching for a new theme should take heed: it’s time to get physical again.

Spencer Adair is the investment manager of Monks Investment Trust. The views expressed above should not be taken as investment advice.

The Bank of England and ECB will be ‘stuck’ with higher rates despite low inflation.

Interest rate cuts have been much talked about all year and some central banks such as the Bank of England (BoE) and the European Central Bank (ECB) seem poised to finally alleviate the pressure on consumers by dropping rates as early as next month.

But there is a finite amount of cuts they can make before they will be forced to stop, according to managers at Aegon Asset Management, who warned that some central banks could be stuck with higher-than-optimal interest rates despite lower inflation and anaemic economic growth.

All will depend on the US Federal Reserve, which opted to hold rates in the 5.25-5.5% range this week following another higher-than-expected inflation print last month.

Stephen Innes, managing partner at SPI Asset Management, noted chair Jay Powell “refrained from explicitly indicating that rate cuts were imminent this year or suggesting that rates had reached their peak, as he had previously stated”.

This week, Darrell Spence, economist at Capital Group, outlined three reasons why the Fed won’t cut rates this year and Nick Chatters, a member of the global rates team at Aegon, noted that expectations for rate cuts have certainly come down since the end of last year.

“Coming into 2024 we had six cuts priced in, we now have just over one,” he said. This is because the data has been puzzling, with inflation proving stickier than many had hoped.

Indeed, the Federal Reserve has told markets that it will only move if it has confidence that inflation is sustainably moving lower – something that has yet to take place. “In fact it has gone sideways,” said Chatters.

“The problem at the moment is the inflation data is consistently surprising to the upside. If that continues it makes the case for the Fed to keep rates on hold for longer than expected and I would put the possibility of another hike as a non-zero probability, although still low.”

There is also the election to contend with, he added, noting the Fed is in a “lose-lose” situation. Whether it cuts rates or does not, “someone is going to have a problem with it”.

But these dynamics of sticky inflation and political pressure are not evident elsewhere. Indeed, based on lower inflation figures, the ECB has indicated it will cut rates in June.

“The inflation and economic data in Europe looks worse [than the UK] but the trajectory for the data such as the Purchasing Managers Index is rising,” Chatters said, noting that this gives the ECB the ammunition to cut now, although it has yet to lay out its plans post June.

Meanwhile he said the Bank of England “would like to [cut] if the data suggests it can”. He expects a “big drop” in headline inflation next month perhaps even below 2%, which would be “optically important for the market”.

But neither the BoE nor ECB can move much without the Federal Reserve, according to Chatters. “They can start but there is only so far they can push up rates. They can’t keep going without the Fed.”

Vincent McEntegart, co-manager of the Aegon Diversified Income strategies, agreed. It means we could end up in the “bizarre” scenario where UK inflation falls below 2% and economic growth remains relatively anaemic at under 1%, yet interest rates continue to hover around 4.5%.

Moving without the Federal Reserve “would devalue the pound and create inflation”, he argued, as savers would move their money to the countries where they can get the best returns on their cash – in this case the US, where rates will be higher.

This would cause the pound to drop, increasing the costs of importing goods from overseas – particularly commodities which are also priced in dollars.

“A strong dollar causes problems. All commodities are priced in dollars for example, so the price of oil goes up and so inflation rises. It means the Bank of England and ECB are stuck with higher rates because the Fed can’t cut its rates,” said McEntegart.

Chatters added that the ECB and BoE “can get away with two cuts without the Fed” but would struggle to go much further.

He suggested that investors need to consider a new long-term ‘terminal’ rate for interest rates of 3.4% in the UK and 4% in the US – much higher than historical rates and above central bank forecast. “At the moment to get the terminal rate lower you will need to see much quicker progress on inflation,” he said.

The youngest investment trust is striving to grow its assets under management to get on the radar of a wider investor base.

Ashoka WhiteOak Emerging Markets has approached Asia Dragon for a merger, as the investment trust seeks to expand following its launch last year.

This move may seem unconventional, as the £34.4m Ashoka WhiteOak Emerging Markets is significantly smaller than its acquisition target, whose assets under management soared to £607.6m after the merger with its stablemate abrdn New Dawn last year.

However, analysts at brokerage firm Numis believe this initiative makes sense as the Ashoka WhiteOak Emerging Markets needs to grow to become relevant to a wider investor base.

They said: “The management group has a strong following and has successfully grown Ashoka India through asset performance and issuance from £45.6m at launch to c.£380m net assets.

“In addition, it has started strongly with Ashoka WhiteOak Emerging Markets delivering NAV total returns of 14.7% versus a return of 9.5% from the MSCI Emerging Markets index since launch in May 2023.”

According to Martin Shenfield, chair of Ashoka WhiteOak Emerging Markets, 56% of shareholders in Asia Dragon support the initiative. Yet, he stressed that there has not been “any meaningful engagement” with the board of Asia Dragon.

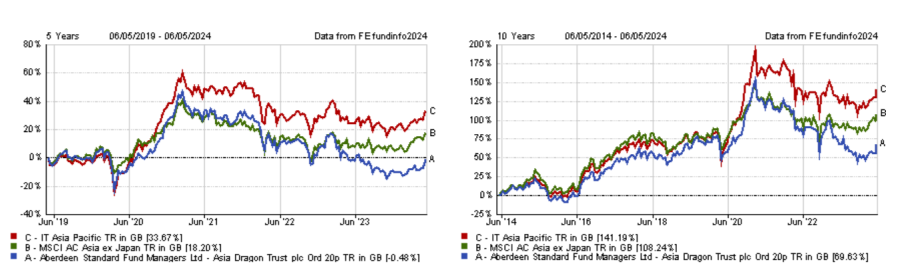

For the analysts at Numis, it is “easy” to understand why shareholders in Asia Dragon are interested in this offer when looking at the performance of the trust. It consistently ranks at the bottom of the IT Asia Pacific sector across all of the standard investment periods and also lags its benchmark.

Performance of investment trust over 5yrs and 10yrs vs sector and benchmark

Source: FE Analytics

They added: “It is also unusual to see an aggressive M&A approach as they have historically been hard to achieve, particularly for an equity investment company, which can mount the defence of returning capital at close to NAV.

“However, these proposals already include a 50% exit for Asia Dragon shareholders and the Ashoka WhiteOak Emerging Markets annual redemption facility means investors that wish to could exit in full at NAV less costs will be able to in December.”

JISAs could have made 10.6% a year from global equities or just 2% from cash.

More than 60% of junior ISAs (JISAs) are held in cash, meaning that families are missing out on gains they could potentially make from investing in the stock market.

Wealth manager Quilter calculates that the UK’s child savers have lost out on £3.4bn by sheltering in cash rather than investing in the stock market since JISAs were introduced in 2011.

Quilter has assumed a 2% annual return from cash accounts since 2011 because although some cash accounts offer double that amount currently, the past decade or so includes many years of ultra-low interest rates.

By comparison, the average fund in the IA Global sector has returned 250.8% in total or 10.6% on an annualised basis since JISAs became available on 21 November 2011.

Parents and grandparents across the UK have invested an average of £530m in JISAs every year since 2011. These accounts are now worth £5.6bn, having generated a 2% compound annual return from cash since 2011, Quilter said.

Had the JISAs been funnelled into global equity funds instead they would now be worth £9bn (based on the IA Global sector peer group) – hence the £3.4bn shortfall.

Ian Futcher, a financial planner at Quilter, said: “Given interest rates have been relatively high recently due to inflation, many heads have been turned by attractive junior ISA cash saving rates. People perceive cash as risk free despite inflation decreasing its real terms value and choose not to face the potential volatility inherent to the stock market even though it has historically given better returns.”

Sheltering in cash means that child savers “miss out on the miracle that is compound growth,” he continued, as JISAs have long enough time horizons to ride out periods of short-term volatility in equity markets.

Tim Bennett, head of education at wealth manager Killik & Co, added that confusing saving with investing is a classic but costly mistake.

“The difference between these two key words is simple – saving is putting cash away, whereas investing is all about buying and holding securities, such as bonds and equities,” he explained.

“The problem with confusing the two is it can lead to people keeping too much cash to one side and underinvesting. Over time, this leads to inflation-driven wealth erosion.”

For parents considering moving their JISA out of cash and into the stock market, Trustnet asked several experts about the right mix of investments for a JISA and which funds to choose.

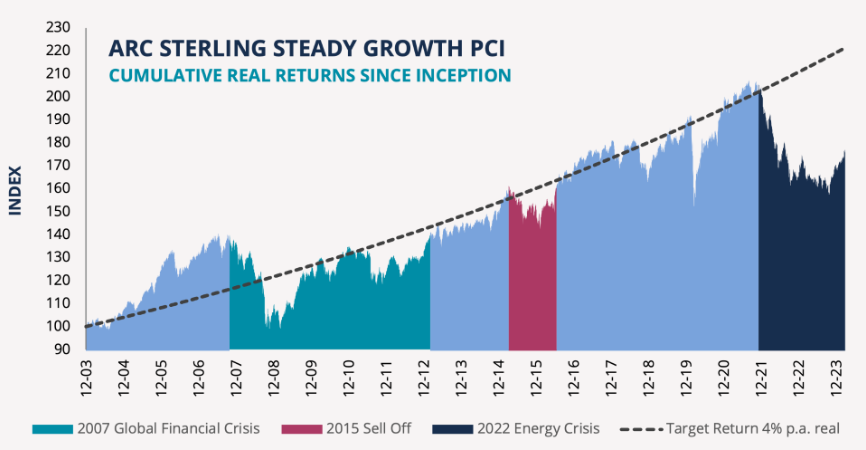

Research by ARC reveals the impact of high inflation on investors’ real wealth.

The typical investor’s portfolio currently has the same value after inflation it did in 2016 despite stock markets across the globe reaching new record highs, research by Asset Risk Consultants (ARC) suggests.

The investment consultancy found inflation has “dented” the value of private client portfolios after it caused the real wealth of the typical sterling private client investor to fall by 15% from its 2021 peak. This was compounded by the re-adjustment of bond yields in 2022, which resulted in a “one-time downward shift” in the wealth of investors.

Graham Harrison, chairman ARC Group, says: “Thinking that recovery in nominal terms means their portfolio is back on track is accepting an illusion. This may make an investor feel more comfortable when their portfolio recovers to a previous numerical high, but the ‘real’ question is at what point previous purchasing power recovers.”

Source: ARC

The analysis is based on the performance of the firm’s ARC Sterling Steady Growth Private Client Index (based on the most common risk profile run by discretionary investment managers), adjusted for inflation. This can be seen above.

Since inception, the index has made an annual real return of 4% but the recent dip means it needs to achieve returns of 7.3% over inflation per year for the next decade for real wealth to be restored to the trend line.

Investors make regular withdrawals from their portfolios should consider whether now is the time to “tighten their belts” as the sustainable withdrawal level is probably around 20% lower today than it was at the start of the decade.

In addition, ARC suggested investors take another look at their investment risk appetite and asset allocation mix given the changes in the investment backdrop.

“Over the past decade, the optimal portfolio consisted solely of equities, a viewpoint encapsulated in the acronym TINA (There Is No Alternative), as equities were driven ever higher by excess liquidity and bond yields moved to ultra-low or even negative levels,” Harrison finished.

“The 2020s are surely going to be the decade when TARA (There Are Reasonable Alternatives) once again comes to the fore. The return of positive real interest rates in bond markets means that multi-asset class investing should once again offer both risk diversification and positive real returns.”

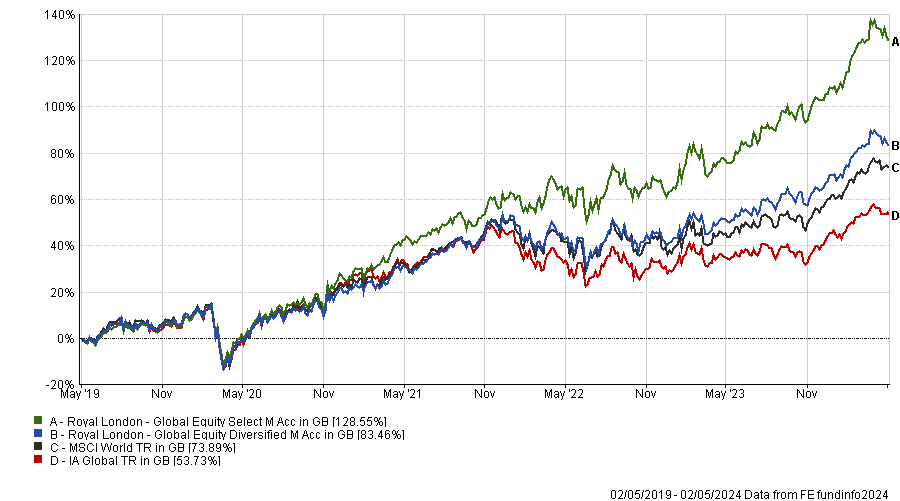

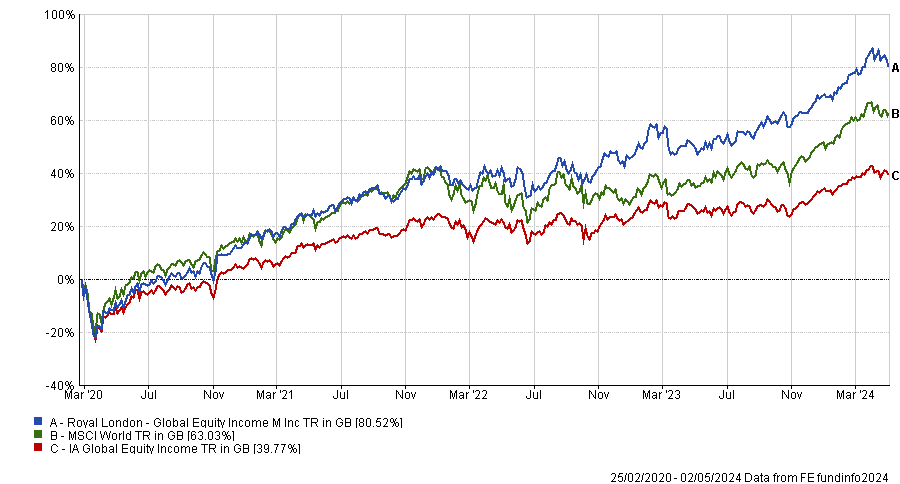

Five RLAM global equity managers are establishing a boutique.

The top-performing Royal London Global Equity Select fund is so popular it had to soft close, barring the door to new investors, but now that its three portfolio managers are leaving, anyone with money currently in the fund faces a tough choice.

Should they stick with the £803m fund or follow its managers, Peter Rutter, James Clarke and Will Kenney, who are establishing a new boutique? The same choice awaits investors in the £4.9bn Royal London Global Equity Diversified fund, which the trio also manages.

They will be joined at their new venture by Nico de Walden, who manages the £1.2bn Royal London Global Equity Income fund, and Chris Parr, who runs the £369m Royal London US Growth Trust. The team has already secured financial backing from Australian multi-affiliate firm, Pinnacle Investment Management.

Stick don’t twist

Ben Yearsley, director of Fairview Investing, and Jason Hollands, managing director of Bestinvest, think investors in RLAM’s global equity range should remain there for now.

Hollands said the portfolios are unlikely to change dramatically in the short term and, besides, there are not many other comparable options. “The approach on these funds was very distinct and there aren’t highly similar funds that spring to mind,” he noted.

The investment process centres upon the life cycle stages of a company. Rutter and his colleagues define companies according to whether the business is accelerating, compounding, slowing and maturing, mature, or in a turnaround situation. Slowing and maturing businesses tend to pay higher dividends and although the fund’s holdings are split across the stages, this is the only area where it is overweight versus its benchmark.

Global Equity Select, a concentrated portfolio of 44 holdings, will pass to Mike Fox, head of sustainable, who Hollands and Yearsley both rate.

“Fox is a veteran fund manager with a very strong track record on the Royal London Sustainable Leaders fund (which is on the Bestinvest best-buy list) although it is focused on UK equities,” Hollands said.

Yearsley agreed: “He is a top quality investor so I’ve got no qualms with sticking with that fund even though the Select fund hasn’t got a sustainable mandate.”

RLAM’s chief investment officer Piers Hillier, meanwhile, is taking over the Global Equity Diversified fund and Yearsley noted he would give him “the benefit of the doubt”.

“The diversified fund has done an excellent job over the long term and gives decent equity exposure at a low cost. It’s arguably their flagship so why would they do anything to jeopardise the long-term excellent performance?” he said.

Performance of funds vs sector and MSCI World over 5yrs

Source: FE Analytics

Fold don’t hold

On the other hand, Chelsea Financial Services is selling its holdings in the Global Equity Income fund, said managing director Darius McDermott.

“Royal London has built an incredible franchise, due in large part to the expertise of the outgoing team. Their departure creates uncertainty regarding the future direction of these funds,” he explained.

In a similar vein, FE Investments was conducting due diligence on the income fund with a view to investing but has decided against going ahead. Analyst Zach Ryan and Sophie Turner said the individual portfolio managers and their investment philosophy were the key selling points.

FE Investments had originally wanted to invest in Global Equity Select but as it was soft-closed, Global Equity Income was another way to access the team’s intellectual property. It was a good fit because the analysts were looking for a global income fund with a slight value bias.

Another attraction of Global Equity Income is, unlike many other income funds, it has a meaningful allocation to the US – not a typical income market because American companies tend to prioritise share buybacks and capital gains over dividends.

Ryan said the fund’s performance has been “absolutely exceptional, across the board, through time”. Not only has it captured the upside during value rallies but it has held its own through periods when growth stocks were in the ascendancy, outperforming other value-biased funds. It has also exceeded its target to deliver a yield 20% higher than the benchmark.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Watch and wait

Yearsley is not an advocate of following the outgoing managers to their new venture on day one because “we know so little about it”. This includes the types of funds they will run, how available they will be and when they will launch.

The main question for Turner and Ryan is how much of the investment process can be brought to Pinnacle given that RLAM owns the intellectual property rights.

It is impossible to predict whether the investment process will perfectly translate and whether the fund managers will have all the programmes they need, the right financial support, and whether the risk committee at their new firm will act in the same way as RLAM’s, Ryan said.

Hollands also thinks investors should wait and see how the portfolio managers get on in their new set-up. “They have great track records but how they will fair in a new and perhaps very different environment needs to be considered. We would want to understand the new set-up, resources and whether the approaches will be the same or differ,” he said.

“For example, the Royal London Global Equity Select fund has a quantitative element to the process and those proprietary tools – and the person who built them – remain with RLAM.”

The managers of the UK’s largest equity income fund have profited from Tesco’s share buybacks and believe BHP’s recent bid for Anglo American is a signal of the latent value in the UK stock market.

Trade buyers are circling around UK plc, swooping upon lowly valued assets in a cheap currency. This isn’t an entirely bad thing for the UK stock market because it is evidence of value, which buyers with longer time horizons can see.

Andy Marsh, co-manager of Artemis Income, used Anglo American as an example of a stock where the market has become “somewhat fixated” by short-term performance and ignored the long-term value.

But things are turning around slowly. International investors are appearing on the share registers of specific companies, for example.

It is not just international investors, however. British corporations themselves evidently believe their own shares are cheap and have been buying them back in droves. Tesco’s share buybacks have eaten significantly into its share count and it is far from alone.

At £4.6bn, Artemis Income fund is the largest fund in IA UK Equity Income sector and 60% of the companies in its portfolio by value have bought back shares in the past year.

Trustnet spoke to Marsh and Nick Shenton, who run the fund in tandem with FE fundinfo Alpha Manager Adrian Frost, about executive pay, M&A activity and share buybacks.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Please describe your investment process

Marsh: Our mantra is cash flow first, dividends second. We are looking for mispriced long-term cash flows and we’re seeking duration of cash flow. We invest in companies that are creating durable value for all stakeholders, not just shareholders. We have diversification across the fund so as not to be overexposed to any one factor or sector.

Shenton: One example of long duration is Informa, the world’s leading operator of events where industries go to meet, such as the Miami Boat Show or the World of Concrete. When you go to these events and see 50,000 people congregating, you realise this is a strong business which should be around for many years to come because it has unique assets.

Does the size of your fund constrain your investment universe?

Shenton: People were asking that when I joined Artemis in 2012 and we have to prove that’s not the case. We want businesses that are large enough that they’ve got a track record and we can understand them but small enough that they’ve got scope to grow. We don’t go near small-cap.

Marsh: Our sweet spot is in the bottom half of the FTSE 100 and our median market cap is around £8bn. These are companies that are large enough to be relevant, often globally, but not so large they can’t grow. If you look at the FTSE 100, 65% of that index is in the top 20 stocks and we have just north of 20% in those names.

What is your view on the spate of international buyers bidding for British businesses?

Shenton: We think it's a signal of long-term value. Most of the entities bidding for UK companies are trade buyers, so these are people who understand the industry and want to own these assets for a long time. It's not private equity using leverage and looking for an exit within five or six years.

Take Anglo American for example. Until BHP’s bid, people were ignoring the long-term value of its assets, particularly in copper. Then a trade buyer signalled value and the shares rose 15% in two days and people started looking at it in a completely different way.

What have been your best and worst performers over the past year?

Shenton: 3i Group has been a tremendous performer and not just over the past year, although it was up 70% and that's unusual. It has one particularly outstanding asset, the European discount retailer Action.

Marsh: One of our most disappointing performers over the past 12 months has been Dr. Martens. The brand has significant global recognition but relatively low penetration of sales across big markets like the US, Europe and Asia.

What we underappreciated was some of the challenges around executing on that growth potential. We continue to own the shares because we still think the revenue opportunities are there, but its ability to convert that revenue into profits has not been as substantial as we expected.

Have many of your portfolio companies been buying back shares?

Shenton: This is a trend we see across the whole UK market. BP and Shell are gobbling up their own shares and 60% of our portfolio by value bought back shares in the past year.

When companies buy back shares on a very cheap valuation, it can create outsized returns. If you're trading at 5-6x price-to-earnings and paying a mix of dividends and share buybacks, you can eat into your share count very quickly.

An interesting example is Tesco, which trades at a 10% free cash flow yield and a 4% plus dividend yield with the balance of cash being returned to investors through share buybacks. Last year we increased our ownership of Tesco by 5% without lifting a finger, just because of share buybacks.

Are there any themes in the portfolio?

Shenton: Turning the threat from technology into an opportunity is a golden thread that runs through. Several companies were trading at low valuations because investors thought they would be disrupted by technology, but actually, they were able to use technology to become better businesses, learn more about their customers and create value for them.

Pearson fits into that camp. It is the world’s leading assessment and qualifications business and is a disruptor in the market for English language qualifications in India. Pearson gets results back to people within a couple of hours so they know whether they have passed the standard of English test to emigrate to a country such as Canada, whereas competitors take days. Personalisation of learning using artificial intelligence is another huge opportunity for Pearson. It doesn’t look expensively valued. It has a free cash flow yield of over 6% and very limited debt.

Do you incorporate sustainability into the fund?

Shenton: We think there’s a great imperative on active managers to be truly active – to create value with the companies. We engage heavily with our businesses on all matters. They call us directly; they know who to speak to at Artemis. We think it’s really important that we lead as fund managers – with the support of a good stewardship team – because we’re the ones who should understand the opportunities and threats to the business.

What do you enjoy doing outside of fund management?

Marsh: I’ve spent years driving my football-mad boys around the country for matches and I have a son who’s just signed his first professional contract with Crystal Palace.

Shenton: With a group of friends, I set up a sports club 12 years ago. We’re trying to play as many different sports as possible.

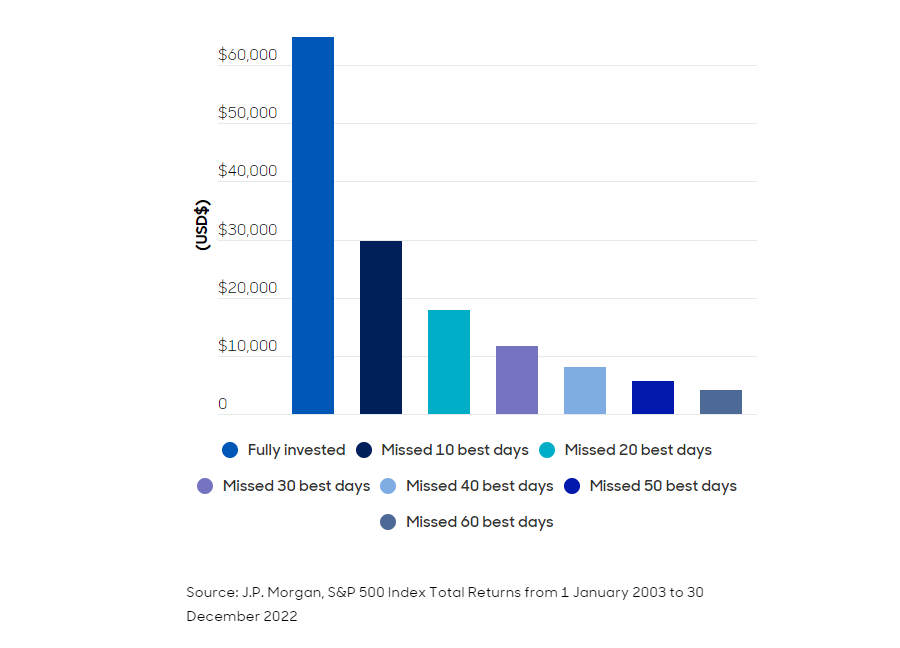

There are plenty of logical reasons why investors might want to shift out of stocks but the data tells us not to.

‘Time in the market is better than timing the market’ is an old adage used by financial experts and one that is typically thought to be the best way for new investors to think about how to put their money to work.

The idea of staying invested came up again this week in a blog post from abrdn, in which its Asia Pacific team highlighted the below chart.

It shows how much an investor would have made if they had put $10,000 in the S&P 500 back in 2003 and left it fully invested for 20 years.

By comparison, the chart also shows the returns that same investor would have experienced if he or she had missed the 10 best days in the market or fared even worse.

How much an investor would have made with $10,000 over 20yrs

This phenomenon of lowering returns when missing out the best days is particularly compounded for income investors, the research noted, as investors will miss out on dividends throughout any periods their money is not being put to work.

It sounds simple: stay invested throughout and reap the rewards. But there will undoubtedly be some that believe they can do even better – why not try to miss the worst days and still reap the rewards of the best?

The reason this is so difficult to do in practice, however, is because quite often these best days come shortly, or even immediately, after the worst days – making it incredibly hard to time.

Yet it would not come as a surprise if investors have in fact been making changes to their portfolios during the past couple of tumultuous years. Indeed, there are plenty of logical reasons why they might want to consider pulling their money out of stocks.

First, cash and bonds now offer compelling yields for the first time in more than a decade, giving investors the chance to move down the risk scale and still achieve steady returns.

This has been compounded by several big events including Covid-19, war in Europe and the Middle East and – new to 2024 – an array of elections in countries around the world including the UK, US and India. All of these have at times posed significant risks to markets.

Then there are the macroeconomic pressures. Inflation has dropped but the final push to central banks’ 2% target is proving difficult to achieve, leaving interest rates in limbo at present and causing more concern that rates may stay higher for longer – something markets are not favourable on.

Lastly, turning to markets themselves, it is easy to come up with arguments as to why now may be a good time to take profits from expensive US stocks such as Nvidia and the other ‘Magnificent Seven’ names that have dominated for the past 18 months, or the ‘Granolas’ in Europe, which have rocketed in recent years.

An investor looking at any or all of these factors could be forgiven for making changes to their portfolios and shifting exposures, taking profits or selling out entirely.

Despite plenty of reasons to move your money elsewhere, whether it be to take on less risk through bonds and cash options, or to move outside of expensive areas such as the US, the data always reminds us that the best course of action is to stay the course and remain invested.

Trustnet asks experienced equity managers whether they are worried about excessive valuations.

Stock markets around the world have hit all-time highs this year and even though most areas – especially the mighty US – began to cool off last month, worries about irrational exuberance and toppy valuations abound.

Against that backdrop, James Thomson, manager of Rathbone Global Opportunities, expects a “rollercoaster” ride in the coming months as optimistic investor positioning runs into the reality of company results.

“Many investors have already positioned themselves for good news so even when a company beats analysts’ consensus forecasts the stock can still go down. It’s usually the best performers that get hit by profit-taking on this ‘sell the news’ phenomenon,” he explained.

Despite US equities being priced for perfection, Thomson does not think valuations are in bubble territory.

“While many investors recoil at US valuations, we counsel that expensive does not always mean overvalued. In fact, when you assess US valuations in the context of their growth potential, resilience and the protected profile of future growth, we still think the US market provides some of the most attractive opportunities to make money over the long term,” he said.

The US stock market was propelled to giddy heights by the ‘Magnificent Seven’ mega-cap tech stocks last year, when artificial intelligence (AI) was the main game in town, prompting talk of an AI bubble. That dynamic is starting to unwind this year, with some of the seven, most notably Tesla and Apple, slipping from their perch.

Terry Smith, manager of Fundsmith Equity, said: “The most obvious areas for worry are the stocks which have been driven by the AI hype. We have yet to see any clear revenue models for generative AI let alone a clear path to profits and returns on the considerable investments.”

Smith is also concerned about the prospects of further rate hikes from the US Federal Reserve and the chaos that might unleash in financial markets.

JPMorgan boss Jamie Dimon said in his annual letter to shareholders last month that the bank was preparing for interest rates to be anywhere between 2% and 8% or even higher. Persistent inflationary pressures and high government spending could compel the Fed to hike rates, he suggested.

Smith warned: “If Jamie Dimon were to be proved right about the risk of rate rises driven by the US budget deficit and the end of quantitative easing, then we could see a more general sell-off in anything highly rated, like we did in 2022.”

The future is by no means bright or certain, therefore. In fact, according to Thomson, “global equity markets are suffering from a scarcity of certainty”.

“I think investment returns will be lower in the years ahead and more inconsistent, but that doesn’t mean you shouldn’t invest,” he added.

Rathbones is staying balanced across a variety of sectors. “We think nimble stock-picking amongst industry champions and overlooked growth stocks should provide significant outperformance for our active approach – albeit with the chance of increased short-term volatility,” Thomson explained.

For Wellington Management, a rollercoaster ride in global equity markets is nothing to be scared of and indeed, short-term volatility provides a chance to rebalance the portfolio.

Yolanda Courtines, who manages Wellington Global Stewards, said: “Market volatility presents opportunities for us to trim our outperforming positions with expanding valuation multiples and lean into companies where the valuation has been compressed.

“This construction philosophy was particularly effective in 2022 when we leaned into positions within financials where valuations multiples had fallen through 2021. The portfolio then significantly outperformed in 2022, partly driven by the financials businesses which benefited from the rising rate environment and the market reengaging with the stocks.”

Courtines and co-manager Mark Mandel aim to hold companies for 10 years or more so the current market environment does not influence whether they buy or sell a stock. Instead, they look for companies with a high return on capital and strong stewardship credentials.

“Our holdings typically have robust balance sheets, world-class management, engaged boards, a long-term orientation, proven capital allocation skill and a stakeholder mindset,” she said.

Like Wellington, GQG Partners focuses on bottom-up stock picking and looks beyond the present macroeconomic backdrop. Therefore Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, who manage the GQG Partners Global Equity fund, said they are not concerned about bubbles in the equity market.

“We employ an adaptable process that is not incumbent upon strong performance in certain sectors, countries or factors for us to outperform,” they said.

The firm’s philosophy is to own a concentrated portfolio of high-quality businesses at reasonable prices that exhibit high visibility on earnings and potential headroom for growth over the next three to five years.

GQG’s global equity fund is overweight select companies within the technology, communication services and energy sectors. Recently, Jain, Kersmanc and Murthy have also been investing in utilities.

Thomson, Smith, Courtines, Mandel and the GQG trio have all been nominated for the FE fundinfo Alpha Manager awards in the global equity category, alongside Royal London Asset Management’s Mike Fox. The winner will be announced on 14 May 2024.

Riddell will become the lead portfolio manager of Fidelity's total return bond strategies by January 2025 at the latest.

Fixed income manager Mike Riddell has left Allianz Global Investors and the flagship Allianz Strategic Bond fund to join Fidelity International in August.

He will become the lead portfolio manager of Fidelity’s total return bond strategies, as well as the £370.6m Fidelity Strategic Bond fund, by 2 January 2025 at the latest. The fund’s current manager, Tim Foster, will assume co-portfolio manager responsibilities.

Since its peak in assets under management in May 2021, when it reached £1bn, the Fidelity Strategic Bond fund has shrunk to the current size, lagging the IA Sterling Strategic Bond sector and returning 0% in the past five years, as the chart below shows.

Performance of fund against sector over 5yrs

Source: FE Analytics

Source: FE Analytics

Riddell’s experience in fixed income markets stretches back 22 years. He joined AllianzGI in 2015 as a senior portfolio manager and previously worked at M&G Investments for 12 years, where he managed index-linked and government bond funds.

Steve Ellis, global chief investment officer, fixed income at Fidelity, said Riddell has a strong long-term track record and “a philosophy centred on providing low correlation to equity in total return and unconstrained fixed income strategies”.

“We are confident that his top-down macro insights will enhance and complement our extensive bottom-up credit and quantitative research resources,” he added.

Riddell has managed the Allianz Strategic Bond fund since 2015. It had a phenomenal year in 2020, returning 31% versus 6.6% for the average fund in the IA Sterling Strategic Bond Sector. However, it has lagged the peer group average since then.

Performance of funds versus sector over 5yrs

Source: FE Analytics

Riddell said: “I am greatly looking forward to taking full advantage of Fidelity’s strength and depth to add further rigor to the investment process, portfolio construction and especially risk management and oversight, which should all help to benefit client outcomes.”

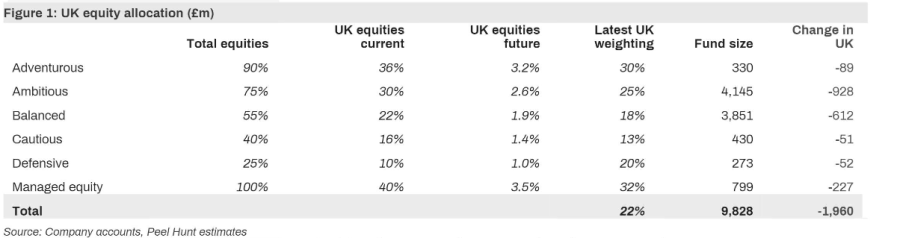

The wealth manager is switching to global funds.

Wealth management firm Coutts (part of NatWest) is pulling £2bn out of the UK equity market as it shifts from a home bias to a global approach.

The King’s bank, which has served the royal family since the time of George IV, is revamping the asset allocation of its six Personal Portfolio funds by cutting exposure to UK stocks and UK investment-grade bonds. It is also introducing a new benchmark, the MSCI All Countries World Index ESG Screened Select Index.

Coutts said it aims to improve diversification as well as long-term returns, but this adjustment will reduce the weight of UK equities from 33% to a mere 2%.

As such, the wealth management firm is poised to sell £1.96bn worth of UK equities, which represents 0.08% of the overall UK market. While it is a small amount, investment bank Peel Hunt warned that it is “very material” in the context of UK outflows.

Allocations to UK equities in Coutts' portfolios

According to figures from Calastone, outflows from UK equities reached £8bn in 2023 and this trend has persisted into 2024.

UK funds suffered net retail outflows of £1.3bn in the first quarter of this year, the Investment Association revealed.

In March alone, British investors withdrew £823m from their domestic equity market, Calastone found. This marked the 34th consecutive month of net selling for UK equity funds.

Charles Hall, head of research at Peel Hunt, said: “This news from Coutts represents a material increase in outflows in the short term. This will inevitably put further selling pressure on the UK market at a time when valuations are already depressed.”

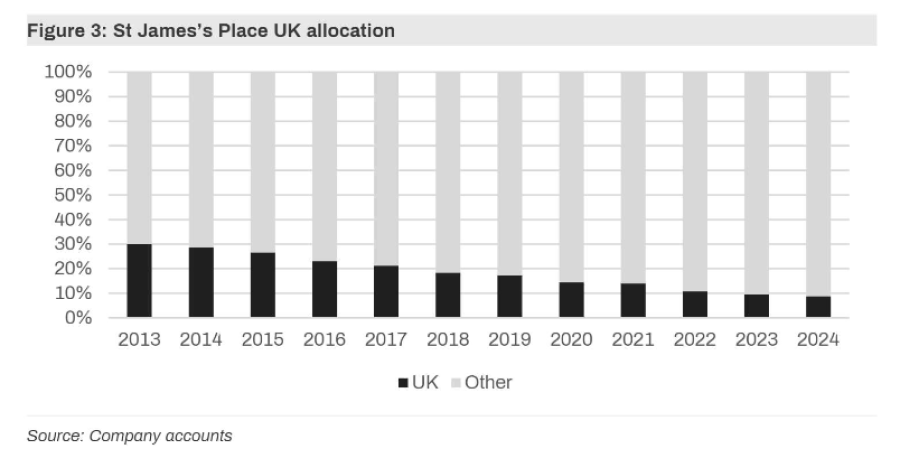

The globalisation dynamic in wealth management portfolios is not exclusive to Coutts; it has been a consistent theme across the industry for the past decade.

For instance, St. James's Place's assets under management (AUM) have surged from £44bn to £179bn since 2013. However, the level of assets held in UK equities has barely changed over the past 10 years. As a result, St. James's Place's allocation to UK equities has fallen from 30% in 2013 to 9% today.

Hall noted that UK retail investors are also abandoning their domestic equity market. On investment platform Hargreaves Lansdown, the total of UK equities, UK equity income and UK small- and mid-sized companies funds fell from 50% in 2015 to approximately 30% at the end of 2023.

As a result, Peel Hunt has urged the government to take action to encourage investors to buy British. The investment bank suggested pension reforms, a British ISA and the removal of stamp duty to incentivise UK investors to return to their home market.

Hall concluded: “If we do not have policies that encourage UK investment, then it is not surprising that there are outflows from the UK and that UK companies underperform.”

Laith Khalaf, head of investment analysis at AJ Bell, was sceptical about how much of an impact a British ISA can make, however. “A wildly unrealistic hope would be that the UK ISA creates an additional £4bn of inflows into UK equities every year. Currently UK equity funds are seeing withdrawals of that order every quarter,” he said.

“Active fund managers plying their trade in UK equities might well be weighing up some mid-life retraining opportunities.”

Sarasin & Partners expects global equities to return 7.7% per annum over the next seven to 10 years. UK equities and gilts are forecast to generate 6.7% and 3.8% p.a., respectively, during this period.

In the past few years, investors have been confronted with one of the most aggressive bouts of inflation seen in decades. The effects of this were amplified by the falls seen in both equity and bond markets in 2022. While there has been a strong recovery in portfolio values over the past year, questions remain as to what the future holds.

To answer some of these questions, we believe it is important to consider how portfolios have historically behaved in such market environments and how these patterns may be applied to future projections.

History favours the patient

Given the surge in inflation experienced during 2021-23, we have specifically reviewed how our multi-asset approach has performed following periods when inflation outpaced the absolute return. The results make for heartening reading, showing a general trend of rebounds in performance.

We found that following a period of negative real returns, investors in the Endowment Model, an investment strategy used by our charity clients, experienced average real returns of 5.6% per annum (p.a.) over the next five years. However, particularly sharp losses (-10% p.a.) have typically been followed by even stronger real returns of 6.6% p.a. over the next five years.

Analysis shows that perhaps the worst decision for many investors would have been to sell in the depths of a market decline and then miss out on the subsequent recovery. If history serves as a guide, investors in multi-asset strategies are likely to experience a rebound in returns, as seen in 2023 and in the first quarter of this year.

The fundamentals that drive projected returns

While the past offers helpful lessons, the key driver of our market projections is the prevailing economic environment and how we expect it to shape investment markets.

Over the long term, returns from equities are driven by the rate at which capital is returned to shareholders through dividends and buybacks, which is ultimately a function of earnings and economic growth.

Over the near term, we expect GDP to grow a little quicker as inflation begins to recede and interest rates are lowered. Growth is likely to decline gradually thereafter, as the working-age population grows at a slower rate. This sets the tone for expected investment returns over the next seven to 10 years.

UK equities and gilts are expected to generate 6.7% and 3.8% p.a. respectively during this period. These returns are lower than the historical average since 1900, as UK equities and gilts have typically generated 9% p.a. and 5% p.a. respectively.

However, we are also expecting inflation to be lower (circa 2.3% p.a.) than the average since 1900 (3.8% p.a.) This is positive for investors’ spending power.

Our projected return for global equities is 7.7%. Once we account for the expected level of UK inflation, this translates into a real return of 5.3%, which exceeds the long-term average of 5%.

Having experienced over a decade of low bond yields, the projected return from gilts is now 3.8%, which equates to a return of 1.5% after inflation. Real returns from corporate bonds appear more encouraging at 2.9% p.a.

What could materially change our outlook?

Forecasting the global economy 10 years from here is complex, as is assessing the implications for multi-asset investment returns. Many things could change, but two particularly merit our attention. These are the rapid advances we are witnessing in technology and the transition to net zero, both of which could have major implications for productivity.

Unlike slow-burning demographic trends, the effect of technology on productivity growth is harder to predict. Technological change can be sporadic, rapid and disruptive – as well as a significant investment opportunity. Two of its biggest drivers are economic necessity (for example due to scarcity of labour, energy, resources or capital) and major threats (such as pandemics, conflict and climate change). These are already very evident in today’s world.

Real improvement comes when a technological breakthrough not only allows an economy to overcome cost increases, but also achieve higher production levels than before the cost pressure occurred. The rapid development of generative artificial intelligence may prove to be an example of this. And despite adding to inflationary pressures and social and political strife, climate change and the transition to net zero economies could be another.

If the historic trend of outperformance following periods of weak real returns does repeat itself, then investors may benefit even further with such advancements.

The views expressed above should not be taken as investment advice. James Hutton is a partner and Kamran Miah is a senior associate partner at Sarasin & Partners.

The information contained within this website is provided by Web Financial Group, a parent company of Digital Look Ltd. unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation.

This is a solution powered by Digital Look Ltd incorporating their prices, data, news, charts, fundamentals and investor tools on this site. Terms & Conditions. Prices and trades are provided by Web Financial Group and are delayed by at least 15 minutes.

© 2024 Refinitiv, an LSEG business. All rights reserved.

Please wait...

Please wait...

Barclays Investment Solutions Limited provides wealth and investment products and services (including the Smart Investor investment services) and is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange and NEX. Registered in England. Registered No. 2752982. Registered Office: 1 Churchill Place, London E14 5HP.

Barclays Bank UK PLC provides banking services to its customers and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.